Consumer Duty – how ebi can help

The Financial Conduct Authority’s (FCA’s) Consumer Duty is a significant shift in regulation across the finance industry. The Duty aims to set higher and clearer standards of consumer protection across financial services. Through outsourcing your Centralised Investment Proposition (CIP), ebi can help support your firm with some of the Consumer Duty requirements.

We are delighted to be an Affiliate Member of the Consumer Duty Alliance

As an Affiliate Member of the Consumer Duty Alliance, we are committed to supporting

the financial services sector in delivering excellent outcomes for consumers.

We contribute to the Alliance’s mission of promoting best practices, sharing expertise,

and fostering a customer-centric approach in line with the FCA’s Consumer Duty.

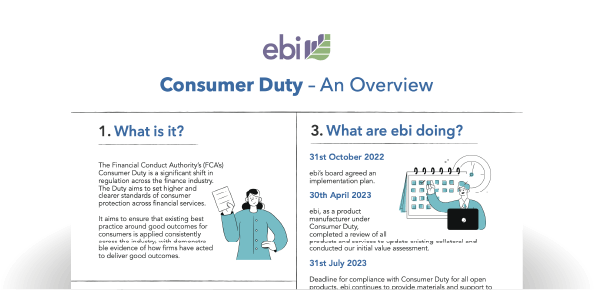

What is Consumer Duty?

The Financial Conduct Authority (FCA) has set out rules and guidance for a new Consumer Duty that will set higher and clearer standards of consumer protection across the financial services industry. It aims to ensure that existing best practice around good outcomes for consumers is applied consistently across the industry, with demonstrable evidence of how firms have acted to deliver good outcomes.

Download our

Consumer Duty infographic

An easy to understand infographic detailing the

new rules surrounding Consumer Duty.

ebi can support your advice firm in the following ways

• a streamlined investment process whilst maintaining adviser role

• more time to spend on client focused activities

• access to lower cost funds

• support materials and tools to use with your clients

• tolerance based rebalancing

• access to investment expertise

How ebi supports its members

ebi has a fiduciary duty to act in the best interest of its clients and to manage its model portfolio service and solutions in a responsible and transparent manner.

How ebi can help you demonstrate this:

• Tolerance based rebalancing – parameters set for each portfolio aim to ensure that investors maintain the chosen level of risk.

• Fund Choice Due Diligence which ebi shares with its members.

• Insight reports – portfolio comparison reports. Request a demo.

• Our passive evidence based investment philosophy is grounded in low cost globally diversified portfolios.

• ebi offer a range of portfolio solutions for various client segments.

• Track record of seeding new funds to deliver better client outcomes, such as our market first ESG bond funds.

• Ability to work with firms either under Agent As Client or Reliance on Others.

ebi are transparent about fees and charges

ebi are clear with the costs associated with its Model Portfolio Service, and seek to reduce costs where possible.

How ebi can help you demonstrate this:

• Access to lower cost share classes

• Negotiated discounts on some platforms.

• Factsheets which are co-brandable

• Core data, which breaks down all costs associated with our models at fund level.

• Features within ebi’s cashflow modelling tool aims to help advisers demonstrate their value. Request a demo.

• The outcome of ebi’s Fair Value Assessment is it offers fair value.

Demonstrating that your firm communicates clearly and

effectively with clients is a key Consumer Duty requirement

How ebi can help you demonstrate this:

• Adviser presentation tools supporting client conversations e.g. capacity for loss, benefits of diversification via tools such as Randomness of Returns is designed to present complex information in a visually friendly and digestible format.

• Co-branded client focused, transparent communications during periods of market volatility.

• Client facing collateral including brochures, infographics, market commentaries and blogs.

Outsourcing your CIP to ebi could save you more than 20% of your

time spent on managing assets and portfolio management (1)

Additional benefits include:

• Full access to ebi’s technology suite, including our cashflow modeller and risk profiler. Request a demo.

• Own brand portfolios available via White label and Partner Portfolio Service. Download our brochure.

• Co-branded marketing collateral.

1. Online – How to choose the right TAMP for your Advisory Business, Orion Portfolio Solutions