ebi’s Portfolio Suites; ESG, Factor,

and Sustainable Investment Solutions

ebi’s portfolio suites are designed to meet a wide range of investor needs, including global diversification,

factor-tilting, ESG-screening, and low capital risk investment strategies.

ebi’s portfolio suites are designed to meet a wide range of investor needs, including global diversification, factor-tilting, ESG-screening, and low capital risk investment strategies.

Our flagship Earth portfolio suite combines a number of these strategies. Featuring globally diversified, ESG-screened, and factor-tilted investment portfolios, the Earth suite aligns with long-term financial goals and sustainable investing strategies.

For those seeking a deeper commitment to sustainability, our SRI (Socially Responsible Investing) and Impact portfolios emphasise investing in companies scoring higher in ESG terms relative to their sector peers, and those generating meaningful environmental and social outcomes alongside financial returns, respectively.

Advisers can confidently align portfolios with their clients’ risk appetite, values, and objectives, whether the focus is on capital preservation or growth.

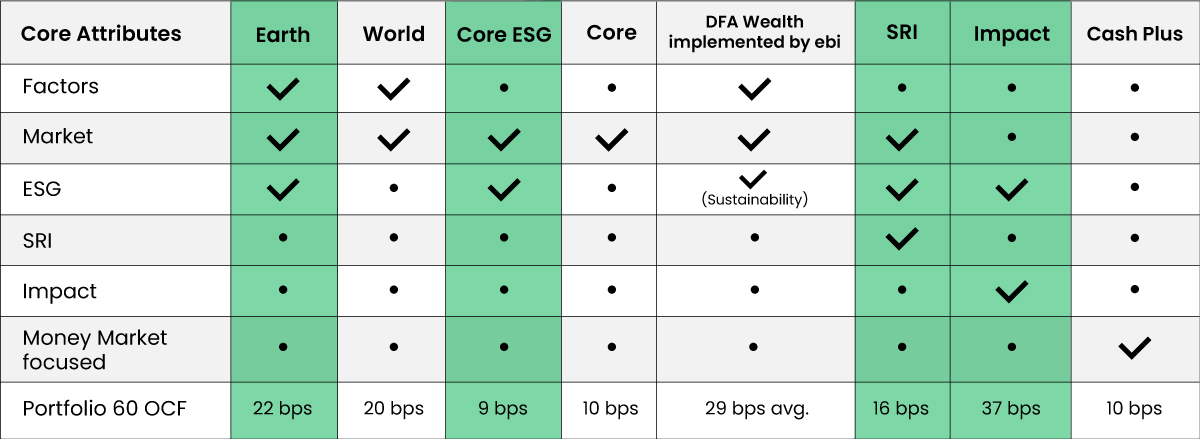

ebi’s portfolio suites at a glance

*Ongoing Charges Figure for the 60% equity portfolio, other than Cash Plus which is a single portfolio solution

Capital is at risk. The value of investments can go down as well as up, and you may not get back the amount you invested. Past performance is not a reliable indicator of future results.

PORTFOLIO SUITE

Earth

The Earth Portfolio Suite embodies ebi’s investment philosophy, offering a globally diversified, ESG-screened, and factor-tilted investment approach. These portfolios are designed for investors seeking a balance between sustainability and financial growth.

The suite invests in index-tracking and rules-based funds screened for ESG criteria. Bond exposure is tilted to a shorter duration than the broader market, enhancing risk management while maintaining alignment with sustainability goals.

PORTFOLIO SUITE

World

The World Portfolio Suite is Earth’s sister portfolio range, providing globally diversified and factor-tilted portfolios.

The suite invests in index tracking and rules-based funds, with its bond exposure tilted to a shorter duration than the wider market.

PORTFOLIO SUITE

Core ESG

The Core ESG Portfolio Suite offers ESG-screened index-tracking solutions. These portfolios aim to broadly replicate the returns of global equity and investment-grade bond markets while adhering to ESG screening criteria.

The suite invests in regional equity funds that track leading ESG indices and includes ESG-screened global bond funds with shorter-duration tilts, balancing risk and return while meeting sustainability objectives.

PORTFOLIO SUITE

Core

The Core Portfolio Suite is ebi’s pure index-tracking solution, with its portfolios seeking to broadly replicate the performance of the global equity and global investment grade bond markets.

The suite invests in a range of index-tracking regional equity funds, and two index-tracking global bond funds tilted to a shorter duration than the wider market.

PORTFOLIO SUITE

SRI

The SRI Portfolio Suite is a range of globally diversified portfolios with a Socially Responsible Investing focus.

The suite invests a range of index-tracking regional SRI equity funds. The equity funds meet the EU Paris Aligned Benchmark minimum requirements and invest exclusively in the top 25% of companies ranked in ESG terms relative to their sector peers. The suite also invests in two index-tracking global bond funds tilted to a shorter duration than the wider market.

PORTFOLIO SUITE

Dimensional Core, Core Plus & Sustainability Wealth Models implemented by ebi

The Dimensional Core, Core Plus and Sustainability Wealth Models are a set of portfolio suites offered by Dimensional and implemented by ebi Portfolios. They provide a research-driven, systematic framework for pursuing a wide range of investment goals.

Dimensional, like ebi, uses decades of academic research and rules-based funds that target specific factors, as opposed to traditional active management where a manager attempts to beat the market. The portfolios are designed for an emphasis on total returns, driven by research-backed drivers of higher expected returns across equity markets (size, value, and profitability).

PORTFOLIO SUITE

Impact

The Impact Portfolio Suite is a range of impact-focused portfolios, aiming to generate positive, measurable, and sustainable social and environmental change, alongside a financial return.

The portfolios are made up of index-tracking global impact equity ETFs, investing in companies whose products and services aim to address critical global challenges, and an index tracking global green bond fund, investing in bonds where the proceeds are applied to projects or activities focused on climate and environmental activities.

PORTFOLIO SUITE

Cash Plus

The Cash Plus Portfolio is a single portfolio solution designed for investors seeking a combination of yield, liquidity, and low capital risk. Ideal for those prioritising capital preservation, this solution provides an efficient approach to low-risk investing.

*The information in ebi’s portfolio suite brochures is accurate as of the publication date indicated on each document.

Capital at risk. The value of investments can go down as well as up, and you may not get back the amount you invested. Past performance is not a reliable indicator of future results. Equity investments are subject to market fluctuations, which can result in significant capital losses. Bond prices are sensitive to interest rate changes. If interest rates rise, bond prices typically fall, which can result in capital losses. ESG investments, while aiming to consider environmental, social, and governance factors, may not outperform traditional investments. High-risk investments carry a greater risk of capital loss and may not be suitable for all investors. This information is for financial professionals only.

Request More Info on ebi’s portfolio suites

Adviser FAQ’s

1. What is factor investing, and how is it incorporated into ebi portfolios?

Factor investing targets key drivers of higher expected returns, such as size, value, and profitability. ebi integrates factor investing into portfolios like the Earth and World suites, enabling advisers to offer clients globally diversified, research-driven solutions that aim to enhance long-term performance potential.

2. What is impact investing, and which ebi portfolios align with this strategy?

Impact investing focuses on delivering measurable social and environmental outcomes alongside financial returns. ebi’s Impact Portfolio Suite may be suitable for clients seeking to invest in companies and projects addressing global challenges, such as climate change and sustainable development, through vehicles like global impact equity ETF’s and green bonds.

3. How can ebi simplify portfolio management for advisers?

ebi offers a comprehensive range of portfolio suites designed to meet diverse client objectives, from low-risk options like Cash Plus to ESG-screened and factor-tilted strategies. These solutions enable advisers to align portfolios with clients’ risk appetites, values, and financial goals.

In addition, ebi’s in-house tolerance-based rebalancing strategy helps maintain risk, enhance performance, and reduce time out of the market.

4. What does ebi offer to sustainability focused investors?

ebi offers several solutions for sustainability-focused clients:

- Earth Portfolio Suite: Balances ESG screening, factor investing, and global diversification for clients seeking long-term growth aligned with sustainability principles.

- Core ESG Portfolio Suite: Provides ESG-screened, index-tracking portfolios with robust sustainability criteria.

- SRI Portfolio Suite: Focuses on socially responsible investment strategies by adhering to the EU Paris-Aligned Benchmark and investing exclusively in companies with top ESG rankings, ensuring ethical alignment alongside financial goals.

- Impact Portfolio Suite: Delivers measurable social and environmental impact through investments in global impact equity ETFs and green bonds, addressing clients’ demand for impactful, purpose-driven investing.

- Dimensional Sustainability Wealth: Invests in funds that generally seek to reduce exposure to firms with less sustainable business practices and focus on key environmental considerations, such as greenhouse gas emissions and potential emissions from fossil fuel reserves.

Advisers can leverage these solutions to meet the growing demand for sustainable investment options while ensuring financial performance aligns with clients’ objectives and regulatory expectations.