May Economic Background

- UK interest rates remain unchanged at 5.25%.

- Market concentration highlights the importance of diversification.

- Trade tensions rise as new U.S-China tariffs are imposed.

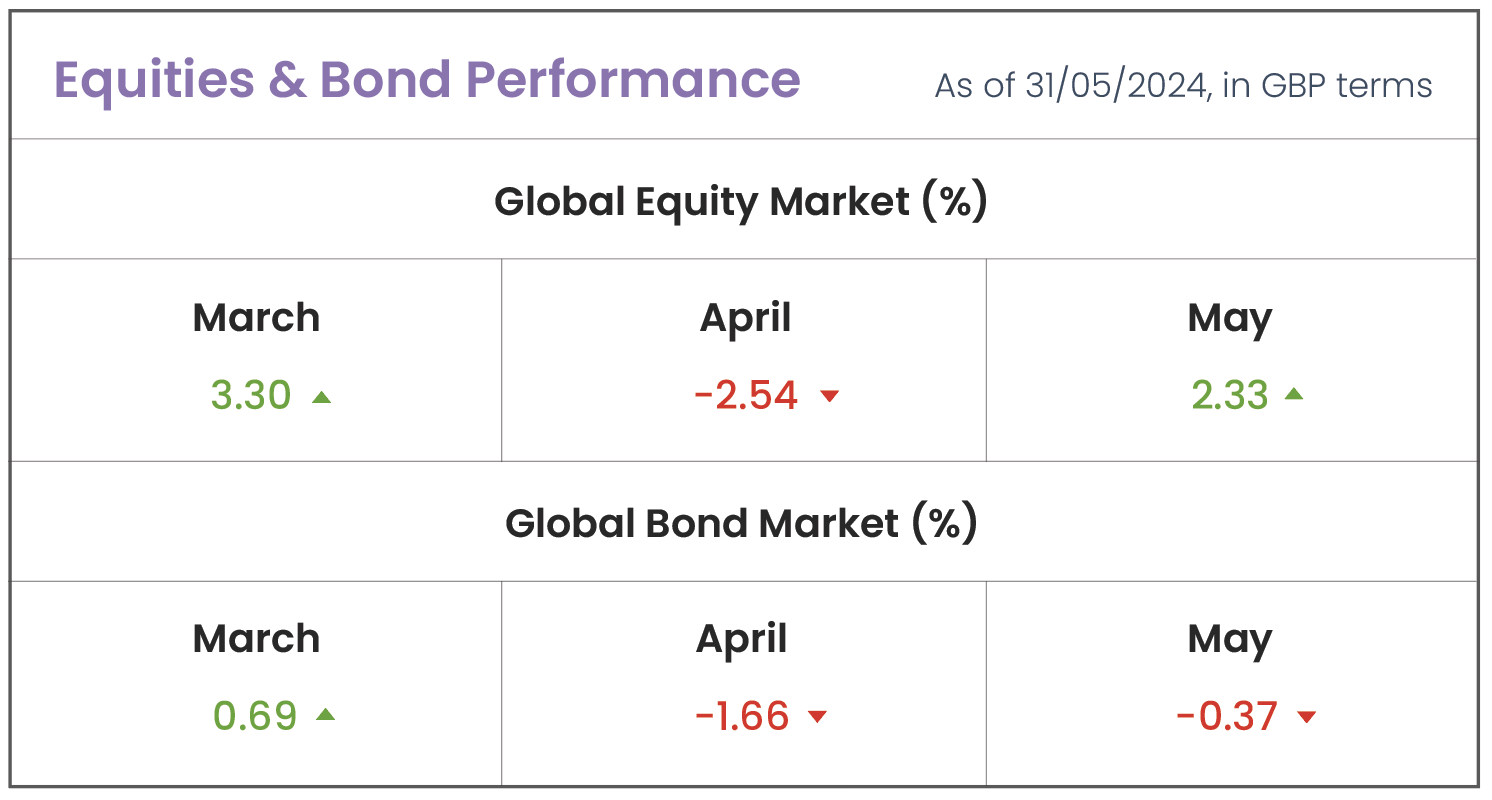

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

Interest Rates: On May 9th, the Bank of England (BoE) announced that interest rates would remain at 5.25%, the highest level since 2008 and in line with expectations. Notably, two committee members favoured reducing rates by 0.25%, up from just one member in the previous meeting. Officials also revised down the inflation forecast while boosting the growth outlook, economic conditions which generally support rate cuts. Bank governor, Andrew Bailey, stated, “It’s likely that we will need to cut interest rates over the coming quarters, possibly more so than is currently priced into market rates.” This positive news coincides with UK inflation (2.3%) falling to its lowest level since July 2021, edging closer to the 2% target. The BoE’s possible first rate cut in four years holds political significance ahead of this year’s general election, as the UK economy emerged from last year’s technical recession with a surprising 0.6% growth in the first quarter of 2024, the highest quarterly growth in two years. As the general election nears, this encouraging economic data supports Rishi Sunak in convincing voters that the UK is recovering from the cost-of-living crisis. Albeit, the UK economy has only grown by 1.7% since the fourth quarter of 2019, just before the pandemic. This is significantly lower than the 8.7% growth seen in the U.S. and 3.4% growth in the Eurozone during the same period.

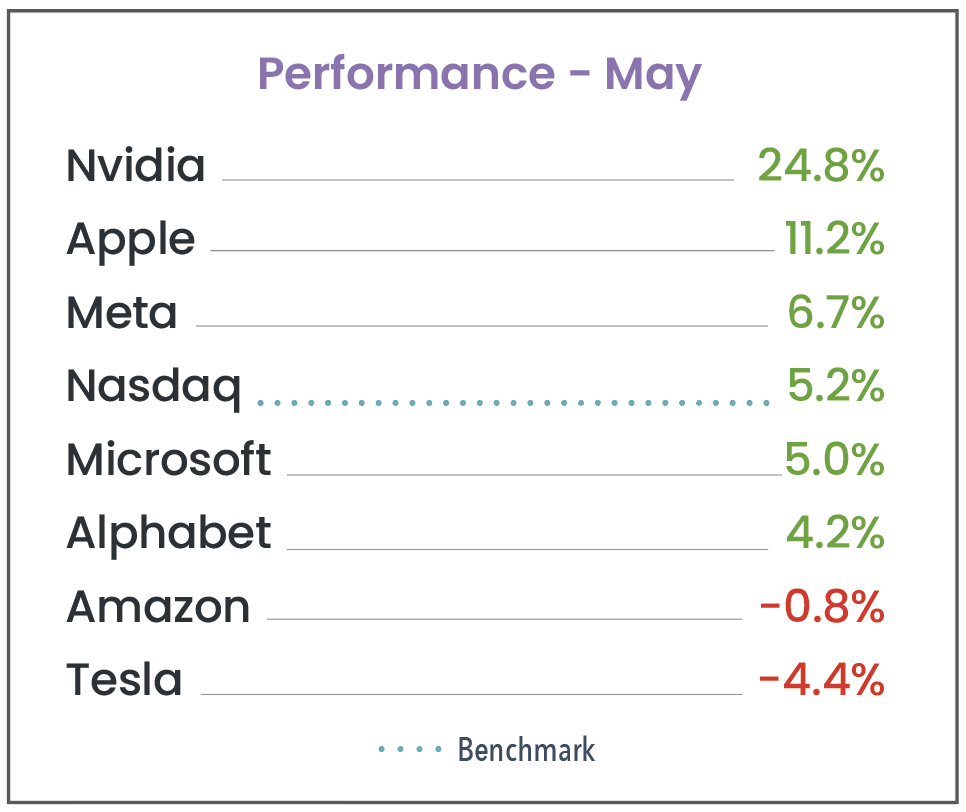

Magnificent Seven: Artificial Intelligence (AI) continues to be a major focus for investors watching the “Magnificent Seven”, as the group saw impressive gains in 2023 but have recently shown signs of slowing down. Four of the seven companies (Tesla, Amazon, Alphabet, and Microsoft) have underperformed the Nasdaq Index this month, meanwhile Nvidia, Apple, and Meta have outperformed. Nvidia stands out as the only exception, however there are still mixed opinions among investors; some regard it as an inflated bubble on the brink of collapse, while others regard it as a pioneering force in the realm of AI. Market concentration and the dominance of major stocks hasn’t been this pronounced since the Dot-Com Bubble, a period marked by technological innovation and market optimism. Given historical patterns where market leadership tends to change over time, it simply highlights the importance of remaining well diversified so that investors are well positioned to experience both the ups and downs of the stock market.

(Magnificent Seven: Nvidia, Apple, Meta, Microsoft, Alphabet, Amazon, Tesla). The Nasdaq Composite Index is a market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the technology sector.

Source: Morningstar. Data as of 31/05/2024

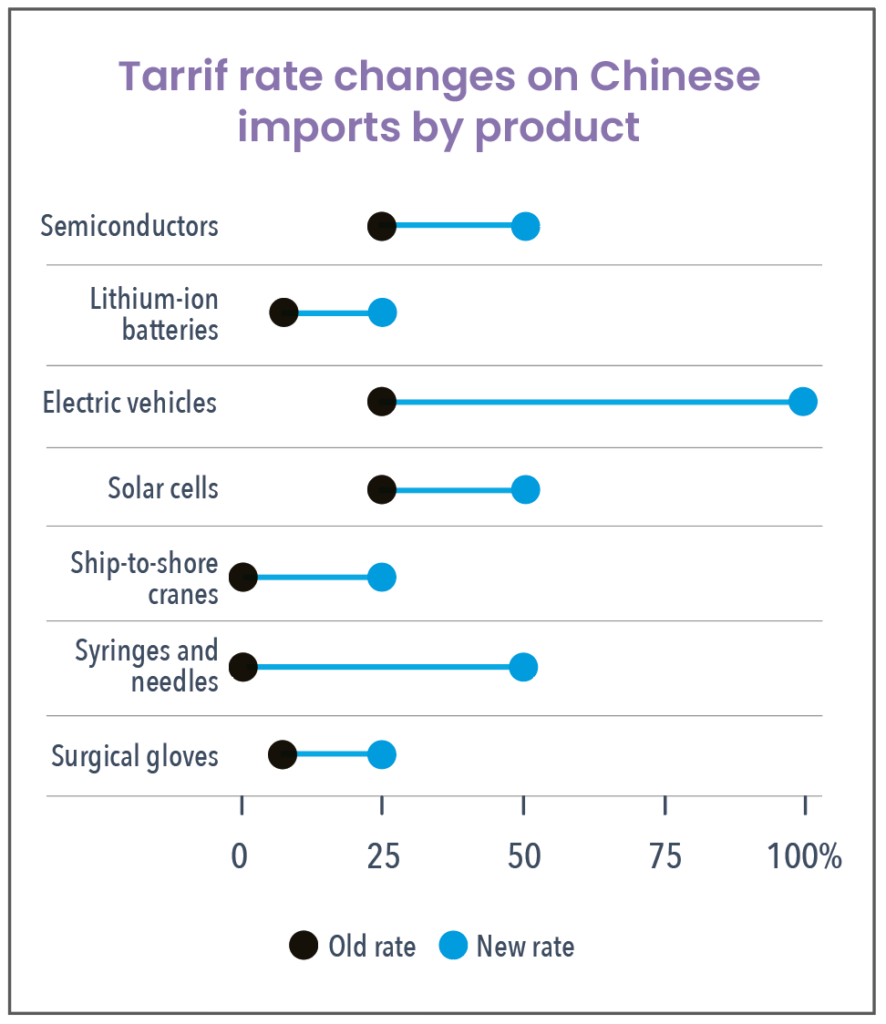

U.S-China Trade Tensions: Prior to the U.S. elections, President Joe Biden is significantly ramping up tariffs (a form of import tax) on Chinese imports as a measure to safeguard American jobs. The sharp rise in tariffs comes amid mounting concern that China could flood the U.S market with cheap electric vehicles (EVs), threatening the American car industry. Despite only 2% of imported EVs coming from China, higher tariffs will make it more expensive for Chinese companies to export goods to the U.S, providing American manufactures more time to develop the technology to compete with China. Biden emphasised, “Whether it’s gas, electric or hybrid, we’re never going to allow China to unfairly control the market for these cars” and later announced plans to quadruple tariffs on Chinese EVs to 100% by the end of the year.

Source: Northern Trust

Increased tariffs on EVs are anticipated to have minimal direct impact, given the limited flow of Chinese imports into the U.S. market. Nonetheless, this move by Biden signals a shift towards greater independence, aiming to lessen reliance on China. Meanwhile, across the pond, analysts warn of Germany’s heavy dependence on China, suggesting that it could take decades for German manufacturers to lessen this reliance, considering the deeply entrenched global supply chains that have been developed over the past 50 years. With China being Germany’s primary trading partner, some investors view this relationship as a vulnerability. Consequently, akin to the U.S., German companies might adopt a strategy of reducing their dependence on China and imposing tariffs of their own.

Ultimately, escalating trade tensions between major economies like the U.S. and China can increase geopolitical risks. Such tensions can lead to policy changes, tariffs, and sanctions that can impact global trade and economic stability, causing greater market volatility. This further highlights the importance of diversification in order to minimise exposure to any single risk.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024