Market Backdrop, 2022

- Concerns surrounding the Russian invasion of Ukraine have exacerbated inflationary pressures.

- European stocks endured inflationary pressures which were at the forefront of policy decision making, heightened by geopolitical risks resulting in a sharp rise to the price of oil and gas.

- The reversal of China’s “zero-covid” policy gave rise to a late Asian stock market rally, after a difficult year driven by the Omicron variant which spread largely unmitigated across the country, sparking concerns of a new wave of infections as tourism and travelling recommences.

- Emerging markets appear increasingly attractive from a valuation perspective as they trade at near historic discounts.

- Central banks around the world have had to balance the pressure of inflation with an already slowing growth rate, maintaining a hawkish stance throughout the year.

- Growth stocks have been under pressure from rising yields and have underperformed their economically linked value peers, reversing a trend that has been seen for the last decade.

Drivers of Market Conditions in 2022

Central Banks

A common theme throughout the year was the hawkish stance adopted by central banks in an attempt to quell the ever-present inflation concerns. Policymakers continued to anticipate that ongoing increases in rates would be appropriate and that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2%. The main concern was that central banks may dampen growth in their efforts to get inflation under control and cause stagflation, an economic cycle characterised by slow growth, a high unemployment rate and high inflation, a combination which policymakers find extremely difficult to handle.

- UK – Bank of England

A ninth consecutive rate rise from the Bank of England meant rates finished the year on 3.5%, pushing the cost of borrowing to the highest level since late-2008, capping a year that has seen a vast shift in monetary policy. Throughout the year, officials noted that the labour market remained tight and inflation continued its upward trajectory, which justified a forceful policy response. Bank governor Andrew Bailey pointed to further increases in rates if there is no break in price rises, however inflation peaked in October at 11.1%, followed by two consecutive falls in November and December to end the year on 10.5%, small signs the rate rises are taking effect.

- U.S. – Federal Reserve

At the start of the year the Fed rate was 0.25%-0.50%, with the Fed still buying billions of dollars of bonds every month to stimulate the economy, despite inflation hitting 40-year highs. Inflation continued to climb, peaking at 9.1% in June, with the Fed finally deciding it was time to act, thus raising the fed funds rate by three percentage points in six months. Albeit, signs of U.S. economic resilience and the easing of inflation towards the end of the year led to a 50bps hike, as opposed to the usual 75bps increase we have seen at the previous four Fed meetings. Investors initially reacted negatively to the expectation that rates may stay higher for longer and stocks gave up earlier gains as this new level marks the highest Fed funds rate since December 2007.

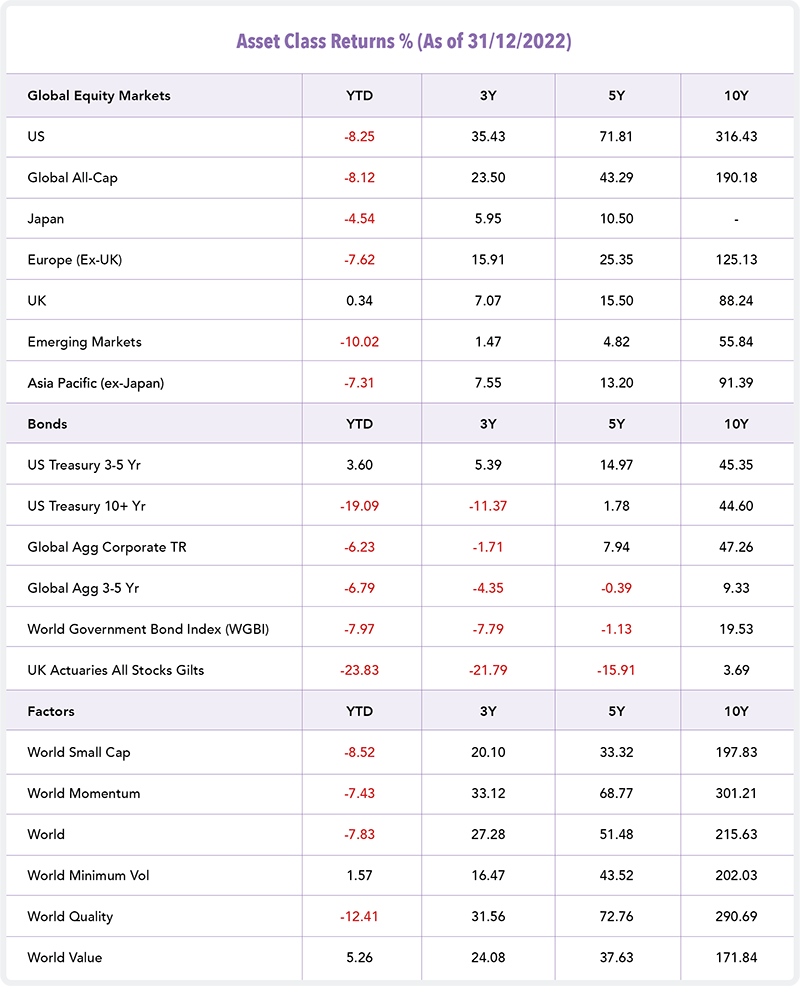

UK Equities

UK equities have been more resilient than many other world markets in 2022, supported by strong growth in energy stocks, coupled with augmented currency gains. A large proportion of FTSE 100 companies conduct their trade in U.S. dollars; being the preferred currency of international commodity markets and international banking, the extraordinary run in the U.S. currency has been a further transitional boost to their sterling earnings, creating even more financial headroom for these companies to return cash to their shareholders, aiding the UK stock market as it outperformed its peers this year.

Nonetheless, the UK stock market has not forgone the risks to the economic outlook, exacerbated by some self-inflicted wounds in the second half of the year when a mini-budget consisting of tax cuts and increases in government borrowing was announced. The policy put the UK monetary and fiscal policy on a collision course and threatened to unpick the work of the central bank. This put the UK market under tremendous stress and led to a forgetful week for many UK investors as the Pound crashed and fell to a record low of 1.035 against the dollar in September. In spite of that, the decline in sterling has also helped given that c. 75% of the FTSE All-Share’s revenue comes from outside the UK. Even though the UK markets have relished superior performance over their peers, the economic and political upheaval throughout 2022 has meant the overall mood of the market remained sombre.

European Equities

High inflation, the war in Ukraine, and tightening of monetary policies by the Bank of England and the ECB were the main drivers behind the decline in European stock markets earlier in the year. Albeit, European stocks experienced a substantial bounce back in the final quarter as inflation expectations and huge surges in the price of oil, gas, and foods eased, relieving cost pressures.

By February 2022, it was estimated that c. 200,000 Russian troops were encircling Ukraine and warned that a Russian incursion was imminent. This would, in effect, remove the NATO security umbrella from eastern and southern Europe, which caused the Russian Ruble to reach all time-lows in March, whilst oil surged over the $130 per barrel mark for the first time since 2008 with gas prices spiking to all-time highs. Sanctions and export controls have been broad-based to date, targeting Russian banks, exports of high tech, assets, and the issuance of Russian sovereign debt and equity. Ultimately, the Russia-Ukraine crisis has slowed global growth and escalated inflation, predominantly linked to Russia’s energy supply disruption. This caused energy and commodities prices to reach record levels and forced already heavily indebted governments to raise more debt to protect both consumers and corporations.

U.S. Equities

The U.S. was among one of the worst performing regions in 2022, with Fed comments throughout the year inferring that they would move with more haste to quell the ever-present inflation concerns. This was evident as the rates continued to climb, increasing by a further 50bps to 4.25-4.5% in their last monetary policy meeting of 2022. Many of the big U.S. companies fell heavily, eroding billions of dollars as the six “mega-cap” companies (Amazon, Apple, Alphabet, Microsoft, Meta Platform, and Tesla) accounted for about half of the decline in the S&P 500. Pandemic-induced supply chain disruptions and unprecedented demand caused ongoing pressure to these companies. A large sell-off for Tesla as a consequence of missed market expectations for fourth-quarter deliveries also caused an outsized influence on the poor returns, with the only stocks offering U.S. investors any hope being those in the energy.

Asia & Emerging Market Equities

Asia-Pacific’s equity returns were powered by a late rally in 2022 from Chinese stock optimism surrounding the nation’s re-opening. A vast reversal was announced in the final month of the year, with president Xi Jinping acknowledging the mistakes of his excessively tight “zero-covid” policy. This assisted the negative returns for the first, second, and third quarter as the effects reverberated through the country’s economy and global supply chain as companies and sectors were heavily reliant on Chinese business. A re-opening of the economy could lift the value of Chinese shares, with both the U.S. and European markets to be among the beneficiaries, as an undeniable level of pent-up demand is expected to spur global growth across a range of sectors.

The war in Ukraine shone a spotlight on geopolitical risks and the hostilities between China and Taiwan spawned additional challenges for global stock markets as economic activity is at risk of disruption and would have a global impact on trade and investment, leaving few countries untouched. Multinational companies (MNCs) involved in the Chinese market would face immediate revenue risk, predominantly from disrupted global semiconductor trade which will be a major blow to the prosperity in the auto, manufacturing, and technology sectors.

Emerging markets, just like developed markets, came under pressure due to worsening external conditions such as the strong appreciation in the U.S. dollar, coupled with tightening financial conditions and a slowdown in the Chinese economy where the property market imploded as consumer spending was very depressed. The failure of indebted-developer Evergrande spawned investor uncertainty and as emerging markets are closely tied to China, the pressures continued to escalate throughout the year. Albeit, the sharp drop in prices have made this asset class look increasingly attractive from a valuation perspective to investors, trading at near historic discounts in comparison to the developed world.

Bonds

Global bond markets encountered significant losses across 2022, arising from central banks boosting interest rates to fight inflation. Economic suffering was acknowledged as they increased the pace and magnitude of rate hikes, but central banks clearly prioritised lower consumer prices over economic growth and financial market stability. The “higher-for-longer” chorus on interest rates harmonised with the hard landing recessionary fears, which led to an inversion of the yield curve on 1st April between the 2-Year and 10-Year Treasury, closing the year on 4.4% and 3.5%, respectively. This rare economic signal has spurred speculation that foretells a future recession, as experts suggest short-term rates have greater impact on economic activity, such as corporate borrowing trends.

The Bank of England announced it would carry out temporary purchases of long-dated UK government bonds from 28th September until 14th October to restore orderly market conditions. This central bank move came after the British pound tumbled to record lows against its U.S. counterpart and UK bond prices (gilts) collapsed in response to British finance minister Kwasi Kwarteng’s mini-budget, which included £45bn in unfunded tax cuts. Over the past two decades, defined benefit schemes have widely adopted liability-driven investment (LDI) to sustain and improve their funding levels. The fall in gilt prices resulted in a rise in yields, and the need for collateral to meet margin requirements increased, causing a forced sell-off in gilts into a declining market, creating a vicious price/liquidity cycle that only abated when the Bank of England intervened. Although LDI strategies generally held up well during the 2008 global financial crisis, the events of 2022 were catalysed by the disastrous mini-budget, causing a significant loss as experts estimate £500bn was lost in assets.

Sector Returns

- The FTSE 100 finished the year strong, with BAE systems among the top performers as defence contractor shares jumped over the last year, with the Ukraine war shifting investor attention onto the long-term prospects for the sector. Most major defence programmes tend to be over a long cycle, meaning the contracts secured now will be traded for many years and support long-term growth visibility.

- Energy companies are revealing record profits across 2022, with BP announcing profits of $8.2bn (£7.1bn) between July and September; a major catalyst for the strong performance in the FTSE 100 as oil majors reported surging profits attributable to the rise in oil and gas prices because of the Ukraine war. Shell’s chief executive, Ben van Beurden, signalled they are ready to ‘embrace’ higher taxes as the sector’s sustained profits since the Ukraine invasion have fuelled calls for governments to impose a more aggressive taxation of the industry.

- Consumer discretionary goods were rattled by inflation, recession risk and sticky supply chain issues as rising prices deterred customers from purchasing discretionary items (i.e. nonessential goods and services such as appliances and entertainment) as they rein in on their spending.

- Technology stocks saw steep declines across the board due to global semiconductor chip shortages. In absolute terms, Apple was the biggest loser of the year, shedding $846 billion from its market cap, along with semiconductor stocks, like NVIDIA and TSMC who were also hit particularly hard.

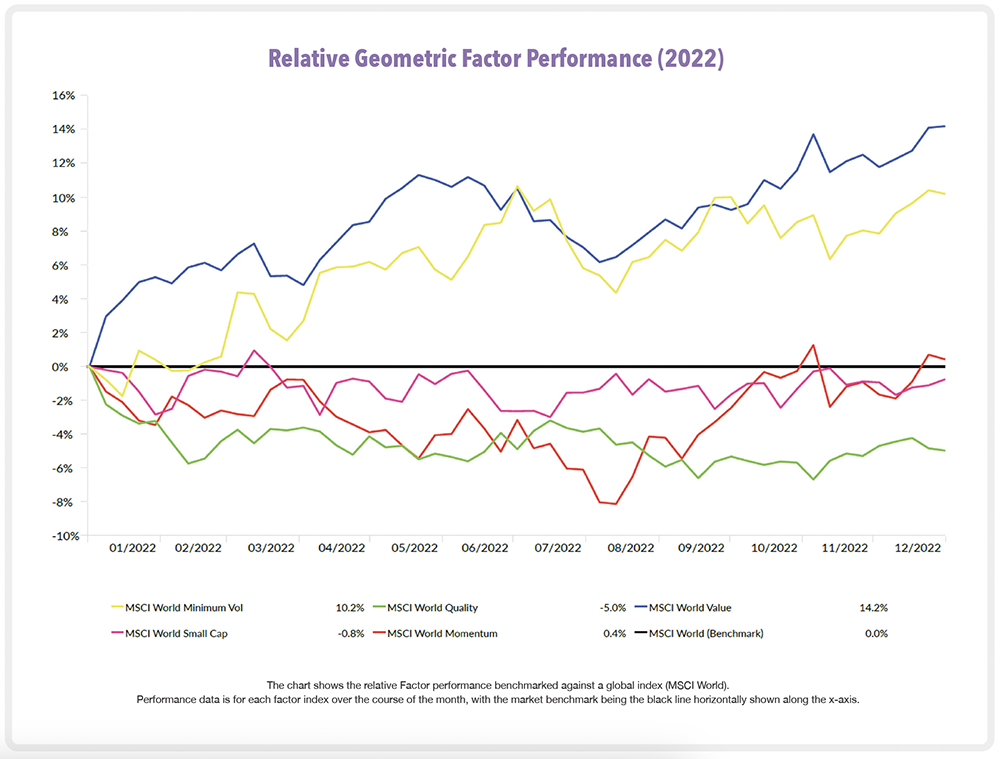

How did Factors Perform in 2022?

- To battle inflation, central banks around the world took a very hawkish stance in 2022. This hurt growth style equities which have been under pressure from rising yields for much of the year, thus underperforming their economically linked value peers, reversing a trend that had lasted for much of the past decade. This can largely be explained by the high starting valuations for growth stocks, coupled with growth disappointments and the effect of rising interest rates, making value stocks appear relatively cheap. The value of future earnings were impacted by rising interest rates, increasing the cost of capital, creating a difficult year in growth stocks.

- Stocks with low volatility characteristics helped provide investor confidence through its downside resiliency, during what can only be described as a turbulent year in global equity markets. With the elevated volatility in 2022, this particular factor tends to lose less during down markets while capturing a meaningful portion of the upside as markets rally, which proved beneficial for investors. The factor deliberately seeks to curtail upside moves by enhancing support on the downside, and we can see this throughout the year as the factor did precisely what it is engineered to do and acted as a safeguard against periods of uncertainty and volatility.

- The same can’t be said for quality stocks, with market conditions benefiting value factors, strong dividend yields, and those companies with higher levels of leverage (debt), characteristics not associated with quality stocks and an inverse of what we have seen historically drive markets over the long-term. Consistency of cash flows have meant growth and quality stocks have been hurt due to increasing interest rates to fight the record inflation prints. Ultimately, this has led to a higher discounting rate which makes future income relatively less today.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

Like some of you who left a comment, I too was taken in by the Fast Invest adventure. I started investing in January 2021 and I must say that the return on investment was more than conclusive. Then I wanted to test the withdrawal to make sure everything was OK to continue, and that’s when the trouble started. At the time of registration, there were no particular rules, but a few months later, it was impossible to make a full withdrawal of the sums available for investment. We had to proceed in increments of around €47000. Which is what I did every month. I contacted Fast Invest several times at the end of 2021 and the answer was always that they were in difficulty but that the money would be paid out. On 29/12/2023, they closed all withdrawal requests with the reason “return to account”. On my account, I can see them in the debts category. I was frustrated until I came across a legal forensic team (mustangggrc@gmail.com) who helped me recover my money. They trace and recover datas, blocked accounts and money. Their powerful recovery tool has empowered me to share their good deed.