Emerging or Submerging Markets?

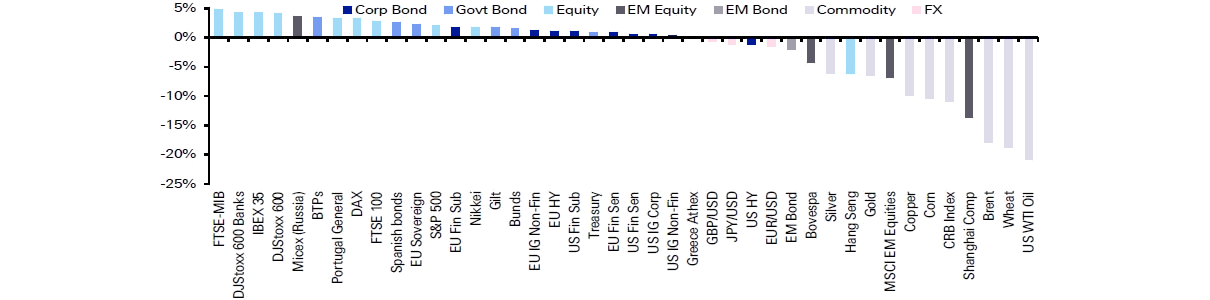

Emerging Markets had a torrid month in July. Only 5 out of the 23 EM markets made gains, as worries over falling Commodities and rising political tensions prompted Investors to withdraw large amounts from both Fixed Income and Equity funds. According to ETF.com, $15.9 billion has been redeemed from ETF’s in 2015. The banner image above shows that losses were concentrated in Commodity and Emerging market Indices. The Chinese market has seen a 28% intra-month range (High to Lows) as Authorities have tried to contain almost panic-selling, whilst Brazilian equities have fallen 4% in July too.