The U.S. Federal Government Hits Debt Ceiling

On 19th January, the U.S. government hit its borrowing ceiling of $31.4 trillion (as voted for back in December 2021 in Congress), raising concerns that any form of default would cause catastrophic effects on both domestic and global economies. Defined as the statutory limit for the amount of money the U.S. Treasury can borrow to finance existing federal operations, this artificially imposed cap has been raised 19 times since 2001, escalating pressures for Congress to once again approve an increase to avoid any form of debt default. Analysts at Bank of America cautioned in a report last week that “there is a high degree of uncertainty about the speed and magnitude of the damage the US and global economy would incur”. Albeit, markets have remained relatively calm, contingent on the governments ability to make a series of accounting manoeuvres to give enough financial headroom to handle its day-to-day expenses for the coming months. Ultimately, a breach of the debt ceiling would undermine the role of the dollar as a global reserve currency and create fears of global financial instability.

Tech Giants Boost Equity Returns

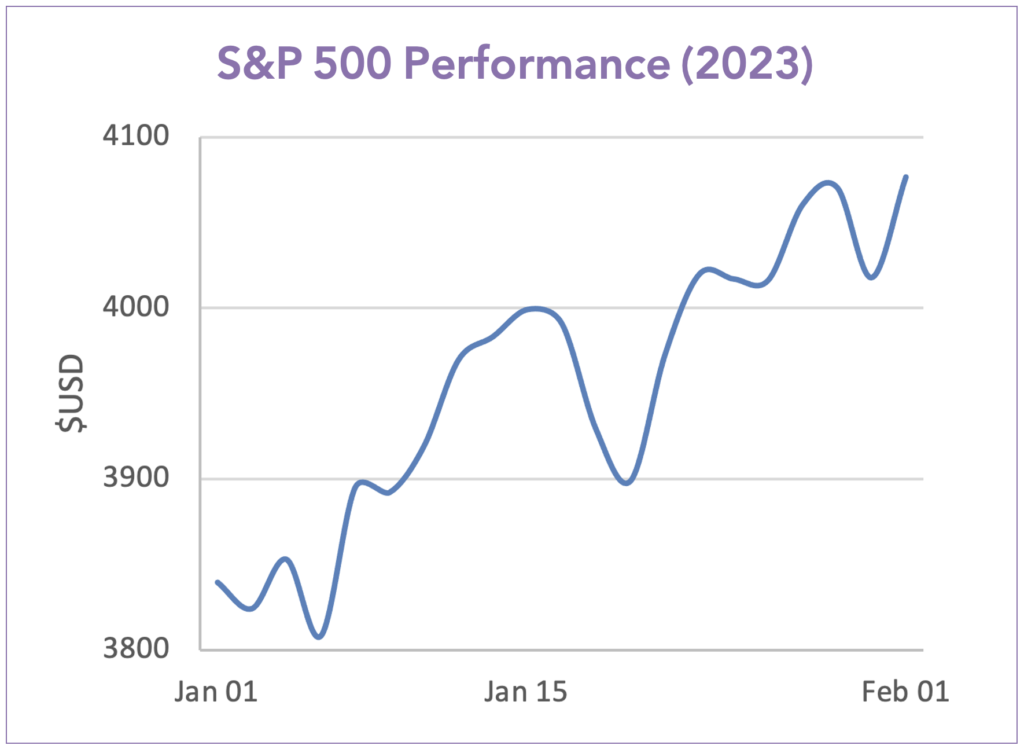

Global equity markets started the year strongly, with the S&P 500 climbing to its best level in nearly eight weeks, supported by mega-cap tech and growth stocks reporting actual EPS (Earnings Per Share) well above estimates. Microsoft confirmed a multibillion-dollar investment in ChatGPT bot maker OpenAI, marking its biggest bet into artificial intelligence systems yet, with CEO Satya Nadella saying that “the next major wave of computing is being born”. Tesla also reported record revenues, exceeding expectations on Wall Street, with Musk stating the company could produce 2 million cars this year which would represent a production jump of about 37%.

Strong corporate data has provided hope that the U.S. economy can withstand last years blizzard of rate hikes, however this also carries counterintuitive risks – it could push the Fed to keep rates higher for longer to ensure inflation really is suppressed.

Inflation Targets Remain A Concern

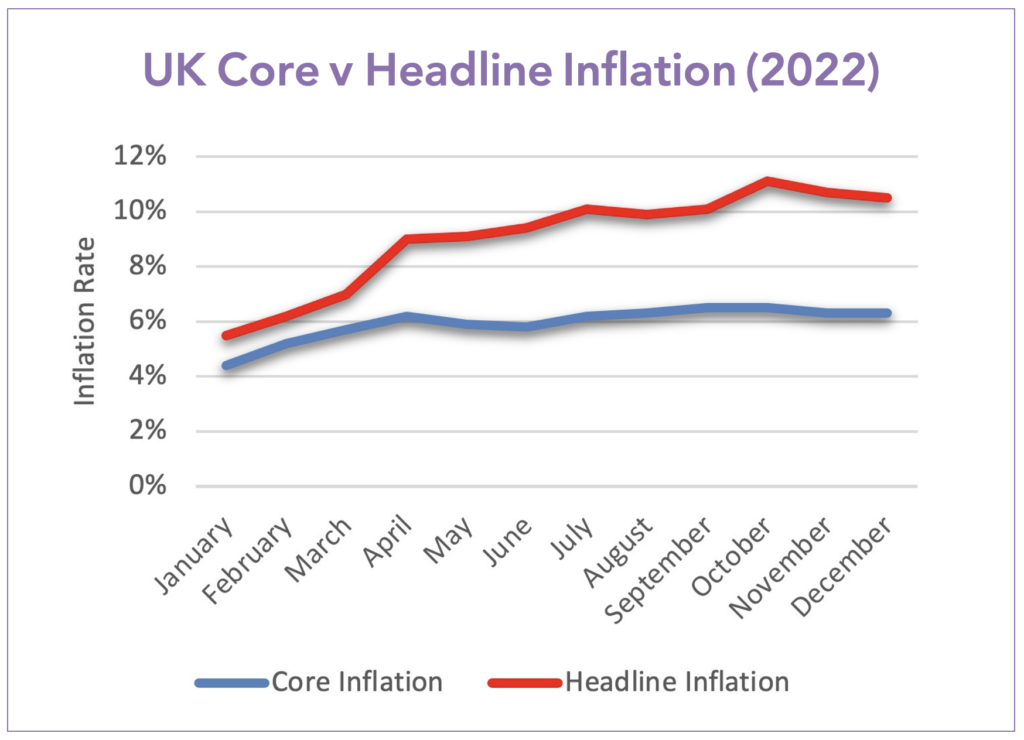

As we write today, inflation is elevated, but on its way down. The U.S. passed peak price increases over the summer, whereas high energy costs have kept inflation in Europe higher for longer, but recent readings show the beginnings of a decline. As we progress from the complications of Covid and the Ukraine invasion, inflation will settle, but a return to 2% may be a long way off.

Headline inflation is the raw inflation figure reported through the Consumer Price Index (CPI), whereas core inflation excludes the food and energy sectors because their prices are much more volatile. As we can see, these two sectors have been the main driving factors in inflation across 2022. On 2nd February, the Bank of England raised rates from 3.5% to a 14 year high of 4%, the tenth consecutive increase in the policy rate since December 2021, marking their fight against inflation in the UK, which is the highest among G7 economies.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024