1 Year Since the Russian Invasion of Ukraine

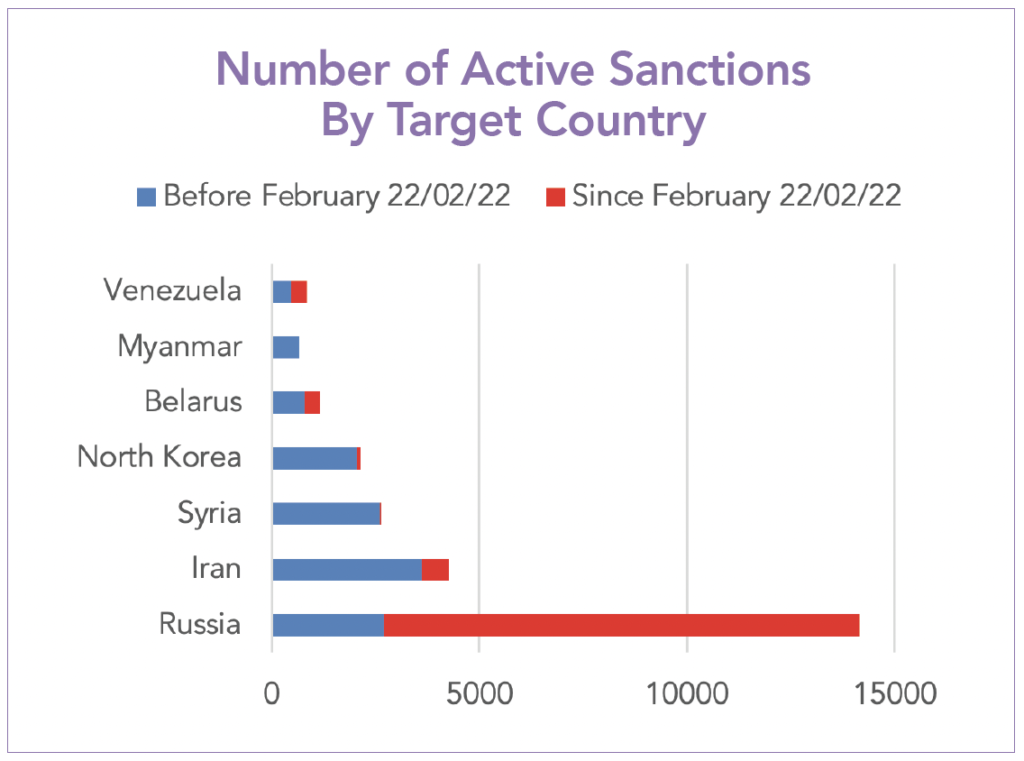

On 24th February 2022, Russian forces rolled into Ukraine, hoping to take over the country in a matter of days. One year later, the ongoing conflict remains a key risk both economically and geopolitically. Russia’s actions have resulted in them becoming the world’s most sanctioned country, with over 14,000 limitations forced on its individuals and corporations. Western economies have imposed import bans or cut their reliance on Russia- with Europe suffering the most, contending with rapidly rising oil and gas prices, exacerbating inflationary pressures. Nonetheless, earlier in the month the U.S. Energy Information Administration (EIA) lowered its 2023 natural gas price forecast to $3.40 per MMBtu, down from $6.42 per MMBtu in February last year.

Bank of England Raises Interest Rates to 4%

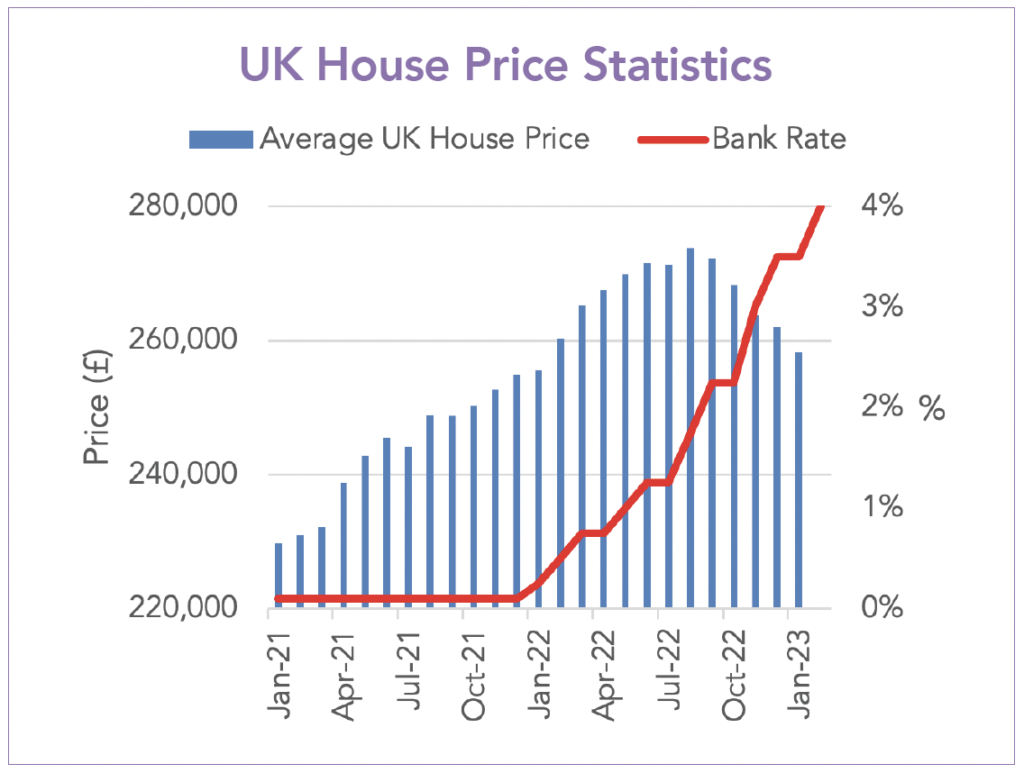

At its meeting on 1st February 2023, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority 7-2 to increase the bank rate by a further 0.5 percentage points, to 4%, their highest level in over 14 years. Inflation remains close to its highest level for 40 years (more than five times the central bank’s target of 2%), with bank governor Andrew Bailey stating that the continued rate hikes are starting to take effect as inflation appears to be falling, but warned there are still “big risks out there” which could continue to have an impact on the economy. The annual double-digit growth that the property market has enjoyed over the past couple of years looks unsustainable, albeit a crash still appears some way off, as industry experts predict that the most likely short-term outcome is for prices to start levelling off. We are already beginning to see this throughout the UK as the average house price falls for the fifth month in a row.

Tech Sector Layoffs and Market Volatility

After remaining relatively low for months, the VIX index, also known as Wall Street’s fear gauge, rose above 23 towards the end of February, its highest level since the first trading day of the year. Readings below 20 typically signify complacency, while those closer to 30 signal increased volatility and fear in the market. U.S. stocks have wobbled as investors prepare for further interest rate increases from the Federal Reserve in order to combat inflation, as economic data reinforces the Fed being tighter for longer. Uncertainty has been amplified as U.S layoffs start the month on a two-year high, with Tech giants such as Google, Microsoft, and Meta cutting thousands of jobs to strengthen and retain the functioning of their ‘core structure’. The technology sector has long been one of explosive growth, attributable to the surge in online activity during the Covid-19 pandemic, however rising interest rates and the high levels of inflation have weighed on growth prospects. Over-hiring, coupled with possible recessionary fears have resulted in large-scale cut backs from many within the industry, as investors encourage companies to reduce expenses as revenues slow.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024