Inflation & Interest Rates

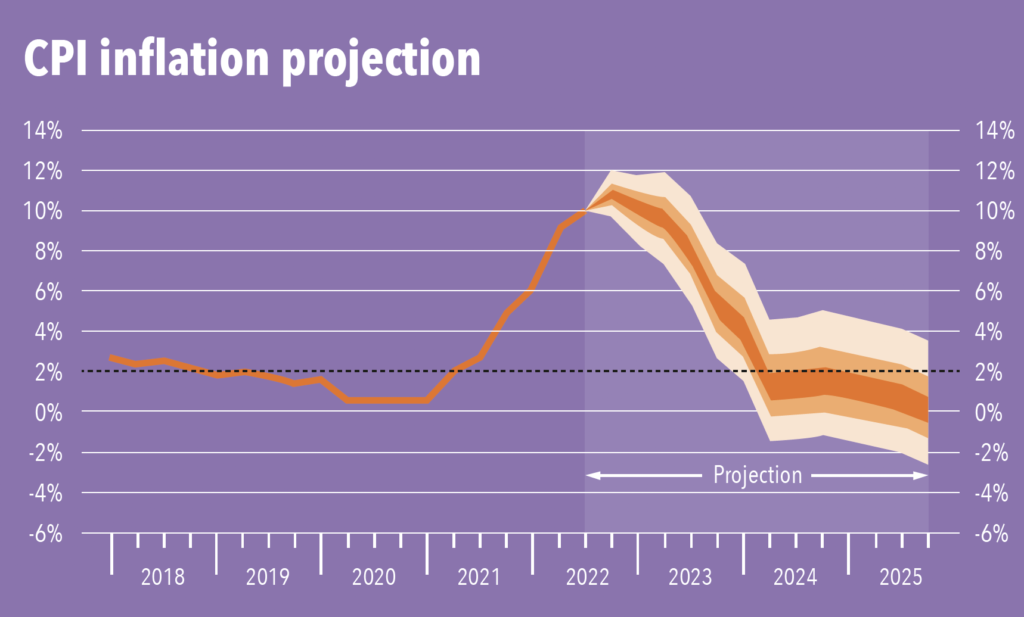

Despite remaining above their target of 2%, the central bank anticipates that inflation should start to moderate as the economy slows, the labour market weakens, supply chain pressures continue to ease and Europe manages to diversify its energy supply. The annual inflation rate in the UK jumped to 11.1% in October of 2022 from 10.1% in September, again surpassing market forecasts of 10.7%, driven by rising housing and household services, namely gas and electricity. To help control the soaring inflation, the Bank of England raised interest rates by 75 bps to 3% during its November meeting, the largest rate hike since 1989, increasing the cost of borrowing to the highest level since late-2008. Looking ahead, GDP projections continue to fall throughout 2023 and 2024, as high energy prices and materially tighter financial conditions weigh on spending, while CPI inflation starts to fall back from early next year before dropping sharply to some way below the 2% target in two years’ time.

Sector Performance

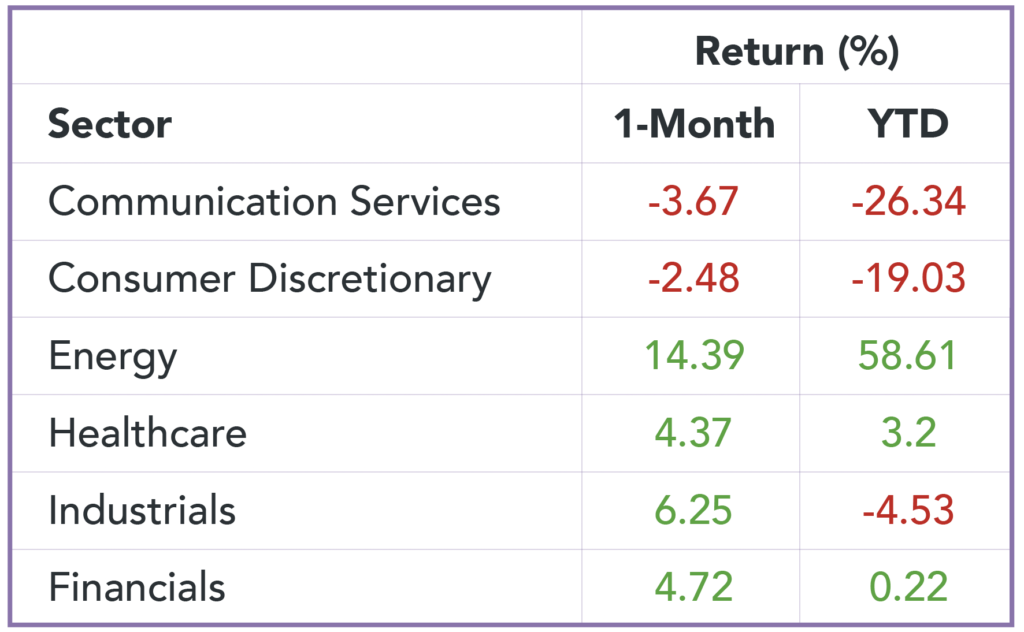

- Notably, Energy remains the best performing sector after record third quarter profits are announced – with BP announcing profits of$8.2bn (£7.1bn) between July and September.

- Global semiconductor chip shortage caused by pandemic-induced supply chain disruptions and unprecedented demand may cause ongoing pressure to the communication service sector for the foreseeable future.

- Rising prices deter customers from purchasing discretionary items (i.e. nonessential goods and services such as appliances and entertainment) as they rein in on their spending, thus causing underperformance during economic contractions.

Are Emerging Markets Becoming More Attractive?

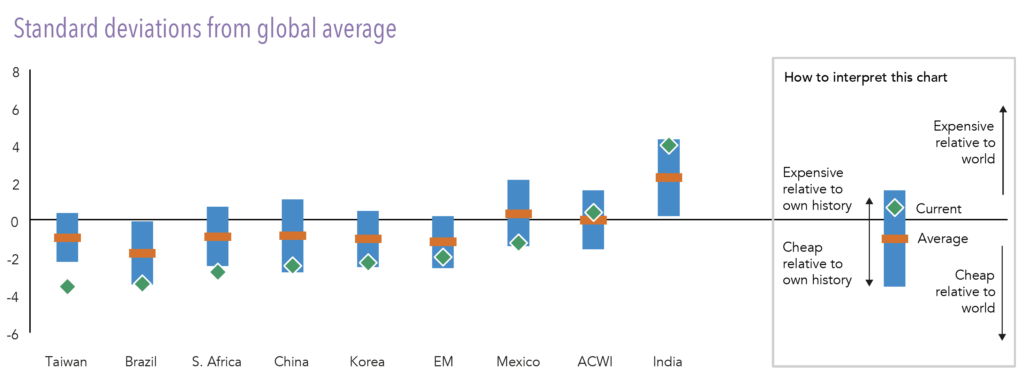

Emerging markets were hit by multiple headwinds, including a slowing economy, escalating political risks, and the fastest Federal Reserve tightening cycle in more than three decades. By the end of October, the MSCI emerging markets index had lost 29% in 2022, underperforming developed market equities by 10%. Nonetheless, the sharp drop in prices have made emerging market equities now look increasingly attractive from a valuation perspective.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024