March Economic Background

• U.S and UK interest rates remain unchanged while Japan ends era of negative rates.

• Chancellor Budget Announcement on 6th March.

• UK inflation falls to 3.4% year-on-year in February.

• Commodity prices jump amid attacks on Russian energy facilities.

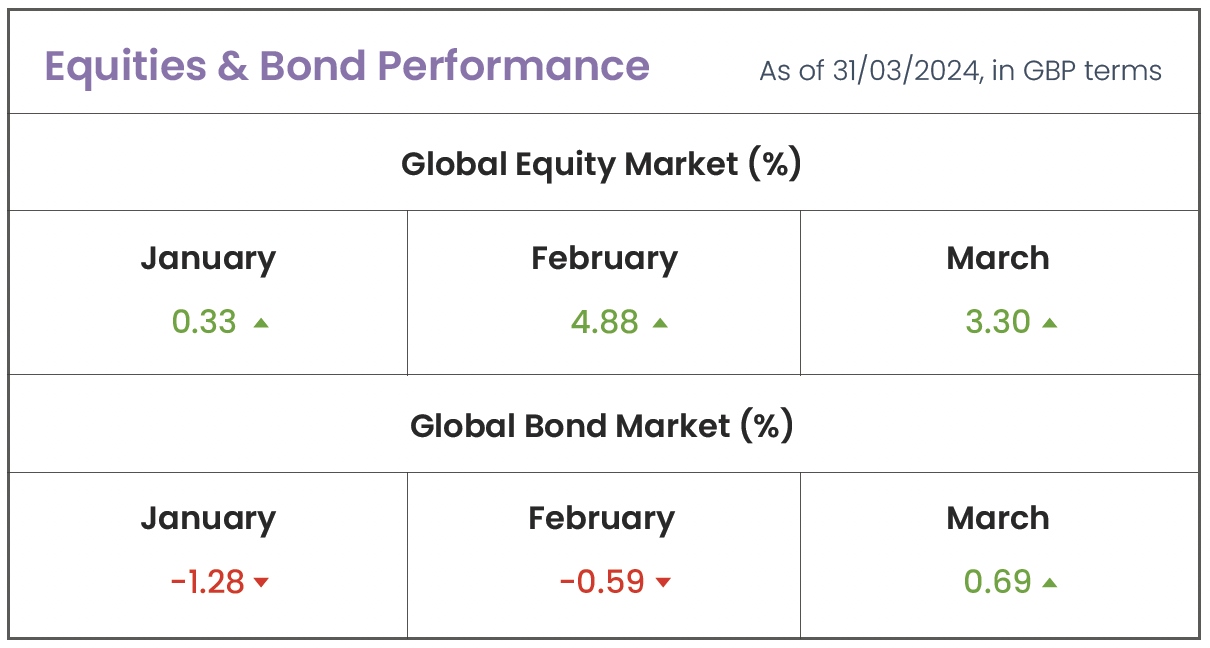

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

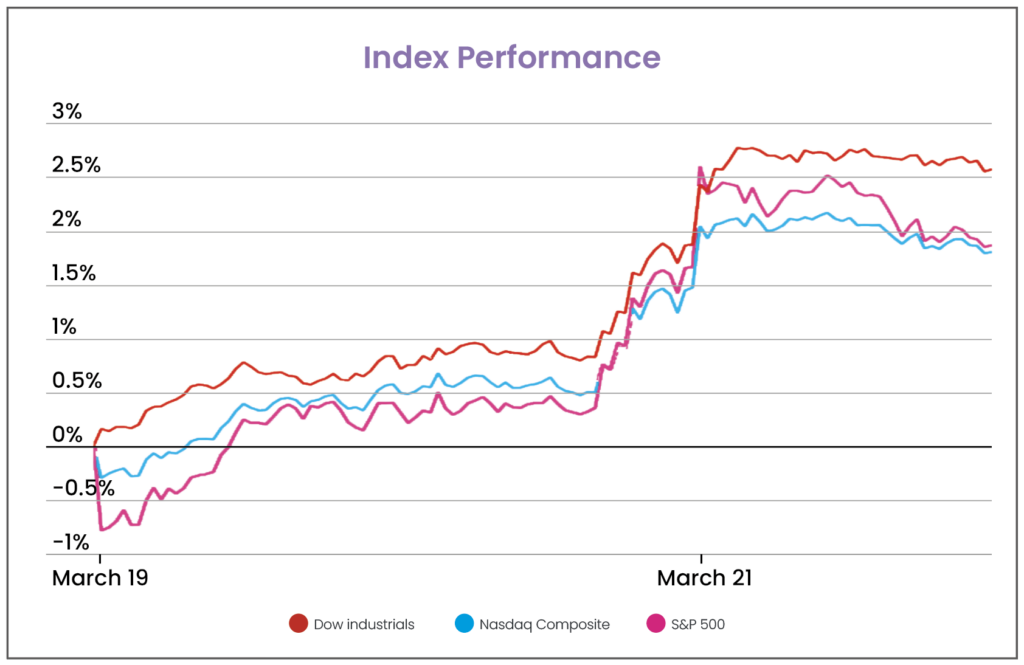

Interest Rates: During a busy week for central banks, the Bank of Japan (BoJ) made headlines by announcing its first interest rate hike since 2007, marking the end of its negative interest rate policy which commenced in 2016. Negative rates were implemented to spur loan demand by reducing borrowing costs and to stimulate the economy by incentivising consumer spending rather than saving. The following day, on March 20th, the Federal Reserve (Fed) opted to maintain its rates at a 23-year high of 5.25-5.5%, triggering a positive response from stock markets and propelling U.S. equity markets to historic highs. All three major U.S. stock indexes achieved record closings as Fed officials reaffirmed their anticipation of interest rate reductions later in the year. Meanwhile, the Bank of England (BoE) convened a day later, on March 21st, also deciding to hold rates at 5.25% amidst a drop in inflation to 3.4% year-on-year in February, down from the 4% recorded in both January and December, falling below market expectations of 3.5%.

Source: Factset

Chancellor Budget Announcement: Following Chancellor Jeremy Hunt’s midday speech disclosing the spring budget, the FTSE 100 showed relative stability, hinting at a lack of noteworthy surprises. By the session’s close, it had gained 33.15 points, representing a 0.43% increase, reaching 7,679.31. A notable aspect of Hunt’s budget was the introduction of a British ISA, providing investors with an additional tax-free allowance of £5,000 specifically designated for UK equities once they hit the current yearly limit of £20,000. This proposal elicited mixed reactions, with some expressing skepticism about its effectiveness due to the restricted number of wealthy investors who could take advantage of the additional allowance. In contrast, some raised concerns that it could encourage investors to concentrate their investments solely on one market rather than diversifying their portfolios. Further announcements included highly anticipated measures such as a 2p reduction in national insurance contributions and revisions to the “non-dom” tax regime. The pound exhibited a subdued initial response and UK government bonds (gilts) remained relatively stable. This was attributed to the government’s borrowing plans for the upcoming financial year aligning closely with expectations, thus avoiding a repetition of the volatility witnessed following the interim budget issued in September 2022 under then-finance minister Kwasi Kwarteng.

Oil & Gas Price Rise: Ukraine’s persistent drone assaults on Russian oil refineries are continually elevating the risk premium within the oil market as both nations’ assaults on energy infrastructure are casting doubt on the stability of oil and gas supplies. As concerns mount over dwindling supplies and the perpetual volatility in the Middle East, speculative bets on global oil prices persist in an upward trajectory, as ongoing attacks increasingly threaten oil production capacity. Despite facing western sanctions, Russia maintains its status as one of the world’s primary energy exporters. However, apprehensions arise among the U.S. and several other nations across Europe as Ukraine’s targeting of Russian facilities, some located hundreds of miles from the border, risks provoking retaliation from Russia, potentially impacting energy infrastructure crucial to the West. These concerns coincide with Biden’s challenging re-election bid amidst soaring petrol prices, having surged nearly 15% this year to approximately $3.50 per gallon. Although Europe’s refineries have faced long-term decline due to major oil companies closing plants to align with net-zero emissions goals and combat the rise of electric vehicles (EVs), the ongoing conflicts in Ukraine and tensions in the Red Sea have shifted energy analysts’ perspectives. They currently foresee a promising outlook for European refineries, driven by increased margins that could increase even further in the face of additional supply shocks, however this doesn’t come without further risks, as volatility in the sector remains significantly elevated.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024