Overall Market Backdrop, Q1

• Central banks continue their rate hikes to tackle inflation

• Banking sector turmoil sent shockwaves through the market

• Geopolitical tensions retrace some of January’s gains in U.S and Asian markets

• European equities start the year strong despite aforementioned headwinds

• Sector returns have shown a contrasting pattern to the previous quarter

Drivers of Market Conditions in Q1

Central Banks

Rising interest rates and sticky inflation have continued throughout the first quarter of 2023, with the Bank of England (BOE) announcing their 11th successive rate rise, hitting the highest level since 2008. After announcing a 0.5% and 0.25% rate rise in February and March, respectively, it suggested that suppressing inflation is at the epicentre of their decision making. In January, UK inflation fell to 10.1%, however a surprise upside in inflation for February (10.4%) against expectations (9.7%) pinned back

a sharp pickup in consumer confidence after a strong start to the year. Across the pond, the Federal Reserve (Fed) continued its hawkish sentiment as rate rises reached their fastest pace since the 1980’s. However, the latest increase (of 0.25%) by both the Fed and BOE was smaller than previous meetings. In turn, markets repriced at the possibility that we could be “over the hump” as the rate at which rates are rising slowed for the first time since August of last year. Nonetheless, bank governor Andrew Bailey said that “the prospects of a recession had been on a knife-edge back in February”, but he now feels “a bit more optimistic” and expects inflation to fall sharply in the summer.

Banking crisis

March saw increased fears regarding the health of the banking sector. Broadly speaking, these fears have materialised due to investor concerns over the impact of higher interest rates. For example, as interest rates have increased, banks holding longer-dated fixed income portfolios have experienced greater (unrealised) losses, unless they fully hedged out the interest rate risk. While any losses would be manageable if the banks could hold the assets to maturity, if a significant number of customers seek to withdraw deposits this might force the bank to sell these assets, leading to a crystallisation of the losses and potentially bringing into question the banks’ solvencies.

Several concerns manifested in various forms, one of which was Silvergate, a lender with a focus on cryptocurrencies, declaring its closure in early March. This was followed by California-based Silicon Valley Bank (SVB), experiencing an escalating-bank run from its tech- and life science-focused depositor base, following a failed share sale. Having received demands to withdraw approximately a quarter of its total deposits in a single day, SVB failed on the 10th March, and was put into receivership by the Federal Deposit Insurance Corporation (FDIC).

U.S. regulators intervened on the 12th March and announced that SVB depositors would be repaid for the full amount of their deposits. This was controversial as it effectively amounted to a full backstopping of deposits (i.e. including those in excess of the $250k FDIC guarantee), and brought into question concerns regarding moral hazard at other banks. At the same time the Fed, U.S. Treasury, and FDIC announced a number of measures to shore up the stability of the banking system, including the Bank Term Funding Program. This is a program that boosts liquidity to banks through providing them with loans against the par value of certain types of bonds pledged as collateral. Regulators also acted in relation to the Signature Bank of New York (a separate US bank, with a customer base concentrated in the tech and cryptocurrency industries), putting the bank under FDIC control, and announced customers would have full access to their deposits the following working day.

These concerns led to tremors the other side of the Atlantic as Credit Suisse appeared on the brink of failure on the 17th March. After a weekend of franticly exploring options, on the 19th March it was announced that UBS acquired Credit Suisse, in an all-share deal worth c.$3.25bn. As part of the deal, the Swiss National Bank offered UBS a liquidity line valued at over $100bn, with UBS also securing a loss guarantee of c.$10bn. Controversially, Credit Suisse’s Additional Tier 1 (AT1) bonds were wiped out as part of the deal, with some investors exploring potential legal action in response. This was followed by a wider banking sector sell-off on the 24th March, led by Deutsche Bank which had seen a spike in the cost of insuring its debt against default (through credit default swaps). As the quarter drew to a close, some stability had returned to the banking sector, however the prospect of further developments remains as we progress through the second quarter.

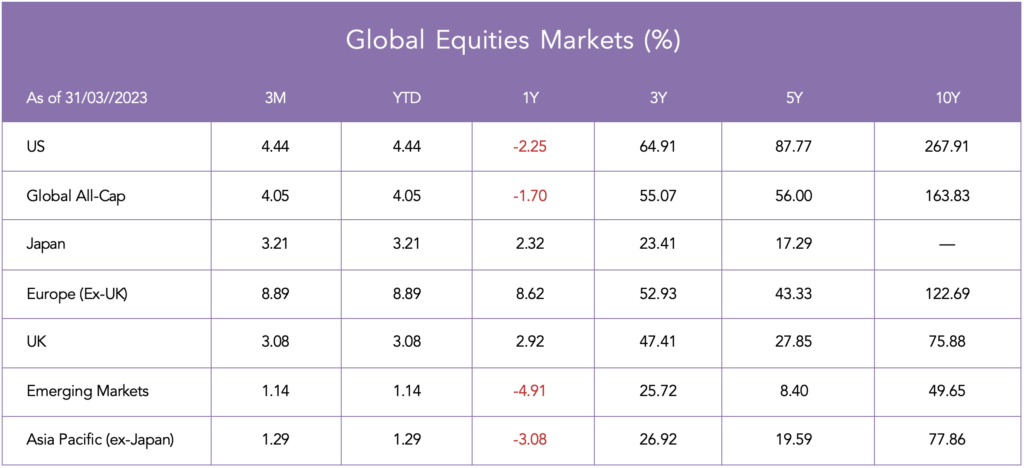

UK & European Equities

The Russia-Ukraine war, coupled with political instability and potential energy shortages exacerbated inflationary concerns throughout 2022 and weighed heavily on European stocks. As aforementioned, Europe drastically underperformed the U.S. last year and in the first quarter of 2023, a strong bounce back materialised and a lot of the lost ground was recovered. The strong performance over the last 3 months stemmed from signs that inflation levels were easing and gave confidence around interest rate decisions, ultimately providing investors with greater optimism. That being said, an abundance of macro risks remain which certainly have the power to influence markets. Bank failures in the U.S. and the acquisition of Credit Suisse have erased some of the early gains as UK bank shares fell in tandem (with the sector representing c. 10% of the UK market) and the Chancellor’s Spring budget did little to boost market sentiment.

U.S. Equities

2023 has seen lacklustre performance from U.S. equities. Despite potential banking difficulties, the Fed and other central banks indicated that it would not deter them from pursuing further tightening measures. In response, U.S. authorities acted quickly to mitigate the spread of any negative effects by safeguarding depositors against potential bank collapses. However, considering valuations alone, it appears unconvincing that the U.S. will continue to dominate. Currently, the U.S. market has a forward price-to-earnings ratio of 18.3x, which is 48% higher than the rest of the developed world and 59% higher than emerging markets. A noteworthy observation which has sparked a rotation and reflects a larger shift in sentiment this quarter is that the supremacy of the U.S. dollar seems to have reached its peak in September of last year. A weakening U.S. dollar has the potential to cause inflation, which could reduce the value of U.S. companies’ earnings and overall profitability. Additionally, it could result in higher input costs for U.S. companies, thereby impacting their earnings negatively.

Asia Equities

China’s economy received a boost from the reopening, however January’s gains were soon retraced as diplomatic tensions with the U.S. escalated following a controversy over an alleged spy balloon that was shot down by the U.S. military. In March, the focus turned to a three-day visit by Chinese President Xi Jinping to Moscow, as the two nations sought to enhance their ties amidst an increasing divide with the West across several domains, including geopolitics, economics, and military affairs.

Emerging Markets

Following a positive start to the year, the performance of emerging market (EM) equities waned in February due to the loss of momentum in the China re-opening rally as the situation was compounded by the resurgence of tensions between the U.S. and China. Similarly, the ongoing military conflict between Russia and Ukraine is still influencing the overall economic forecast and potential hazards for emerging markets located in Europe, the Middle East, and Africa (EMEA). The extent of its impact will vary based on each country’s location and economic ties to the conflict, as well as their level of involvement in commodity trade.

Tightening of global financial conditions continue to act as a headwind, whereby the combination of slower growth and elevated vulnerabilities create adverse feedback loops. In spite of that, institutional investors have poured money into EM stocks and bonds at near record rates so far this year, albeit the geopolitical uncertainty remains the biggest threat to the asset class as the ongoing turmoil bears on investors’ willingness to take risks.

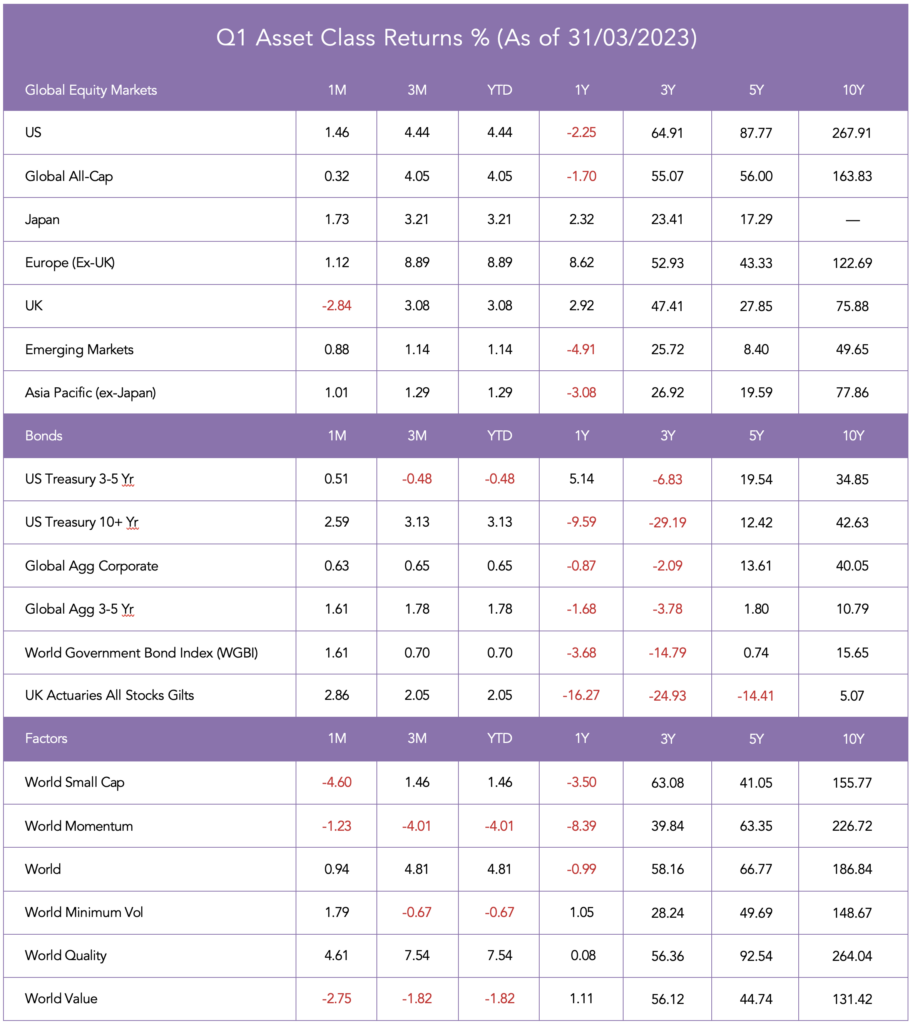

Bonds

The negative performance for bonds in 2022 can be largely attributed to inflation – unfavourable for bond investors due to their inverse relationship with interest rates. However, soft signs that inflation may be peaking may prove more of a tailwind than a headwind in 2023. Fixed-income investors perceived these events as indications that the tightening cycle was drawing to a close, primarily to combat a recession, and thus anticipated rate reductions this year. As a result, there were broad gains across the asset class, with sovereign debt, corporates, and EM bonds rebounding from three quarters of losses.

From a country-specific perspective, the strongest flows were primarily focused on Bunds and OATs (German and French government issued bonds, respectively). Investment grade experienced a significantly greater increase in activity compared to high yield, with the latter displaying a lower level of enthusiasm as flows rebounded slightly from their previous lows, but ultimately settled back to their usual long-term average. The ongoing ambiguity surrounding growth prospects for this year is expected to make investors cautious towards lower-rated credits, which are likely to be hit the hardest from increased fears in defaults.

U.S. bond markets experienced substantial losses last year; however, in the first quarter, they made a slight recovery as yields, which have an inverse relationship with bond prices, decreased. At the beginning of the year, the 10-year U.S. treasury yield was at 3.88%, but ended the quarter at 3.48% (reaching intra-quarter lows of 3.38%).

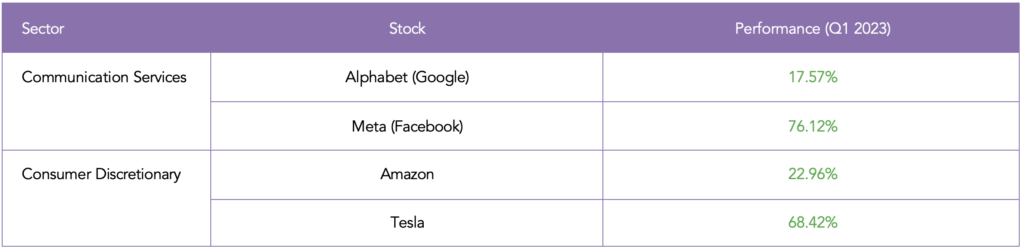

Sector Returns

The market trends in 2023 have shown a contrasting pattern to the previous year, where technology, communication services, and consumer discretionary stocks suffered significant losses, while oil and gas stocks performed exceptionally well. Consumer discretionary and consumer services, which were among the worst-performing sectors in 2022 (-6.42% and -4.72%, respectively), have emerged as the top-performing sectors for Q1 (10.33% and 13.34%, respectively).

Weight in sector index: Alphabet (13.19%), Meta (9.74%), Amazon (13.40%), Tesla (8.50%), as of 28th February 2023.

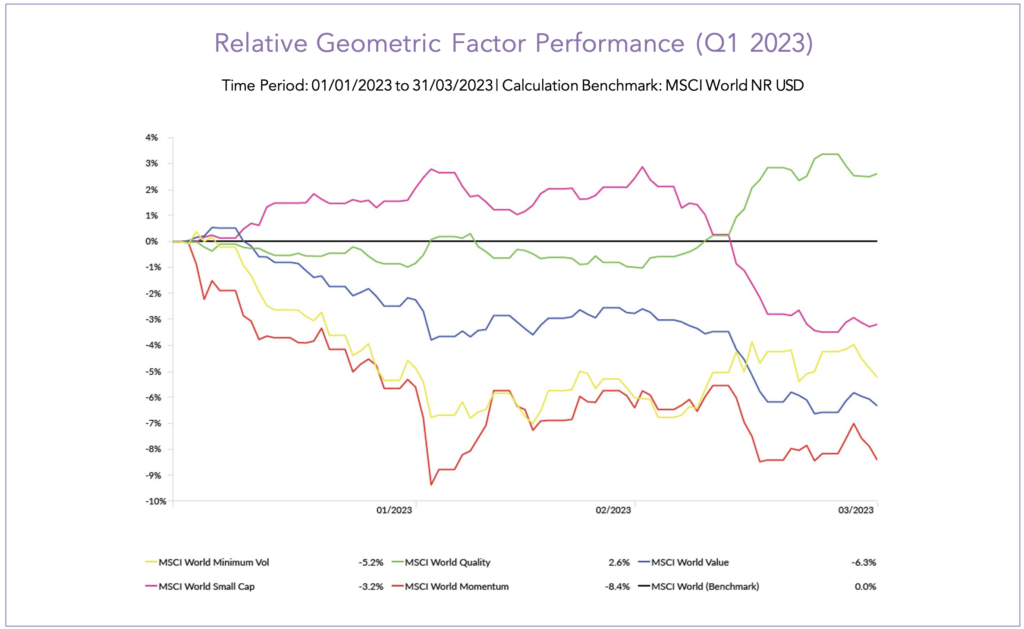

How did Factors Perform in Q1?

- The performance of factors was varied, with quality showing the highest return (7.54%) and momentum displaying the weakest return (-4.01%).

- Characterised by robust financial strength and consistent free cash flow, quality stocks have performed best during the high interest rate environment which has created economic volatility and uncertainty as investors are willing to pay a premium for their stability and predictability.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024