UK Government borrowing hits record levels

On Wednesday 21st December, it was announced that UK government borrowing hit £22bn for November, nearly three times the £8.1bn reached in the same month last year. Borrowing was on a downward trend for more than a year following on from the reopening of the economy and the end of government Covid-19 support, but has started to rise again, reflecting the fiscal implications of continued energy bill support and higher inflation. The widening deficit also pointed to a slowdown in government investment, prompting fears about the UK economy’s capacity for growth alongside a weakening pound.

UK House Prices Contract for the 4th consecutive month

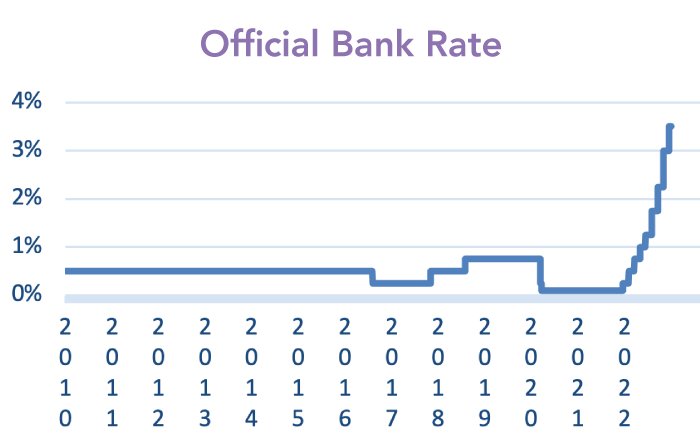

UK house prices fell for the fourth consecutive month in December, marking the longest contraction since the 2008 financial crisis, as rising interest rates deter prospective buyers. The changes in mortgage rates reflect the increase in central bank policy rates that have risen sharply as many central banks battle the fastest pace of inflation for decades. The US, UK, and Eurozone combined have increased rates by nearly 900 basis points over the past year, with markets expecting another 400 basis points combined increase by summer next year.

This year housing demand has been driven down by higher interest rates, low consumer confidence, and a negative outlook for house prices, following drops each month since September.

The historical low level of interest rates have supported housing demand in recent years, but the continued rate hike has created financial pressure on households and consumer confidence has continued to diminish in the midst of the ongoing cost of living crisis. CPI data from Europe’s largest economies suggested inflationary pressures cooled sharply in December as the Bank of England suggested inflation has already peaked. Albeit, policymakers in the US and Europe signalled more interest rate hikes would be delivered this year to combat inflation, with data showing UK CPI inflation falling to 10.7% in November, from a 41-year high of 11.1% in October, still well above the target of 2%.

China removes their “Zero-COVID” policy

After years of strict lockdowns, mandatory testing, and major travel restrictions, president Xi Jinping announced the mistakes of his excessively tight covid policy which failed to contain the virus and sparked a huge exit wave of infections. The major policy shift could pose further complications as people resume international travel, causing other nations to impose restrictions on Chinese air travellers. Amid widespread protests on December 8, the reopening of the economy also exacerbates concerns for fuel prices, with the price of Brent crude jumping from $76 per barrel to $84 since Beijing dropped their “zero-Covid” rules, creating higher levels of demand. The rising price of oil could in turn result in higher prices for drivers at petrol forecourts, following a sustained fall since the summer. Stock investors have turned more bullish for the new year amid bets that China’s reopening from Covid curbs, while chaotic to begin with, will eventually boost the economy and corporate profits.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024