Unanticipated Growth in UK House Prices

Nationwide Building Society chief economist, Robert Gardner, has noted “tentative signs of a recovery” in the UK housing market, following a 0.5% rise in house prices last month (after taking into account seasonal effects). This increase reflects an improvement in consumer confidence, likely in part due to a recent decrease in mortgage rates. This is the first monthly rise in UK house prices in seven months, with the average price rising to £260,400 from £257,100 in March, indicating that the market may be starting to stabilise. Nominal wage growth remaining robust in the private sector and the easing of mortgage rates may improve affordability in the coming months, however, many economists do not expect it to lead to a significant market rebound. This is because there is an expectation that inflation will decline by year-end, and the Bank of England’s base rate is nearing its peak, leading buyers to delay purchases in the hopes of a rate reduction.

AI Progression

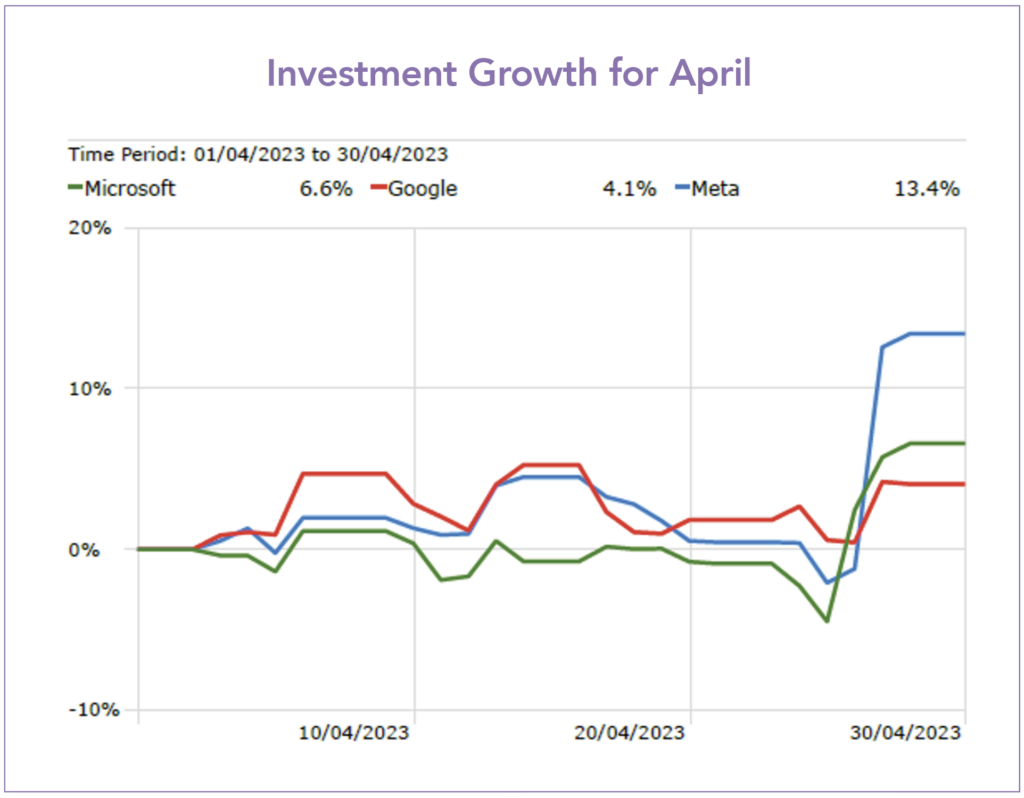

Following the debut of ChatGPT last year, tech giants Microsoft, Google, and Meta have undergone notable transformations in their approach towards artificial intelligence (AI). As they all seek to gain an edge in this field, they have poured considerable resources into incorporating generative AI technology into their products and services, leading to intensified competition. After a period of cost-cutting, mass layoffs, and AI investment, the big tech trio appear to have successfully navigated a challenging period, and are now looking for AI to boost valuations moving forward. The aforementioned stocks received a notable price boost as a result of strong quarterly revenue and profit estimates released in the final week of April, fueled by the development and sales of AI services. While the early enthusiasm for AI has increased investor confidence, it remains unclear whether the required investment by these companies will translate into the revenue necessary for significant returns.

Eurozone Inflation

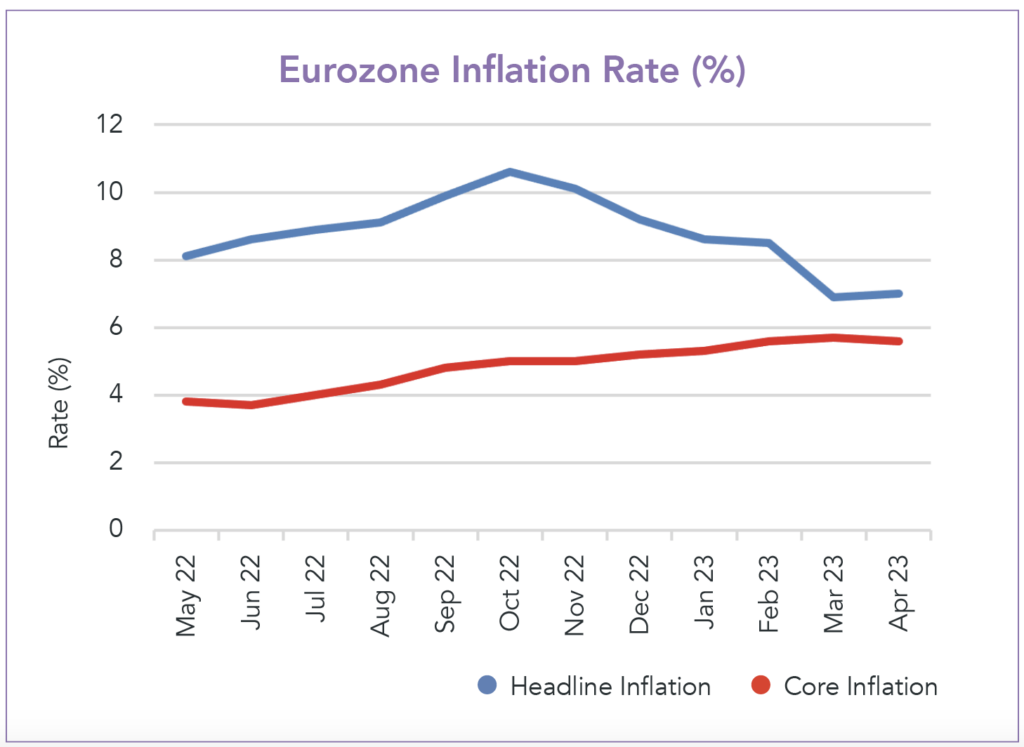

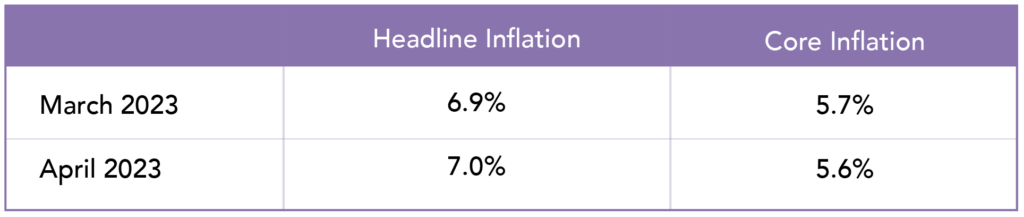

As we await UK and U.S. inflation figures, Eurozone inflation surprisingly rose slightly to 7% in April, up from 6.9% the previous month, posing a challenge for the rate-setters at the European Central Bank (ECB) who meet in early May to address the stubbornly high inflation. Despite the slight rise in headline inflation, core inflation, which excludes the volatile food and energy categories, saw a small decline from 5.7% in March to 5.6% in April.

The surge in energy prices resulting from Russia’s invasion of Ukraine contributed to the persistent rise in consumer prices, with headline inflation peaking at 10.6% in October of last year. Inflation then fell, reaching its lowest level for a year in March following a decline in energy costs, however April’s data revealed year-on-year energy prices rising to 13.1%, complicating matters further for future rate decisions. Much of the recent improvement in headline inflation has been from falling energy and food prices, but a resurgence in inflation would be damaging to inflation expectations and may be difficult to tame, thus ECB officials have said they do not expect to stop raising rates until underlying inflation declines significantly.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024