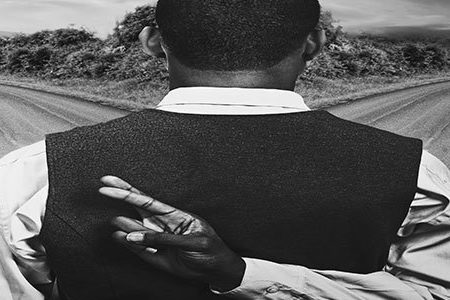

What do we know?

“As we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones” -Donald Rumsfeld 12/2/2002. “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so”- Mark Twain