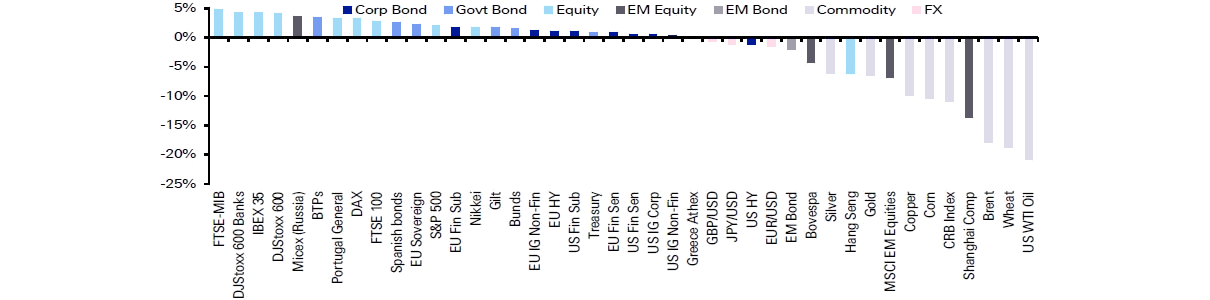

Emerging Markets had a torrid month in July. Only 5 out of the 23 EM markets made gains, as worries over falling Commodities and rising political tensions prompted Investors to withdraw large amounts from both Fixed Income and Equity funds. According to ETF.com [1], $15.9 billion has been redeemed from ETF’s in 2015. The banner image above shows that losses were concentrated in Commodity and Emerging market Indices. The Chinese market has seen a 28% intra-month range (High to Lows) as Authorities have tried to contain almost panic-selling, whilst Brazilian equities have fallen 4% in July too.

We are already seeing Investors retreat from these markets, by withdrawing money. According to the FT [2], Investors pulled £9.9bn out of funds run by Aberdeen Investment Management, (which is Europe’s largest listed asset manager), in the three months to the end of June, which analysts said was down to under performance and turbulence in Emerging Markets.[2] Investors are dumping billions of dollars’ worth of gold, commodities and Emerging Market assets in a wave of “capitulation” selling, Bank of America Merrill Lynch said on Friday. A net $3.3 billion was pulled from Emerging Markets funds, bringing the total outflow over the last fortnight to $10 billion. [3]

The fate of many Emerging Markets is closely linked to the price of Commodities, as many are major producers thereof. Oil, Copper and Iron Ore prices have all fallen between 10-20% in the past month, putting pressure on many nation’s finances. M&G Investments have noted the Ratings Agencies response: “S&P placed Brazil’s foreign currency ratings (BBB-) on negative outlook yesterday, only one small step away from junk status. S&P’s negative outlook implies that there is a probability higher than 33% that Brazil’s rating will be subject to a downward revision in the next 18 months.” [4]

The slowdown in both China and Brazil combined with the Dollar’s strength have reduced Investor appetite for Emerging Market assets. In contrast, Developed Markets have held up well, partly on repatriation flows, but also on a sense that they are starting to see (some) growth.

However, this needs to be put in context-as Jim Reid of Deutsche Bank notes, “China equities have still been one of the better performing asset classes YTD, however a significant portion of these gains have now been wiped out with the moves of the last three weeks. At the June 12th high, the Shanghai Comp had risen +60% YTD. Those gains have now shrunk to +11% and so putting it behind the Nikkei and in-line with a number of European equity markets. The numbers are even more eye-popping with the Shenzhen which at one stage had risen +122% Y-T-D, only to now be +36%.” [5]

The question is why now? Albert Edwards, Societe Generale’s Chief Strategist has a theory:

“One theme that has played out over the last year has been the rapidly deteriorating balance of payments (BoP) situation of emerging market (EM) countries, as reflected in sharply declining foreign exchange (FX) reserves (the BoP is the sum of the current account balance and private sector capital flows). We like to stress the casual relationship between swings in EM FX reserves and their boom and bust cycle. The 1997 Asian crisis demonstrated that there is no free lunch for EM in Fixing a currency at an undervalued exchanged rate. After a few years of export-led boom, market forces are set in train to destroy that artificial prosperity. Boom turns into bust as the BoP swings from surplus to deficit. Why? When an exchange rate is initially set at an undervalued level, surpluses typically result in both the current account (as exports boom) and capital account (as foreign investors pour into the country attracted by fast growth). The resultant BoP surplus means that EM authorities intervene heavily in the FX markets to hold their currency down. We saw that both in the mid-1990s and before and after the 2008 financial crisis. Heavy foreign exchange intervention to hold an EM currency down creates money and is QE in all but name [assuming that it is un-sterilised] and underpins boom-like conditions on a pro-cyclical basis. Eventually this boom leads to a relative rise in inflation and a chronically rising real exchange rate even though the nominal rate might be fixed. EM competitiveness is lost and the trade surplus declines or in extremis swings to large deficit. The capital account can also swing to deficit as fixed direct investment flows reverse as EM countries are no longer cost effective locations for plant. Ultimately as the BoP swings to deficit and FX reserves fall, QE goes into reverse, slowing the economy and exacerbating capital flight. As a virtuous EM cycle turns vicious (like now), commodity prices, EM asset prices and currencies come under heavy downward pressure – at which point it is difficult to discern any longer the chicken from the egg. In my view the egg was definitely laid a few years back as EM real exchange rates rose sharply and the rapid rises of FX reserves began to stall.” [6]

As an aside, this may mean that the (relative) strength of Developed Market currencies (especially the US Dollar) may be about to end, putting in jeopardy Federal Reserve plans to raise rates this year, as the re-cycling of Asian trade surpluses into US Dollars slows, and ultimately reverses.

EBI Portfolio Performance

[For illustration purposes, we shall look at EBI 60 to ascertain portfolio exposures and performance].

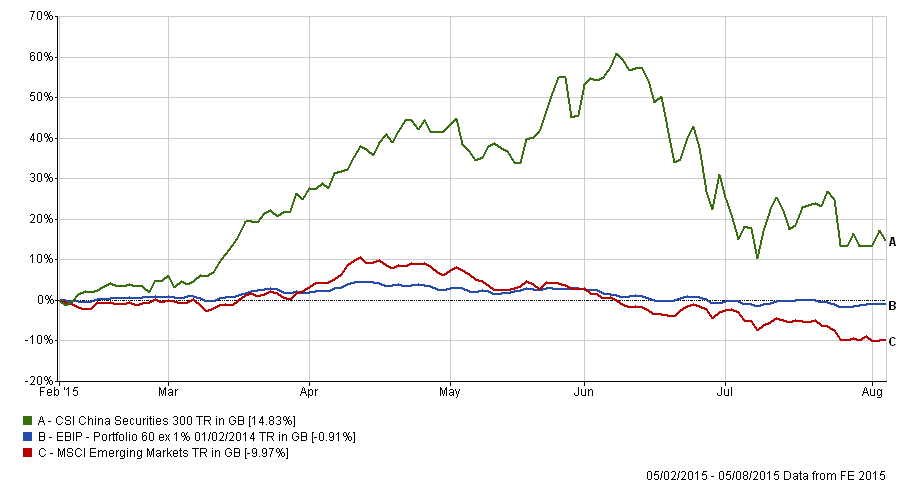

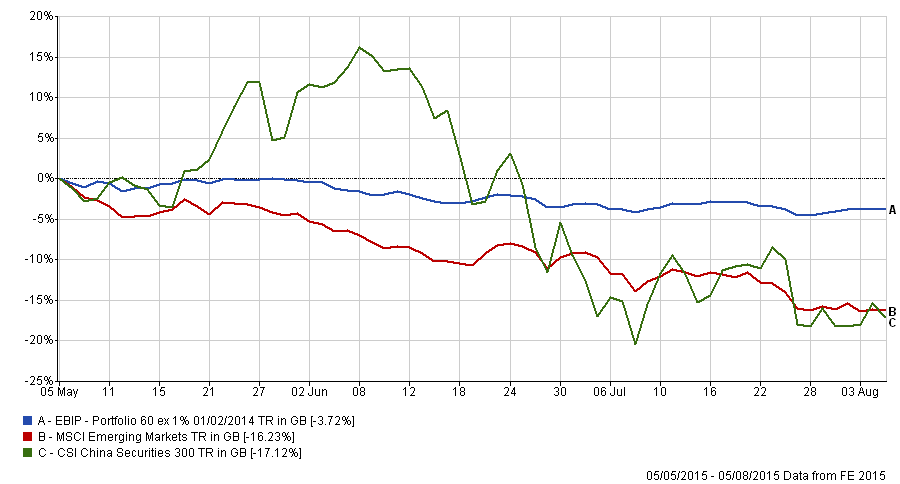

The above charts show the extent of recent declines in both Chinese and Emerging Markets Indices, together with the performance of EBI 60. As can be seen, the reaction has been muted.

As per the EBI Website home page the idealised Portfolio 60 Emerging Market weighting is 10.8% in Equity (07/08/2015). In the Bond holdings, as of 30/06/2015, the holdings in Vanguard’s Global Bond Index fund and the Global Short-Term Bond Index fund for Brazil,Turkey,China and India totalled 1.1% and 1.6% respectively. None of the other Bond Funds had EM holdings at that point. Indeed, given the minimum credit quality threshold employed by the Funds we hold, it would be surprising if any new positions were added during the last 8 months, and it is very likely that they have been reduced further.

As a result of the recent market declines the Portfolio is now below the proscribed weightings, at 9.45%. Thus, as the sector falls, the Portfolio becomes less and less affected by them. However, the weightings are now close to the 20% tolerance band at which we would be looking to re-balance, which would occur if the combined weighting falls to 8.64% or less, which represents a fall in the value of EM holdings as a proportion of the total Portfolio of 2.16%. At EBI, we see this as a chance to re-balance the Portfolio in line with our risk-management philosophy (see p.51 of our I.P.S Document here). Markets tend to over-react, especially on the downside, and the current fears will no doubt subside, leaving Active investors wrong-footed once again.

Footnote

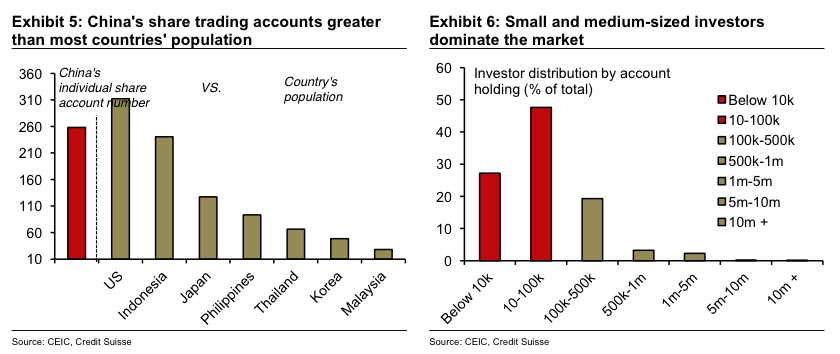

It has long been understood that Asian investors tend to enjoy a good gamble. The proliferation of Sports Betting syndicates attest to this reality. But the recent rise in Chinese stocks has taken this to another level of hyperactivity. It appears that they have not so much been buying as renting shares.

According to the (Chinese) Bank of Communications, quoted in Schroder’s The Value Perspective, the average holding period for Chinese stocks is just one week. [7] By way of comparison, the average holding period for US Mutual funds is 7 months, and UK Unit trusts is 9 months (both at multi year lows, but a far cry from the Chinese situation). The charts below highlight the different structure of the markets- Institutional investors have nowhere near the same influence on valuations etc. as they do in Western markets.

With this backdrop, it is not surprising that Emerging Markets in general (and China in particular) are very volatile. This is something that goes with the territory, and should not be a barrier to long term investors. Indeed, we are on the alert for opportunities to take advantage of the current malaise by re-balancing at what may prove to be advantageous prices.

- [1] ETF.com 4/8/15

- [2] FT.com 1/8/15

- [3] Reuters article 24/7/15

- [4] M&G Investments

- [5] Jim Reid, Deutsche Bank, Commentary 7/7/15

- [6] Societe Generale research 30/7/15

- [7] Shroders – The Value Perspective 28/7/15