April Economic Background

- UK CPI inflation eases to 3.2%

- Congress passes bill in support of Ukraine

- Japanese yen falls to lowest level since April 1990

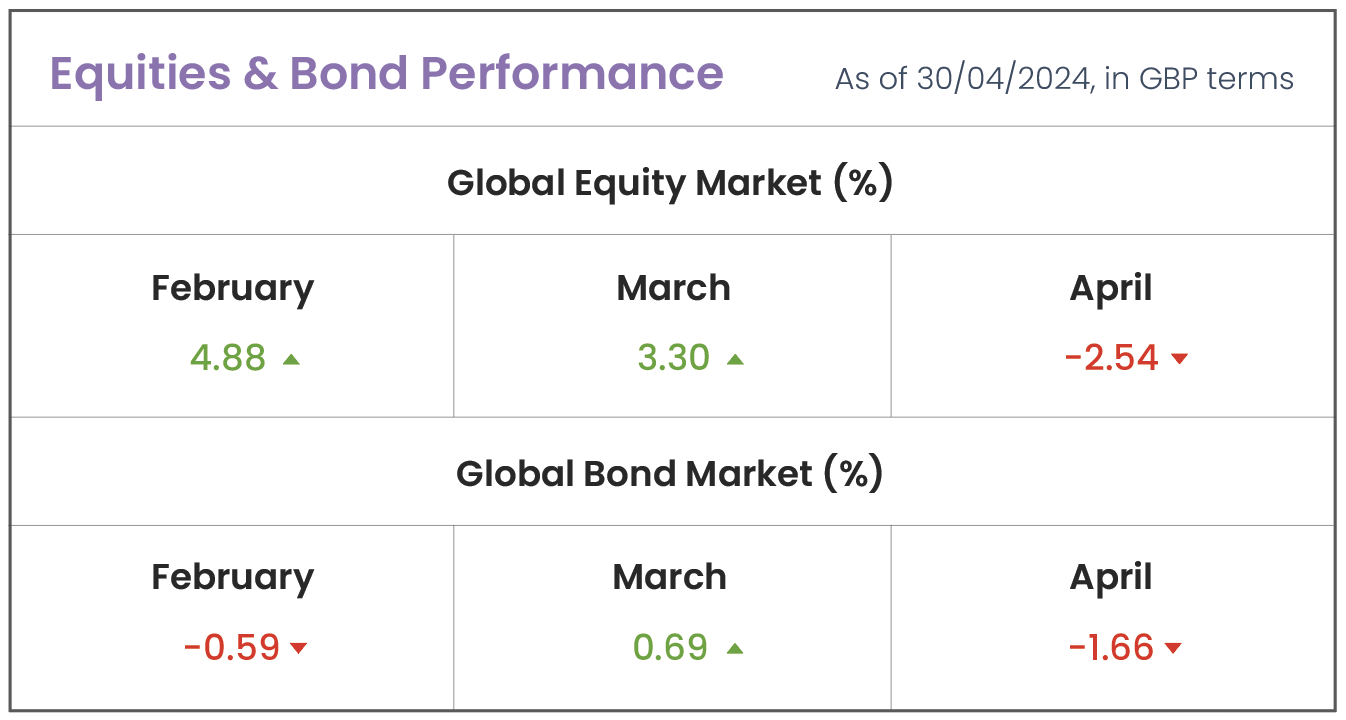

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

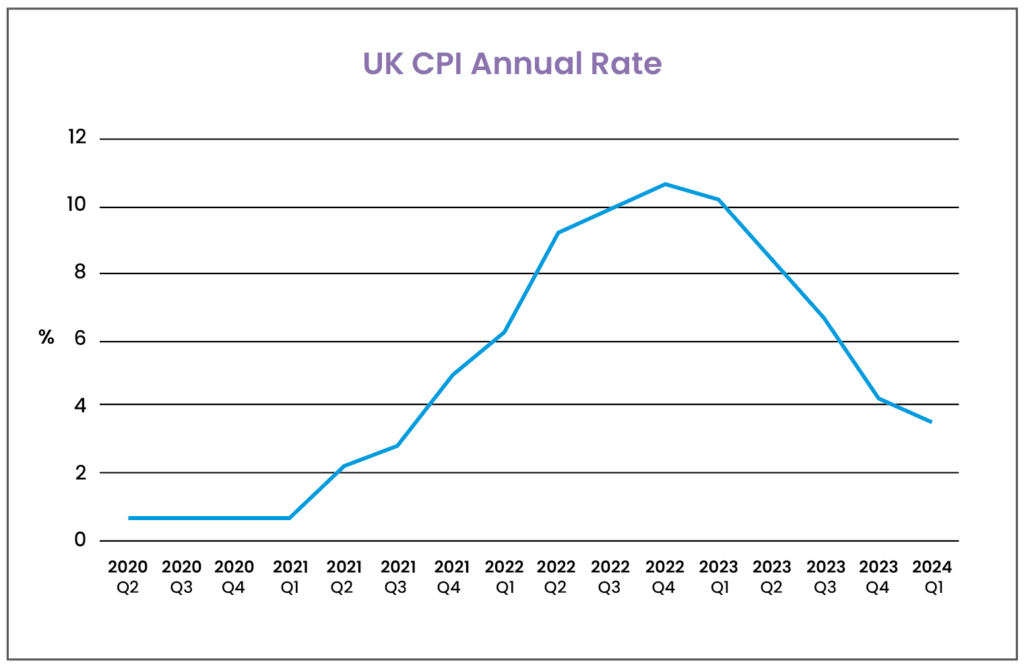

Interest Rates: On 17th April the Office for National Statistics’ (ONS) latest report on the Consumer Prices Index (CPI) stated that UK CPI had fallen to 3.2% in the twelve months to March 2024, down from 3.4% in February. Similarly, Core CPI (an index excluding the more volatile food and energy prices) was down from 4.5% in February to 4.2% in March, a reduction driven in part by the Bank of England’s (BoE) continued elevated interest rate regime.

Whilst it’s widely anticipated that the BoE will begin to reduce interest rates, analysts remain divided on whether this adjustment will occur during the summer months (following the Monetary Policy Committee’s meetings in June and August) or later in 2024. The U.S Federal Reserve (Fed) and the European Central Bank (ECB), institutions the BoE typically aligns with to maintain the competitiveness of the pound, continue to maintain high rates compared to recent history, with the first U.S rate cut now not priced in until September, following more persistent inflation than expected.

Source: UK Office for National Statistics

Congress continues to fund war effort in Ukraine: In April, U.S Congress passed a $95 billion (£76 billion) deal which ensured further funding for Ukraine in its war against Russia. Although the bill had bipartisan support overall, several right-wing lawmakers (particularly those close to former President Donald Trump) had held up the bill, and its eventual passing is seen as a victory for current U.S President, Joe Biden. The bill also included over $8 billion (£6 billion) for military assistance to Taiwan, which was protested by the Chinese government, and Israel, who engaged in direct military conflict with Iran throughout April.

In response to this and additional pledges by European governments to increase defense spending, European investors have provided large inflows into defense related exchange traded funds (ETFs), which are formed of securities issued by defense related corporations that stand to benefit from the continued conflict on Europe’s eastern border.

Japanese yen hits multi-decade low: The Japanese yen fell to a multi-decade low at the end of April, reaching almost 160 yen per U.S dollar. While Japanese interest rates have been maintained at around 0% to encourage spending and fight potential deflation, the Fed has hiked rates to 5.25-5.5% in a concerted effort to control inflation. This dynamic encourages traders to sell yen and buy dollars, thus dampening demand for the yen and lowering its price. Following a sudden short jump in the value of the yen, there was speculation that Japanese authorities intervened in the market to prevent further falls in the currency.

While there may be some concerns over the impact of the weak yen on domestic consumption and living costs, a lower yen benefits domestic companies exporting goods abroad, while boosting inbound tourism. Alongside this, Japan has observed persistent falls in the yen over a number of years, so while the longer-term impacts of these changes remain unclear, the immediate short-term concerns remain somewhat limited.

Blog Post by Jonathan Simpson

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024