[This post is intended to try to explain current market trends and what it means looking forward. As Yogi Berra said, “its tough to make predictions, especially about the future”, so we won’t try. But, we can try to understand what is causing this huge shift in investor sentiment, as it may help us withstand whatever lies ahead. The views expressed are my own.]

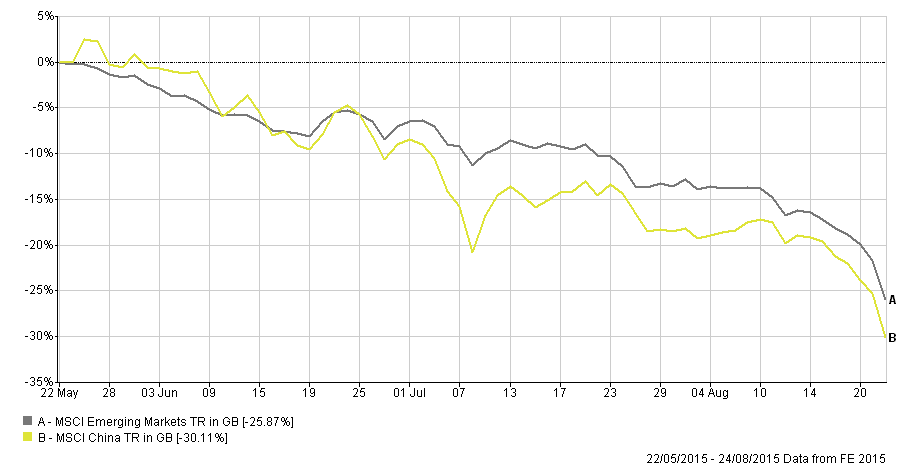

The last month has been a traumatic time for (some) investors. The emerging markets and China have been hit particularly hard as the following FE chart demonstrates. The defining event was the decision by the Chinese to devalue the Yuan, but at 5% (subsequently less than that) this could only be a trigger rather than a cause. Slower growth (in both China and thus the rest of the world) has also been cited, but that is not really news either. More likely, it is just a function of risk premiums widening in a rapid fashion after a long period of comparatively benign markets. Volatility is normal, and should not be assumed away just because it hasn’t appeared in the recent past.

The contagion has spread to commodities, and most recently, developed markets, where prices have gone on a wild ride. On the 24/8/15, the Dow Jones Index moves a total of more than 4000 points intra-day (or 26% of it’s closing value!). Needless to say, volatility indices have also exploded, as traders rush to protect themselves from the storm. Once it takes hold, volatility can be self-reinforcing, as seller be gets seller and so on. But it soon exhausts itself and today’s’ action (27/08/15) may be the start of that process.

Source: Zero Hedge.com

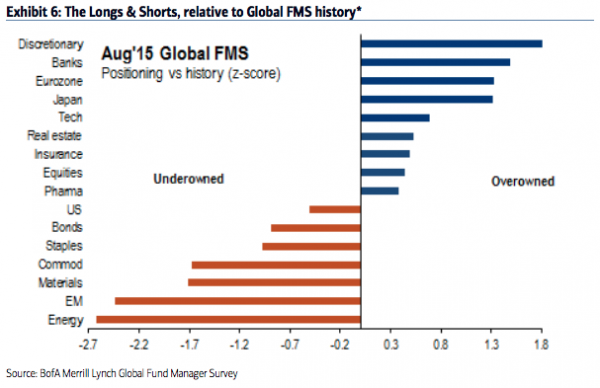

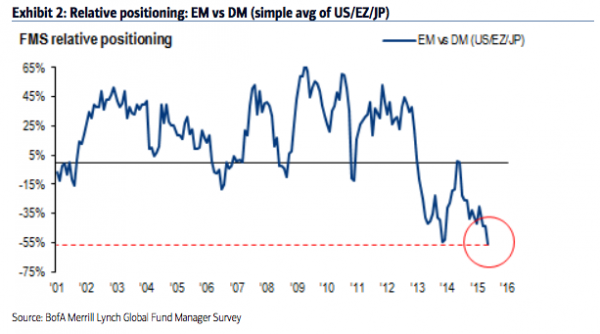

Sentiment has taken an extreme turn for the worse. Global Fund Managers (FMS) have taken the axe to emerging market and commodity positions in the past 30 days and are now hugely underweight relative to their own historical norms and to developed markets.

This looks suspiciously like capitulation, the point at which investors throw in the towel and get out of the asset concerned at (almost) any price. This often marks the low point, as once the forced sellers are out of the market, there is no-one left to sell. This, of course, is why we look to re-balance.The benefits of buying into under owned assets (at necessarily low prices) can be substantial, as the process forces the buying of cheap assets and selling of more expensive ones. This, of course is hard to do, but the rewards of banking on long term mean reversion more than justify the perceived risks.

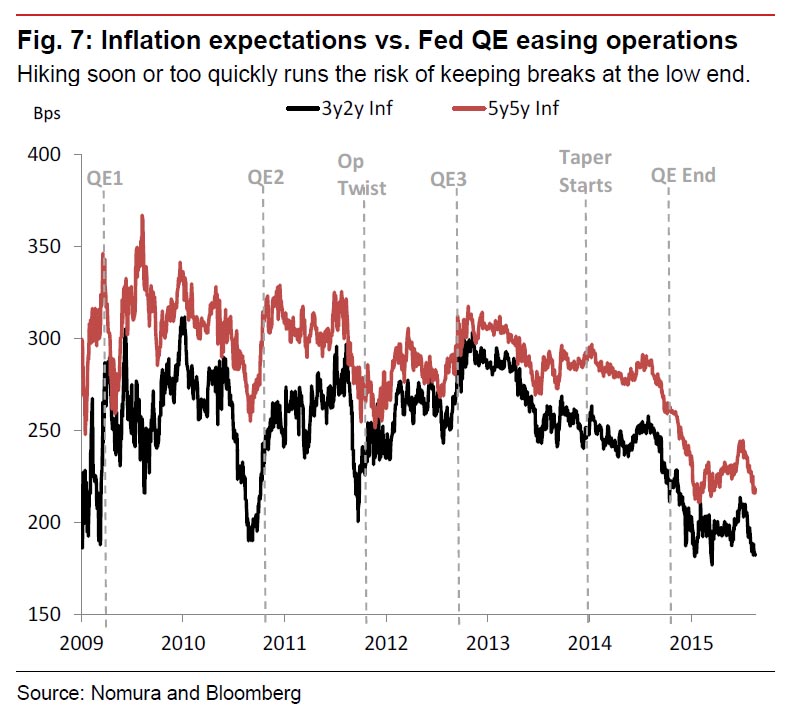

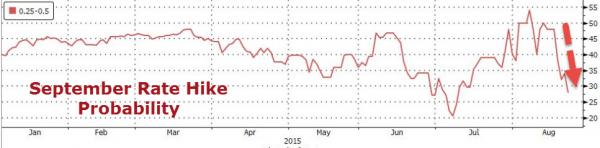

One of the consequences of this market turmoil has been the ebbing of market concerns about the prospect of US Interest rate hikes. As the commodity induced deflation wears on, inflation expectations (and thus the prospect of interest rate rises) fall ever lower, as the following charts show. This has helped stabilise the system, as fear of the economic effect of a US Dollar rate hike, especially in Asia was driving the EM Foreign Exchange rates of those nations ever lower, hurting their bonds in the process. The charts below shows that investors are now expecting deflation to get worse over the next 3-5 years, and the probability of a Fed rate hike has dropped sharply (according to Fed Funds futures contracts) to less than 1 in 3.

Source: Bloomberg

What is to be done?

There are many things that can be done, but most of them are self-defeating. The most unsettling part of market declines is that it reminds us of how little we know and understand in markets. “Markets hate uncertainty” is a cliché because markets are always uncertain. Too often analysts mistake certainty for a bull market!

Don’t fixate on the short term and if possible avoid the news – the media loves scare stories and the constant drip, drip effect on investors can wear away their resolve to stay on track. Nobody (least of all the news anchors on TV) knows the future and the worst thing one can do is to over-react to sudden moments of crisis. Furthermore, markets have a long and less than distinguished record of predicting the future. It is said that stock markets have predicted 9 out of the last 5 recessions (see here), and that the collective “failure of forecasters to predict recessions is virtually unblemished”, according to some – so there is no need whatsoever to take doom and gloom predictions seriously, let alone act on them.

The declines in markets creates the risk premiums (in small cap and value shares for example) that generates the long term returns investors seek. Ultimately, if there were no corrections, there would be no risk premiums to harvest.

Always keep in mind one’s investment objectives. Align your portfolio with your goals, tolerance for risk and investment horizon, diversify as broadly as possible to maximise risk control and don’t abandon your discipline when moments like the current period hits. Consider the overwhelming evidence that strongly supports the notion that long term investment pays off handsomely, but above all, remember this.

Nurture strength of spirit to shield you in sudden misfortune. But do not distress yourself with dark imaginings.