August Economic Background

• Bank of England increases base rate from 5% to 5.25%

• UK CPI inflation came in at 6.8% for July

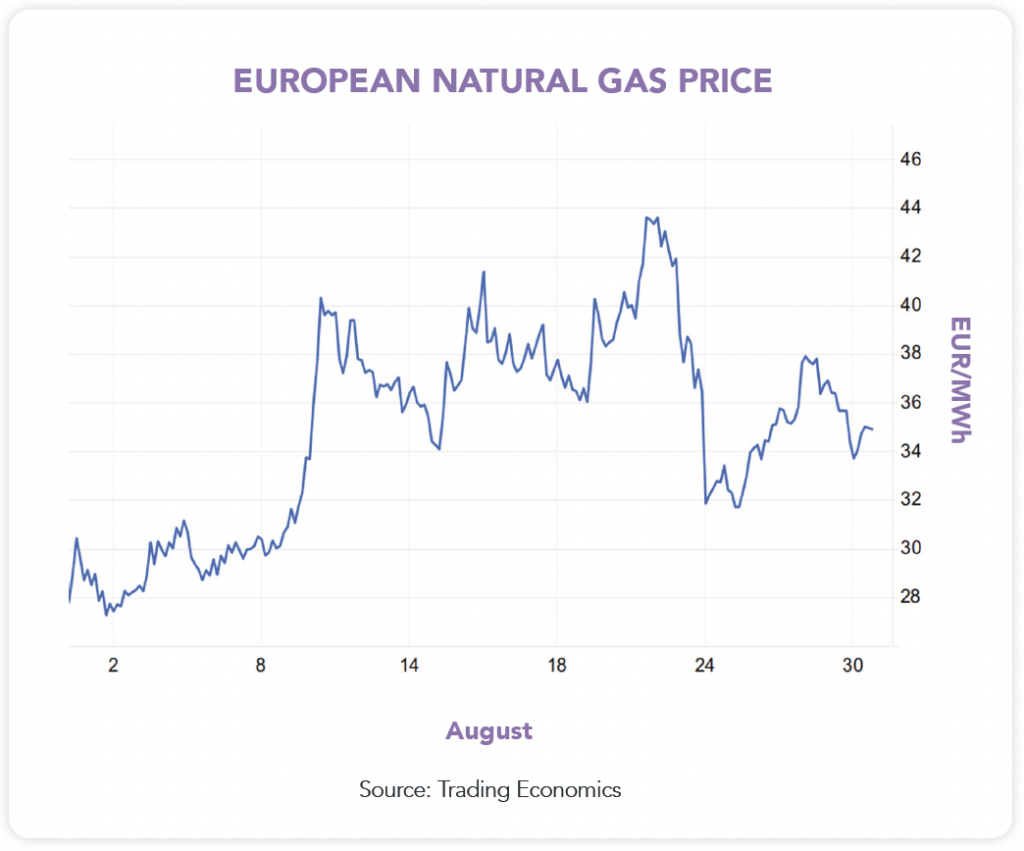

• European gas prices fluctuate amid supply disruption

fears

• S&P 500 falls over August, but experiences a late rally

fueled by interest rate optimism

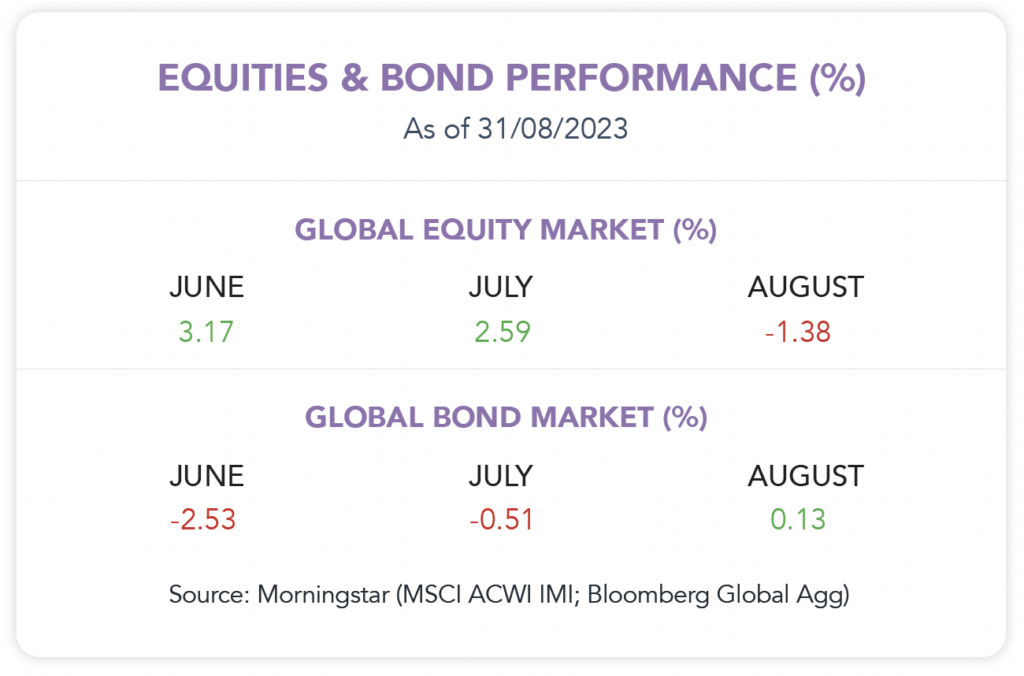

Market Review

UK inflation and interest rates: On August 3rd, the UK’s monetary policy committee (MPC) voted to take interest rates to a 15-year high, raising rates from 5% to 5.25%. Most economists had forecast a quarter-point increase after inflation had fallen to a 15-month low of 7.9% in June. CPI Inflation data for July arrived 2 weeks later on August 16th, standing at 6.8%, predominantly driven by easing food cost pressures. Albeit, the MPC cautioned that “it was too early to conclude that the economy was at or very close to a significant turning point”, meaning that borrowing costs are likely to remain elevated despite inflation slowing for the second consecutive month.

European gas prices: In early August, European gas prices surged almost 40% overnight due to supply disruption fears after reports of planned strike action at LNG (Liquified Natural Gas) plants in Australia. While Australian LNG supplies rarely flow directly to Europe, they have become increasingly dependent on global LNG shipments to fill the gap left by reduced Russian supplies following the Ukraine conflict. With the majority of Australian natural gas resources being distributed to Asian markets, the prolonged strike could prompt Asian buyers to explore alternative sources and intensify their competition with Europe. However, towards the end of the month, after unions in Australia reached a tentative agreement, the strike action that threatened to develop subsided and European natural gas prices fell sharply. Albeit, recent market fluctuations highlight Europe’s vulnerability to price surges and instability within the gas industry, whereby rising energy prices will make it even more challenging for the central bank to bring inflation under control and back closer to their target of 2%.

Late rally in the U.S: The magnificent seven (Microsoft, Apple, Amazon, Google, Tesla, Nvidia, and Meta) are responsible for over three-quarters of the S&P 500’s gains so far this year, however the first half of August saw more than $600bn lost in market capitalization as their shares tumbled and the U.S. stock market experienced a broad sell-off. The S&P 500 closed August -1.6% for the month, with the negative returns tempered by a stock market rally materialising in the final trading days of August – as data for new job openings in the U.S. fell to 8.8m in July, against expectations of 9.5m, signaling a slowdown in the labour market. Ultimately, this will ease pressure on the Federal Reserve (U.S. central bank) to further raise interest rates this year, which fueled investor optimism and resulted in the S&P’s largest one-day gain in nearly 3-months.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024