October Economic Background

• Eurozone inflation falls to 2.9%

• European Central Bank holds rates at 4.0%, after 10 consecutive rate rises

• Middle East conflict raises concerns over oil prices and inflation risks

• U.S. 10-year yields reach 5% in October

Market Review – October 2023

Eurozone inflation: On October 26th, the European Central Bank (ECB) decided to halt their series of 10 consecutive interest rate hikes, keeping rates steady at 4.0%. This move came as no surprise, as the ECB had strongly hinted at this decision in its prior meeting. Additionally, the year-on-year inflation rate in the Euro Area dropped to 2.9% in October, marking its lowest point since July 2021, and falling below the market consensus of 3.1%. This development further reinforces the belief that the ECB’s actions have been effective in bringing inflation closer to their 2% target. However, economists caution that the downward trend in inflation may slow due to rising energy prices, attributable in part by the Israel-Hamas conflict, and as the effect of last year’s higher energy prices become less pronounced.

Middle-East conflict: The world has been horrified by the distressing scenes emerging from Israel following the attacks by Hamas, as another geopolitical risk comes into focus. However, the immediate impact of these events on global markets was rather limited, as monetary policy decisions in the West and diminishing global growth forecasts continued to dominate market sentiment. The same can’t be said for local stock markets, as stock indices in Israel, Palestine, Turkey, Qatar, the UAE, and Saudi Arabia experienced substantial declines immediately after the attacks.

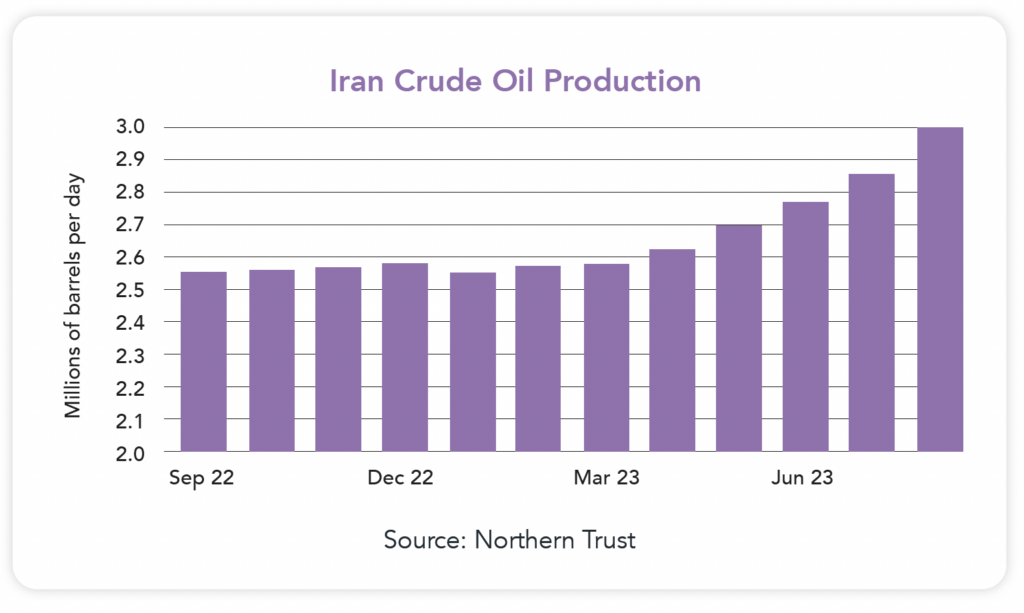

The Middle East accounts for just under a third of global oil production, so a prolonged conflict in the region could heighten the possibility of a significant disruption to global oil supply. Major players in the market, like Iran, may opt to decrease or withdraw their supply, potentially causing additional surges in oil prices and consequently driving up inflation. Following the attacks, the price of crude oil surged by nearly $5 per barrel, and market are now closely monitoring the potential long-term consequences this might entail.

U.S 10-year yield: Surpassing the 5% mark for the first time since 2007 serves as an indicator of the tightening financial conditions in the U.S. Federal Reserve’s (Fed) interest rate increase cycle. Over the past two years, the 10-year yield has surged by over 3 percentage points, primarily because investors have embraced the Fed’s commitment to “keeping rates higher for longer”, and the term premium, representing the additional yield required by investors for holding long-term bonds, has also seen an upturn.

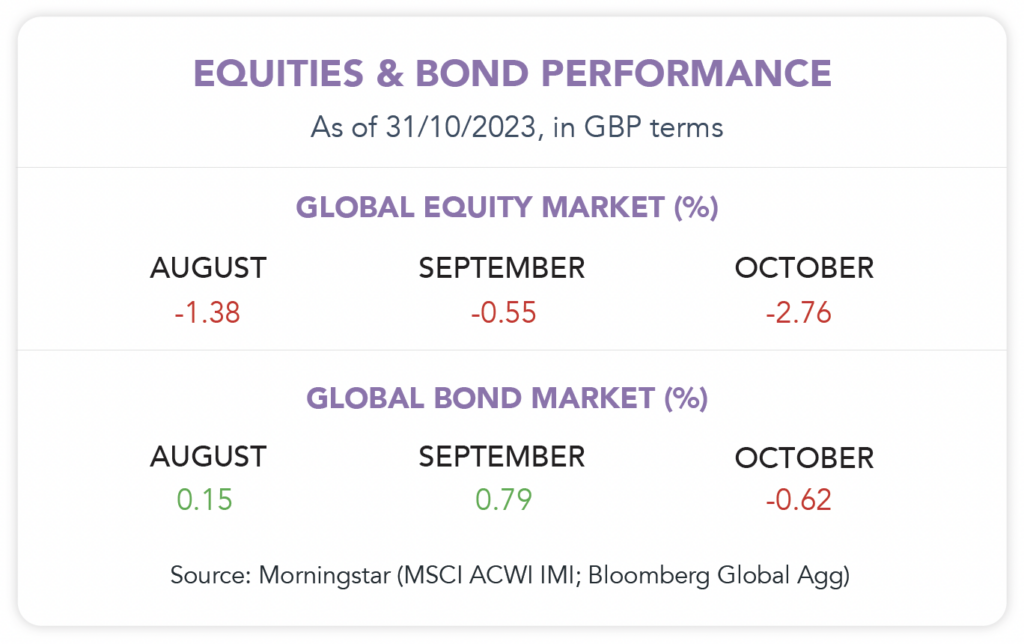

The Fed uses interest rates as a tool to raise borrowing costs to slow economic activity with the objective of reducing inflation. While inflation trended lower after its mid-2022 peak, it still remains above the annual target inflation rate of 2%. Rising bond yields are a challenge for existing bondholders because of the inverse relationship between bond yields and bond prices. When yields (interest rates) rise, the price of current bond issues fall as their rates become less attractive. Mortgage rates, which are closely linked to longterm treasury yields, will therefore become more expensive, further exacerbating fiscal concerns throughout the economy.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024