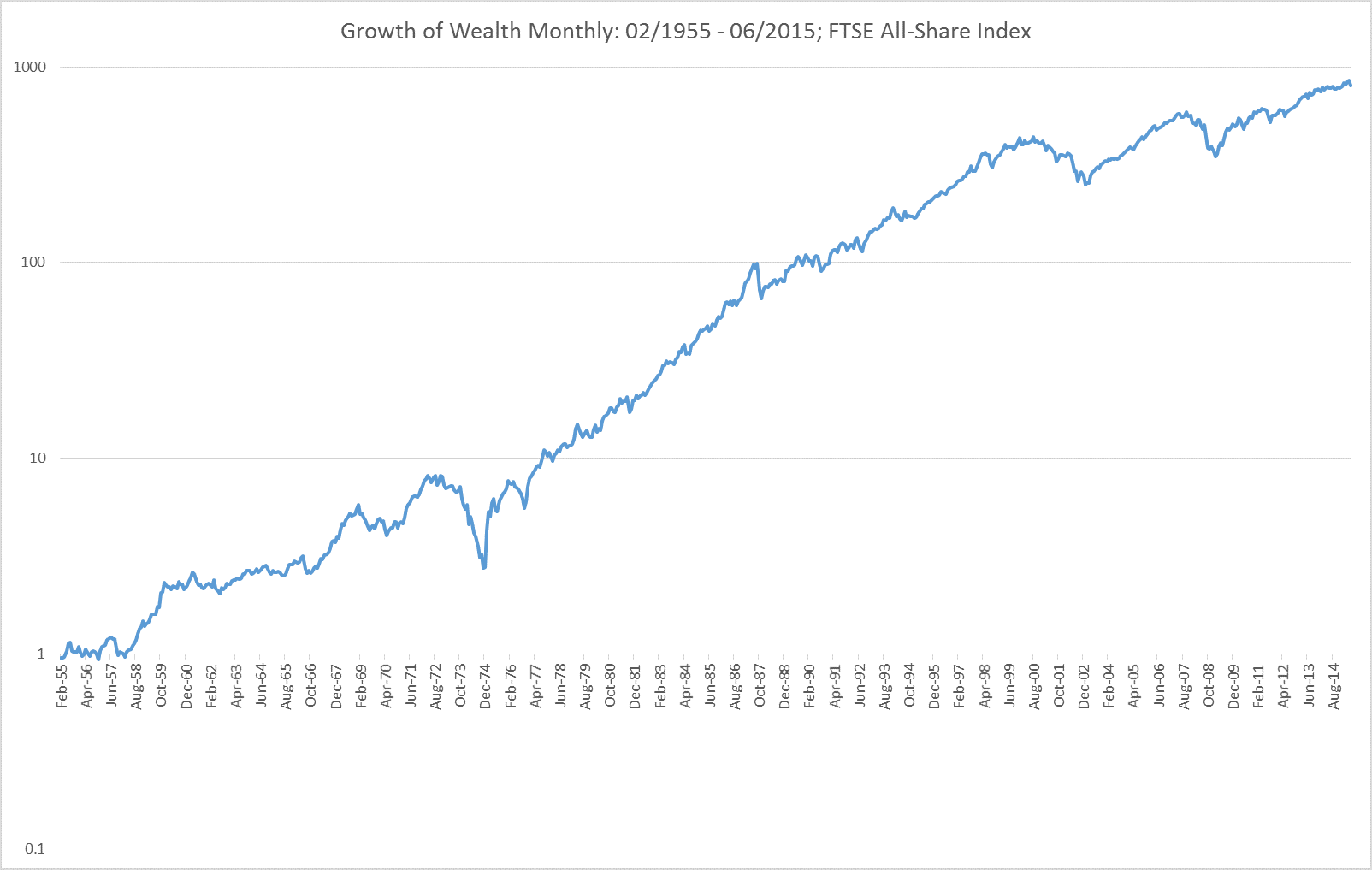

The media frenzy is in full swing today as markets see sharp falls, especially in China (and today Hong Kong). But what will this all look like in 10 (or even 20) years? The chart below shows the FTSE All Share Index on a log basis. Without knowing when it occurred, it may be difficult to see the “crash”, when shares fell 21% in one day(!). This underscores the crucial importance of not over-reacting (or over-analysing) market movements. There is a distinction between the map and the terrain – volatility is the norm, not the exception, and those who can ignore the news, the hype, the scaremongering of the financial media will survive and prosper.

An awful lot of things have happened since 1962, but none of it was terminal. Life (and capitalism) went on, and the long term progress of growth, profits and dividends continues regardless. Remember – there is only one top but plenty of lows in any given time period. The odds are that this is shaping up to be another one…

(CityWire.co.uk 10/04/2012)