June Economic Background

- UK and U.S. interest rates remain unchanged.

- Election setback hits India’s stock market.

- Artificial Intelligence (AI) continues to surge.

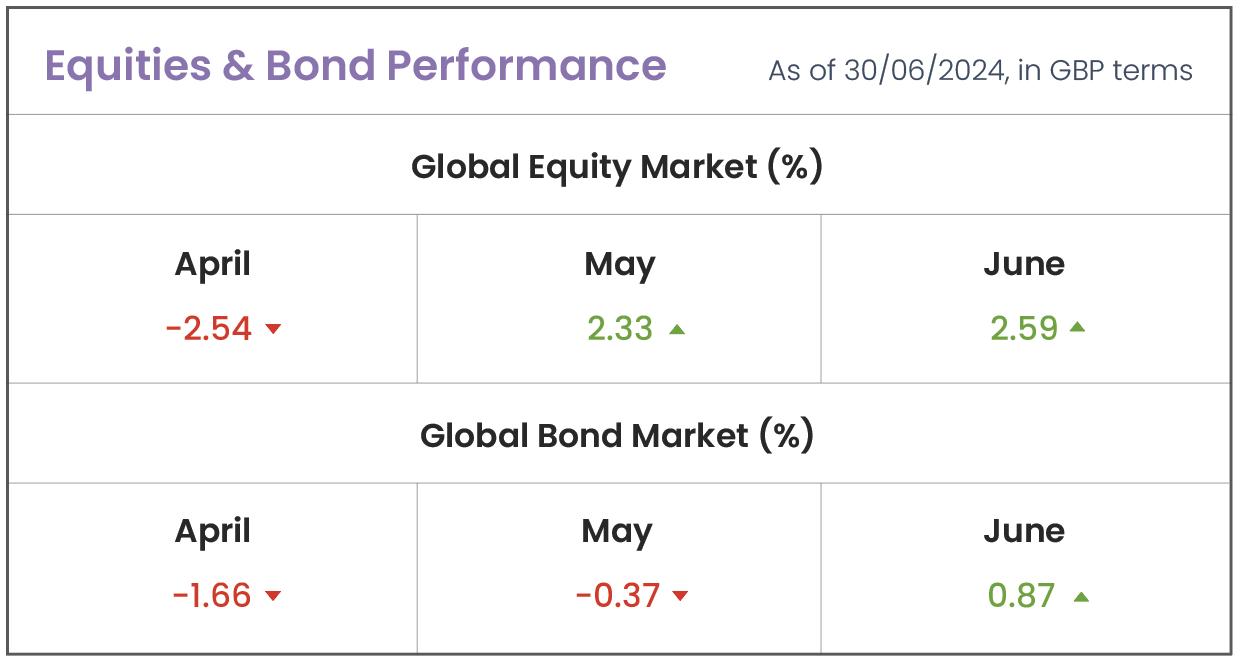

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

Interest Rates: On June 12th, the Federal Reserve (U.S. central bank) decided to maintain its interest rates at the current range of 5.25% to 5.5%. Despite previously indicating in March that there would be three rate cuts this year, the Fed has now revised its forecast to just one rate cut in 2024. Across the pond, the Bank of England (BoE) followed suit and held rates steady at 5.25%, maintaining 16-year highs. However, the BoE hinted at a potential rate reduction as early as its next meeting in August, prompting traders to increase their bets on a summer rate cut. This decision followed data revealing that headline inflation had dropped to the BoE’s target of 2% for the first time in three years. Albeit, some BoE members, who voted to hold rates, emphasised the importance of obtaining additional evidence that inflation will remain stable around the target and not surge again. On the contrary, the European Central Bank (ECB) has diverged in strategy by lowering interest rates for the first time in nearly five years, reducing rates from a previous high of 4% to 3.75%. The ECB’s rationale for this decision was anchored by persistently lower levels of inflation, positioning itself ahead of both the U.S. Federal Reserve and the BoE, which have not yet implemented rate cuts.

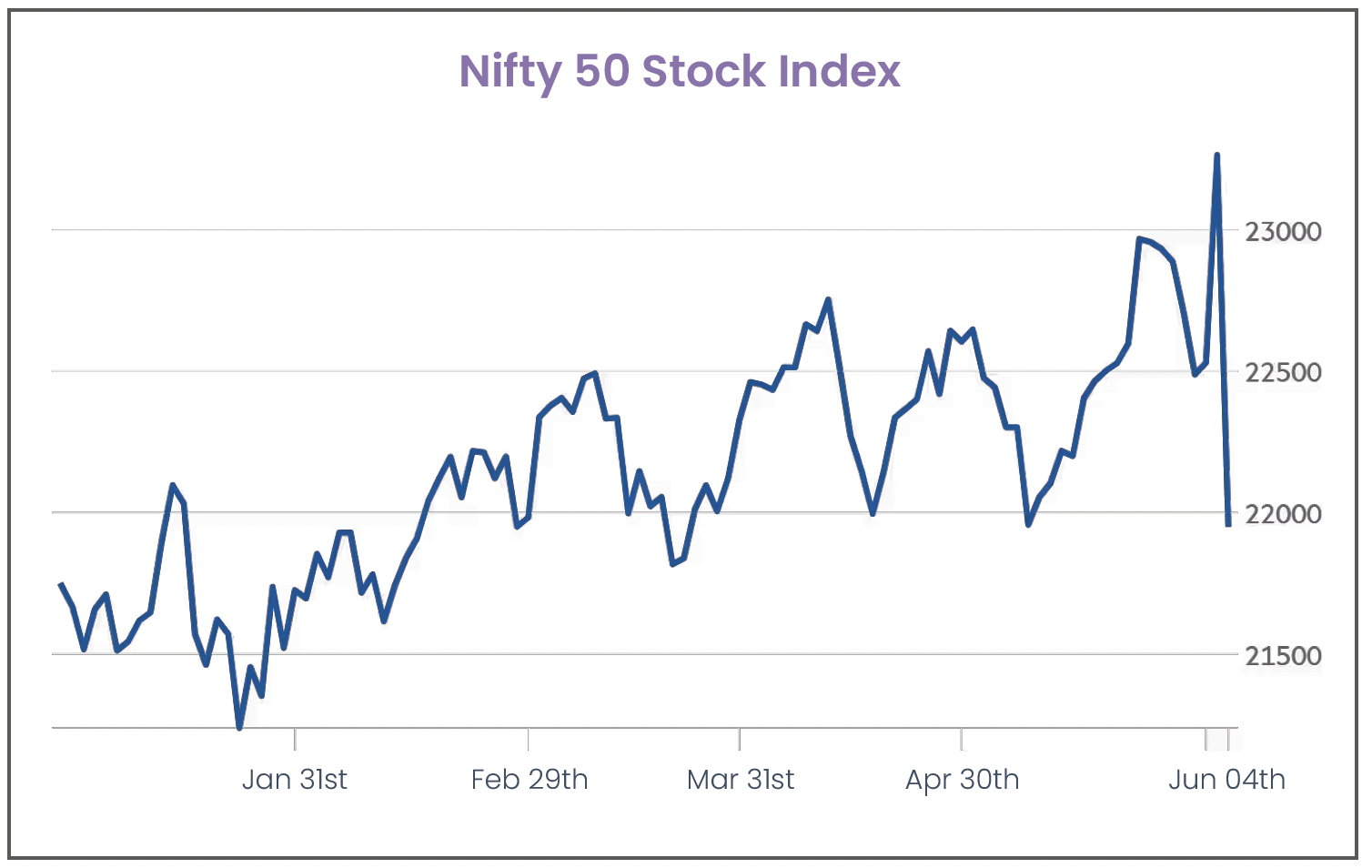

India’s Stock Market: Following a seven-week election period, Narendra Modi took office as India’s prime minister for a third consecutive term. However, his party’s failure to secure an absolute majority for the first time in a decade caused India’s stock market index (Nifty 50) to tumble from record highs. The index, which had hit a record high days earlier following exit polls predicting a comfortable victory for Modi, closed 6% lower on the day the election results were announced. The closer-than-expected results indicate a potentially less stable political environment for Modi’s third five-year term. Modi’s leadership effectiveness had previously been bolstered by his party’s clear majority, ensuring smooth passage of reforms and legislation without coalition hurdles. His pro-business policies and transparent fiscal stance have significantly contributed to India’s recent economic strength, however he has faced criticism for his increasingly authoritarian leadership style and a sometimes divisive election campaign.

Source: Bloomberg

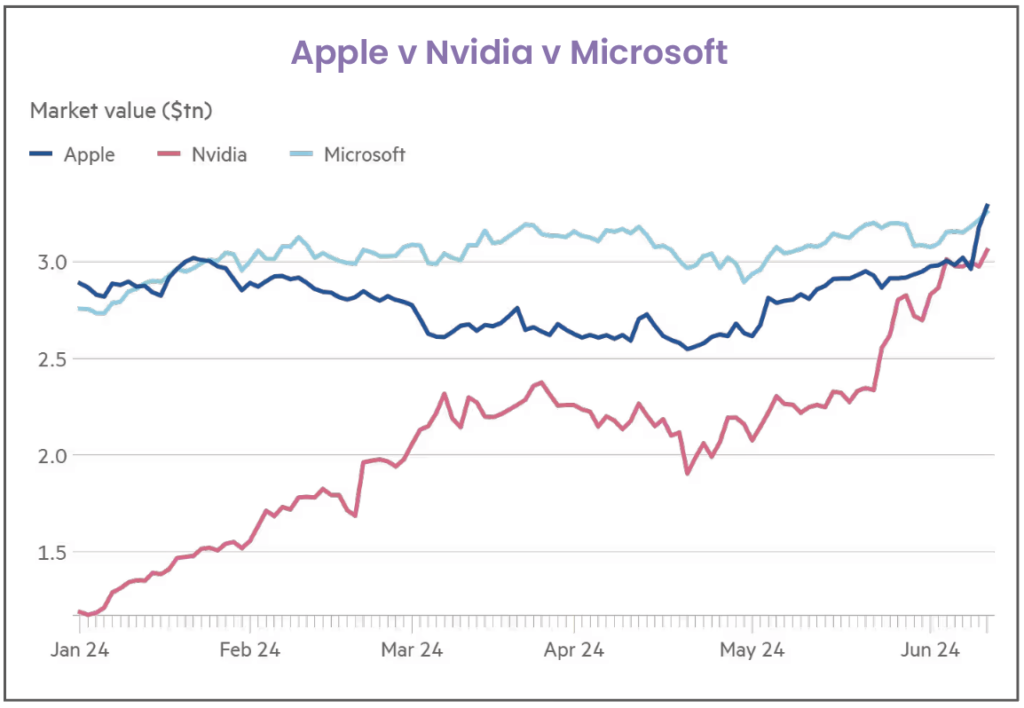

AI Surge: In mid-June, Apple surpassed Microsoft to become the world’s most valuable company as investors showed enthusiasm for Apple’s expansion into artificial intelligence (AI). On June 11th, Apple shares surged by 7.2%, followed by an additional 3.7% increase the following day, which lifted Apple’s market capitalization to $3.28 trillion, edging past Microsoft’s $3.25 trillion valuation. The boost came after Apple’s announcement of a collaboration with OpenAI to incorporate ChatGPT into its products, easing concerns among investors about the company falling behind rivals in embracing generative AI technology. Nvidia briefly held top spot but by month end, Microsoft reclaimed its position as the world’s most valuable listed company.

A significant topic of discussion in financial markets has been the “Magnificent Seven,” which have seen substantial gains over the past 18 months due to increased excitement surrounding advancements in the AI industry. Some investors may ask: why not simply invest in these stocks? However, extensive research into the performance of professionally managed active funds, which frequently maintain higher concentrations in individual stocks, reveals that the majority consistently underperform broader, diversified benchmarks over time. For investors seeking to minimise risks associated with stock selection and market timing, holding a diversified portfolio that provides exposure to the wide market, rather than specific subsets of it, is likely to provide a more optimal strategy for successful long-term investing.

Source: Bloomberg

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- August Market Review 2024

- Understanding the VIX: Navigating Market Volatility

- Market Update, August Volatility

- Reports of ESG’s death are greatly exaggerated

- July Market Review 2024