September Economic Background

• Following 14 consecutive rate rises, the Bank of England chose to pause its rate hiking campaign and held rates at 5.25%

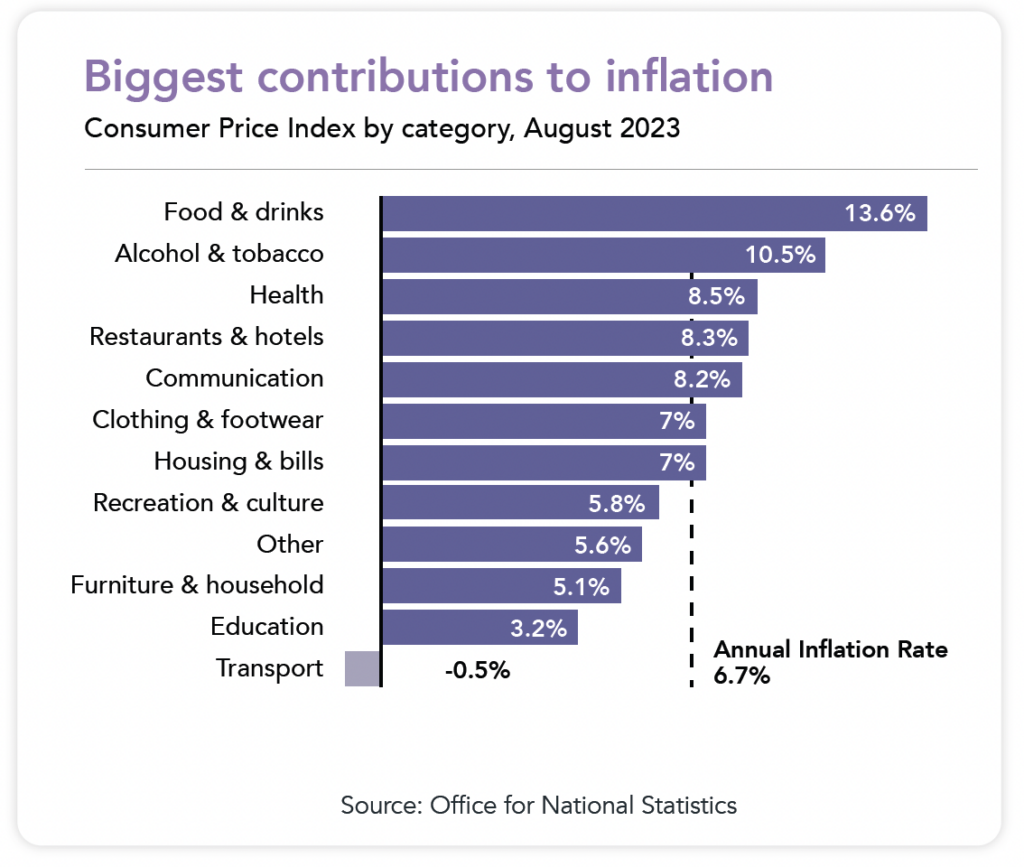

• UK CPI inflation came in at 6.7% for August

• Russia implemented a ban on fuel exports as a measure to stabalise domestic markets

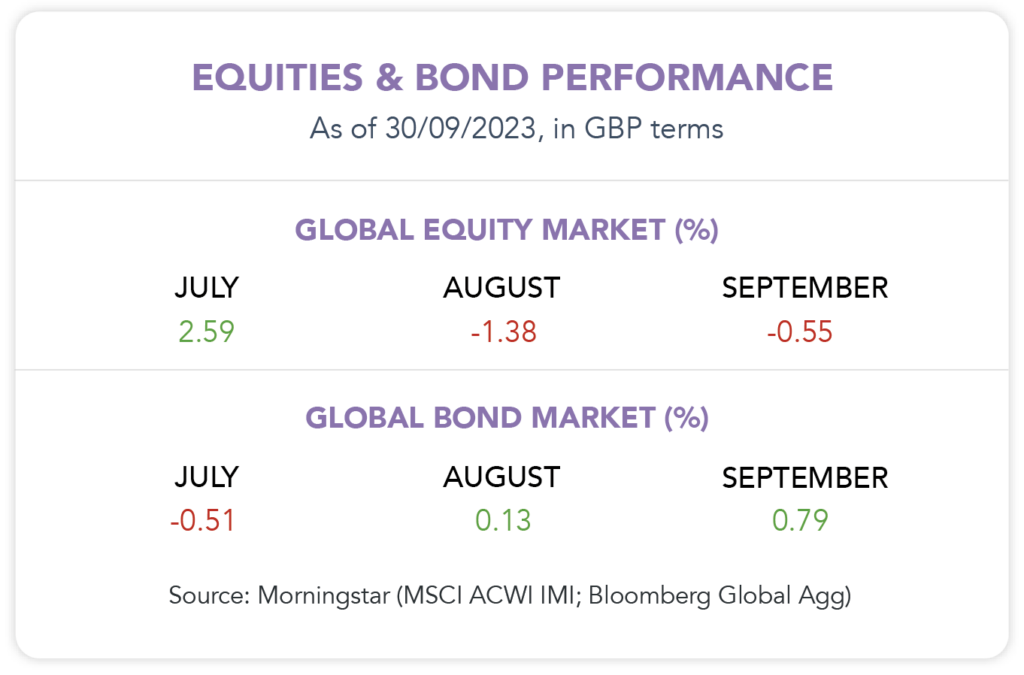

Market Review

UK interest rates: In September, the Bank of England opted to maintain its current interest rates, keeping them steady at 5.25%, the highest they have been in 15 years. This decision follows the central bank’s assessment that the rate of price increases (inflation) is now slowing down faster than initially anticipated. The unexpected deceleration in inflation during August, as reported on September 20th, contributed to this choice. Andrew Bailey, governor of the Bank of England, stated, “inflation has experienced a substantial decline in recent months, and we anticipate this trend to persist.” Nonetheless, he also noted that the 14 consecutive rate hikes were a tricky balancing act, as raising rates too aggressively could cause people to cut back on their household spending, hitting businesses and economic growth. Higher rates have translated into higher monthly mortgage payments for numerous homeowners and increased borrowing costs. On the flip side, they have also resulted in higher savings rates. While many analysts predicted another rate increase, the decision to maintain the current rate raises the possibility that a turning point in this monetary policy approach may be at hand.

Inflation rates: Inflation, which measures the rate of price changes over time, declined to 6.7% for the year ending in August, marking a decrease from the 6.8% recorded in July and the third consecutive month of decline in this figure. Contrary to the expectations of most experts, who foresaw an uptick in inflation driven by higher oil prices due to an increase in petrol and diesel costs last month, the overall inflation rate was tempered largely by a slowdown in food prices. When the inflation rate drops, it does not signify an actual decrease in prices but rather a slower rate of price increases. The Chief Economist at the Office for National Statistics described this as presenting a “mixed picture”, as consumers are still grappling with higher prices compared to last year, however the fall in manufacturing and producer costs is gradually making its way to consumers.

Russia’s export ban: In an effort to maintain stability in its domestic fuel prices, Russia made an unexpected announcement on September 21st, imposing an immediate ban on the export of diesel and gasoline. This move has added further pressure to an already tight global fuel market and has led to significant adjustments in global supply chains. Throughout September, Russia had notably increased its fuel shipments to military units located near and within Ukraine, reaching peak levels of fuel deliveries seen since the invasion. Russia plays a vital role as a supplier of refined fuel products to global markets, exporting approximately 1 million barrels per day of diesel. In fact, Russia ranks as the second-largest exporter of diesel, trailing only behind the U.S. in terms of export volumes. As we approach the Northern Hemisphere winter, a period associated with increased demand, economists are closely monitoring this development, as it has the potential to elevate inflation levels further.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024