The new year has not started brightly – geopolitics in the Middle East, literal rumblings in North Korea and the chaos in Chinese asset markets has put equities on the back foot. The real concerns, however, may lie elsewhere.

On the 16th December, the Federal Reserve finally followed through on their repeatedly stated intentions to raise interest rates, by announcing that the Fed Funds rate (the rate at which US financial institutions lend to each other), was to go up, such that the new target rate was between 0.25 and 0.5% . It was so heavily telegraphed that only cave-dwelling Amish adherents would have been surprised by the decision. The reaction from analysts has been positive, and the phrase “dovish tightening” has been coined to assure us that all is well. However, amongst all the relief from self-styled experts and the pointing to the strong market rally (Dow Jones +1.08% on the day), small details appear to have been overlooked: how exactly are they going to achieve this? As of Thursday lunchtime, with the Dow now down 6.1% in the last 5 days, it may be beginning to dawn on some that this may not go according to plan, especially for investors in equities.

It is one thing to “command” an interest rate rise (maybe EBI should try it !), but actually putting it into practice is another thing entirely. The way the Fed implements it is through the money markets, via what are called Reverse Repo Operations(1). Before we go further, we need to look at what is called “liquidity preference“, to see what the Fed will need to do in practical terms to get their way on interest rates.

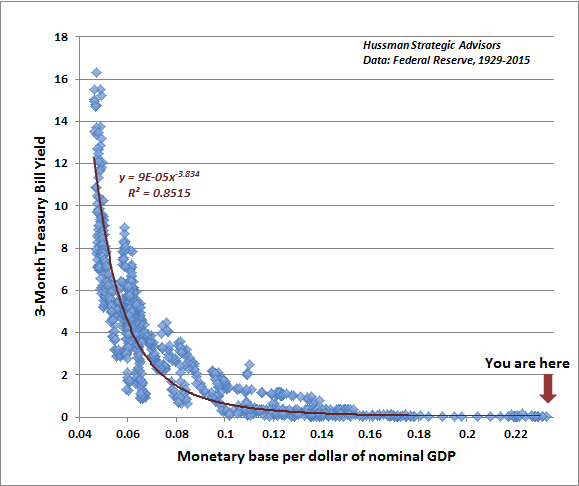

The chart below plots the relationship between the change in base money and the three month T-Bill yield. The fit is quite close, as you can see, with the former explaining about 85% of the change in the latter. To achieve the 0.25% required rate on Fed Funds, they will need to take money out of the system, to force interest rates higher. How much money ? Analysts’ estimates vary, with Citigroup estimating $1 trillion (others are suggesting as much as $1.7 trillion). This would have the effect of reversing all of the stimulus from QE3, and a bit more besides. Point 0.13 in the chart below represents a net drain of $1.7 trillion in liquidity, which would correspond to a 3 month T-Bill yield of 0.25%).

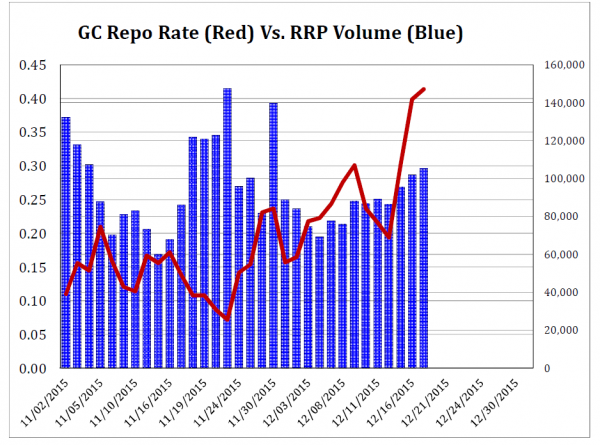

But on the 17/12/2015, a strange thing happened. The first reverse repo post the rate hike saw a net drain of just $3 billion, way below what seemed necessary to achieve the Fed’s ambitions. Just $103 billion was accepted in the repo, only $3 billion above that which was processed the day before the rate rise.

One repo market observer dubbed this “market by decree” – the Fed announces a rate rise and the market complies regardless of the excess liquidity still in the market place, as shown below. This may explain why nothing of significance happened to markets on the day of the hike.

But this raises as many questions as it answers with regard to the Fed – either 1), the Fed is interested in raising (and keeping) rates higher, in which case there will have to be a massive draining of liquidity from the US financial system at some point which the market has not yet priced in, or 2), it is all for show, and the Fed is not serious in raising rates (since if it were, it would have enlarged the reverse repo by a factor of 5-10 times). They risk looking foolish if the markets ignore the “command” and keep market rates at previous levels, but a liquidity drain may also have very negative repercussions for risk assets. In extremis, they may then be forced to reverse the rate rise, which would be hugely damaging for their credibility, with unknown long term consequences. It is also possible that the much touted “excess liquidity” in the system is nowhere near as great as some observers have assumed, meaning that they wont have to do nearly as much as some believe, though that then raises the issue of where it has all gone…

Maybe the bottom line is that they are between a rock and a hard place, making it all up as they go along. James Bianco (2) points out that the Fed is in uncharted territory:

“The Fed could raise rates by raising the reverse repo rate and/or interest on excess reserves. It has never used these tools to raise rates. The reverse repo rate was invented only two years ago. There could be some severe problems in the money markets if the Fed misjudges a tool that it has never used to raise rates.”

Recent market movements, with equities and junk bonds falling sharply and (government) bond yields doing the same, suggests that the market perception of bond market risks are once again misplaced. It is said (though disputed by some) that the then Chinese Prime Minister Chou En Lai, when asked in 1972 about the impact of the French Revolution (of 1789), replied that it was “too soon to tell”- we are in the same position with regard to interest rates (and thus bond market prospects). We need to see what the Fed does, and pay less attention to what it says to guide us. If the current equity market falls continue, however, it may all be moot: as Bloomberg have noted that the odds of another rate hike by April 2016 have already fallen from near 60% at the end of 2015 to just 43% as of 7/1/16, as per Fed fund futures contracts. They were previously expecting four rate moves in 2016 – that has now fallen to less than two. So maybe bonds will do just fine in 2016…

(1) A Reverse Repo (or Reverse Repurchase Agreement) is the opposite of the traditional repurchase agreement, whereby one party borrows cash in return for putting up collateral (normally US treasuries bonds) as security. In this case, the Fed lends out treasuries – which after QE it has lots of – and takes in cash, in the process draining the money markets, which in turn should lead to a rise in the Fed funds rate, thereby enforcing their will. For a full explanation of the Fed’s processes, liquidity preference etc, see this article from late December.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.