Overall Market Backdrop, Q4

- Falling inflation sparks hope of an end to Europe’s price surge

- Easing China uncertainty to drive Asia Pacific equity returns

- Emerging markets remain resilient despite multiple headwinds, though now look increasingly attractive from a valuation perspective.

- Value has been the best performing factor for Q4.

Drivers of Market Conditions in Q4

Central Banks

Central Banks have rounded off 2022 with further rate rises in spite of early signs that inflation may be peaking. In December, the Bank of England announced a 0.5% hike, bringing rates to 3.5% along with its ninth consecutive rise, capping a year that has seen a vast shift in monetary policy. Minutes from the Bank of England meeting showed officials were still mindful of the potential persistence of inflationary pressures, pointing to a tight-labour market and wage increases as areas of concern. Bank governor Andrew Bailey suggested that further increases in rates are likely if there is no break in price rises, albeit there has been some apparent easing of inflationary pressures across the pond, providing the Federal Reserve leeway to raise rates by 0.5% rather than 0.75% as had been typical in recent meetings. The annual inflation rate in the UK eased to 10.7% in November of 2022 from 11.1% in October which was the highest since October 1981. Likewise, the annual inflation rate in the US slowed for a fifth straight month to 7.1% in November of 2022, the lowest since December last year and below forecasts of 7.3%, as it follows a reading of 7.7% in October. Nonetheless, it is clear in both cases that significant pressures remain.

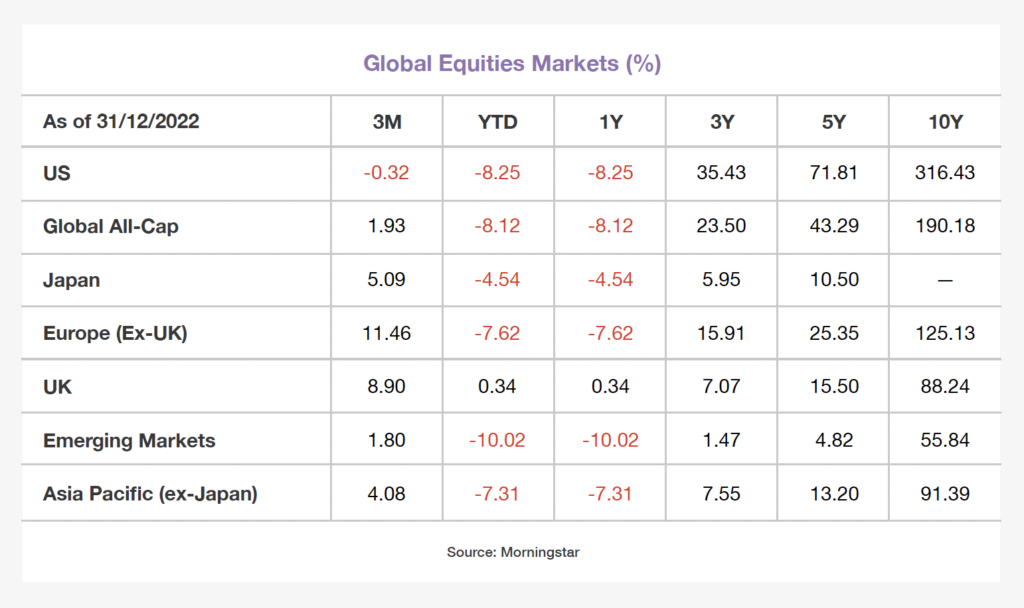

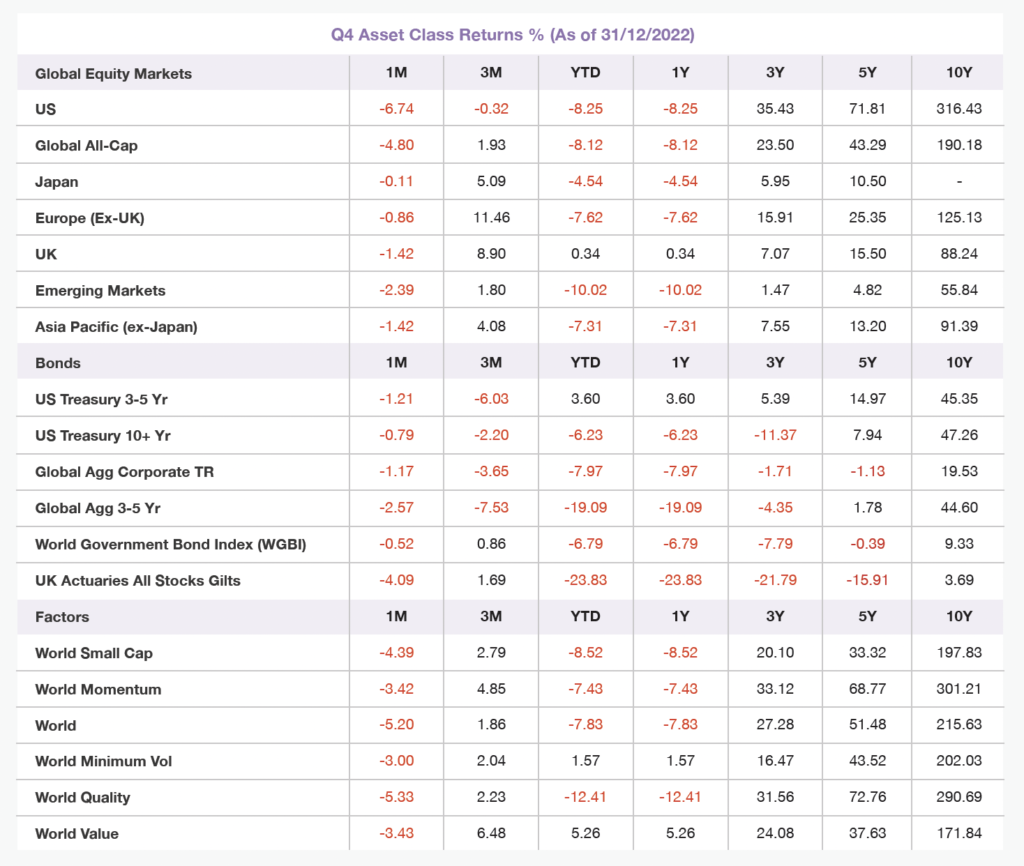

European & US Equities

After a strong advance towards the end of the year arising from economically-sensitive areas like energy, financials, and industrials, European stocks ended the year well outperforming other regions. Equity gains were supported by hopes that inflation may be peaking across Europe, coupled with falling gas prices which helped alleviate some cost pressures.The US stock market experienced its worst year since the 2008 financial crisis, with sticky inflation and aggressive rate hikes from the Federal Reserve battering growth and technology stocks, in part because of rising interest rates, inflation, and a strong US Dollar. Global semiconductor chip shortage caused by pandemic-induced supply chain disruptions and unprecedented demand may cause ongoing pressure to these companies. A large sell-off for Tesla as a consequence of missed market expectations for fourth-quarter deliveries also caused an outsized influence on the poor returns posted in Q4.

Asia Equities

After a difficult year for Asian stock markets, there is some thawing of investor sentiment towards the region in the final quarter of 2022. The catalyst consisted of an improving outlook for China upon reversal of the regions “zero-Covid” policy, with president Xi Jinping announcing mistakes of his excessively tight policy. Prior to Q4, significant Covid restrictions and problems in the property sector due to the failure of indebted-developer Evergrande spawned investor uncertainty. However, a lot of this bad news had already been priced into the Chinese stock market valuations. Easing of restrictions and signs the economy is starting to open up could have a significant impact on both global and regional growth. A number of structural risks remain for China: the property sector is still around 25% of Chinese GDP and the recent communist party reshuffle handed president Xi a third term, initially prompting a sell-off in Chinese equities as investors were worried that China was prioritizing ideological objectives over economic growth. The outlook for China looks more promising in the year ahead as valuations are more compelling, and even though risks remain, these appear to be well-understood by investors.

Emerging Markets

Emerging market equity valuations are trading at near historic discounts in comparison to the developed world. As inflation began to accelerate post-pandemic, emerging economies were preemptive in tightening interest rates. The UK, Eurozone, and US are still attempting to catch up with rising inflation, whilst many emerging economies have largely completed their tightening cycle. A slowing global economy, escalating political risks, and the fastest Federal Reserve tightening cycle in more than three decades hit emerging markets hard throughout 2022, but the sharp drop in prices have made this asset class look increasingly attractive from a valuation perspective to investors.

Bonds

The dominant narrative driving markets throughout the year was central banks’ efforts to tame runaway inflation, with bonds suffering the most as a result of the sharp rise in interest rates. Eurozone bond yields continued to rise after the European Central Bank (ECB) opted to raise interest rates by 0.5%, following identical moves from the Federal Reserve and the Bank of England. The US 10-Year Treasury closed Q3 on 3.8%, rising to 4.1% 1-month later (October), however fell back down by 20 basis points to close Q4 on 3.9% as inflation expectations eased. The hawkish stance adopted by central banks in an attempt to bring inflation closer to target (2%) have led to some expectations that bonds will have a much better year in 2023 as markets are already starting to anticipate a decline in inflation and a peak in interest rates. A key question for bond investors is fast becoming less about where you think rates will peak, but how fast and how far rates are likely to fall after that.

Sector Returns

Sector returns for Q4 followed the same pattern as throughout the year, with Energy posting the highest returns (8.90%) and Consumer discretionary remaining down (-6.42%). November was a strong catalyst for Energy stocks as record third quarter profits were announced, with BP reporting profits of $8.2bn (£7.1bn) between July and September. While rising prices deter customers from purchasing discretionary items (i.e. nonessential goods and services such as appliances and entertainment) as they rein in their spending, thus causing underperformance during economic contractions.

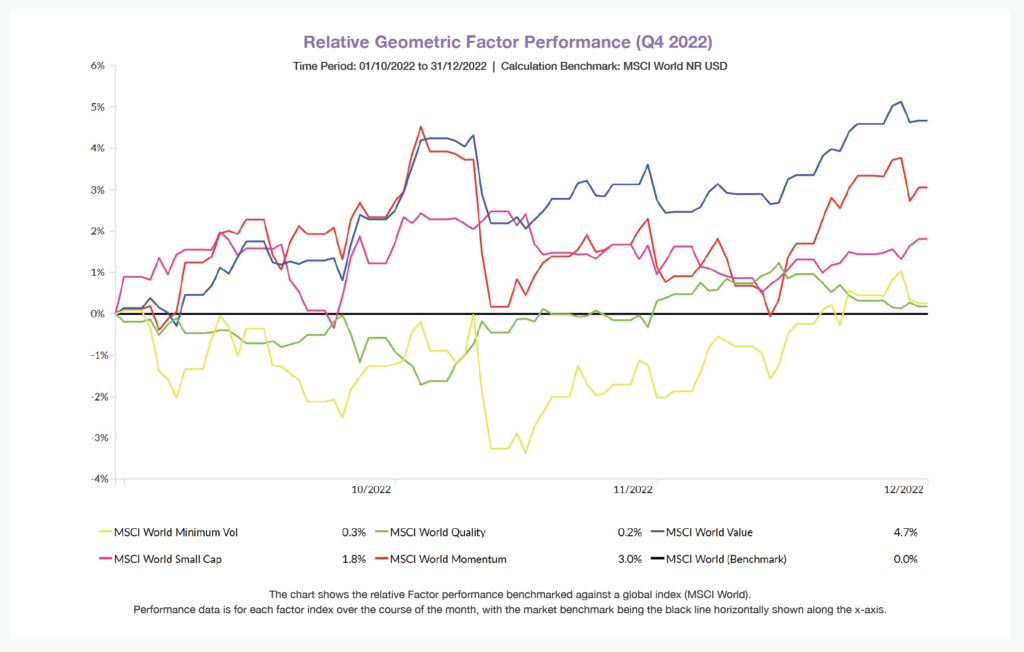

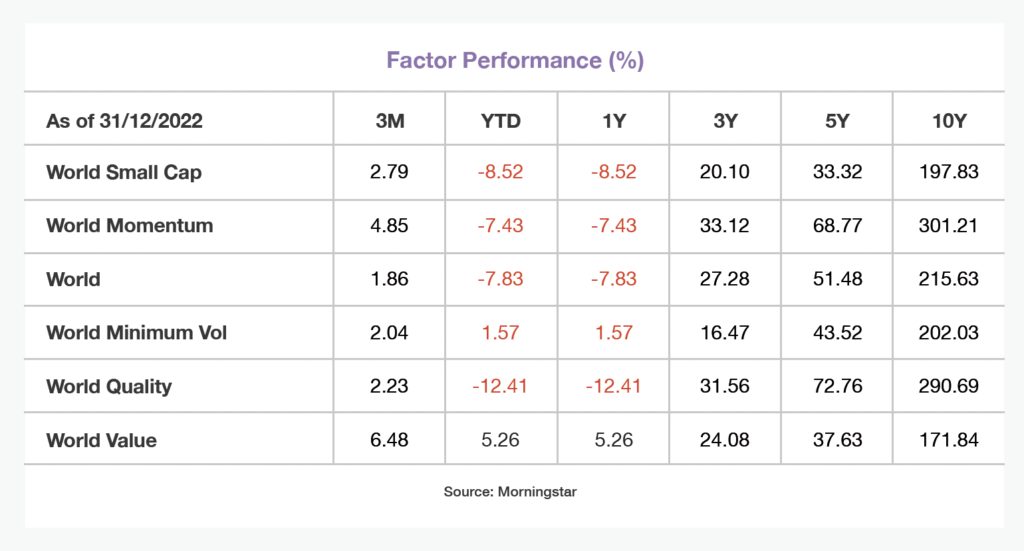

How did Factors Perform in Q4?

- All factors generated positive returns as equity markets have recorded somewhat strong returns over the last quarter.

- Value was the best performing factor both YTD and throughout Q4, the only factor to exhibit positive returns for each month throughout the quarter. Relatively cheaper valuations made value stocks more compelling for investors as their strong cash flows served well during times of high inflation.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024