Changes in UK Government

On Tuesday 25th October, Rishi Sunak was appointed as Britain’s new Prime Minister, the third in the space of two months. Jeremy Hunt will remain as chancellor and will present a debt-cutting plan in the coming weeks to help tackle what Sunak described as a “profound economic crisis” faced by the country. In his speech, he prioritised achieving “economic stability and confidence” but went on to say it would mean “more difficult decisions are to come”.

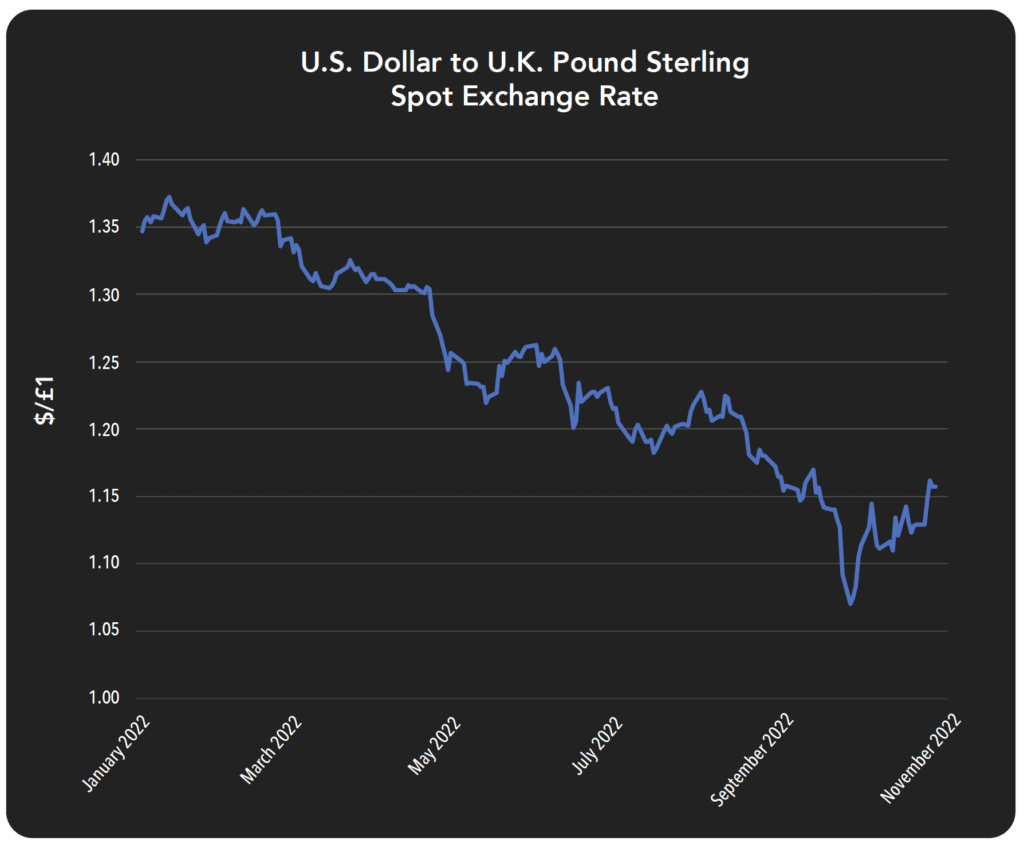

This all comes after Truss’ disastrous “mini” budget with £45bn of debt funded tax-cuts. Consequently, pound sterling plunged, gilt yields (UK government bonds) rose, and the Bank of England was forced to intervene and she sacked her chancellor (Kwasi Kwarteng). Currency fluctuations will affect a portfolios value, so ebi’s bond funds are all hedged to Pound Sterling, meaning that any movements are offset to protect investors from currency risk.

Investors have welcomed Sunak’s appointment as prime minister, with the pound reaching its highest level since mid-September, with experts advising it was partly a “relief rally”, but also due to the dollar losing strength.

Energy Sector Boom

Energy companies are revealing record profits across the third quarter, with BP announcing profits of $8.2bn (£7.1bn) between July and September and Shell’s chief executive, Ben van Beurden, signalling they are ready to ‘embrace’ higher taxes. The oil and gas sector’s sustained profits since the Ukraine invasion have fuelled calls for governments to impose a more aggressive taxation of the industry.

BP expects to pay approximately £700m in windfall tax on its North Sea operations this year, however, anticipates spending more than three times that (£2.17bn) on a share buyback programme, which will hand surplus cash back to its shareholders instead of using it for renewable investment or lowering prices, sparking controversy and increasing the pressure on the UK government to react.

The Fight Against Inflation

The annual inflation rate in the UK rose to 10.1% in September, from 9.9% in August, returning to a 40-year high and surpassing market expectations of 10%. The main contributors are soaring energy and food prices, with the latter having risen to a multi-decade high of 14.6% and economists explaining how poorer families would be hit hardest. At more than five times the Bank of England’s 2% target, it will add pressure on the central bank for a large interest rate rise in November to help tackle the high inflation rates throughout the UK economy.

Looking Ahead

The appointment of Rishi Sunak as the new British Prime Minister restored some market confidence, rattled by former Prime Minister Liz Truss’s mini-budget. The new government is now discussing tax and spending plans ahead of an economic statement planned for November 17th. Meanwhile, traders await the Bank of England’s monetary policy decision, with expectations being that interest rates will rise by 75bps, its 8th consecutive rate hike.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024