OVERALL MARKET BACKDROP, Q2

• Bank of Japan

• Interest Rates

• FCA Regulation

Unforeseen Shift: BOJ adapts yield-curve control strategy

On July 28th, the Bank of Japan (BOJ) surprised markets with an unforeseen change to its yield-curve control policy. The BOJ increased its limit on ten-year government-bond yields from 0.5% to 1%, leading to ten-year yields reaching c.0.6%, the highest in almost ten years. The yield-curve control policy, in place since 2016, involves purchasing government bonds to keep yields close to the cap, but sticky inflation has led other central banks to raise interest rates, positioning the BOJ as an outlier.

Japan’s ultra-loose monetary policy regime was implemented to stimulate the country’s sluggish economic growth and prevent deflation. However, as inflation has risen, the policy has come under pressure. The BOJ’s massive bond purchases to support the policy have raised concerns about market liquidity and potential losses. The decision to widen the yield-curve control band aims to increase flexibility in the bond market and enable the central bank to conduct operations more nimbly. Yet, it also carries the risk of creating confusion about the BOJ’s intentions. The policy shift signals a higher likelihood of increasing interest rates, posing risks to Japan’s government debt, which (including both central and local government debt) is in excess of 250% of GDP on a net basis. The potential strain on the country’s fiscal situation is substantial, considering that interest payments already claim a significant share of the budget, meaning that the BOJ faces a challenging task in effectively communicating and managing this policy change.

Fighting Inflation: Fed resumes its aggressive monetary tightening campaign

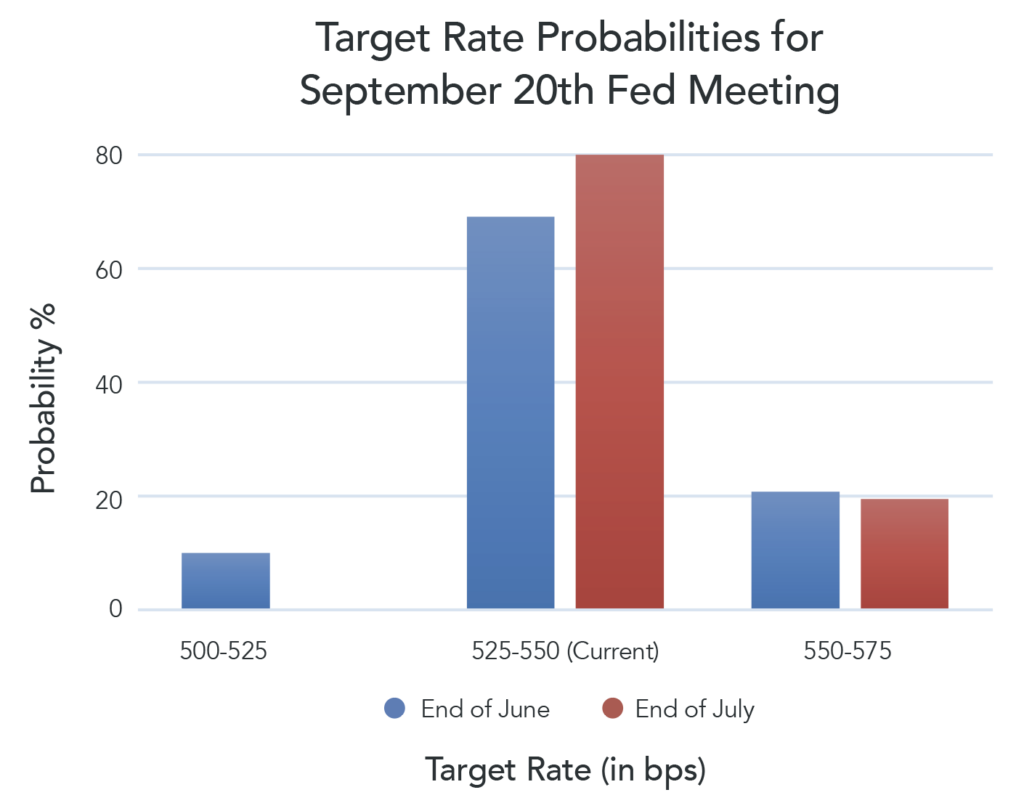

On July 26th, the Federal Reserve (Fed) increased the federal funds rate by a quarter of a percentage point to the highest level in 22 years. The move was part of the most aggressive monetary tightening campaign it has conducted in decades, setting the new target range at 5.25% to 5.5%, with unanimous support from the Federal Open Market Committee (FOMC). Fed Chairman, Jerome Powell, stated that further rate hikes were possible depending on the data, and that the next meeting could see another increase if warranted. The decision came as job gains were robust and economic activity was expanding moderately throughout July. Previously, most officials projected the base rate to peak at 5.5% to 5.75%, implying a potential quarter-point increase in September. However, market participants and economists remain sceptical, with futures markets anticipating a pause at the next meeting which is scheduled for September 20th, allowing for two more rounds of monthly data on jobs, inflation, and consumer spending before any potential decision on further rate adjustments.

Source: CME FedWatch Tool, as implied by 30-Day Fed Funds futures pricing data Accessed 31/07/2023.

Accountability in Action: UK regulator sets deadline for banks to justify low interest rates for savers

The UK’s Financial Conduct Authority (FCA) has established a deadline for banks to explain the reasons behind low interest rates for savers. The decision came after discovering that just over a quarter of recent Bank of England (BOE) rate increases had been passed on to the most popular deposit accounts. The FCA is implementing a new Consumer Duty that mandates “fair outcomes”, and banks with the lowest rates will be required to justify their products’ compliance by the end of August, with failure to do so potentially resulting in regulatory action.

Pressure from regulators and politicians has been mounting on banks to pass on rate increases to depositors more promptly, as they have been doing so for loans to bolster profits. Smaller lenders, however, were found to offer higher interest rates on average than their larger counterparts. Some banks have recently raised their savings rates, but the FCA is urging a broader set of measures, including more frequent assessments to ensure fair value in deposit rates as they found only 28% of BOE rate increases have been passed on to instant access accounts across the UK.

Risk-free assets are investments that are considered to have negligible risk of default or loss of principal. These assets, such as bank deposits, are known for their high level of safety but typically provide lower returns compared to the rate of inflation. This means that while they offer a reliable way to preserve capital, they often don’t keep pace with the rising cost of goods and services over time. As a result, investors may find that their purchasing power diminishes over the long term due to the erosion of returns by inflation.

* The FCA’s research covered nine of the UK’s biggest banks: Lloyds, HSBC, NatWest, Santander UK, Barclays, Nationwide Building Society, TSB, Virgin Money, and the Co-operative Bank.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024