The recent economic environment has not been supportive for global equities and massive headwinds have come from growth concerns, inflation and volatility. The massive sell-off in equities is making investors ask the question – is now a bad time to buy shares, or are there opportunities to be had while others are fearful? This blog will look at the usefulness and efficiency of market timing.

Topics we cover:

• Does timing the market rarely work in the long-run

• Behavioural biases in different times of the economic cycle

• Effects of Continuous buying and selling

• Factors in different market regimes

• What should investors do?

Trying to time the market rarely works in the long-run

Short-term volatility may induce investors to deviate away from their core investment philosophy of a long-term buy-and-hold strategy in an attempt to chase higher returns. The opportunity of trying to time the market may seem clear and enticing in retrospect but is rarely visible in prospect. Empirical evidence suggests that market timing strategies have a minimal success rate and over time this success rate becomes minuscule. Continuously aiming to generate alpha by buying low and selling high requires more frequent trading and in turn, increases the trading costs for a portfolio which are ultimately passed onto the consumer (investor). There are numerous studies that provided empirical evidence to support that buy-and-hold strategies provide superior annualised returns than market timing strategies. A study by Putnam Investments shows that $10,000 invested in the S&P 500 using a buy-and-hold strategy between 31st December 2006 and 31st December 2021 would have given investors an annualized return of 10.66%, 5.61% higher than those investors who missed the best 10 days during that same period [1].

Data from the Bank of America shows that a buy-and-hold strategy invested into the S&P 500 since 1930 would have produced 17,715% compared to 28% if an investor had missed out on the best 10 days per decade. During different economic cycles, some investors collectively develop a herd instinct whereby they replicate the investment strategy of other investors. This is especially the case during bearish periods where some investors panic and sell over fears of prices plummeting and continuous negative returns and consequently, this leads to behavioural biases taking over an investment philosophy and strategy. Panic selling can significantly lower cumulative investment growth for longer-term investors by causing them to miss out on the best days.

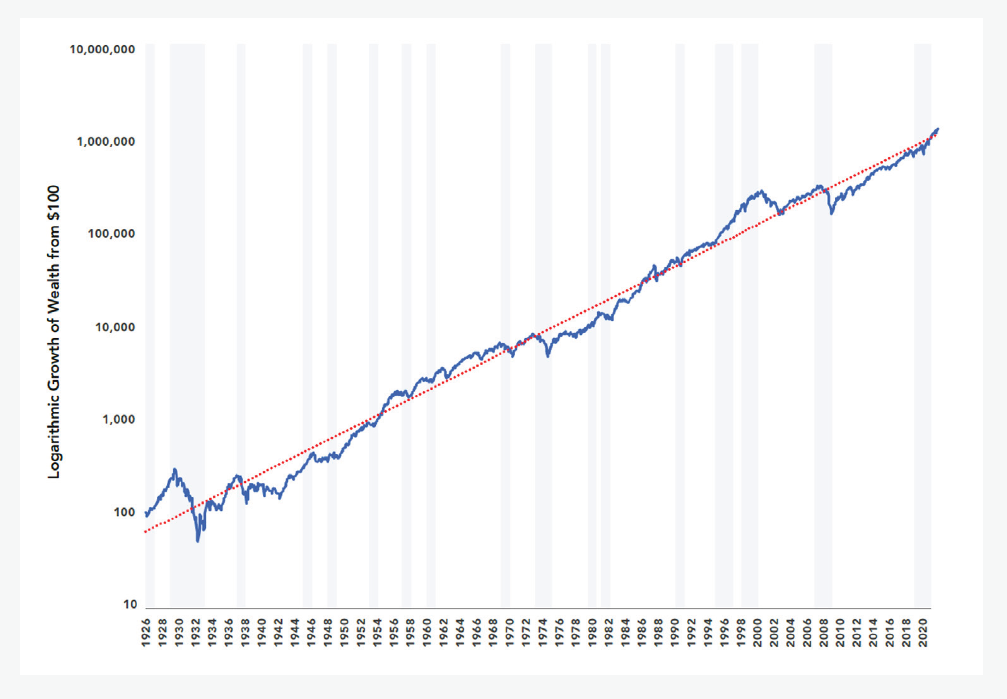

Figure 2: Cumulative growth of wealth from $100 invested in the S&P 500 between 31/01/1926 and 31/12/2021. (Source: Personal Collection)

Figure 2 illustrates the cumulative growth that an investor could have derived from $100 over the last century, irrespective of the highlighted recessionary periods.

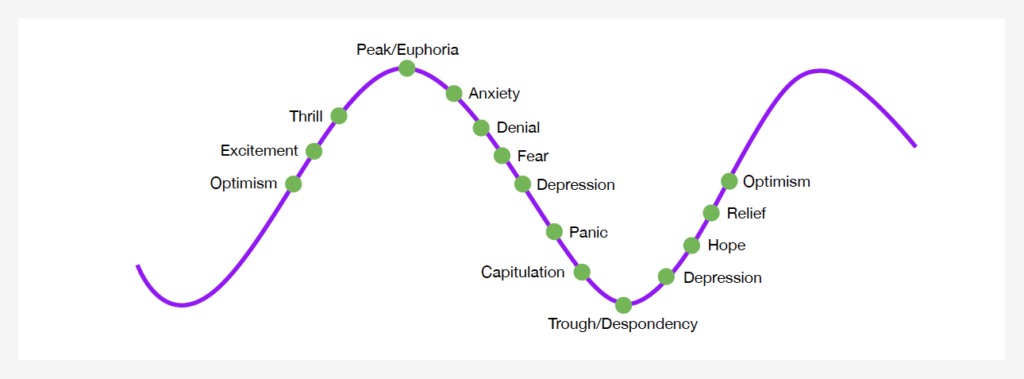

Figure 3: Investor behavior through boom and bust. (Source: Personal Collection)

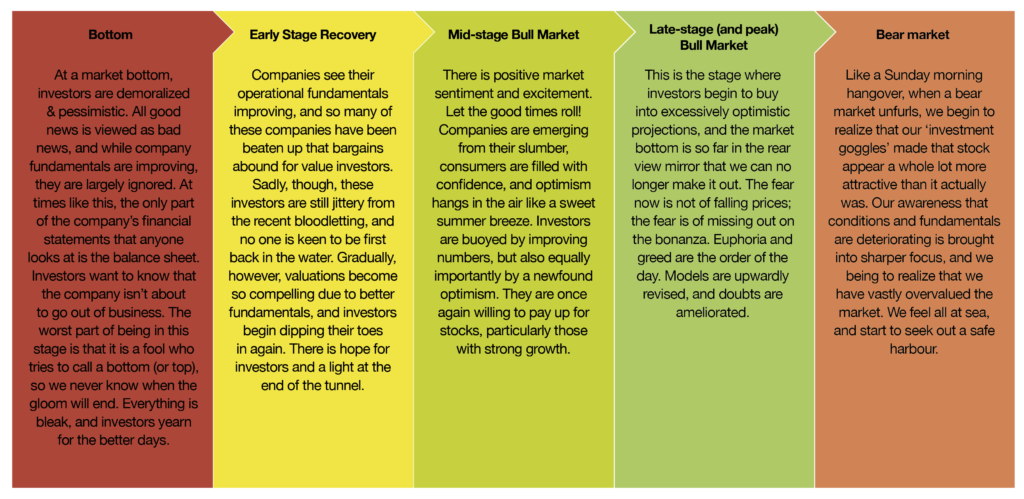

Behavioural biases takeover

A typical economic cycle is somewhere in the order of 5-6 years, though this depends on many disparate factors, not least of which is the monetary and fiscal policies of the government in that market. The figure below is simply the typical time frame for the economy to go from boom to bust and back to boom again. The below figures shows a standard economic cycle alongside the behavioural economics as to why people behave the way they do in the real world.

Continuous buying and selling increases overall costs

Behavioural biases caused by the effects of a changing economic cycle landscape can lead to investors and portfolio managers shifting their investment strategies. Taking a more active approach may offer the potential for added returns but is equally met with additional risks and costs. Different strategies require changing asset and security allocations. This is met with higher trading and transaction costs which can ultimately have a significant drag on an investment’s performance. They might not seem like a big deal initially, but they add up, compounding along with your investment returns. Continuously changing asset allocations can increase the turnover rate of portfolios which is reflected in higher turnover costs.

Factors in different market regimes

At ebi we invest on the core principle that ESG passive investment, with diversification among factors, is the preferred long-term course of action for superior risk-adjusted returns. Accordingly, we don’t engage in tactical asset allocation. Since ebi does not believe in market timing and tactical asset allocating we have therefore given each factor an equal waiting in our portfolios, the argument that these factors have certain moments in the economic cycle where they shine brightly is true. However, moving in and out of these positions and predicting when we are entering a certain stage in the economic cycle is near impossible to do consistently and at optimal times. We, therefore, believe that including factors in our portfolios at all times has positioned them well to deal with any market regime, and only by stepping back and taking a holistic portfolio view over a long-term time horizon can we fully appreciate the interaction among these various factors.

ebi does not seek to employ factor-timing and doesn’t endorse a trading strategy of cutting losses and exiting factors that are suffering a period of underperformance, thereby missing rebounds and future periods of outperformance.

What should investors do?

Investors should maintain the discipline and self-control that is integral to their original plan and avoid being distracted from their plan by short-term turbulence.

Unless client plans have changed then why change the investment portfolio? It’s important to remember that consumption has not come to an end, instead, it has temporarily been frozen. When markets react to bad news investors should maintain discipline and focus on the long term.

The best course of action is to diversify across many factors, regions and asset classes and to remain patient. As long-term investors we will not attempt to time the market, we believe that being invested in the market will once again prevail.

Blog Post by Raj Chana & Amar Ghai

Investment Analysts at ebi

References

[1] 2022. Time, not timing, is the best way to capitalize on stock market gains. Putnam Investments. Available here [Accessed 1 July 2022]

[2] Stevens, P., 2021. This chart shows why investors should never try to time the stock market. CNBC.com. Available here [Accessed 4 July 2022].

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024