Bank of England hikes interest rates by 0.5% to 5.0%

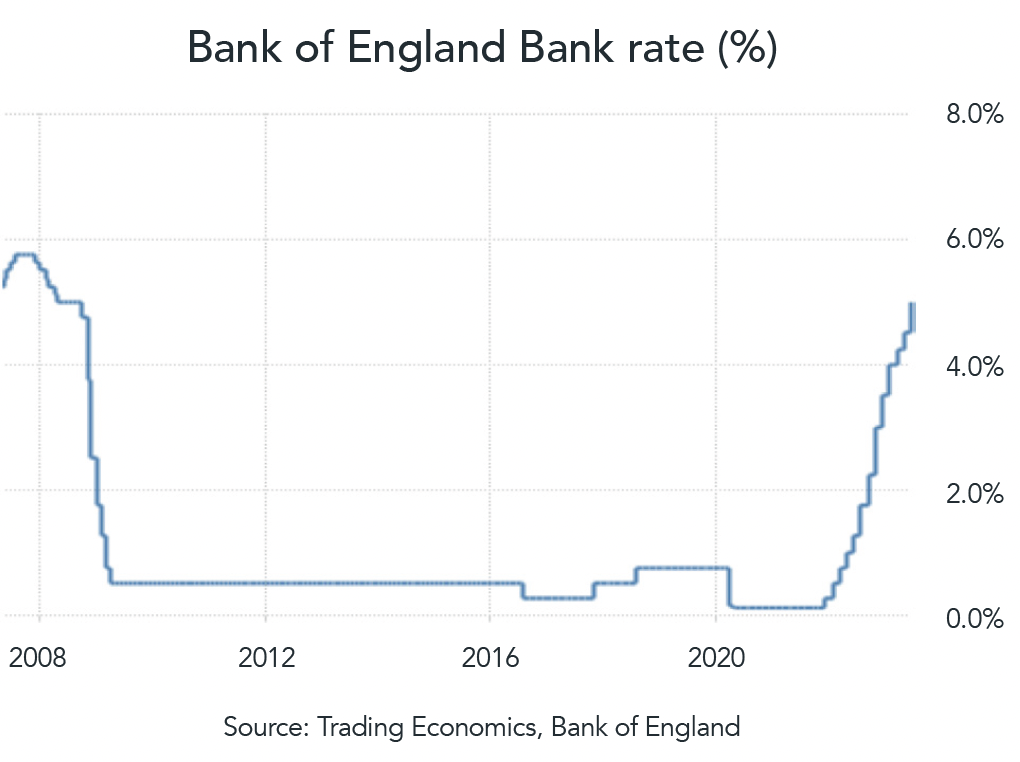

On 22nd June the Bank of England (BoE) raised rates to 5%, with a surprise 0.5% increase (compared to market expectations of 0.25%). This followed the UK continuing to experience ‘sticky’ high inflation, with May’s CPI print coming in at a still elevated 8.7%. At a central bank conference near the end of the month, BoE Governor Andrew Bailey signalled that interest rates in the UK are likely to stay higher for longer than financial markets are expecting, because inflation has proved to be such a persistent problem.

June’s rate hike brought UK rates to their highest level since 2008, with the BoE hoping to regain the initiative through a larger step increase than in recent months, in their goal of bringing inflation back down to the 2% target. The larger rate rise sees the BoE adopting a different stance to other central banks, with the US Federal Reserve holding rates steady at their June meeting, and the European Central Bank hiking rates by a smaller 0.25%.

Fixed rate mortgages in the UK hit the highest level in 7 months

The BoE’s rate hike and associated movements in the UK gilt yield and swap curves (on which mortgages are typically priced) contributed to further increases in the price of fixed-rate mortgages in the UK, with the average two- and five-year fixed-rate mortgage price hitting their highest levels in seven months. At the end of June, financial data provider Moneyfacts quoted the average cost of a five-year deal rising to c.5.9%, and the average cost of a two-year deal rising to 6.3%. As a comparison, prior to the Bank of England’s rate hiking cycle, in December 2021 the average two-year rate stood at c.2.3%. Variable rate customers have also been impacted, with their deals typically linked to the base rate.

The significant and rapid increase in mortgage rates has brought concern to homeowners and the wider industry, with the situation being referring to in the UK press as the mortgage “time bomb”. Given the speed in which the situation has been evolving, and high demand for mortgages (from individuals shortly needing to remortgage and seeking to lock in a rate as quickly as possible), lenders such as Santander and TSB have been rapidly pulling deals from the market and repricing them higher.

The wider uncertainty in money markets, and the extent to which further rate hikes in the UK may be necessary in order to bring inflation under control, continue to exacerbate the situation. As the month drew to a close, data from Zoopla suggested that house prices were being impacted by the mortgage rate volatility, as well as the wider cost of living crisis, noting that two-fifths of UK sellers were now accepting discounts of more than 5% off the asking price on their property.

Commercial Real Estate under continued pressure

Resulting from a combination of factors including rapidly increasing borrowing costs, and changes post pandemic regarding employees’ relationships to working in the office, the commercial real estate industry has also been experiencing continued pressure. With high vacancy rates and low transaction volumes, there are markdowns occurring across commercial properties around the world, with the issues being felt particularly acutely in the US (exacerbated by the regional banking crisis seen in Q1/Q2). However other countries haven’t been spared, with 83% of respondents to the RICS UK quarterly commercial property survey stating that the market is in a downturn, and the news landing in late June that HSBC will be leaving its landmark Canary Wharf HQ and moving to a building in the Square Mile, London’s traditional finance centre. This market backdrop has impacted a range of Real Estate Investment Trusts (REITs – companies that own and/or operate income-producing real estate) across the industry, with for example, the flagship FTSE NAREIT Equity REIT returning c.-24%, and its office-focused counterpart returning over -50% since January 2022 (to 25/06/23, in USD).

Blog Post by Jonathan Griffiths, CFA

Investment Product Manager at ebi

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024