Introduction

This blog aims to compare passive vs active investment management, highlighting how we believe implementing a passively managed investment strategy can benefit investors over the long term.

Passive Investment Management

Passive management aims to deliver returns in line with the market index, rather than seeking to outperform the market through active techniques. This investment approach is typically lower risk than active management, with less trading of securities which typically leads to lower transaction costs, as well as lower management fees.

Research by S&P Dow Jones Indices has shown that in the long run, a passive investment strategy is likely to outperform an active investment strategy due to the lower costs, fewer timing errors and lower likelihood of poor investment choices.

Passive Investment Attributes:

Replicates market returns

Aims to replicate the returns of an index or asset class – rather than targeting excess return, passive strategies aim to match the performance of an index or asset class.

Focus on minimising costs

Portfolios are built around a core of low-cost index tracker funds, with lower trading frequency typically leading to lower trading costs and timing errors.

Access to broad global markets

Trackers provide access to the majority of the world’s public equity and bond markets, through funds managed by some of the world’s largest asset managers.

Belief that markets are efficient

The Efficient Market Hypothesis (EMH) contends that assets will trade at a “fair” price, with any new information quickly being incorporated into the price.

Buy and hold

When investors buy a passive strategy, they are buying the market index and will hold that index unless they choose to sell their investment (with occasional rebalancing to new market weightings taking place). This contrasts an active approach where buying and selling of securities frequently occurs within the strategy, seeking to time markets and achieve excess returns.

Active Investment Management

Active management aims to outperform the market index; active managers analyse the market to identify investments that they believe are undervalued, while selling investments that they believe are overvalued. Typically, fees and risks are higher, as an investment manager must regularly analyse and trade securities, with each trade incurring its own cost.

Active Investment Attributes:

Targets excess returns

Attempts to beat the market and deliver excess returns. This can increase the risk of negatively deviating from the market index, with research showing that over the long term, active managers generally fail to beat the market.

Higher costs

Typically, active management costs are higher due to increased management fees, as well as higher trading costs. Managers will seek to buy and sell securities in an attempt to beat the market, with each trade incurring a cost.

Concentration risk

Active strategies are often constructed in a more concentrated manner than passive strategies. In an attempt to pick the next ‘winning’ stocks, portfolios are tilted to a smaller number of names, leading to fewer securities and lower levels of diversification.

Believes that markets are inefficient

Active management inherently believes that markets are inefficient, and stocks are often mispriced. Active managers attempt to identify market opportunities and exploit pricing inefficiencies.

Risk in timing

Active managers may attempt to time markets by tactical asset allocation. This requires them to make two correct decisions; when to take risk off and when to add it back, something research suggests is extremely challenging to consistently deliver.

Why choose passive over active?

Investing requires taking into account the factor of time, as short-term market cycles and chance occurrences can have a considerable impact on returns. Temporary fluctuations in the short run can obscure two key advantages of low-cost index funds compared to actively managed funds: the long-term performance edge resulting from their generally lower costs, and the absence of sustained outperformance among actively managed funds.

Fees

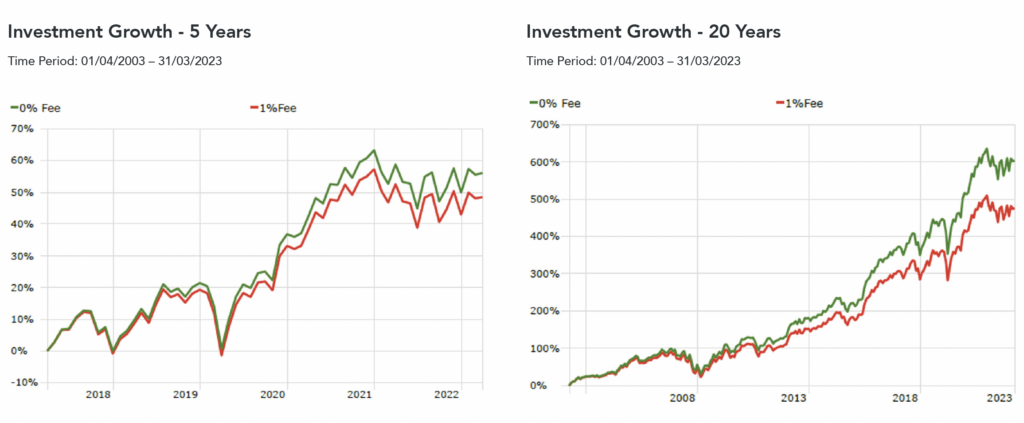

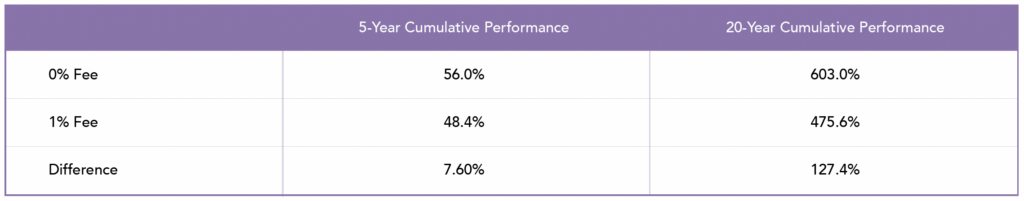

If the reporting period is short, the advantage of low-cost index funds may appear less significant since their cost advantage compounds over time. The reduced fee impact on performance may not be very noticeable over the short term, but when the fee difference is compounded over a longer period, it can result in a meaningful difference in the overall performance. This is shown below using the same portfolio, the only difference being that one has a 0% fee and the other has a 1% fee, showcasing the impact of fees on performance as the time horizon becomes longer.

Performance

Low-cost index investing has proven to be a successful strategy over the long term and has become increasingly popular globally. As shown below, the targeting of sustained outperformance presents a formidable challenge for active managers. As time progresses, this challenge becomes increasingly ominous and may prove insurmountable for many active managers – evidenced by the higher number of active funds closing or merging as the time periods become longer with the likelihood of outperformance diminishing.

Conclusion

Incorporating a passive investment strategy in our portfolios at ebi allows us to benefit from the advantages of low costs, high diversification, and consistent long-term returns. Research suggests that it becomes increasingly difficult to consistently outperform the market over time, making passive investing an attractive option for those seeking more reliable investment returns.

Past performance is no guarantee of future returns.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios