The Market doesn’t care what you think of it !

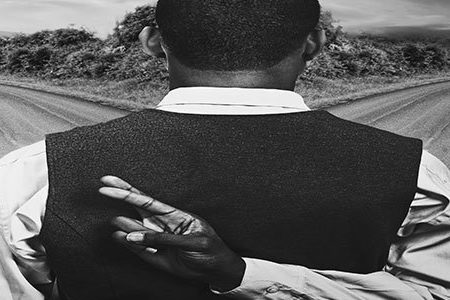

“The secret of success is sincerity. Once you can fake that you’ve got it made.” Jean Giraudoux We have seen a series of big rises and scary falls in the last year. Since the April 2015 highs, the market has gone nowhere, but very fast. As the market continues its most recent ascent, participants are getting increasingly nervous. As the chart below shows, Fund Managers have been hoarding cash, and according to Bank of America’s regular client survey, so-called “smart money” have been net sellers for 17 consecutive weeks