Consumer Duty – Doing our duty

The Financial Conduct Authority (FCA) has introduced a new Consumer Duty, which is a significant shift in regulation across the finance industry. It sets higher and clearer standards of consumer protection across financial services.

We are delighted to be an Affiliate Member of the Consumer Duty Alliance

As an Affiliate Member of the Consumer Duty Alliance, we are committed to supporting

the financial services sector in delivering excellent outcomes for consumers.

We contribute to the Alliance’s mission of promoting best practices, sharing expertise,

and fostering a customer-centric approach in line with the FCA’s Consumer Duty.

The Financial Conduct Authority (FCA) has set out rules and guidance for a new Consumer Duty that will set higher and clearer standards of consumer protection across the financial services industry. It aims to ensure that existing best practice around good outcomes for consumers is applied consistently across the industry, with demonstrable evidence of how firms have acted to deliver good outcomes.

The FCA has provided documents which set out the final rules and guidance;

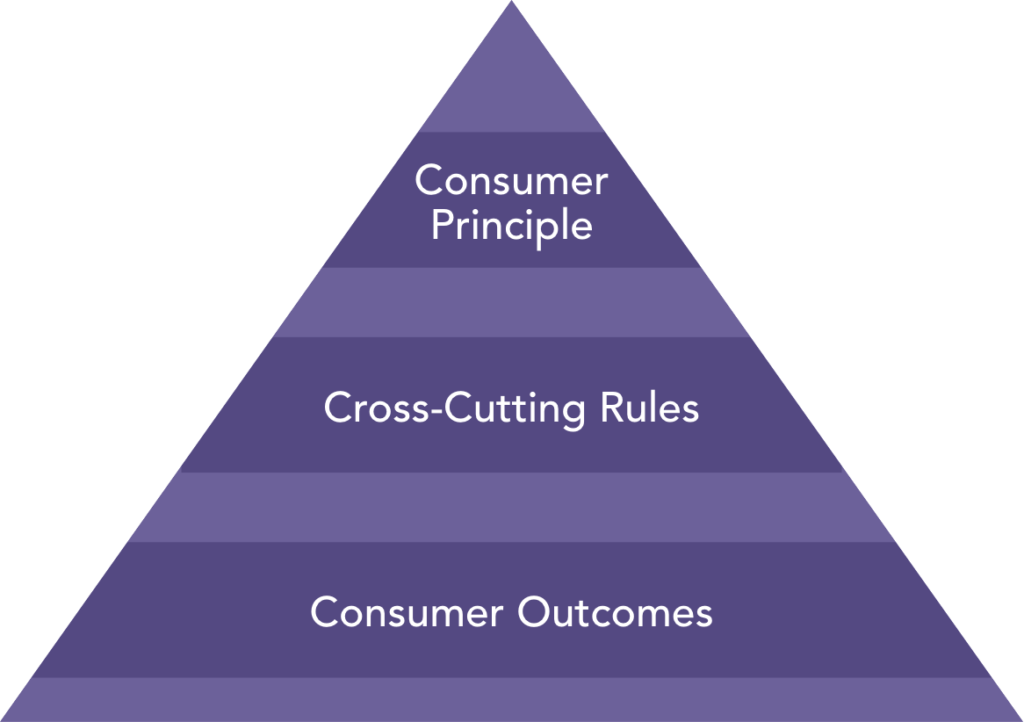

The Consumer Duty is composed of the following elements

Consumer Principle

A firm must act to deliver good outcomes for retail customers.

The Consumer principle is supported by 3 cross cutting rules which develop and clarify the Consumer principle’s overarching expectations of a firms conduct, and set out how it should apply in practice.

Firms must take all reasonable steps to:

- Act in good faith toward retail customers.

- Avoid foreseeable harm to retail customers.

- Enable and support retail customers to pursue their financial objectives.

The ‘four consumer outcomes’

A suite of rules and guidance that set more detailed expectations for a firms conduct in relation to 4 specific outcomes for the key elements of the firm-customer relationship. The outcomes relate to:

- Products and Services – Design products and services that meet the needs, characteristics and objectives of a target group of consumers and ensure that products and services are distributed appropriately.

- Price and Value – Ensure that consumers are receiving fair value, by assessing the price paid for a product or service and the overall benefit a consumer receives from it.

- Consumer Understanding – Deliver communications that meet consumer needs, are likely to be understood by consumers and enable and support them to make effective, timely and informed decisions. In addition, communications must be fair, clear and not misleading.

- Consumer Support – Provide a level of support that meets retail customers needs, including those with characteristics of vulnerability, throughout their relationship with a firm.

ebi has been working hard to ensure it is ready for the new duty, not only to implement the duty across our own business, but also to ensure we provide support to our subscribed financial advisers to help them equally achieve the best outcome for our investors.

31st October 2022

ebi’s board agreed an implementation plan.

30th April 2023

ebi as a product manufacturer completed a review of all products and services to update existing collateral and conduct a value assessment.

31st July 2023

Deadline for compliance with consumer duty for all open products. ebi continues to provide materials and support to help adviser firms meet their requirements.

31st July 2024

Deadline for compliance with consumer duty for closed products.

Ongoing

ebi continues to embed consumer duty

Fair Value Statement

Our latest fair value assessment statement for our Vantage service can be found here.

Our latest fair value assessment statement for our Vital service can be found here.

Target Market Statement

Our latest target market statement for our Vantage service can be found here.

Our latest target market statement for our Vital service can be found here.

ebi’s Managed Portfolio Service would not be compatible with clients who:

- do not have an appointed FCA-regulated financial adviser

- are looking to adopt an active investment strategy

- do not wish to appoint a discretionary investment manager to make investment decisions and manage their investments

- cannot commit to holding the investment for a number of years

- are looking for a guaranteed return

- cannot afford to bear potential investment losses due to market volatility

The investment solutions we offer are available in varying levels of risk from 100% fixed income to 100% equity, low risk to high risk, to cater for individual clients’ attitudes to risk and capacity for loss.

If you would like further information about our approach to Consumer Duty, please get in touch

How ebi can help

Find out how ebi can help support your firm with some of the Consumer Duty requirements.