Fiscal Tightrope: U.S hitting its debt ceiling

There was increased media focus in the last few weeks of May as the U.S. Government approached its ‘debt ceiling’, with a lack of political consensus in Washington raising concerns over the possibility of a potential default. The series of events led to U.S. Treasury secretary Janet Yellen warning that, without an increase to the debt ceiling, the U.S. would be unable to pay its bills by early June.

While this is a situation the U.S. has found itself in many times before, with a political stand-off between the two parties typically occurring until an agreement had been reached as the deadline approached, there was increased volatility and tension observed in the markets as the June deadline came into view. In particular, market volatility followed as the ratings agency Fitch Ratings put the U.S.’ triple A credit rating on negative watch, signalling a potential downgrade to the rating, in light of debt ceiling concerns. As the month came to a close, it was announced that Congress had voted in favour of increasing the debt ceiling, bringing Washington a large step closer to avoiding historic default. The proposal proceeded to the Senate, which signalled its eagerness to act swiftly; this came to fruition as the bill was passed days later on June 1st.

Price Pressure: UK headline inflation slows, however core inflation ratchets up

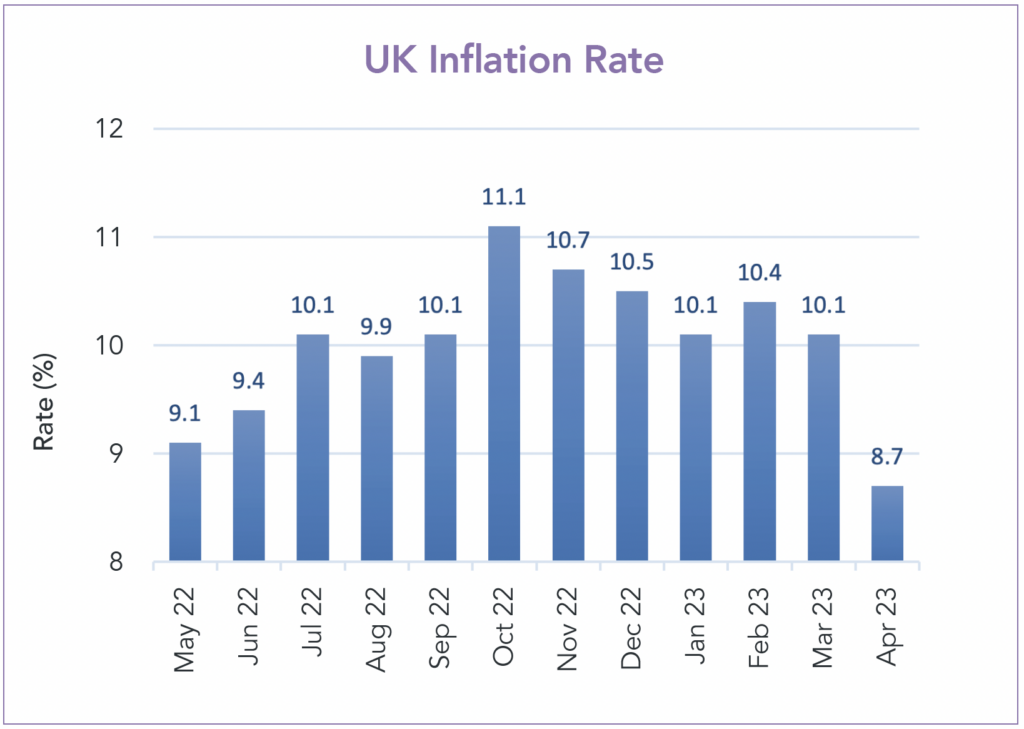

The latest year-on-year headline consumer price inflation in the UK dropped to 8.7%, marking its lowest point since March of last year. This decline was primarily driven by a sharp slowdown in electricity and gas prices, which have started to filter through supply chains and reduce inflation on some consumer staple goods. However, the inflation rate exceeded market expectations of 8.2% and continued to remain significantly higher than the Bank of England’s (BoE’s) target of 2.0% and the equivalent figures from its European counterparts (Spain 4.1%, France 5.9%, Germany 7.2%)*.

Notably, UK core inflation (which excludes energy and food), increased from 6.2% to 6.8% over the month, leading to concerns over whether the UK might be entering into a wage-price spiral. This contributed to a sell-off in gilts following the release of the inflation data, as the market priced in the potential for further rate hikes by the BoE.

Rate Watch: Investors bet Fed will keep rates higher for longer

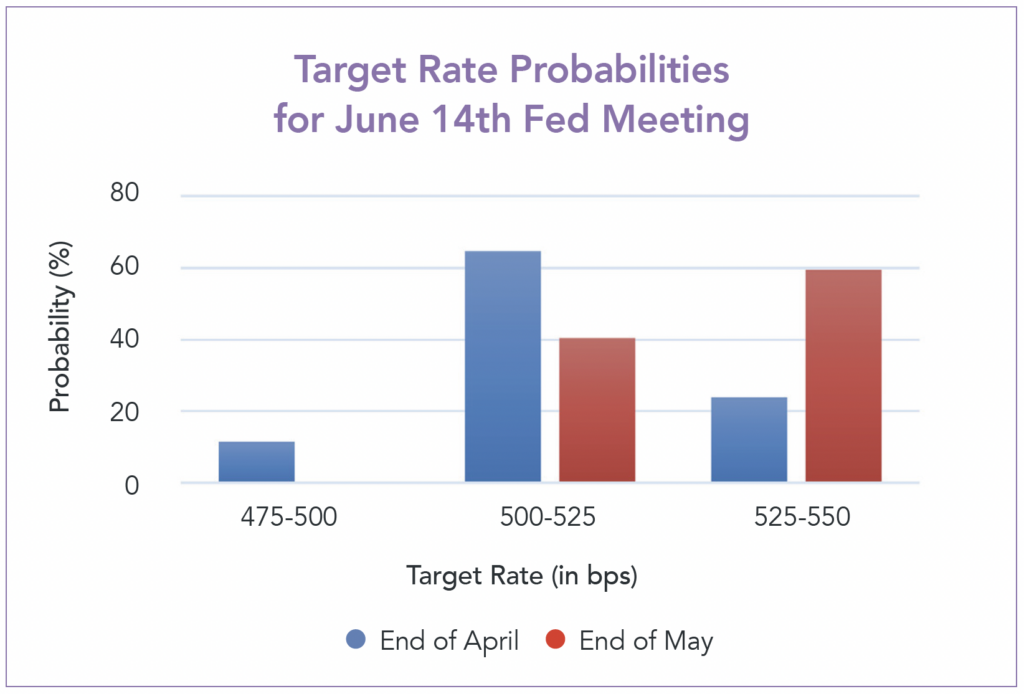

Following the 10th consecutive rate rise in just over a year, the Federal Reserve (Fed) rate stands at 500-525 basis points (bps), with the minutes from the Fed’s May 3rd meeting highlighting that the U.S. central bank is deliberating whether to temporarily halt its vigorous monetary tightening efforts. At the beginning of the month, futures markets indicated the likelihood of a rate pause. However, by the end of May, investor sentiment shifted, anticipating an additional rate increase for their June 14th meeting as Fed chair, Jay Powell, recently stated that ‘rates may not need to rise as much due to bank stress’ but they will be ‘closely monitoring how banking stress would continue to affect business activity and inflation’. As such, further monetary tightening is uncertain but will not be ruled out as officials are locked into an intense debate about whether pausing rate rises next month will be warranted.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024