Introduction

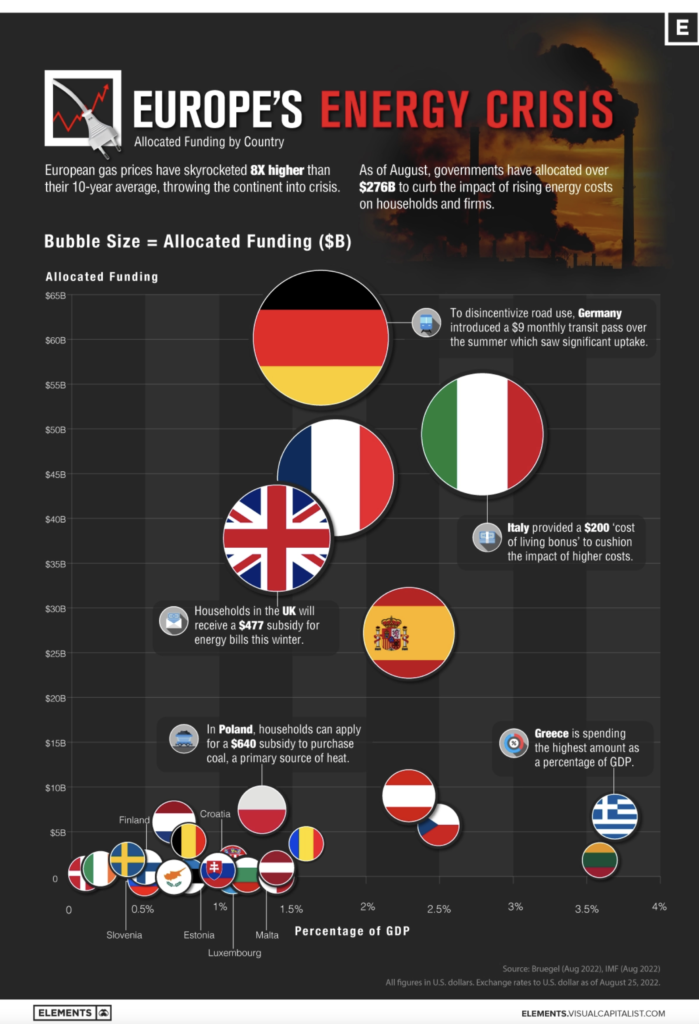

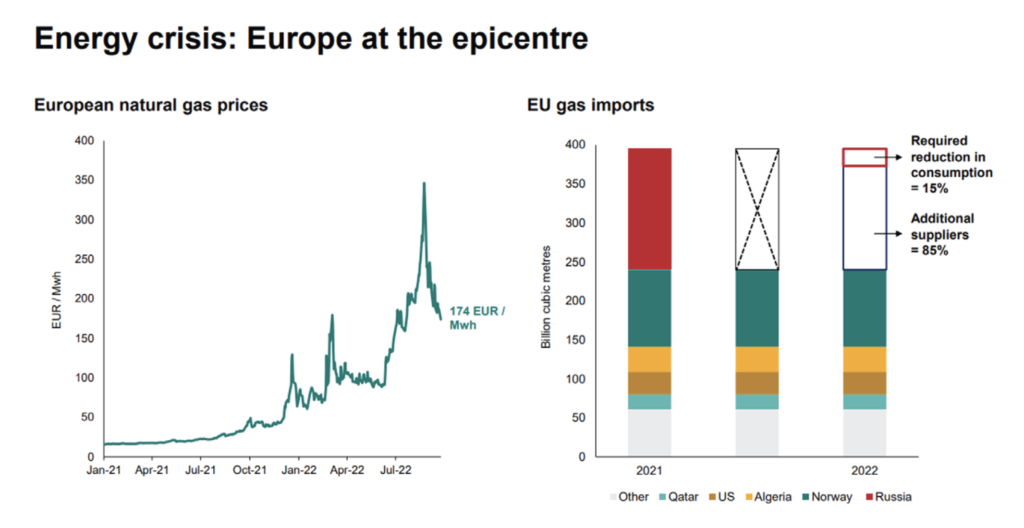

As the world moves towards net zero carbon emissions and renewable energy sources, liquefied natural gas (LNG) may be the ‘clean’ fossil fuel that’s best placed to help us transition to a carbon-free future. As Europe heads into winter with sanctions in place on Russian gas and oil after it invaded Ukraine, it has accelerated talks with leading LNG exporters to substitute the loss in Russian gas supplies. However, some may argue that the damage has already been done with Europe’s energy crisis resulting in gas prices soaring to 8 times their 10-year average1.

What is LNG?

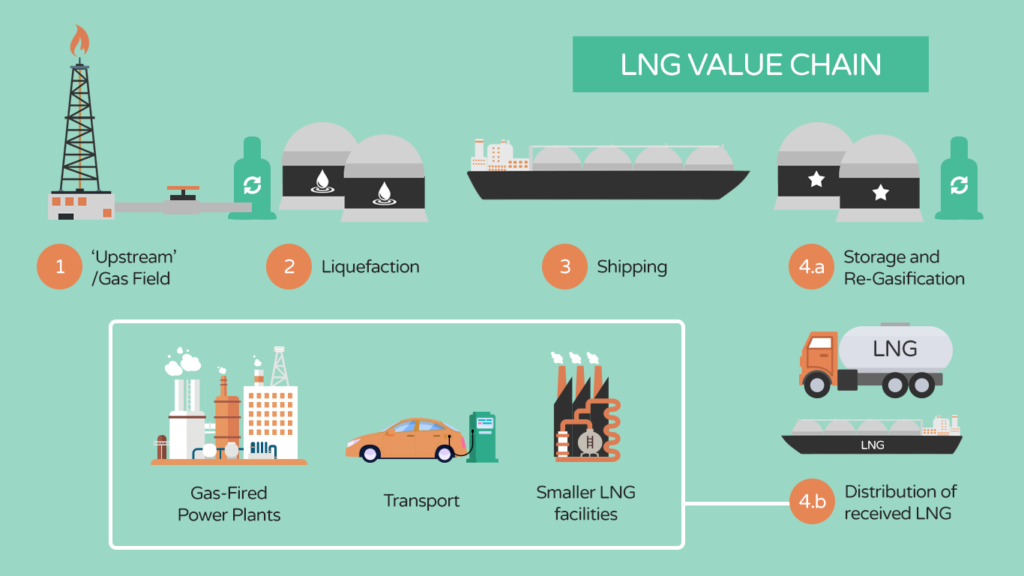

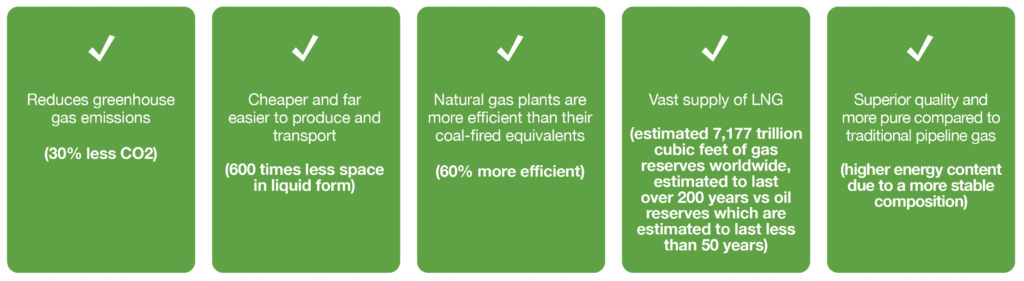

LNG is a non-toxic liquid that has been cooled down from a gas form into a liquid state for ease and safety of non-pressurised storage and transport. A cooling process shrinks the natural gas by approximately 600 times to -162ºC (-260ºF), where it is turned back into gas at re-gasification plants. LNG is used across many business sectors such as industrial, road transport, marine, and commercial sectors. Britain is one of the largest gas trading hubs in Europe and has three LNG import terminals, so is relatively well positioned to expand into this growing market.

Economic implications:

To offset the impact of high gas prices, European ministers are issuing utility bailouts and implementing temporary price caps on gas. Austria’s largest energy company, Wien Energie, received a €2 billion line of credit, coupled with Germany’s Uniper, which also received €15 billion as prices have skyrocketed1. The Organization for Economic Cooperation and Development (OECD) estimates that Russia’s invasion of Ukraine will cost $2.8 trillion in lower economic output by the end of 2023, with the world’s economy forecasted to grow by 3% in 2022, and 2.2% in 2023 after being revised down from 4.5% and 3.2%, respectively2. As part of the bid to diversify away from Russian gas, European nations are developing infrastructure in LNG that helps cut their dependence on Russia, as the chief executive of Shell argues that the energy crisis in Europe will extend beyond this winter, if not for several years.

An overwhelming appetite from Europe for liquefied natural gas to replace Russian pipeline exports is leaving developing countries, such as Brazil and Bangladesh, starved of gas as they are being outbid for LNG by richer countries attempting to fill the hole left by Russia. The UAE plans to double its LNG production to 12 million tonnes a year by 2026, with Germany becoming the most recent country to strike a deal seeking to replace Russian energy3.

With Russia cutting off gas supplies in response to European support for Ukraine, surging prices threaten to plunge the region into a deep recession and the US stands to be the biggest beneficiary. The current energy crisis would allow American producers to export gas at a significant premium, with the LNG market being the most cost-effective and environmentally friendly option available to help meet the strong demand as we head into winter. However, calls from several European countries to impose price caps on gas have been opposed by leading LNG exporters, with energy tycoon Charif Souki, founder of the world’s largest LNG exporter Cheniere, saying a price cap makes no sense because “if you impose it but China, for example, offers more money, then the gas will simply go somewhere else”. He blamed the continent’s “lack of strategic thinking” for the crisis, referring to the dependence on too few sources and warns there is no easy short-term solution; also stating that European countries should seek to secure a “little bit of everything”, whether its renewables, nuclear, coal, or gas4. Even though the damage of coal consumption is much clearer now than it was 30 years ago, countries are faced with the prospect of starving the population from gas and electricity, so the environmental impact becomes the lesser evil.

Long-term solutions lean towards LNG as it generates 30% less carbon dioxide than fuel oil and 45% less than coal, with a twofold reduction in nitrogen oxide and almost no environmentally damaging sulphur dioxide emissions5. Similarly, with large-scale LNG infrastructure developments occurring around the world, securing a deal with a reliable LNG exporter is of growing importance. Nevertheless, the desperation of many European countries to secure a stable supply as an alternative to Russian supplies can come at a cost, one which has assisted the strong growth of the US economy.

LNG process:

Advantages:

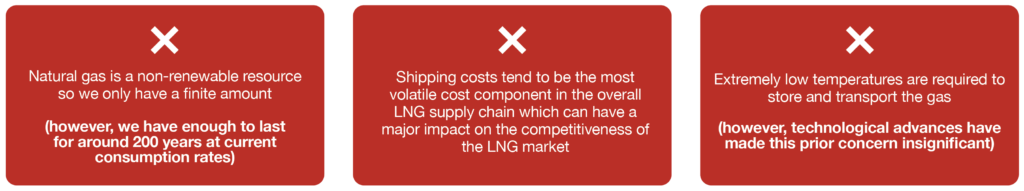

Disadvantages:

Other alternatives

Climate change has dramatically intensified and countries are on the quest to replace fossil fuels with more sustainable and green energy. The most popular alternatives are solar and wind energies; other forms consist of hydro, tidal, geothermal, and biomass. LNG offers a cheaper, cleaner, and more efficient source of energy compared to traditional fossil fuels in order to help meet global demand.

Due to its versatility, Liquefied natural gas has many uses with industry experts expecting to see a significant increase in LNG access, consumption, and production in the coming decades. Downward pressure on oil prices is generally followed by falls in continental gas prices. In spite of that, the EU faces unprecedented risks of gas shortages this winter, with many saying the recent Nord Stream leak was a ‘warning shot’ from Putin and the West should brace for more subterfuge. The decision by Russia to reduce gas imports to Europe is driving up the cost (shown below), and to acquire LNG spot cargoes for delivery during the peak winter consumption season, utilities in Asia and Europe are stepping up their efforts, exacerbating scarcity and cost concerns around the world.

Europe’s reliance on Russia is evident; with Russian gas accounting for approximately 45% of total EU gas imports, thus without them, Europe would need to reduce consumption heavily and find additional suppliers (which will come at a cost).

Vanguard8 September 2022 – Quarterly Investment Outlook, p8. September 29, 2022

Over-reliance on one supplier is proving costly and the liquefied natural gas market offers a replacement as countries aim to transition away from Russian gas. Albeit, many argue the damage has already been done, as seen by the soaring inflation rates and weak economic growth forecasts across Europe. ebi’s investment philosophy is built upon the principles of investing across a range of asset classes, sectors, and regions to remain globally diversified – in doing so, it doesn’t limit exposure to any single asset or risk. Despite ebi’s small exposure to the energy sector (1.78% as of 30th September 2022), the current energy crisis will worsen economic recessions and showcases the importance of having a well-diversified portfolio.

References

[1] D. Neufeld. Online. September 23, 2022

[2] P. Rosen. Online. September 26, 2022

[3] FT; UAE LNG Deal. Online. September 25, 2022

[4] FT; US Boom. Online. September 8, 2022

[5] Elengy; LNG: An energy of the future. Online. Accessed September 25, 2022

[6] Rappler. Online. January 22, 2019.

[7] SHV Energy. Online. Accessed September 25, 2022

[8] Vanguard September 2022 – Quarterly Investment Outlook, p8. September 29, 2022

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024