You’re not really diversified if you don’t hate something in your portfolio at the moment.

Would you want to buy this market? We think that it can make sense…

Source: Bloomberg

One of the most important tasks in Long Term Investment is that of maintaining one’s asset allocation. Once a risk tolerance level has been set, one invests in a portfolio of assets, but that Portfolio will “drift” over time as the investments will generate differing returns. If stocks outperform bonds, for example, an original 60/40 (e.g. EBI 60) could morph into EBI 75 or even higher, which may be above the clients risk tolerance. The Tech bubble and subsequent crash will have pushed the Portfolio weighting above (and then below!) the client’s true risk level

The higher that prices in one asset class rise, the bigger the loss in cash terms when a decline occurs.

For example, assume £10,000 is invested in an asset, and rises 10% p.a for 3 years. That asset is now worth £13,300; a 10% fall from there loses £1,330, taking the value down to £11,980, and leaving a 4 year annualised return of 4.62%. Assuming that the holding had been reduced by 10% PRIOR to the fall, the cost would be £1,198 to the Portfolio.

There are various method employed to achieve this outcome. They are:

- Periodic rebalancing (every 6 months, every year)

- Tolerance band rebalancing (when an asset goes a certain percentage above its target allocation it is automatically sold to buy other assets that are below their target allocation). This is the method that EBI uses.

- Using inflows (new purchases, dividend income, etc.) to adjust the weightings.

All three can work (and are certainly better than NOT re-balancing at all), but the first is somewhat arbitrary, and doesn’t take into account market conditions. The third option can take a long time to achieve the desired aim, and is subject to the vagaries of cash flows, which may not materialise when needed. We prefer to monitor market developments and opportunistically adjust weighting when an asset class goes a certain percentage above target allocation (we sell) and buy when the weighting goes a set percentage below target (buy). [We also have to be mindful of the need to incorporate CGT issues into the decision, which is why we consult with clients before including them in a re-balance process].

Re-balancing also helps to impose a degree of discipline into the investment process. The act of selling out-performers and buying under performers allows the advisor to go with the grain of client wishes, by taking profits on winners and reinvesting in losers,which is what most people find psychologically easiest. (It is also much easier than trying to get them to take losses on holdings, which many are loathe to do).

It also takes advantage of the long term tendency for markets to mean revert- the two 50% + declines in global share prices in 2000-03 and again in 2007-09 scarred many investors, but the markets then rallied sharply, (the S&P more than tripled from the lows ), leaving Investors who had lost faith experiencing huge under performance compared to Benchmark Indices.

Benefits of Portfolio Rebalancing

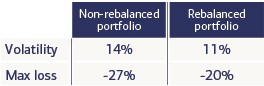

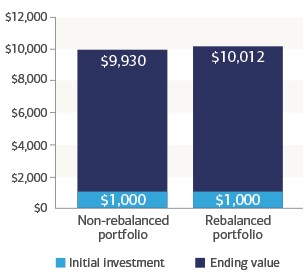

The comparison below shows the performance of two portfolios during the period of 1987 to 2013. Each portfolio starts out with a traditional allocation of 60% stocks and 40% bonds. One is rebalanced annually, and the other is not. The rebalanced portfolio experienced lower volatility and higher risk-adjusted returns.

Source: Bloomberg, Merrill Lynch Investment Management & Guidance (IMG).

There are clearly no guarantees in markets and no strategy will work 100% of the time. In a relentless Bull (Or Bear) market, re-balancing will not create extra returns, and we have no idea ex ante whether one of those situations are about to occur. The Japanese stock market, for example, may well have thwarted attempts to add value via re-balancing –in our simulations, 2009 saw three re-balances, which would obviously have been frustrating at the time. However, it is important to stress that we do not re-balance primarily to increase returns. The process works best when it aligns client’s portfolio weightings with their risk tolerance, because it enables them to stick with the strategy. Thus, the motivation is risk control-it does add value quite often: that’s just not why we do it.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.