Topics we cover:

• Cost-Push Inflation

• Demand-Pull Inflation

• Monetary Policy Committee (MPC) Projections

Central Banks face a difficult predicament in trying to reduce inflationary pressures in their respective economies whilst also alleviating the probability that these economies do not face a prolonged period of negative GDP growth which could lead to a recession.

The UK Consumer Price Index (CPI) 12-month print has risen to 9.1% in May 2022, the highest since March 1982, and nearly five times higher than the inflation target rate of 2% set by the Bank of England (BOE) [1]. The BOE has since warned that inflation could yet worsen with energy and food prices expected to continue to soar with the BOE’s top economist indicating that the Monetary Policy Committee (MPC) are prepared to adopt a more aggressive hiking approach [2]. Gross Domestic Product (GDP) – a measure of the market value of all final goods and services produced in the economy in the last 12 months fell by 0.3% in April 2022 following a 0.1% decline in March; this trend is expected to continue with the cost of living crisis squeezing real wages and the purchasing power for UK households. This news has reignited fears that the UK and other global economies could fall into a recession with market participants transmitting bearish market sentiment which saw the FTSE 100 and S&P 500 have negative 3.14% and 3.25% swings respectively, on June 16th, 2022.

One question on the mind of many of our investors is whether raising interest rates is going to do anything other than cripple the economy without curbing the soaring energy and food prices.

Before answering this question, it is important to acknowledge where the current inflationary pressures have arisen from.

Cost-Push Inflation

Some of the inflation we are currently witnessing is supply-led and a consequence of Russia’s invasion of Ukraine.

The invasion has reduced the supply of both oil and gas pushing energy prices higher and essential commodities such as wheat and barley pushing certain food prices higher. We are witnessing a large reduction in both the production and exportation of these key inputs into European countries causing supply-chain bottlenecks which have made it more expensive for businesses to import these commodities and these higher costs have been passed onto consumers in the form of higher prices.

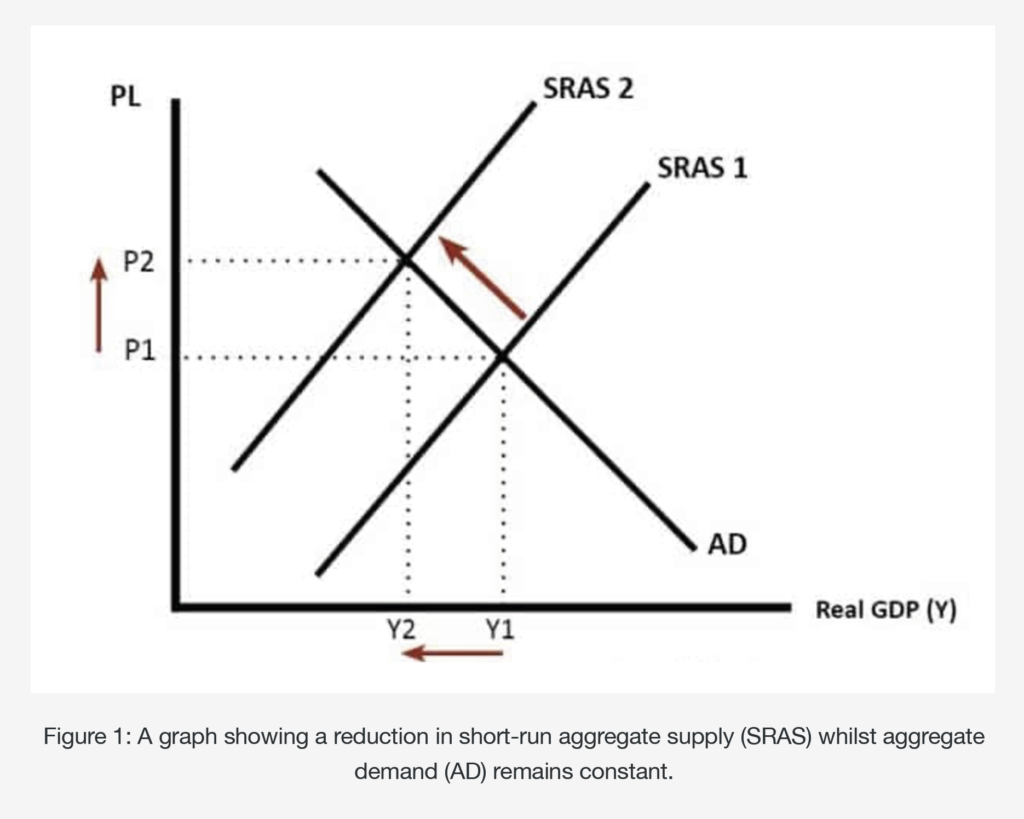

Figure 1 displays the mechanism behind the process. The graph shows that a reduction in production shifts the SRAS curve to the left from SRAS 1 to SRAS 2, and this consequently reduces the production output from Y1 to Y2. This leads to an increase in the price of the product from P1 to P2, ceteris paribus (if all other things remain equal).

Demand-Pull Inflation

There is also some demand-driven inflation that has followed the supply-side bottlenecks. Both energy and food are viewed as ‘necessity’ goods that have an ‘inelastic’ demand. Both energy and food have a derived demand for their uses. For example, fuel enables businesses to transport their goods from production to distribution. Inelastic demand implies that ‘the degree at which the quantity demanded for these commodities changes is smaller than the price change’. The nature of these commodities and the aggregate excess demand which has been caused by geopolitical tensions has contributed to the price of energy and foods soaring which has mainly impacted the headline inflation print.

This however is not the only thing driving inflation. There also remains pent-up demand from COVID-19 which has exasperated inflation causing a dual-inflation effect.

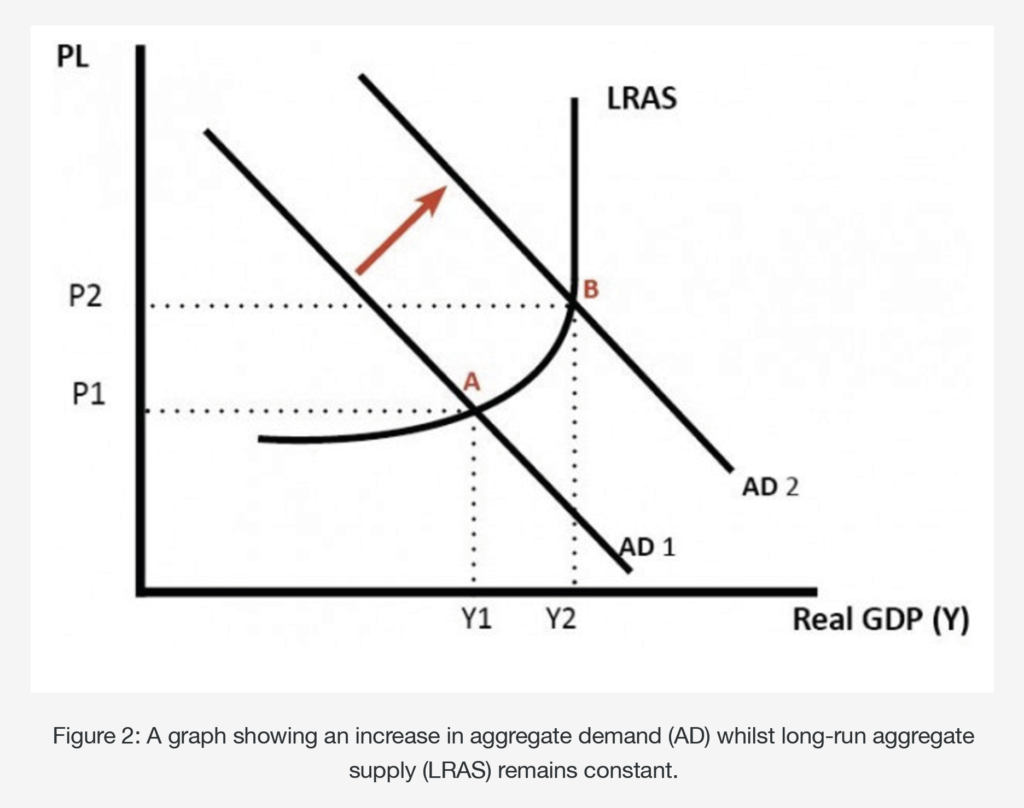

Figure 2 shows that as AD increases leading to a rightward shift from AD1 to AD2, production output increases from Y1 to Y2. This leads to an increase in price from P1 to P2, ceteris paribus (if all other things remain equal).

Economies have witnessed a strong bounce-back in household spending since the easing of lockdown regulations. Households took advantage of increasing their savings during lockdown but have since increased their consumption and investment. Nevertheless, with households now facing lower real wages and tightening discretionary incomes there may be a chance that economic activity falls considerably. Tightening discretionary income represents a reduction in the available income a household has to spend after all necessities such as food, water, and shelter have been covered.

It is now important to address the question by explaining the mechanisms behind increasing interest rates as well as the BOE and Federal Reserve (Fed) projections on an everchanging economic landscape.

The BOE and Fed are currently adopting quantitative tightening by reducing the size of their balance sheets and more importantly in the short-term increasing interest rates. Increasing interest rates aims to both reduce the money supply and liquidity in the economy which consequently reduces the quantity of money demanded. Higher interest rates increase the cost of borrowing which discourages consumer and business spending and investment. These contractionary policies aim to tackle the demand-pull inflation and pent-up demand that remains in the economy. Tackling demand-pull inflation may be the first point of call for central banks rather than cost-push inflation due to the uncertainty surrounding the supply chains across Europe and the difficulty navigating to alternative energy and food sources. Central banks are faced with a challenging few months trying to juggle inflation, growth, and unemployment.

Monetary Policy Committee (MPC) Projections

The MPC is currently projecting inflation to reach its target in mid-2024 but this comes with a consequence for GDP and Unemployment. The MPC’s projections are conditioned on wholesale energy and non-energy commodity prices following their respective futures curves for the first six months of the projection and then remaining constant. A six-month futures curve is an indication of the expected price for an underlying asset in six-months time. The MPC summary- ‘The global outlook’ states that global inflationary pressures are expected to ease in mid-2023 with the forecast assuming commodity prices trend back to normality and supply-chain disruption will start to ease. The Bank Rate forecasts trend upward quickly between 2022-23 but are expected to fall in 2024-25. The MPC aims to navigate their bank rates quicker & sooner rather than hike over a lengthy period to combat the current high inflation but also to try and ensure that households do not suffer even more than expected over the long-term. The report states that total real household disposable income is projected to fall by 1.75% in 2022 but is forecasted to pick up over the rest of the projection.

Federal Reserve (Fed) Minutes & Economic Projections

In the US the CPI Inflation print increased to 8.6% over the year, ended May 2022; the largest 12-month increase for over 40 years. Nevertheless, as the headline print which includes the food and energy sectors increased, the core inflation print (CPI less energy and food) has been on a downward trajectory since March 2022 falling from 6.5% to 6.0% [4]. This showcases the impact that current events are having on headline inflation. The Fed is adopting an aggressive hiking approach to tackle inflation quicker aiming to be ahead of the curve. The Fed minutes for the June meeting state the following:

- Job gains have remained robust in recent months.

- The unemployment rate remains low.

- Overall economic activity appears to have picked up after a negative first quarter.

- Inflation remains elevated and the Committee seeks to achieve an inflation rate of 2% in the long run.

- The Committee is adopting a flexible approach to tackle any unexpected risks that could impede the goals and objectives of stable growth, low unemployment, and low inflation.

The Fed’s forecasted projections expect the federal funds rate to increase throughout 2022 and 2023 reaching a midpoint value of around 3.60%, whilst then falling in 2024 and projecting a longer-term midpoint value of 2.50%. The projections also show that the Fed expects real GDP and the unemployment rate to remain stable in the coming years with values tending towards the upper ranges [5].

On the 23rd of June 2022, Jerome Powell, the chairmen of the Fed delivered a semi-annual Monetary Policy Report to the Senate Banking Committee. The testification produced mixed responses with Jerome Powell stating that “the American economy is very strong and well-positioned to handle tighter monetary policy” but also implied that a soft landing was going to be very difficult [6].

With both demand and supply-side drivers contributing toward inflation, both the BOE and Fed are adopting more aggressive short-term contractionary policies to reduce the current high levels of inflation. Demand-side inflation tends to have shorter-term spiral effects and aiming to alleviate the demand-side inflationary pressures may be a reason for the more optimistic longer-term projections. Both policymakers look to ease off their interest rate hikes in the medium term aiming to alleviate the chances of a recession. Nevertheless, there remain question marks over the supply side of the economy which is outside of the central banks control. The length of time for which the geopolitical tensions between Russia and Ukraine continue will go a long way in determining the long-run inflationary pressures as well as the potential economic growth for countries worldwide.

I have reached out to Wouter Sturkenboom, CFA, CAIA, and chief investment strategist for EMEA and APAC at Northern Trust Asset Management who has provided us with his thoughts.

“Central banks are tightening monetary policy by increasing interest rates and shrinking their balance sheets (quantitative tightening). They are doing so in response to high and rising inflation and inflation expectations. With respect to current inflation, central banks are well aware that higher interest rates cannot in and of themselves lower energy prices or unclog supply chains. Those cost-push factors are outside of the central banks control. But higher interest rates can create an offsetting force of negative demand-pull inflation. By making it more expensive to borrow money to consume or invest, central banks hope to depress demand. Although it takes time for monetary policy to have this effect, interest-sensitive sectors like housing already tell us it is having an effect. Over time, as interest rates continue to move higher the impact of negative demand-pull inflation will become bigger as the economy slows down. Labor markets will deteriorate, dampening wage growth, and companies will lose pricing power. As all this plays out, central banks will be very sensitive to the evolution of inflation expectations. Rising expectations can create a self-fulfilling prophecy that challenges the central banks inflation target mandate. To make sure that doesn’t happen central banks will adjust their current and future policy mix”.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

References

[1] Gooding, P., 2022. Consumer price inflation, UK: May 2022. Available here [Accessed 22 June 2022].

[2] Goodman, D., Edwards, A. and Lacqua, F., 2022. BOE’s Top Economist Says Bank Prepared for Aggressive Rate Hikes. Bloomberg.com. Available here [Accessed 20 June 2022].

[3] Bankofengland.co.uk. 2022. Monetary Policy Report – May 2022. Available here [Accessed 21 June 2022].

[4] U.S. BUREAU OF LABOR STATISTICS. 2022. Available here [Accessed 22 June 2022].

[5] 2022. Summary of Economic Projections. Federal Reserve. Available here [Accessed 22 June 2022].

[6] 2022. Statement by Jerome H. Powell. United States Senate Committee. Available here [Accessed 23 June 2022].

Blog Post by Amar Ghai,

Investment Analyst at ebi Portfolios.

What else have we been talking about?

- Q2 Market Review 2025

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025