Evidence Based Investing

Can Corbyn win, and what if he does?

[The following is NOT a forecast – according to some bookies, Corbyn has only a 14% chance of being the next Prime Minister. What follows is an unlikely potential scenario which would have a high impact on markets – a so-called Black Swan event] There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know. – Donald Rumsfeld Black Swan: An outlier event, with an extreme impact…

The Long Term view on EM

It hasn’t been a great period for all things Emerging recently. Predictably, analysts have turned negative co-incidental with the market falls. EPS forecasts have collapsed as this chart shows. As this article points out, however, that is a bullish sign for investors. Warren Buffet is often quoted as saying, “Be fearful when others are greedy, and greedy when others are fearful”, and this may be one of those moments. Meanwhile, aggregate Developed Market Bond and Stock valuations are at their highest level of all time, according to Deutsche Bank.

Keeping your Balance

You’re not really diversified if you don’t hate something in your portfolio at the moment. – A Wealth of Common Sense, Ben Carlson 1/9/2015 Would you want to buy this market? We think that it can make sense… Source: Bloomberg One of the most important tasks in Long Term Investment is that of maintaining one’s asset allocation. Once a risk tolerance level has been set, one invests in a portfolio of assets, but that Portfolio will “drift” over time as the investments will generate differing returns. If stocks outperform bonds, for example, an original 60/40 (e.g. EBI 60) could morph into EBI 75 or even higher, which may be above the clients risk tolerance. The Tech bubble and subsequent crash will have pushed the Portfolio weighting above (and then below!) the client’s true risk level…

This Too Shall Pass

[This post is intended to try to explain current market trends and what it means looking forward. As Yogi Berra said, “its tough to make predictions, especially about the future”, so we won’t try. But, we can try to understand what is causing this huge shift in investor sentiment, as it may help us withstand whatever lies ahead. The views expressed are my own.]

The Value Premium – Missing in Action?

In investing, the value premium refers to the greater risk-adjusted return of value stocks over growth stocks. Eugene Fama and K. G. French first identified the premium in 1992, using a measure they called HML (high book-to-market ratio minus low book-to-market ratio) to measure equity returns based on valuation. “The value factor clearly works, but the explanations for why vary. Historically, value stocks have outperformed growth stocks. The evidence is persistent and pervasive, both around the globe and across asset classes. While there’s no debate about the premium, there are competing theories to explain its existence”. Notwithstanding the above quote there is definitely a debate to be had on the existence of the “Value Premium”, not least because it has been conspicuous by its diminishing presence in the recent past. The chart below shows the returns to value over the past 20 years. As of 28/2/15…

Small Caps – Is there still a premium?

Are Small Caps a truer proxy for UK plc? The performance of UK Small Cap shares has outshone both the overall market and the widely quoted FTSE 100 Indices as the chart below shows. It is worth going over the make-up of the various Indices. The FTSE 350 Index is the sum of the FTSE 100 and the FTSE 250 Indices (in Market Cap terms) The FTSE All Share Index is the sum of the FTSE 350 Index and the FTSE Small Cap Index (in Market Cap terms) FTSE 100 Aggregate Market Cap £1.71 Trillion FTSE 250 Aggregate Market Cap £354 Billion FTSE 350 Aggregate Market Cap is thus £2.06 trillion FTSE Small Cap Aggregate Market Cap £77.05 billion. FTSE All Share Aggregate Market Cap is therefore £2.14 trillion.

Emerging or Submerging Markets?

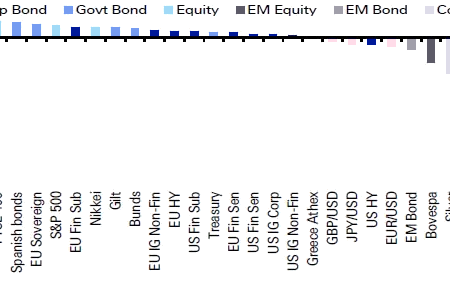

Emerging Markets had a torrid month in July. Only 5 out of the 23 EM markets made gains, as worries over falling Commodities and rising political tensions prompted Investors to withdraw large amounts from both Fixed Income and Equity funds. According to ETF.com, $15.9 billion has been redeemed from ETF’s in 2015. The banner image above shows that losses were concentrated in Commodity and Emerging market Indices. The Chinese market has seen a 28% intra-month range (High to Lows) as Authorities have tried to contain almost panic-selling, whilst Brazilian equities have fallen 4% in July too.

Staying the Course

The media frenzy is in full swing today as markets see sharp falls, especially in China (and today Hong Kong). But what will this all look like in 10 (or even 20) years? The chart below shows the FTSE All Share Index on a log basis. Without knowing when it occurred, it may be difficult to see the “crash”, when shares fell 21% in one day(!). This underscores the crucial importance of not over-reacting (or over-analysing) market movements. There is a distinction between the map and the terrain – volatility is the norm, not the exception, and those who can ignore the news, the hype, the scaremongering of the financial media will survive and prosper.

The Perils of Market Timing

This is an example of a report I was asked to prepare for a client who was interested in the oil market. It was written on the 27th March 2015 when the oil price was less than $50 per barrel. Post this report, the oil price rose relentlessly, reaching $64 within a month. It clearly demonstrates the limits of using “fundamental analysis” to gauge future market movements. The fact that it was almost completely wrong, despite the wealth of data to support it, reminds one that trying to foretell markets’ behaviour is a fool’s errand. Markets are designed to wrong-foot the majority, and so it is much more sensible to just take what the market gives you. That is what Index Investing is all about. The Oil Market: How to Profit from Price Moves There are several ways to gain exposure to a rise in oil prices: Buy low cost oil producers Buy oil service companies…