Our latest market commentary covers the drivers of market conditions across Q4, along with factor and asset class.

Key Events

October

Global equities rally as easing inflation data reinforces rate-cut expectations.

US Treasury Secretary reassures markets on Fed independence following Trump criticism

China announces targeted fiscal support for infrastructure and housing

ㅤ

November

US equities pull back after renewed tariff rhetoric from Trump during mid-term campaigning

Eurozone growth forecasts revised lower amid weak industrial data

Oil prices fall sharply on signs of slowing global demand

ㅤ

December

Federal Reserve signals further gradual rate cuts in 2026 after rates hit a 3-year low

ㅤ

UK Autumn Budget passes with limited fiscal disruption

ㅤ

Global markets stabilise into year-end despite thin liquidity and elevated valuations

Overall Market Backdrop

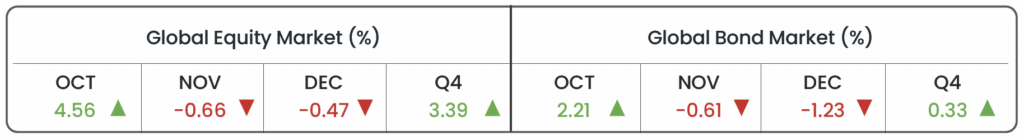

Global markets posted modest but positive returns in Q4, ending the year on a steadier footing after strong earlier gains. Global equities rose around 3.4%, led by a strong October rally on softer US and European inflation, which reinforced expectations of easier monetary policy. Sentiment weakened in November amid renewed tariff rhetoric and political uncertainty, driving higher volatility and a shift toward defensive assets, before stabilising in December. Fixed income markets were broadly flat, with small gains overall. UK gilts led the way as clarity on government finances pushed yields lower, while US Treasuries rose slightly after the Fed’s December rate cut.

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 31/12/2025 in GBP terms.

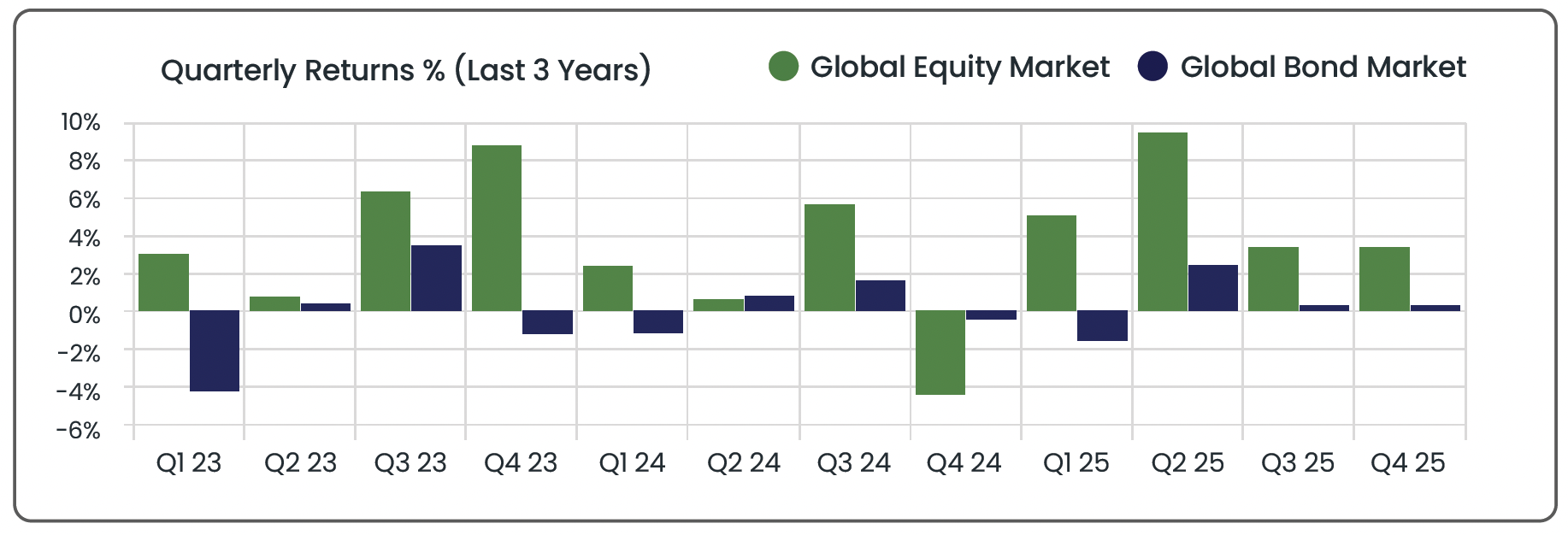

Source: Morningstar. Data from 01/01/2023 to 31/12/2025 in GBP terms.

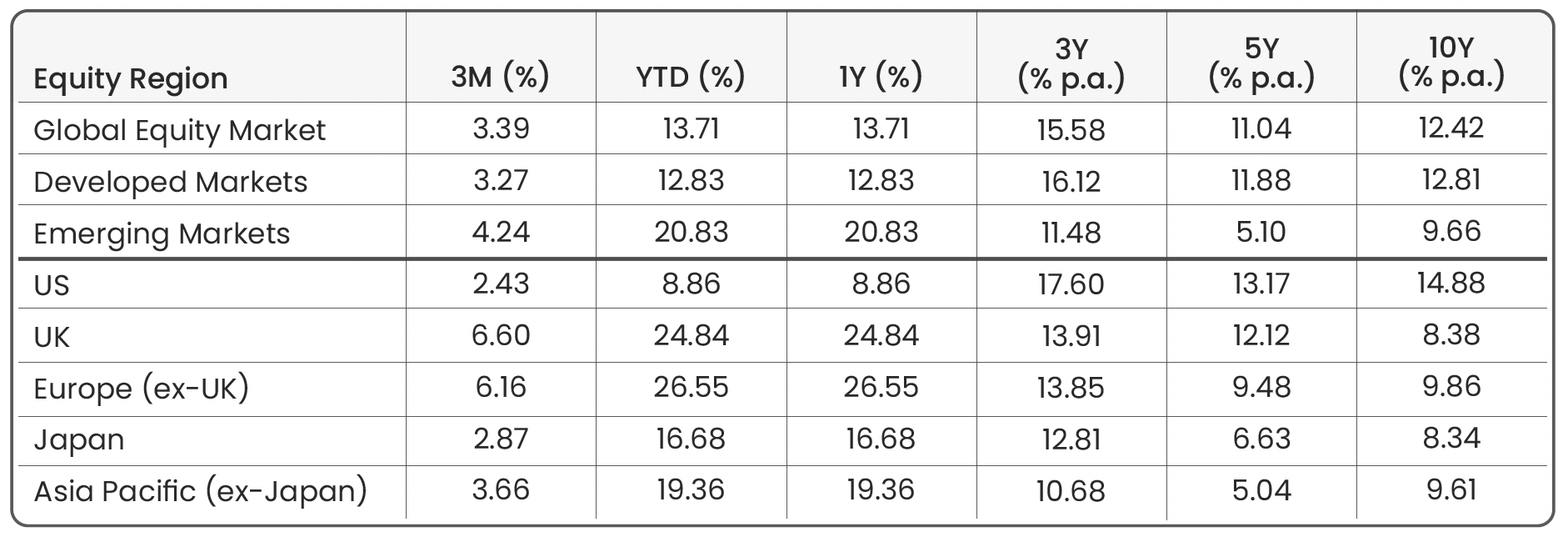

Equity Markets

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/12/2025.

U.S. +2.4%

US equities posted modest gains in Q4 (+2.4%), with performance marked by sharp month-to-month swings. October was particularly strong as equities rallied alongside falling bond yields, supported by encouraging inflation data and early signs that the Federal Reserve (the Fed) could ease policy without triggering a recession. This environment created a supportive backdrop for growth assets, with large-cap technology stocks again leading the advance, benefiting from continued investment in AI infrastructure and resilient earnings growth.

Momentum faded in November as markets digested renewed political uncertainty. President Trump’s increasingly confrontational rhetoric toward the Fed and key trading partners unsettled investors, reviving concerns over potential tariff escalation and policy unpredictability. At the same time, weaker consumer spending and downward revisions to corporate earnings guidance tempered the rally.

December saw further pressure as US unemployment rose to 4.6% in November, the highest level in over four years, highlighting ongoing weakness in the labour market. Some relief emerged when the Fed signalled that any future rate cuts would be gradual and data-dependent, culminating on 10th December with a 0.25% cut to a three-year low. These developments

UK +6.6% | Europe (ex-UK) +6.2%

UK equities were among the strongest regional performers in Q4, delivering a +6.6% return, supported by improving macro conditions and reduced fiscal uncertainty. October set a positive tone as falling gilt yields and clearer expectations around the Autumn Budget boosted investor confidence. The FTSE’s defensive sector composition helped limit downside during bouts of global volatility, while energy and financials provided early support, benefiting from stable interest rate expectations and easing funding pressures. Strength was maintained through November and December despite periods of market volatility. The Autumn Budget passed without major fiscal disruption, helping to ease concerns over government borrowing and supporting sentiment into year-end. In a quarter marked by heightened political and trade uncertainty, the UK’s relatively attractive valuations helped sustain equity gains, leaving the market well positioned among global peers.

European (ex-UK) equities also performed strongly, returning +6.2% in Q4, driven by falling consumer price inflation, lower bond yields, and rising expectations that the European Central Bank (ECB) would continue its move toward monetary easing in 2026. Improved financial conditions supported industrials, financials, and other cyclical sectors, while easing energy prices provided additional relief to the broader economy. However, structural growth concerns continued to temper enthusiasm. Sluggish industrial output in Germany and political uncertainty in France remained headwinds, while increased competition from Chinese exporters weighed on certain sectors. European auto manufacturers, in particular, faced pressure as Chinese electric vehicle makers expanded their presence in the region. Despite these challenges, supportive policy expectations and stabilising financial conditions allowed European equities to deliver one of the strongest regional performances of the quarter.

Japan +2.9% | APAC (ex-Japan) +3.7%

Japanese equities delivered mixed performance in Q4. October gains were supported by a weaker yen and continued progress on corporate governance reforms, which remained a key structural tailwind. However, volatility increased later in the quarter as investors reassessed the outlook for global trade and exports, particularly in light of renewed US tariff threats. By December, Japanese equities had stabilised as domestic demand indicators improved and the Bank of Japan (BoJ) reaffirmed its commitment to accommodative policy.

Asia-Pacific (ex-Japan) equities experienced a more uneven quarter. October strength, led by China and Taiwan, reflected optimism around stimulus measures and continued demand for AI-related exports. November saw a strong pullback as trade concerns resurfaced and global risk appetite softened. December stabilisation was driven by targeted Chinese policy support and improving sentiment toward regional technology supply chains, allowing the region to close the quarter with modest gains.

Emerging Markets +4.2%

Emerging markets delivered positive returns in Q4, however underperforming earlier quarters as global risk appetite cooled. Exceptional October gains (+6.4%) were supported by a weaker US dollar and falling global yields, which eased financial conditions and supported capital inflows into Emerging Markets (EM). China played a central role, with targeted fiscal stimulus helping to stabilise sentiment after a challenging summer amid USChina trade tensions.

November proved more difficult, particularly for export-oriented EM economies, as renewed US trade rhetoric weighed on currencies and global equities. India remained under pressure following earlier tariff measures, while Latin American markets were hit by falling commodity prices. December brought some relief as the Fed’s dovish guidance supported EM assets, but overall returns reflected a more cautious global environment and increasing sensitivity to political and trade developments.

Shortly after quarter end, emerging markets faced additional uncertainty following developments between the US and Venezuela in early 2026. While outside the Q4 reporting period, these events briefly unsettled energy markets and highlighted the ongoing influence of geopolitical risk on EM sentiment.

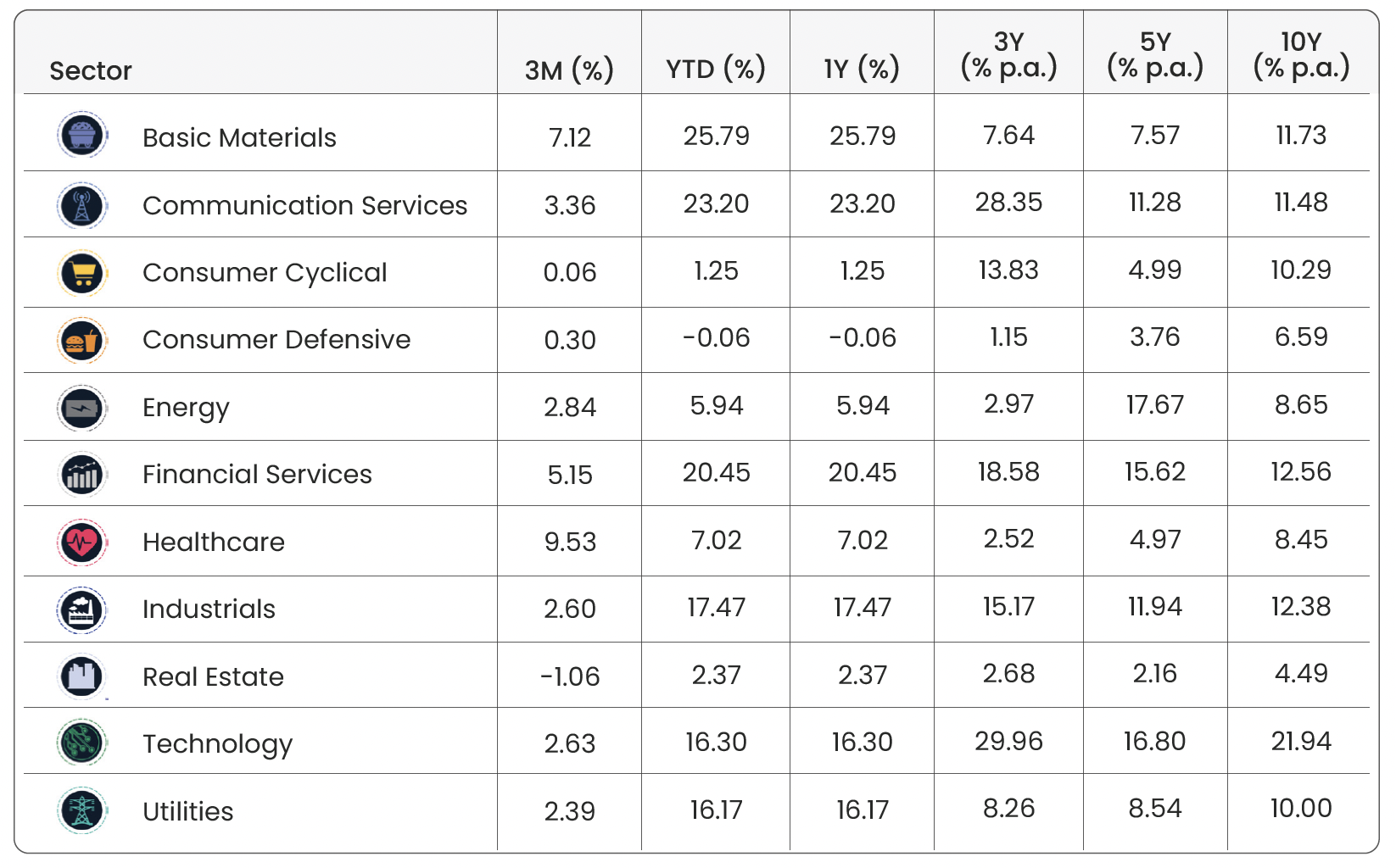

Sectors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/12/2025.

• After a blistering +13.9% gain in Q3, Technology’s growth moderated significantly in Q4 to +2.6%. The moderation reflected profit-taking after the Magnificent-7 mega-cap stocks had run sharply higher earlier in the year, combined with rising valuation concerns and uncertainty around AI investment cycles and long-term sustainability. While demand for AI-related products and cloud infrastructure remained robust, the sector’s outperformance narrowed as investors rotated into defensive and value-oriented sectors, signalling that the momentum that had driven earlier gains had started to fade as the year came to an end.

• Consumer Defensive was the only sector to finish the year in negative territory (-0.1%). Weakening labour markets in the US and UK reduced discretionary income and dampened demand for consumer staples, while European political uncertainty and US-Asia geopolitical tensions continued to weigh on global consumer confidence. Q4 returns were modestly positive at +0.3%, supported by stable pricing in essential goods and steady demand for non-cyclical products, but this was insufficient to offset earlier losses. Overall, persistent economic headwinds limited upside, keeping the sector subdued throughout the year.

• Healthcare was the top-performing sector in Q4 (+9.5%), benefiting from its defensive characteristics amid market volatility and investor rotation away from richly valued Technology stocks. Supportive developments, including progress in high-impact therapeutics such as obesity and diabetes treatments, as well as broader innovation in drug discovery and diagnostics, reinforced investor confidence. Despite these gains, Healthcare’s full-year performance was modest relative to other sectors, reflecting earlier headwinds from pricing pressures, slower elective procedure volumes, and a broader preference for cyclical or high-momentum areas.

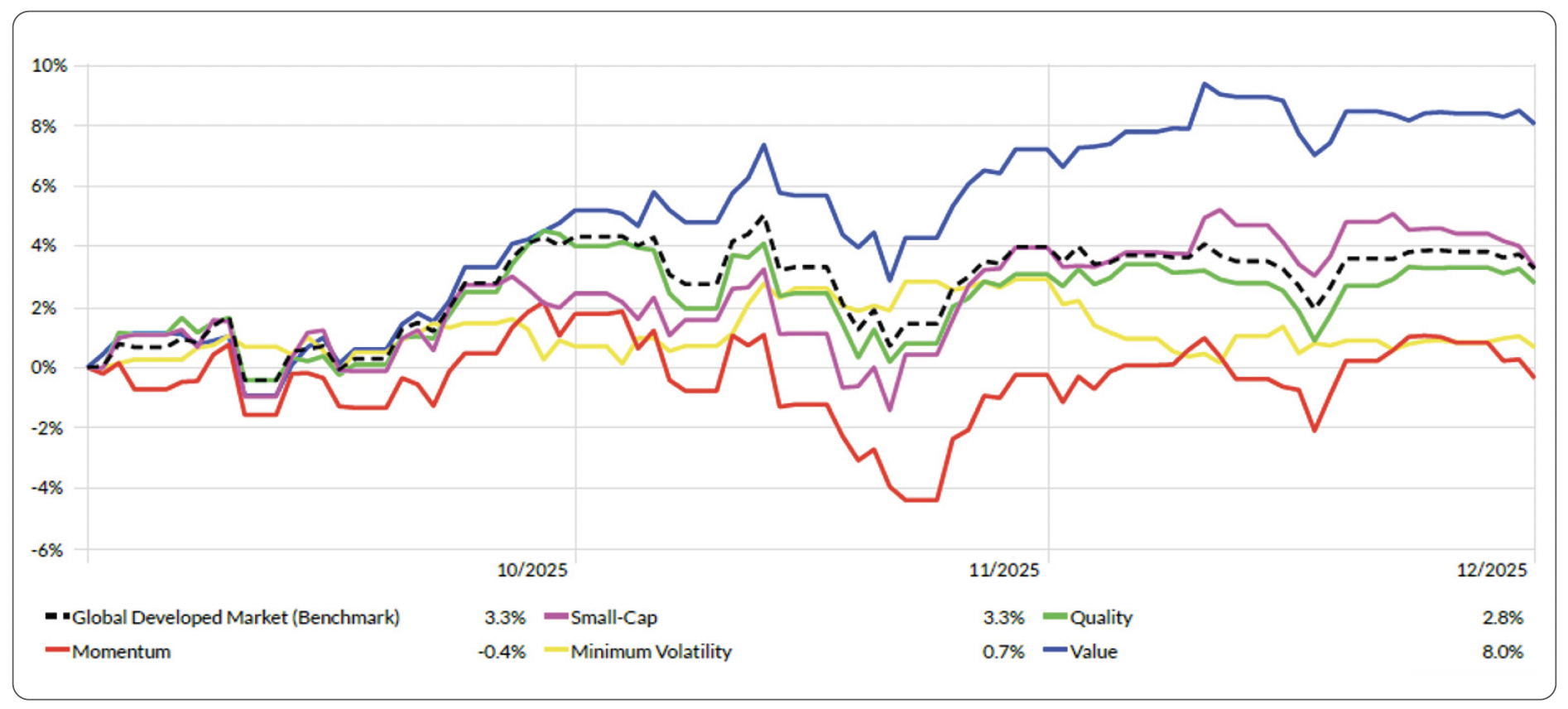

Factors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/12/2025.

Source: Morningstar. Data from 01/10/2025 to 31/12/2025 in GBP terms.

• Momentum stocks saw a modest pullback in Q4 (-0.4%) after a strong run earlier in the year. Profit-taking and a rotation into more defensive and value-oriented areas weighed on performance, as investors balanced optimism with caution. The adjustment was particularly focused on US mega-cap technology names, where relatively high valuations prompted selective profit-taking. While leadership remained concentrated in high-growth and tech-related sectors, this quarter highlighted a more cautious environment, with investors reassessing risk amid elevated market levels and geopolitical uncertainties.

• Value stocks rebounded strongly in Q4 (+8.0%) as investors rotated out of richly priced growth names, including technology and high-momentum stocks such as the Magnificent Seven, into more attractively valued areas. The rally was supported by easing consumer price inflation, signs of stabilising global growth, and resilient earnings in cyclical sectors. Financials, energy, and industrials were key contributors, benefiting from higher interest rate visibility and renewed infrastructure activity.

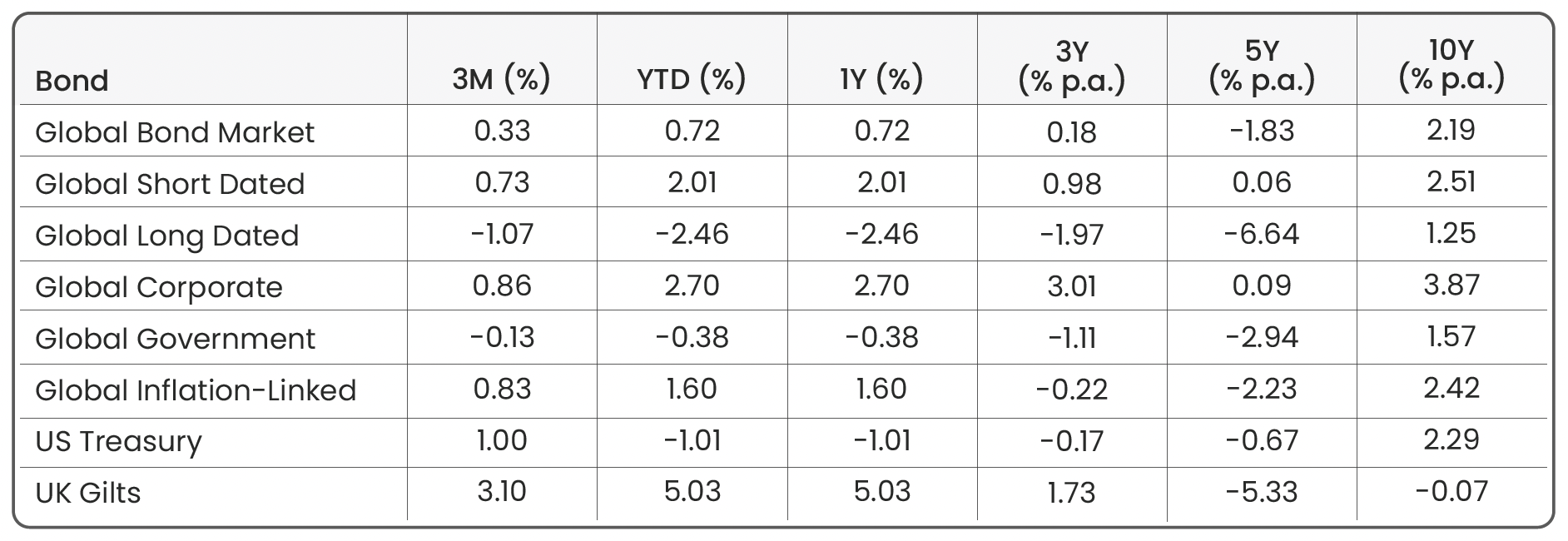

Bond Markets

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/12/2025.

Global bonds delivered modest gains on average in Q4, with short-dated bonds outperforming longer-dated issues. Investors favoured shorter maturities as uncertainty around central bank policy and economic growth persisted. Corporate and inflation-linked bonds also posted small positive returns, supported by resilient earnings and easing inflation expectations, while government bonds were broadly flat.

In the US, Treasuries gained +1.0% for the quarter. December marked the end of the Fed’s largest-ever quantitative tightening cycle, during which $2.4 trillion in assets rolled off its balance sheet. Fed Chair Jerome Powell signalled a return to balance sheet expansion to maintain “ample reserves,” effectively restarting a form of quantitative easing. This move is designed to keep borrowing costs manageable, support market liquidity, and give the Fed flexibility in a complex economic environment. The quarter also saw a 0.25% rate cut, taking the federal funds rate to a three-year low, which helped support bond prices.

UK gilts delivered strong gains in Q4 (+3.1%), as falling yields eased funding pressures and supported the smooth passage of the Autumn Budget. Stabilising inflation expectations and improved confidence in the UK’s fiscal outlook further supported returns, making gilts a relatively safe and attractive component of fixed-income portfolios amid broader market uncertainty.

Overall, Q4 highlighted the importance of central bank policy, inflation, and fiscal developments in driving bond markets. Short-dated bonds and government debt with stable fiscal backing offered relative safety, while longerdated bonds remained sensitive to shifts in rates and broader economic signals. Bonds continued to provide portfolio stability, balancing risk amid a relatively volatile and uncertain quarter for equities and global markets.

Market Proxies

Equity Indices: Morningstar Global Markets (Global Equity Benchmark) | Morningstar Developed Markets | Morningstar Emerging Markets | Morningstar US Market | Morningstar UK Market | Morningstar Developed Market Europe (ex-UK) | Morningstar Japan | Morningstar Asia Pacific (ex-Japan)

Sector Indices: Morningstar Global Basic Materials | Morningstar Global Communication Services | Morningstar Global Consumer Cyclical | Morningstar Global Consumer Defensive | Morningstar Global Energy | Morningstar Global Financial Services | Morningstar Global Healthcare | Morningstar Global Industrials | Morningstar Global Real Estate | Morningstar Global Technology | Morningstar Global Utilities

Factor Indices: Morningstar Developed Markets (Factor Benchmark) | Morningstar Developed Markets Small-Cap | Morningstar Developed Markets Quality | Morningstar Developed Markets Momentum | Morningstar Developed Markets Min-Vol | Morningstar Developed Markets Value

Bond Indices: Bloomberg Global Aggregate (Global Bond Benchmark) | Bloomberg Global Aggregate 3-5 Yr | Bloomberg Global Aggregate 10+ Yr | Bloomberg Global Aggregate Corporate | Bloomberg Global Aggregate Government | Bloomberg Global Inflation-Linked | Bloomberg US Treasury | FTSE Actuaries UK Conventional Gilts All Stocks

All data is sourced from Morningstar and presented in GBP terms, unless otherwise specified. An appropriate index from the Morningstar database has been selected. For further details about each index, please refer to the corresponding index provider’s official website.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Simpson

Investment Oversight Analyst at ebi Portfolios

What else have we been talking about?

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025

- October Market Review 2025