February Economic Background

• The S&P 500 and Nasdaq hit records marking the best February in nearly a decade.

• UK interest rates remain unchanged, and inflation holds steady at 4.0%.

• Wins for Trump and Biden amid court appearances and Israel controversy.

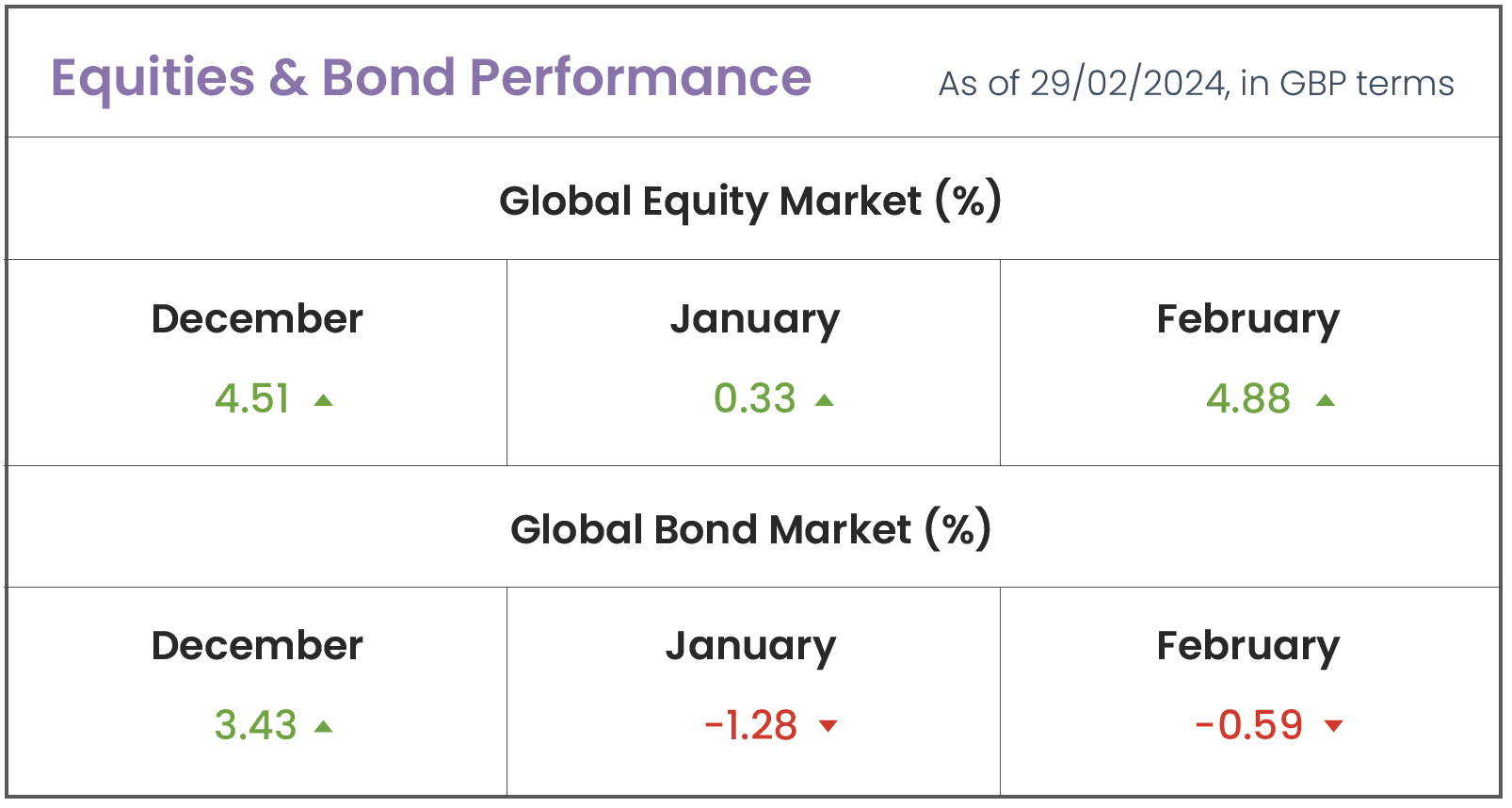

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

U.S Rally: U.S Rally: U.S stock markets rallied as the S&P 500 and Nasdaq concluded with the most robust February performance in nearly a decade, as investors processed pivotal inflation metrics. In January, the fundamental Personal Consumption Expenditures (PCE) index, excluding food and energy costs and favored by the Federal Reserve (Fed) as an inflation benchmark, climbed 2.8% over the last year. This marks the slowest annual rise since March 2021’s 2.2% increase. Fed officials have indicated that they don’t require more favorable inflation news to lower interest rates, just continued good news, which bolstered U.S equities. The tech-heavy Nasdaq ended a streak of 569 trading days without a record close, the longest since the bursting of the dot-com bubble in March 2000 through April 2015, ending February on 16,091.92. Meanwhile, the S&P 500 closed out the month with gains of 6.0% after posting 0.5% on the final trading day (Thursday 29th), as investor optimism about artificial intelligence continues to fuel surges in heavyweight tech stocks such as Nvidia, who surged 25.5% in the month.

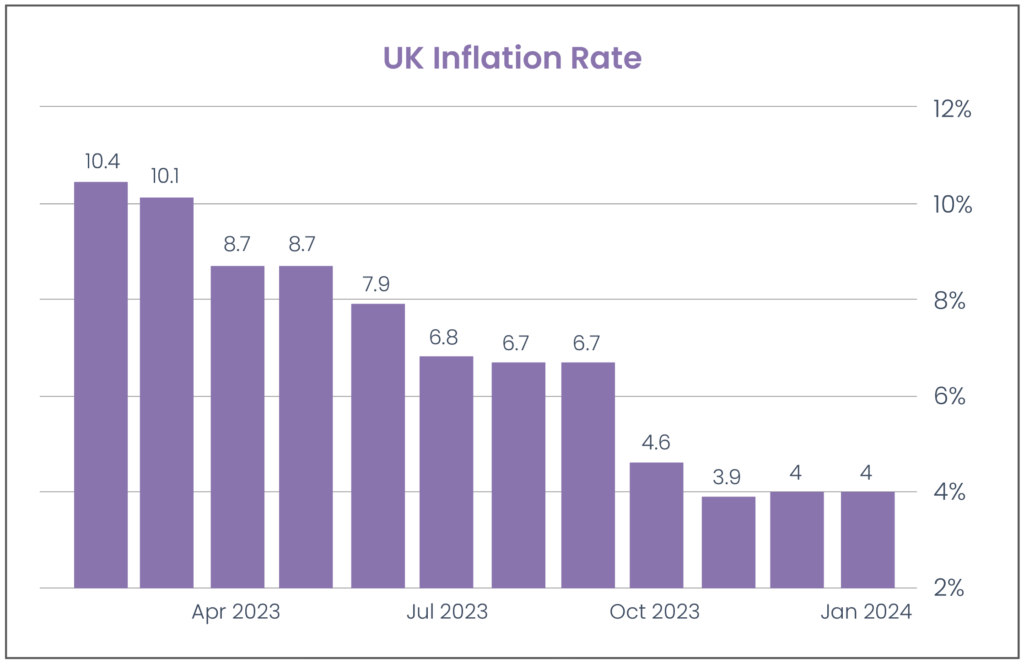

UK Economy: In January 2024, the UK’s inflation rate held steady at 4.0%, holding close to the two-year low recorded in November and falling below market expectations of 4.2%. As supply chains normalised and diversified to replace imports from Russia, retailers intensified their competition to maintain competitive prices. This development was welcomed by consumers, as noticeable areas of price deceleration include food and non-alcoholic beverages (6.9% compared to 8.0% in December), and furniture and household goods (0.4% compared to 2.5%). Nevertheless, inflation remains twice the Bank of England’s (BoE) target of 2.0%, reinforcing the BoE’s decision to keep rates unchanged at 16-year highs of 5.25%. Albeit, two policymakers advocated for a 0.25% increase, while one member favoured a decrease of 0.25%. Bank officials emphasised that monetary policy must maintain a restrictive stance for an adequate duration to effectively bring inflation back to the 2% target in the medium term, despite inflation risks being more evenly balanced than we’ve seen previously.

Source: Trading Economics

U.S Election Race: It looks ever more likely that the U.S presidential race, which will culminate in election day on 5th November this year, will be contested between President Joe Biden and Republican candidate Donald Trump, who this week won a landslide in the Michigan Republican primary with 68.1% of the vote. Trump’s closest rival, Nikki Haley, has since had funding halted from a Koch brothers backed network, piling pressure on her run for the nomination. Despite political controversy and multiple state and federal court cases, Trump remains well placed to clinch the nomination at the Republican National Convention in July. On the left, there is currently no viable alternative to Biden, despite questions having been asked in the media concerning his mental health after he recently was labelled as an ‘elderly man with poor memory’ by special council, Robert Hur, and mistaking the names of the Egyptian and Mexican presidents in the subsequent press conference. Despite a protest vote in the Michigan primary this week where 100,000 voters voted ‘uncommitted’ as a rebuke of the White House’s support of Israel in the ongoing conflict in the Middle East, Biden still won the primary with 81% of the vote. In a shock development at the end of February, the Supreme Court, which is currently weighted 6-3 in favour of the Republicans, voted to hear Trump’s claim of presidential immunity whilst a presidential candidate. The case looks set to rumble on deep into the election, further complicating a race in which there appears to be no popular candidate.

A Trump presidency could likely have an impact on global markets once elected owing to his perceived softer stance on Russia’s war in Ukraine, recently saying that he’d encourage Russia to attack NATO allies who do not pay their contributions to the military partnership. Russian forces have made gains in eastern Ukraine so far this year, and the U.S, UK and Germany were among NATO allies this week to reject the idea of deploying NATO troops to Ukraine after it was suggested by French President, Emmanual Macron, that ‘nothing should be excluded’.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024