Inflation is one of the most detrimental forces facing investors as it erodes the real returns of your investment. Inflation linked bonds can be used to eliminate the risk of inflation, however recent performance in bond markets, coupled with interest and inflation rate expectations, have led to investors questioning their added benefit within a portfolio.

Introduction

Inflation, defined as the sustained increase in the general price level of goods and services in an economy over a period of time, is one of the most detrimental forces facing investors as it erodes the real returns of investments. The Consumer Price Index, (CPI), is the most widely used indicator of inflation. The UK central bank sets an annual inflation target of 2%, but as of October 2022, the annual inflation rate rose to 11.1%1, returning to a 40-year high and surpassing market expectations of 10%. Through monetary policy, the Bank of England will control inflation levels by changing interest rates, thus adjusting consumer spending and saving with the aim of restoring inflation levels closer to target.

Inflation will affect asset classes in different ways. Those with fixed long-term cash flows will see their purchasing power eroded, with commodities and tangible assets, such as property, exhibiting a positive relationship with inflation. Real estate is generally considered a good hedge against inflation as house prices and rental incomes generally increase in line with inflation. Equities are one of the possible safe havens from rising prices as companies’ earnings should increase at similar rates as inflation. In theory, that would drive share prices up along with the general consumer and producer goods.

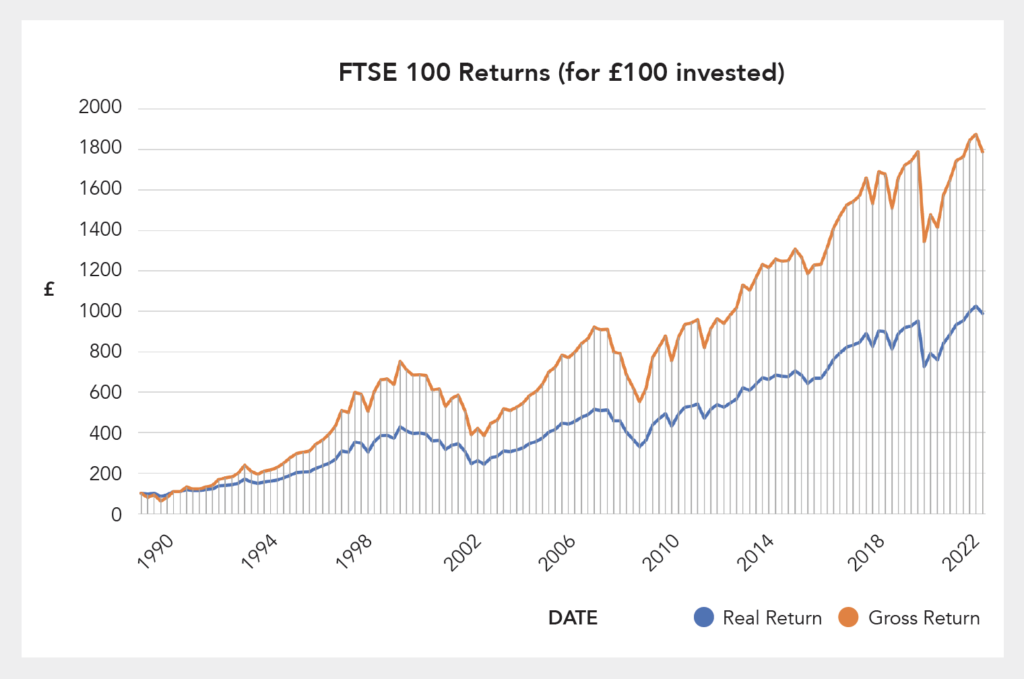

Source: Morningstar Direct

However, not all stocks tend to perform well during periods of high inflation. Businesses with larger market capitalisation typically achieve higher returns than their smaller peers as their market presence is more established and revenue streams are more diversified. Competitive advantages can arise for larger companies as they achieve economies of scale, whereby they become more efficient in production to lower costs. On the other hand, growth stocks that expect most of their cash flows to arrive in the future, such as tech stocks, may underperform in periods of high inflation. The power of inflation is shown above, with ‘real’ returns, (i.e. without inflation), being significantly lower than ‘gross’ returns, (i.e. with inflation), displaying how persistently inflation erodes investor returns over the long term

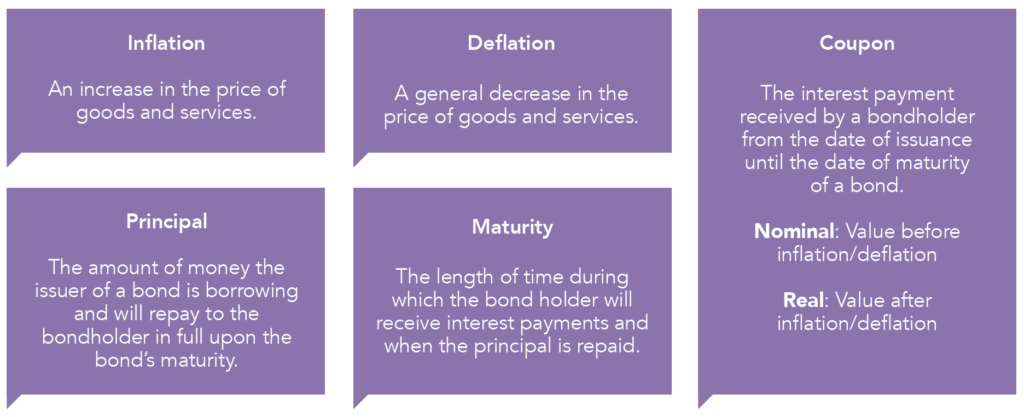

Jargon Buster

What are inflation linked bonds?

Inflation linked bonds, (ILBs) or ‘linkers’, are fixed income securities whose principal and coupons are linked to inflation through a price index (CPI). They are designed to eliminate the risk of inflation to the holders of the bond. As inflation expectations increase, bond yields tend to increase and prices fall, ceteris paribus. On the other hand, linkers provide protection against inflation as their coupons and principal values adjust based on changes in the underlying price index, thus protecting investors against a decline in purchasing power. Intuitively, the soaring inflation levels would surely make linkers attractive to investors, however, this blog will discuss why this hasn’t been the case, identifying the reasons for the poor performance displayed by inflation linked bonds.

Recent performance of linkers

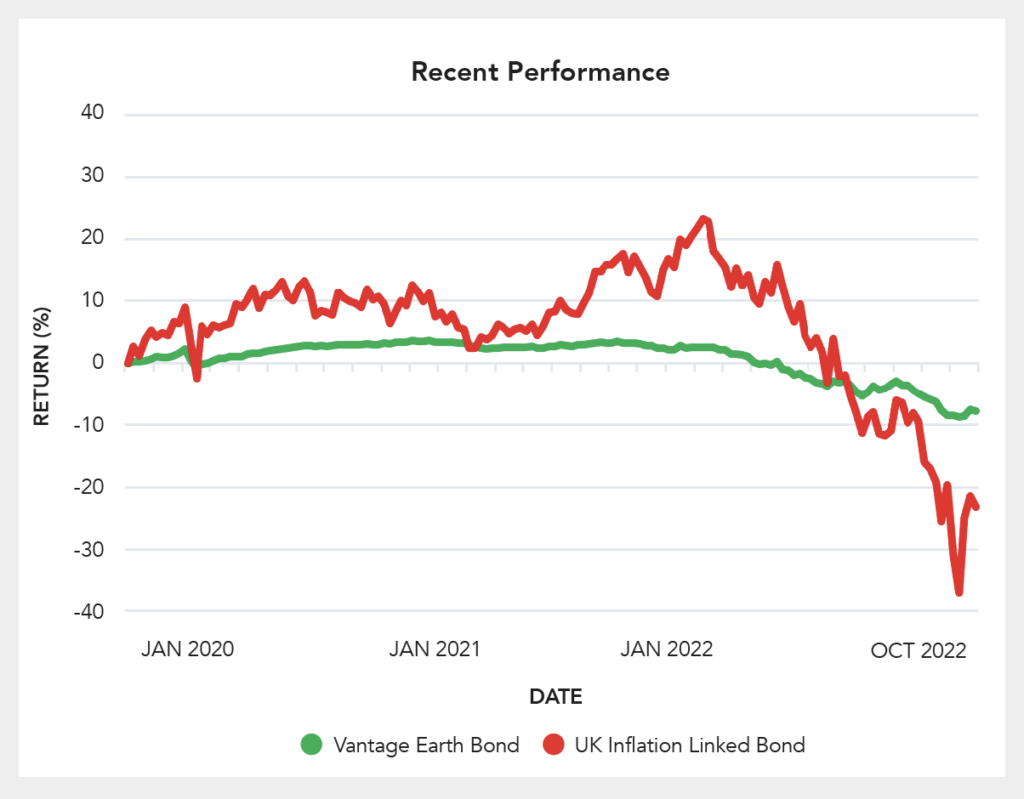

As inflation begins to rise above the Bank of England’s target of 2%, the Central Bank may intervene and raise interest rates, creating incentives for consumer saving as opposed to consumer spending, thus cooling the economy and lowering inflation. The lower relative rates now offered on bonds makes them less attractive and investors begin to sell as higher rates are offered elsewhere in the market, causing the price of bonds to fall. The gain made on linkers from their principal and coupon payments rising in line with inflation has been completely wiped out by the fall in price. In theory, linkers are perfect for investors looking for income that can keep pace with inflation and to avoid the negative real yields from conventional bonds. Albeit, this gain has been entirely negated by their fall in price (shown below).

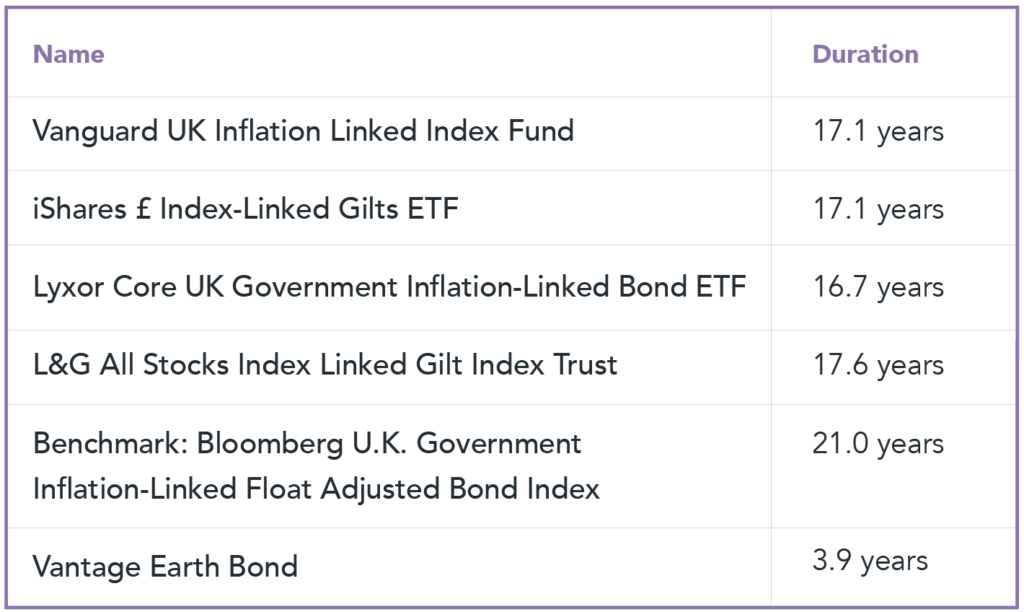

The poor performance posted by linkers is attributable to rising interest rates in an attempt to curb the ongoing inflation pressures. Duration is a metric used to provide a measure of a portfolio’s interest rate sensitivity. A lower duration entails a smaller interest rate risk, with shorter-duration bonds experiencing smaller capital loss in a increasing yield environment. The Vanguard UK Inflation Linked Bond has an average duration of 17.12 years, over 13 years more than ebi’s Bond portfolio. Consequently, if interest rates were to rise by 1%, the bondholders in the Vanguard Inflation Linked Bond would encounter a 13+% larger capital loss relative to bondholders in ebi’s Earth Bond portfolio. Short duration bonds inherently have less inflation and interest-rate risk and pursue the idea of minimising the potential for negative excess returns, which can severely impact compounded portfolio returns over a long-term period.

Source: Morningstar Direct

ebi believe that passive fixed-income continues to play a significant role in a diversified portfolio as volatility dampeners and risk diversifiers. The volatility displayed by the inflation linked bonds opposes our investment strategy for fixed income and therefore supports the rationale to not include them within our portfolio.

Other Alternatives

As previously discussed, inflation linked bonds perform poorly as interest rates rise because of their high duration. The universe of UK inflation linked bonds is very limited, (see below), they also have a high duration in order to offset long-term unexpected inflation, an approach ebi does not adopt for the reasons outlined above.

Source: Morningstar Direct

ebi’s stance

ebi incorporate passively managed, long-only investment grade, government and corporate bonds for the primary aim of risk mitigation and to provide an anchor for our diversified portfolios during times of financial volatility and economic distress. As previously mentioned, during times of deflation, inflation linked bonds will suffer from falling coupon payments and run the risk of receiving a principal payment that is lower than face value, (i.e. what the investor paid for the bond at issue is more than what they receive back at maturity). Although inflation erodes coupon payments in fixed rate bonds, empirical evidence suggests that equities and bonds have a low negative correlation. Consequently, corporate earnings are positively related to equity prices, hence the loss created from inflation is offset by the growth experienced from the equity portion of the portfolio. The primary objective of including fixed income in a globally diversified portfolio is not to make above-market returns but to provide a buffer in times of economic decline.

Conclusion

The analysis presented in this blog highlights the specific characteristics of linkers and their behavior under different macroeconomic scenarios. Bonds are designed to act as a tool for risk mitigation and should be used to reduce the volatility of a portfolio, as opposed to attempting to achieve higher returns. Investors seeking a higher return should increase their equity exposure as opposed to incorporating more volatile and riskier fixed income instruments.

Please see the ‘Pricing Mechanics’ section below which illustrates the performance of fixed rate bonds vs inflation linked bonds in both inflationary and deflationary scenarios. As discussed, although linkers may appear beneficial during times of inflation, the inflation linked gains have been entirely wiped out from the fall in price of these bonds, as a result of rising interest rates.

This not only highlights the importance of having short dated bonds which entail lower inflation and interest rate risk, it also shows that, just because inflation is occurring doesn’t mean inflation linked bonds exhibit positive returns for investors.

Pricing Mechanics

Example: a 5-year fixed rate bond vs a 5-year inflation linked bond (ILB), with the same coupon rate (5%) and principal (£100), during times of inflation vs times of deflation.

For a fixed rate bond holder, they will always receive a principal payment of £100, whether there is inflation or not. In the inflationary scenario, the price index (CPI) has risen to £118, creating a £18 shortfall. However, in the deflationary scenario, the price index (CPI) has fallen to £83, creating a surplus of £17. Regardless of inflation or deflation, the fixed rate bond holder will always receive £100 at maturity (i.e. Year 5).

Coupon payments are also affected when there is inflation/deflation. During inflation, the fixed rate bond has a nominal coupon of £5 which remains constant (fixed) throughout the lifetime of the bond, however, due to inflation, the real coupon declines over time.

Alternatively, during deflation, the fixed rate bond has a nominal coupon of £5 which remains constant (fixed) throughout the lifetime of the bond, however, this time due to deflation, the real coupon actually increases over time. This would suggest that the fixed rate bond serves investors best during times of deflation, as inflation erodes the ’real’ value of your investment.

For inflation linked bonds (ILBs), the principal payment and coupon will adjust based on the price index (i.e. if there is inflation it will rise; if there is deflation it will fall).

As previously mentioned, in the inflationary scenario, the price index has risen to £118, thus the owner of the ILB will receive a principal payment of £118 at maturity (£18 more than the fixed rate bondholder). In the deflationary scenario, the price index has fallen to £83, thus the owner of the ILB will now receive a principal payment of £83 at maturity (£17 less than the fixed rate bondholder).

Coupon payments also move in line with inflation/deflation. During inflation, the nominal coupon payments will rise with inflation, whereas during deflation, the nominal coupon will fall at the same rate. Intuitively, ILBs are more beneficial during times of inflation where the interest payments and principal keep pace with inflation.

Investor B illustrates the additional risks investors take when opting to use inflation linked bonds in their portfolio. In a deflationary environment, the principal on the ILB has fallen to £83, whereas the fixed rate bondholder received £100. The continued high inflation levels throughout the UK would presumably make inflation linked bonds attractive to investors – albeit the poor performance posted by linkers has contradicted the rationale for their position within an investor’s portfolio during times of high inflation.

References:

1 Bank of England, November 2022

2 Vanguard Products, November 2022

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team

- The FCA lifts its ban on Cryptocurrency ETNs

- September Market Review 2025