Do political events impact financial markets? In May, Prime Minister Rishi Sunak announced a general election would be taking place on 4th July 2024, the first summer election to be held in the UK since 1945. At the time of writing, the Labour party are predicted to win around 42% of the vote, with the Conservatives standing on 21%, suggesting a strong chance there will be a new majority in parliament next month, and a new Prime Minister in Downing Street.

Naturally, whenever there’s uncertainty in the political landscape, investors begin to wonder how these changes will impact their portfolios, and some will even try to use it to their advantage. However, as a discretionary fund manager with a passive buy-and-hold approach, ebi does not make short-term tactical decisions regarding market performance, nor does it use market uncertainty to try and boost returns. Our philosophy incorporates the Efficient Market Hypothesis (EMH) which states that all publicly available information is already incorporated into market prices, and that only genuine surprises will cause the markets to readjust. Simply put, we think the only way to use an upcoming event to your benefit is to know something that all other market participants don’t. Second guessing market trends and making active trades will, on average, lead to lower overall returns compared to a strategy that ‘rides’ the general upward trend of the market over long-term time horizons.

Nevertheless, ebi’s investments are impacted by market performance, which in turn are dependent upon real-world events, and we understand that over the coming weeks, clients may have questions about whether the general election this summer will impact their investment performance. Asking whether politics impacts investment performance is a nuanced question, depending on context, location, timing, and the current state of the financial markets. As we’ve seen over the last few years, geopolitics can certainly have consequences for investment returns. For example, Russia’s invasion of Ukraine in 2022 has been an important factor in spiking energy prices around the world, causing major disruptions to financial markets. Global events like these can have an impact on investment portfolios, as suggested by the EMH, by virtue of them being unpredictable and therefore creating unanticipated price swings across markets. But does national politics have the same impact for UK residents that these unforeseen geopolitical events do?

While elections are known about in advance, their results aren’t, and therefore future fiscal policy (which can heavily influence the financial markets) remains uncertain. The two major political parties in Britain do tend to have different approaches to fiscal policy. Left-wing parties tax more and spend more, whereas right-wing parties typically tax less and spend less. The lower taxes implemented by a fiscally conservative government tend to increase companies’ earnings, and because equity prices fluctuate according to the market’s expectations of these future earnings, it follows that corporations, and therefore financial markets, should, in theory, tend to do better under more fiscally conservative governments. However, the counterargument made from the left, particularly recently, is that poor decision making by ruling conservative parties, has led to a range of knock-on impacts including elevated inflation and a degradation in living standards, which has led to a poorer overall environment for business.

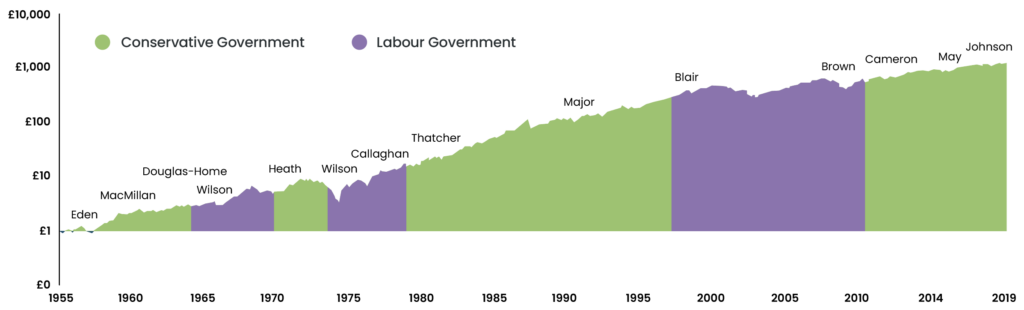

The chart below shows how £1 invested in the FTSE All Share Index has grown between 1955 and 2019 and clearly demonstrates an upward trend, regardless of the party in power. There are various reasons for this, including the increasingly globalised nature of business, meaning the impact of UK economic policies has reduced significantly compared to earlier in history. Additionally, the case can be made that monetary policy conducted by central banks such as the Bank of England, has a greater impact than fiscal policy conducted by ruling governments. As one example, in response to the COVID-19 pandemic, the Bank of England conducted another round of a quantitative easing which led to purchasing an additional £450bn of gilts – it could be argued that this had just as significant an impact on stock market returns as decisions made by the government around the same time.

Growth of Pound invested in the FTSE All-Share Index (Jan 1955 – Dec 2023)

Investors could expect there to be a limited relationship between who occupies Downing Street and the performance of UK markets over the coming decades. It would also be a reasonable assumption that the major party in power will keep switching over time as it has previously (though, clearly, there is variation in the length of political tenures), implying that it’s futile. Making investment decisions over the course of years or decades based on who happens to be in office at any given time.

However, it should be noted that there are specific instances in which party leadership can have a significant and rapid short-term impact on financial markets. The clearest example in recent times being Liz Truss and Kwasi Kwarteng’s September 2022 mini-budget, which caused a spike in UK government yields and significant destabilisation in the UK defined benefit pension scheme market (which is focused on liability-driven investing, based on UK government yields).

Another consideration is how the general election might impact the value of the pound (GBP) relative to other currencies. The pound tends to strengthen when the market considers an event to be beneficial for the economic future of the UK, and weaken when the market deems an event to likely have negative net consequences. For instance, when the UK voted to leave the European Union on 23rd June 2016, the value of the pound slipped from $1.50 US dollars (USD) when polling stations closed to $1.33 when it became clear that the majority of the public had voted to leave. This depreciation was simultaneously mirrored relative to other major world currencies too, such as the euro (EUR), and represented the market’s estimation of the impact it thought Brexit would have on the earnings potential for British business.

Though this example demonstrates the impact that political events can have, it is by no means an indication that the upcoming general election will have an effect of the same magnitude. For one thing, the impact of a general election is almost certainly considered by the markets to be less consequential than Brexit in the long term, and secondly, it’s the uncertainty about the future that causes foreign-exchange market volatility, and there is considerably less uncertainty about the result of the upcoming election than there was about the implications for Britain’s future in the days following the Brexit vote.

When we take a step back, the global diversification of ebi’s portfolio, as well as their broad alignment to the geographic distribution of the world’s financial markets,, it is unlikely that the UK election in July will have large consequences on performance for investors in our portfolio solutions, regardless of the outcome of the election. The UK makes up roughly 4% of global equity markets, and we hold broadly the same allocation to the UK in our portfolios (the major exception to this being our UK-biased portfolios, which purposefully overweight UK equities for those investors who wish to hold such a position). The true importance of UK-based companies in our solutions is further reduced by globalisation, with a significant proportion of revenue for companies listed on the London Stock Exchange coming from abroad. Nevertheless, we encourage investors who are invested in UK-biased portfolios to remain invested for the long term, and not to become ‘spooked’ by any financial volatility linked to the general election. There will be market participants who attempt to use the election to their advantage, and while some may be successful, this will be due more to luck than judgement, assuming they have the same information as other market participants.

In conclusion, whilst UK general elections can cause sudden ‘bumps’ in markets if their results are unexpected, it’s virtually impossible to actively use these fluctuations to an investor’s advantage. As such, we believe the benefits of adopting a truly globally diversified approach stand both the tests of logic and time, and we will continue to invest in this manner within our solutions.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- Q2 Market Review 2025

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025