January Economic Background

• U.S inflation higher than anticipated

• Federal Reserve holds rates at 5.25-5.5%

• Chinese equities continue their downward trend

• Red-sea conflict causes shipping rates for Asia-to-Europe routes to surge

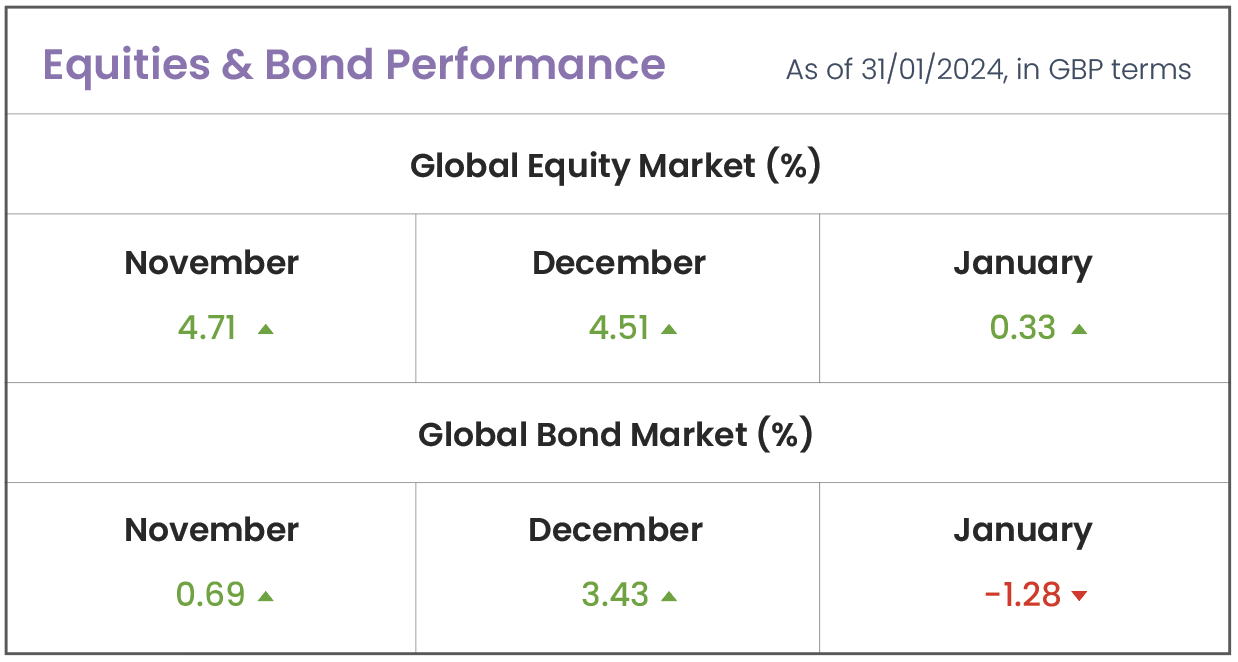

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

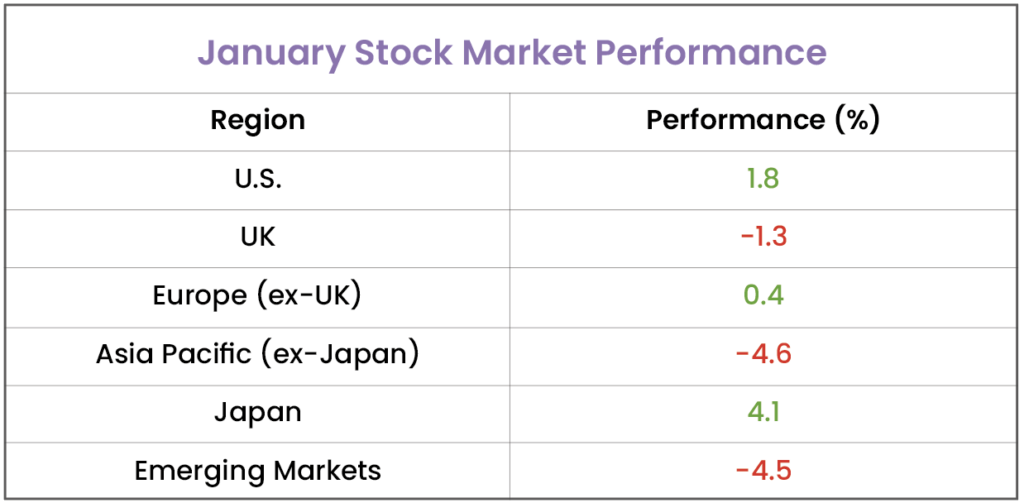

U.S Economy: In December, U.S. inflation exceeded predictions, reaching 3.4% annually – surpassing the expected 3.2%. This development dampened market expectations of an imminent decrease in interest rates, originally anticipated for March. Adding to the surprise, non-farm payroll figures surged, indicating the addition of over 200,000 jobs to the economy in December. Generally, a rise in employment signifies business growth and increased consumer spending, fuelling further economic growth and inflation. Federal Reserve (Fed) officials project the implementation of three quarter-point cuts over the course of the year, but have indicated that maintaining stable interest rates in the initial quarter is crucial to effectively manage inflation. As a result, on January 31st, the Fed opted to keep rates steady at 5.25%-5.5%. Policymakers clarified their decision by mentioning the need for additional data to validate the ongoing decline in inflation, expressing doubt about the likelihood of a rate cut in March. Albeit U.S stocks posted modest gains in January (1.8%), as six out of the “Magnificent Seven” mega-cap tech stocks continued their upward trend from 2023. However, Tesla shares plummeted this month (-24.6%), as falling margins, continued price cuts, and concerns over auto-pilot features weigh on analysts’ long-term views.

Asian Equities: Chinese stock markets continued their downward trend in January, with the sharp decline dampening Beijing’s recent efforts to paint a rosy picture of economic recovery. Official government reports indicate a 5.2% growth in China’s GDP for 2023, but analysts outside China express scepticism, offering estimates as low as 1.5%. This doubt arises from concerns about China’s manipulation of official data, adding to the Chinese stock market’s broad lack of credibility. In response, China is attempting to stabilise a slumping stock market with potential plans to buy approximately 2 trillion yuan ($280bn) of domestic shares as part of a stabilisation fund. Meanwhile, Japan experienced robust gains (4.1%) in January. Subdued wage data and a decline in household spending enabled the Bank of Japan (BoJ) to sustain negative interest rates. This serves as a positive force for Japanese stocks, by encouraging consumer spending over saving.

Source: Morningstar. Data from 01/01/24-31/01/24. U.S; S&P 500. UK; FTSE All-Share. Europe (ex-UK); MSCI Europe (ex-UK). Asia-Pacific (ex-Japan); MSCI Asia Pacific (ex-Japan). Japan; TOPIX JPY. Emerging Markets; MSCI Emerging Markets

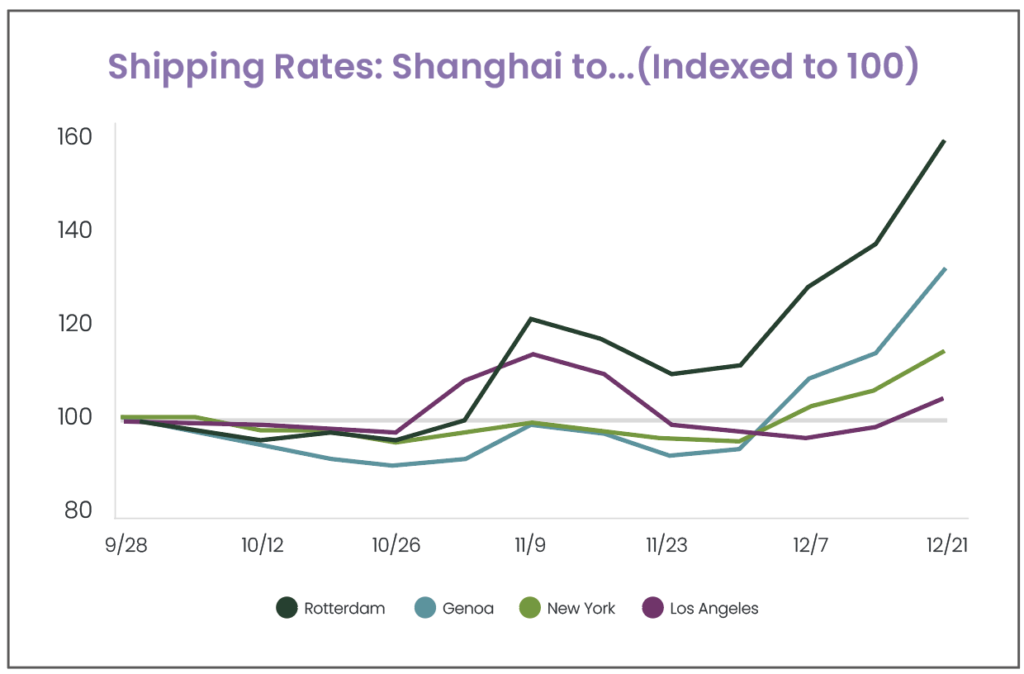

Red-Sea Conflict: Attacks on vessels in the Red Sea along Yemen’s coast by the Houthis are progressively jeopardising global trade, causing delays and increasing transportation costs. These assaults have led to the most substantial redirection of international trade in decades, prompting the world’s five largest shipping companies, representing approximately 65% of global shipping capacity, to halt navigation through the Suez Canal. Given that the Red Sea route serves as the most direct passage from Asia to Europe, the effective closure to Western ships is anticipated to have the most significant impact on Europe, shown by higher shipping rates to European destinations from Asia following the attacks. Companies such as Tesla and Volvo have announced temporary suspensions in manufacturing activities at two factories in Europe due to component shortages caused by the ongoing crisis. In contrast, manufacturing activities based in the U.S, which can import from Asia across the Pacific Ocean, face fewer challenges. Whilst U.S. forces are actively engaging Yemeni targets to limit the Houthis’ ability to continue targeting ships in the Red Sea, the situation shows limited signs of improvement.

Source: Northern Trust.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024