Interest Rates Raised to 4.25% by the Bank of England

On the 23rd March, the Bank of England (BofE) announced a quarter point (0.25%) rate rise to 4.25%, marking their 11th successive rate rise, hitting the highest level since 2008. Looking at the future path for rates, bank governor Andrew Bailey had already removed the language about acting forcefully and downgraded it to the further need for tightening if necessary. This was evident in their latest monetary policy decision, after February provided a surprise upside in inflation (10.4%) against expectations (9.7%), indicating that suppressing inflation is at the epicentre of their decision making. In the days prior, the European Central Bank (ECB) and Federal Reserve (Fed) announced rate rises of 0.50% and 0.25% respectively, followed closely by the BofE who also raised their rates by 0.25% amid February’s inflation figure. This will present challenges for homeowners who have chosen to take variable rate mortgages in the hope that inflation falls and they can fix into a lower long-term rate.

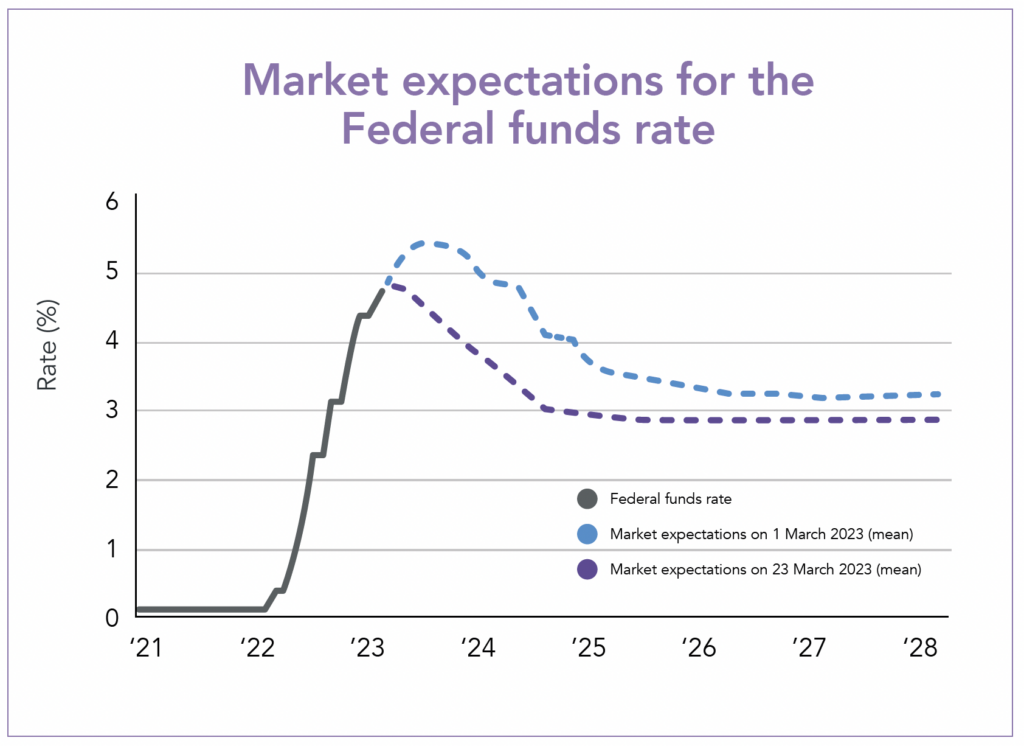

The previous five meetings from the BofE saw either a 0.5% or 0.75% rise, suggesting we could now be “over the hump” as the rate at which rates are rising slowed for the first time since August of last year. Across the pond, markets started the month expecting Fed rates to be higher for longer, however the mid-month banking crisis was taken into consideration for the Federal Open Markets Committee (FOMC) meeting on the 21st, and ultimately softened the hike. The continued rate rises have been attributable to persistent inflation, driven by high food and energy costs, however markets have already started to reprice their expectations for future Fed rates. Albeit, the same question remains, at what point will central banks halt their hiking campaigns when the trade-off between inflation fighting and financial stability becomes untenable.

Silicon Valley Bank Collapse

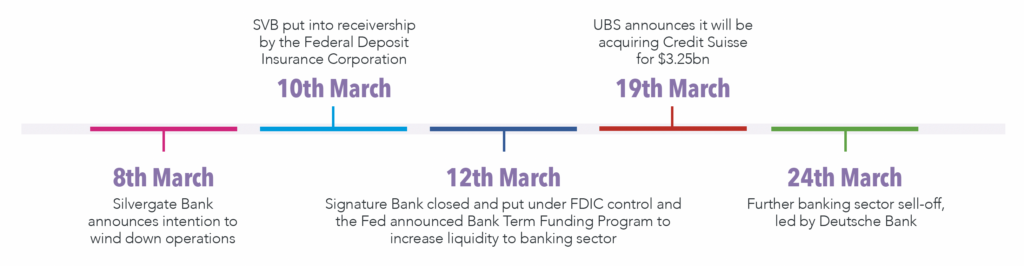

Shockwaves were felt throughout the financial world, as a series of bank failures took place, starting in the US and then spreading to Europe. During the week of the 6th March 2023, California-based Silicon Valley Bank (SVB) experienced an escalating bank run from its tech and life science-focused depositor base. This followed an unsuccessful attempt to shore up its capital base through a $2.3bn share sale, and an announcement by a separate (cryptocurrency-focused) lender, Silvergate, that it was winding down operations. SVB ultimately failed on the 10th March, and was put into receivership by the Federal Deposit Insurance Corporation (FDIC).

On the 12th March, US regulators carried out a significant intervention and announced that SVB depositors would be repaid for the full amount of their deposits (i.e. backstopping all deposits, including those in excess of the $250k FDIC guarantee). At the same time the Fed, US Treasury, and FDIC announced a number of measures to shore up the stability of the banking system, including the Bank Term Funding Program, which boosts liquidity to banks through providing them with loans against the par value of certain types of bonds pledged as collateral. Regulators also acted in relation to Signature Bank of New York (a separate US bank, with a customer base concentrated in the tech and cryptocurrency industries), closing the bank and putting it under FDIC control. In a similar fashion to SVB, regulators announced that customers would have full access to their deposits the following working day.

While these significant interventions by central authorities brought some stability, they were not sufficient to fully soothe the market’s fears about the financial health of other banks, both in the US and Europe. As interest rates have increased, banks have experienced losses on longer-dated fixed income portfolios; while this would be manageable if the banks could hold the assets to maturity, if a significant number of customers seek to withdraw deposits this might force the bank to sell these assets, leading to a crystallisation of the losses and potentially bringing into question the banks’ solvencies.

These concerns led to tremors on the other side of the Atlantic – as with SVB, following a week of an escalating bank run, Credit Suisse appeared on the brink of failure on the 17th March. After a weekend of frantically exploring options, on the 19th March it was announced that UBS acquired Credit Suisse in an all-share deal worth c.$3.25bn. Controversially, Credit Suisse’s Additional Tier 1 (AT1) bonds were wiped out as part of the deal, with some investors exploring potential legal action in response. This was followed by a wider banking sector sell-off on the 24th March, led by Deutsche Bank, which had seen a spike in the cost of insuring its debt against default (through credit default swaps).

While there are clearly concerns from investors regarding the stability of the banking sector, the robust responses from governments, regulators and central banks (in both the United States and Europe) have led to at least a temporary pause in the banking contagion. ebi builds highly diversified portfolios broadly reflective of global markets, seeking to enhance risk-adjusted returns through a factor-based approach. As such, the equity element of our portfolios held extremely marginal exposures to SVB, Signature Bank, and Credit Suisse (0.0070%, 0.0041%, 0.0046% respectively, as of 28th February 2023), thus investors are well positioned for a wide range of market outcomes due to our investment approach.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Q2 Market Review 2024

- June Market Review 2024

- Do Political Events Impact Financial Markets?

- Is there an AI bubble?

- May Market Review 2024