Overall Market Backdrop for May

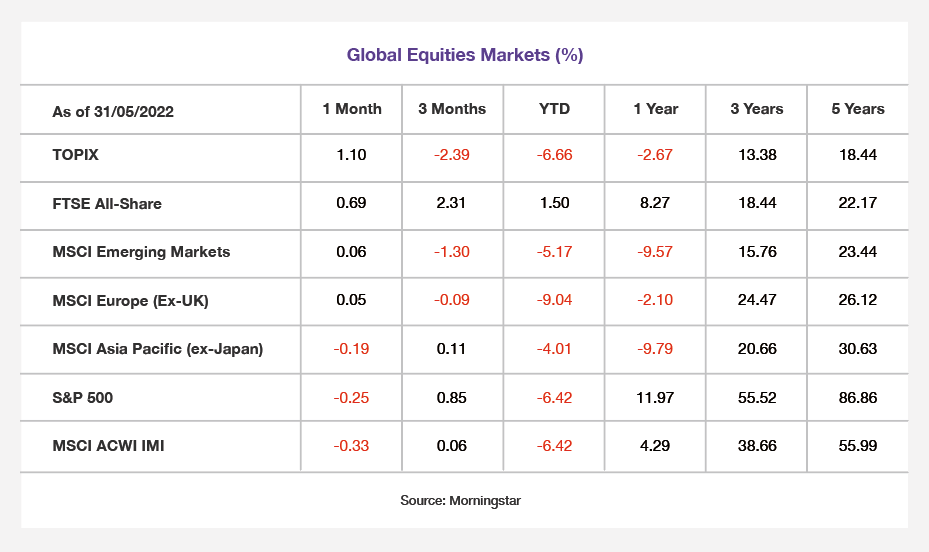

- Global markets had a mixed month and even with mass amounts of volatility and some regions ending on negative returns, most markets ended the month flat; the range between the performances was only 1.43%.

- Central banks are now seen to be walking on a tightrope, causing concerns for investors as they tend to balance the pressure of inflation with an already slowing growth rate.

- After a few months of bond yields rapidly increasing, in May they were more tame and flat. the US 10-Year Treasury yields dropped by 4 basis points and ended at 2.84%.

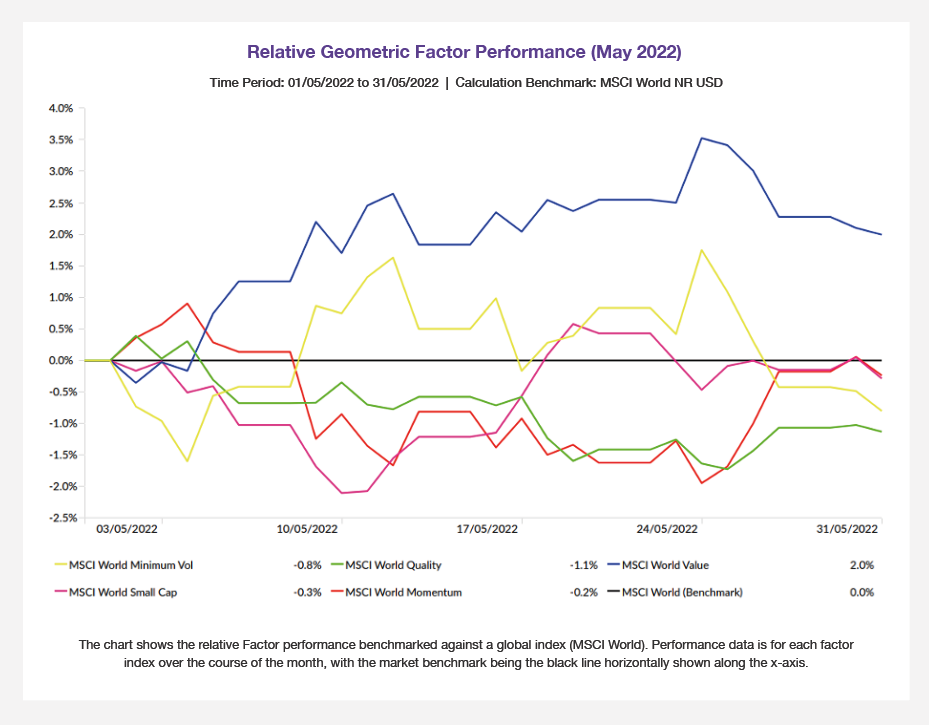

- Value has now been the best performing factor for May.

Drivers of Market Conditions in May

- US equities had a volatile start and investors had to digest news from central bank meetings and economic data such as earnings reports and labour market data. Consequently, US equities fell and the lingering bad smell of surging inflation concerned investors and hurt sentiment as they continued to worry about the Fed’s ability to tame surging inflation. US investors had to also deal with a greater-than-expected US CPI print and a weakening consumer demand. The amalgamation of bad segments of the US earnings reports, weakening consumer demand, rising inflation and slowing economic growth made the S&P 500 one of the worse performing equity indexes for May. The only solace for US equities came towards the end of the month when US equities pushed higher as the Fed signalled further rate hikes however, it was a little too late as this couldn’t prevent the S&P500 from ending in negative territory.

- European and UK equities started the month on a slippery slope as the Bank of England (BoE) issued a statement that stated we are entering a period of high recession risk. European equities also continued to feel the effect of high inflation spearheaded by spiralling food and energy prices, which ultimately weakened global sentiment. There was some positive news towards the end of the month as the UK announced stimulus plans to tackle the country’s cost of living crisis.

- Central banks continue to work on a tightrope to try and balance the ongoing high inflation with a slowing growth rate. The Fed raised rates by 50 bps which was forecasted and in line with expectations. The Fed also stated that a 75 bps hike in the future is very unlikely. As well as the Fed the BoE also increased rates by 25 bps which gives a final rate of 1.0%. The ECB President Christine Lagarde also suggested a potential for monetary policy tightening later this year with a first rate hike in July.

- Even with there being downward pressure coming from a high inflationary environment, there is still strong economic data pouring out in the form of corporate fundamentals. Many of the S&P 500 companies have reported strong earnings YTD which exceed the long-term average.

- US Treasury yields have seesawed in May and the end result was UK 10-Year Treasury yields dropped by 4 basis points to 2.84%. The start of the month saw US yields fall due to the Fed ruling out the possibility of 75 bps hikes. The continued sell-off of growth style equities also pushed investors towards bonds as they searched for safety amid the chaos. During the mid-month, yields did rise slightly on the back of the Federal Reserve chairman Powell’s comments that the Fed was committed to fighting inflation and inferred additional upcoming rate hikes.

- In Europe, bond yields hit some particular milestones with the 10-Year German Bund yields reaching 1% for the first time since 2015. This was driven by the ECB rate hike expectations, which finally pushed the yield to 1.13%. In the UK the 10-Year UK Gilt yields ended at 2% after it slightly dipped due to the BoE comments on their recession concerns.

- While for the majority of the month Shanghai was locked down there was some relief and as the month progressed some reopening occurred. However, in other parts of China such as Beijing and Tianjin, restrictions were tightened in response to growing cases. There was some positive sentiment as Chinese export data crushed expectations and saw a figure of 3.9% year on year.

How did Factors Perform in May?

After a painful start to the year, investors have gained some respite in Value Stocks which have continued their strong performance since Q4 2021. Value companies benefited from a macroeconomic backdrop of higher interest rates. The Value sector has also been driven by the energy sector. The energy sector has profited from a combination of supply concerns stemming from the Russian-Ukraine war which has pushed prices higher and also the ability to pass over inflationary pressures to the consumer. In May alone, the MSCI ACWI IMI Energy sector returned 11.52% and YTD has returned 45.77%.

Blog Post by Raj Chana,

Investment Analyst at ebi Portfolios.

What else have we been talking about?

- All that glitters…

- Q1 Market Review 2024

- March Market Review 2024

- February Market Review 2024

- January Market Review 2024