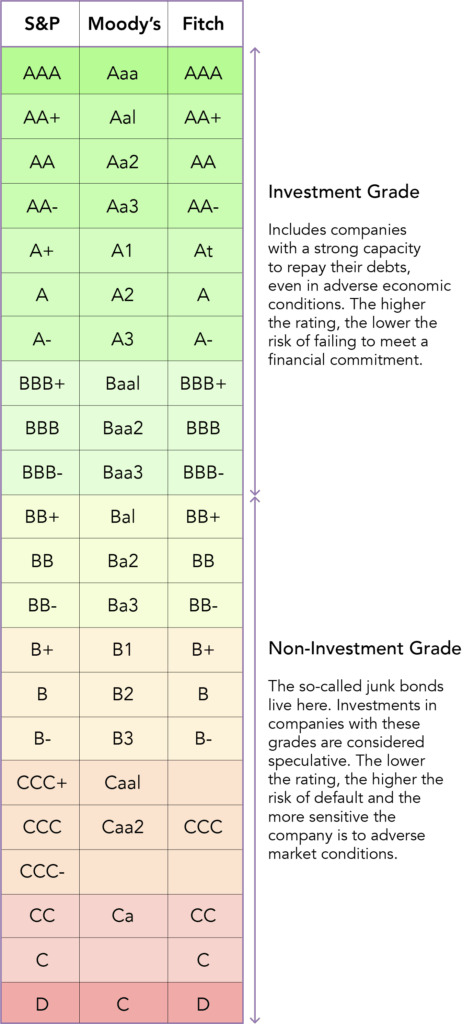

On August 1st, Fitch Ratings announced it cut the U.S. debt rating from triple A (AAA) to double A plus (AA+), just two months after a political standoff as the US approached its debt ceiling. As a result of this standoff, Fitch had placed the triple A credit rating on negative watch in May, with this week’s downgrade arriving despite lawmakers and the White House striking a last-minute agreement to suspend the federal borrowing limit in June, narrowly avoiding a historic default.

Fitch is one of three major rating agencies whose perspectives are observed by global market participants and economists. Moody’s, on the other hand, maintains its triple A rating for the U.S., whereas S&P reduced its own rating for the U.S. to double A plus back in 2011 following a prior clash over the debt ceiling.

On Wednesday (August 2nd), all major U.S. stock markets closed the day with losses. The Nasdaq, which has a focus on technology stocks, experienced the most substantial decline, falling by more than 2.0%. Simultaneously, the S&P declined by 1.4%, and the Dow exhibited a decrease of 0.8%. This downward trend extended beyond U.S. markets, affecting stock exchanges in both Europe and Asia. The FTSE 100 index in the UK dropped by 1.4%, reaching a two-week low, marking its most significant single-day drop in nearly four weeks. Similarly, Germany’s DAX and France’s CAC both faced losses of approximately 1.3%. Japan’s Nikkei 225 witnessed a substantial drop of 2.3%.

The notion that when the U.S. sneezes, the rest of the world catches a cold holds true in this case, evident in the global market volatility caused by the U.S. government’s credit rating downgrade. According to Fitch’s assessment, a gradual decline in governance standards has occurred over the past two decades, encompassing fiscal and debt-related issues. The recurrence of political standoffs over the debt limit and the reliance on last-minute solutions have progressively diminished trust in its fiscal administration. These factors collectively serve as the basis for Fitch’s decision to downgrade the credit rating.

A better credit rating is an indicator of an entity’s (such as a government or corporation) creditworthiness and ability to repay debt obligations. A higher credit rating implies lower credit risk, and there are several ways in which a better credit rating reduces risk:

Lower Borrowing Costs

Entities with higher credit ratings are seen as less risky borrowers. As a result, they can secure loans and issue debt at lower interest rates. This reduces their cost of borrowing, making it more affordable for them to raise funds through debt issuance.

Access to Capital

A better credit rating enhances an entity’s ability to access capital markets. Investors are more willing to invest in bonds or other financial instruments issued by entities with strong credit ratings, as they perceive these investments to be safer. This broader investor base provides greater access to funds when needed.

Confidence and Reputation

A high credit rating signals financial stability and responsible management. This can instill confidence in stakeholders, including customers, suppliers, and investors. Maintaining a good credit rating helps preserve an entity’s reputation and can foster positive relationships with various stakeholders.

Reduced Counterparty Risk

Financial transactions often involve multiple parties. A better credit rating reduces the risk that the entity will default on its obligations, which in turn reduces the counterparty risk faced by other entities in transactions or agreements.

Lower Collateral Requirements

Lenders might require less collateral from entities with strong credit ratings. This is because a higher credit rating implies a lower likelihood of default, making the lender more comfortable with extending credit without demanding extensive collateral.

Economic Stability

In the case of countries or governments, a strong credit rating can contribute to economic stability. It can attract foreign investment, stabilize currency values, and lead to stronger overall economic growth.

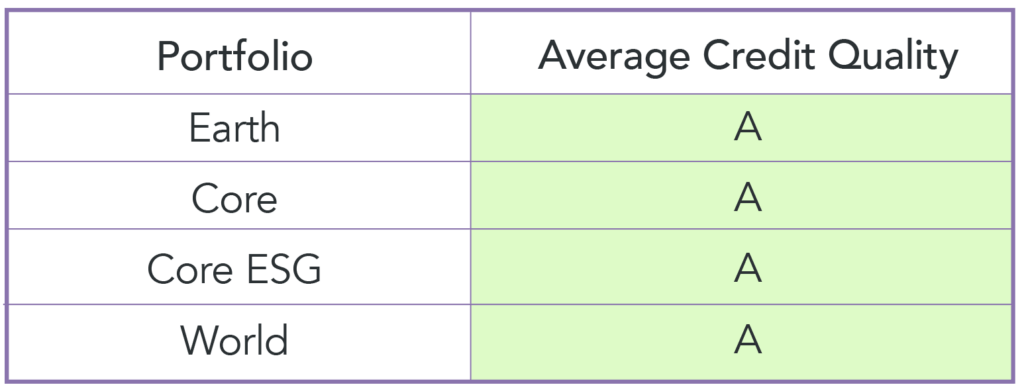

In summary, a better credit rating indicates a lower perceived risk of default, which translates into various financial advantages as aforementioned. ebi invest in investment-grade bonds from around the world (currency exposure is hedged to avoid unwanted exchange rate-driven volatility), with the average credit quality being ‘A’ throughout our portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios