Overall Market Backdrop, Q1

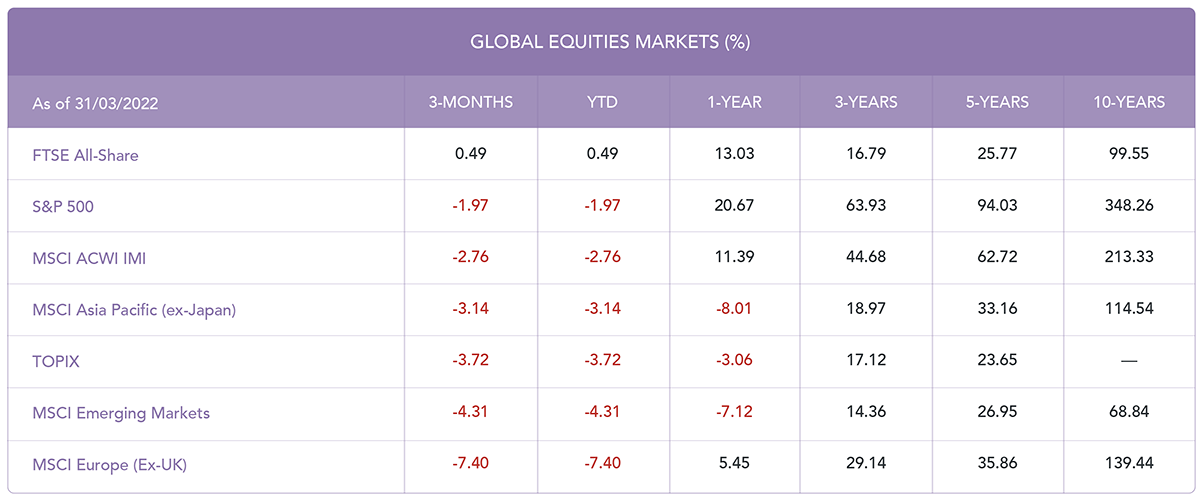

- While developed equities had an exceptional performance in 2021, the new year has not been so kind, welcoming developed equities with increased volatility stemming from a multitude of avenues.

- Emerging markets have continued to struggle in the first quarter of 2022, largely driven by Chinese equities.

- The market environment has created a unique situation where inflation concerns are putting downward pressure on both bonds and equities, this has pushed central banks to become more hawkish. As a result, the 10-year Treasury bond yield reached 2.4%, up from only 1.5% at the start of the year.

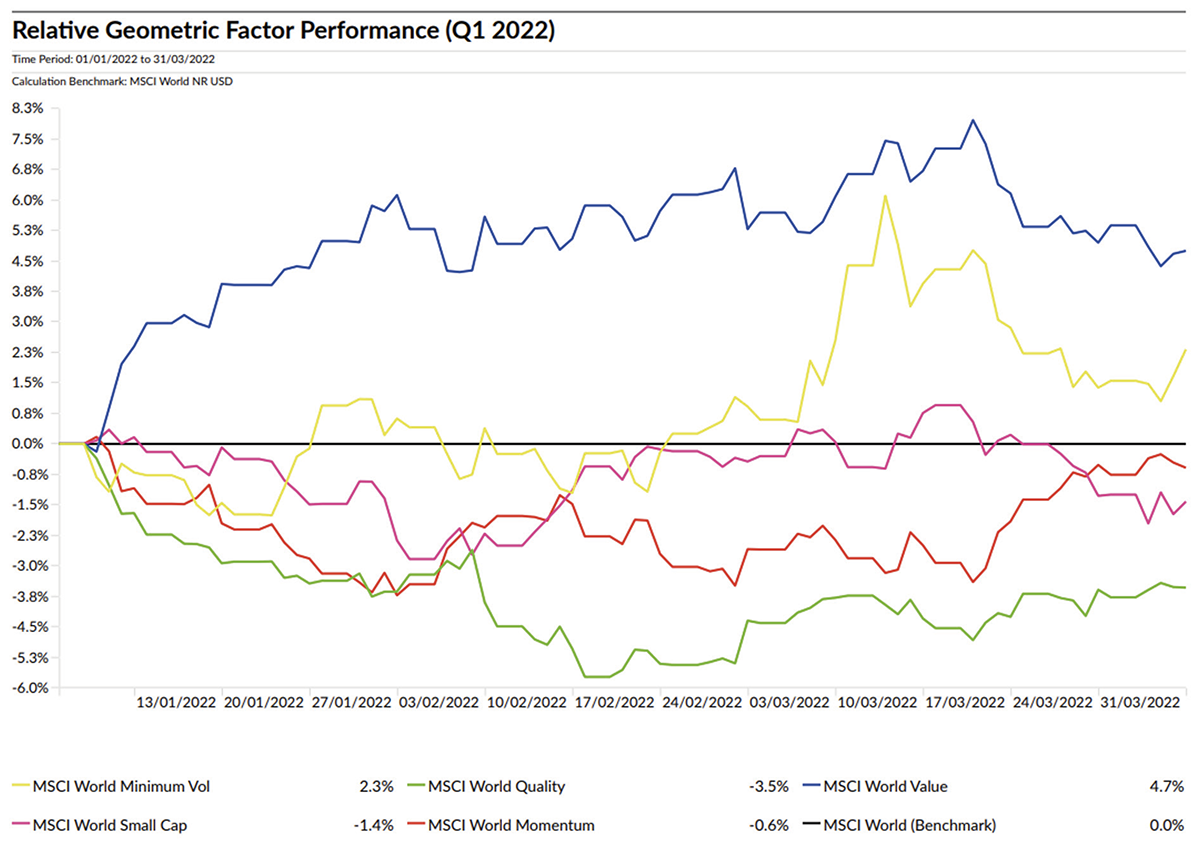

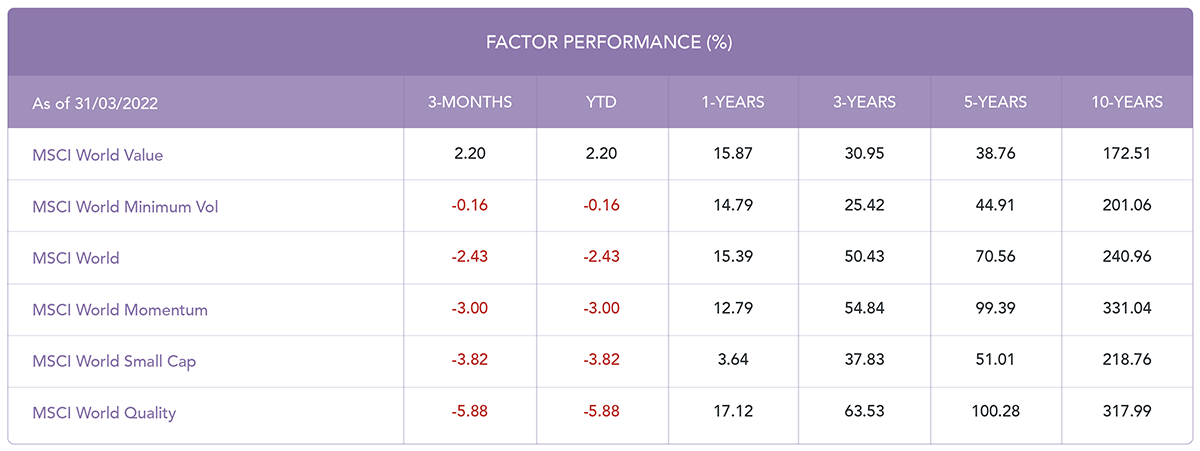

- Value has been the standout factor for Q1, returning 2.2%.

Drivers of Market Conditions in Q1

- In contrast to 2021, the first quarter of 2022 provided many trials and tribulations for the developed market which proved to be too hot to handle. With the exception of the FTSE All-Share, all other global equity markets had negative returns for the quarter. It seemed like markets were exposed to a barrage of bad news as they faced major setbacks from the Russia-Ukraine war. While markets were dealing with record-high inflation, the unexpected and unwelcomed news that Russia had begun a full-scale invasion made the situation evidently worse. The sanctions used to cripple Russia financially also bottlenecked many of the commodity supply chains that Russia had with the rest of the world. Now the Fed are taking the view that a faster pace of interest rate hikes is the best route to combat higher inflation.

- US equities struggled in the first quarter of 2022, the Fed started the year with a very hawkish view and this was iterated throughout the quarter. The consensus is that a quicker pace of US monetary policy normalisation may be on the horizon. The start of the year also saw some of the effects of Omicron creeping into economic data and disrupting recent progress. While Fed comments inferred that the central banks would move with more haste to quell the ever-present inflation concerns, the main concern was that central banks may dampen growth in their efforts to get inflation under control and cause stagflation. Poor economic data coming from earning misses also took hold as a tech sell-off occurred mid-quarter. While most of this volatility was partly priced into the market, the markets were rocked by the Russian invasion of Ukraine, which at most was unexpected. As a result, we saw the S&P 500 entering correction territory for the first time since 2020, falling 10%from its January 3rd highs. Due to this, the Fed played its part in the latter stages of the quarter to uplift equity markets. We also saw supportive economic data coming from March which proved to provide more support for US equities, a strong jobless claims report and robust performance of semiconductor stocks helped the S&P 500 reach robust gains in March.

- European equities sang to the same tune as every other developed market on inflation concerns. The European market, however, is more exposed to the energy crisis which has intensified due to elevated tensions between Russia and Ukraine. The sanctions that developed markets have put in place to cripple the Russian economy have also dealt a seppuku effect and as a result, dealt a blow to their own economies. Europe has been the hardest hit equity region which comes as no surprise as it has around a quarter of its crude oil imports and 40% of its natural gas imports come from Russia. Nevertheless, European equities did see a slight rally towards the end of the quarter when the ongoing geopolitical tensions in Ukraine had some positive shifts with potential talks and ceasefires.

- UK equities were the only equity region on display that has positive returns, although at a very modest amount. The difference between the UK market is that it had slightly better positive economic data seeping through. For example, the region had positive earnings data and unemployment figures flowing in. The UK equity market benefitted from the large weighting towards financials and other Value related companies and low weighting to expensive technology stocks. UK markets still felt downward pressure from the ongoing invasion by Russia, which is shown by the FTSE having negative returns in January and February.

- Inflation concerns have rapidly increased in the quarter, the central banks thought inflation would partly normalise and take care of itself in 2022 but were blindsided by the unexpected Russian invasion of Ukraine. The biggest issue we are seeing is when certain industries can pass off inflationary pressures to the consumers:

- Prime examples are the energy, automotive and retail industries. In January, Core CPI (which excludes the food and energy sector) printed as 5.5% Year-on-Year rather than 7% including these sectors.

- Something that we have seen across the UK and US is that housing demand continues to outstrip supply, causing an increased inflationary effect on house prices and pushing up the average house price to record highs.

- Prime examples are the energy, automotive and retail industries. In January, Core CPI (which excludes the food and energy sector) printed as 5.5% Year-on-Year rather than 7% including these sectors.

- With inflation being on the forefront of investors’ mind, pressure is being put on central banks to support the economic market. Central banks are finding themselves to be in a problematic situation; the war between Russia and Ukraine led to a commodity supply shock and poses a dilemma for central banks who are forced to choose between trying to tame inflation or support growth. The method now has to consist of dealing with high inflation without running into the storm that is stagflation and has caused many central banks to now drift away from each other and have slightly different stances on monetary policy. Russia is also a major energy and commodity producer and the sanctions put in place have had an effect on energy and commodity prices, pushing them exponentially to extreme levels, exacerbating the surge in inflation, supply chain disruption and the risk to global growth. The policy changes we are beginning to see in the developed world are stemming from lower Omicron risks, a tight labour market, and elevated inflation:

- The Bank of England (BoE) raised rates again by another 25 bps to give it a final figure of 0.75%. However, the BoE showed a more dovish tone and gave recognition to the challenges ahead caused by a tricky growth and inflation backdrop. The reason may be that in the UK, headline CPI continued to rise to 6.2%; the highest number since the measure started in 1997.

- In Europe, we had a statement from the ECB President Christine Lagarde who played down the chances of a “measurable tightening” of monetary policy and suggested any shift would be gradual. The European Central Bank (ECB) went a different route and kept interest rates unchanged but revised the purchase schedule for its APP. They confirmed that the tapering of the pandemic emergency purchase programme (PEPP) will conclude in June and the asset purchase programme (APP) will gradually end over the third quarter of 2022.

- The Fed reacted to the elevated inflation and a tight labour market and raised policy rates for the first time since 2018. This provided major support to the S&P 500 in March. Historically rate hikes have delivered robust returns over the past six Fed hiking cycles, averaging a 9.5% annualized return. While the Fed raised the rate by 25 bps, they also signalled that they will most likely continue to increase rates at each of their six remaining meetings in 2022.

- Unlike its western counterparts, the Bank of Japan has consolidated its policy and maintained its current easing stance and emphasised concerns regarding the impact of the Russia-Ukraine situation on growth rather than inflation.

- The Bank of England (BoE) raised rates again by another 25 bps to give it a final figure of 0.75%. However, the BoE showed a more dovish tone and gave recognition to the challenges ahead caused by a tricky growth and inflation backdrop. The reason may be that in the UK, headline CPI continued to rise to 6.2%; the highest number since the measure started in 1997.

- Emerging Markets have continued to struggle in Q1, largely driven by Chinese equities. China is now seeing a new wave of the Omicron variant and this weighed heavily on equities while being paired with broader geopolitical concerns. The increase in cases has caused China to go into shutdown mode and the country has locked downed Shenzhen, Shanghai and other cities. This has also meant the temporary closure of manufacturing plants which further intensifies global supply constraints in some crucial sectors.

- In fixed-income, we have seen bond prices fall and yields increase throughout the quarter. The main narrative being the shift in gears by the central banks on hawkish stances has led to further downward pressure on bond yields. The market environment is very unique in that bonds and fixed income are falling together due to inflationary pressures. The unfortunate events taking place in Ukraine were unforeseen and created unexpected inflation which was before the hawkish stance coming from central banks. With expectations that rate hikes could happen in abundance throughout the year and already started to occur in the UK and US, this has consequently pushed the US 10-Year yields to a new pandemic high of 2.32%. The UK and European bond markets have also followed suit, as hot inflation prints increased expectations for further monetary tightening. What we are witnessing now is that the US yield curve is continuing to flatten which could lead to a possible inversion. Towards the end of the quarter, however, there was a palpable transition on a worldwide scale which could imply the recovery of international risk appetite as a whole as equities started to rally while bond prices kept declining.

How did Factors Perform in Q1?

- Value Stocks have continued their strong performance from Q4 2021 and have been the standout factor for Q1 2022. Value companies are traditionally known for their relatively low valuations but have characteristics of generating high dividend yields, with inflation and interest rates on the rise, Value stocks have largely benefitted because the profit from Value stocks comes much sooner whereas growth stocks have been largely valued due to their future earnings forecasts. Due to this, an increase in interest rates to fight the record-high inflation prints has led to a higher discounting rate which makes future income relatively less today.

- While not having a positive return, the Minimum Volatility factor has performed better than the market and shielded itself from the full brunt of the economic environment. With high volatility in Q1 from unexpected inflation, it’s pleasing to see that the Minimum Volatility factor is doing what it is designed to do. The combination of continued volatility coming from geopolitical and inflation worries and mixed investors sentiment while waiting on central bank decisions has created the optimal environment for the Minimum Volatility factor. The factor deliberately seeks to curtail upside moves by enhancing support on the downside, and we can see this in Q1 as the factor did precisely what it is engineered to do and acted as a safeguard against periods of uncertainty and volatility.

What else have we been talking about?

- All that glitters…

- Q1 Market Review 2024

- March Market Review 2024

- February Market Review 2024

- January Market Review 2024

Blog Post by Raj Chana

Investment Analyst at ebi Portfolios.