October Economic Background

• The Federal Reserve delivers another rate cut, but further easing remains uncertain

• AI-driven tech rally creates investor caution amid rising “bubble” concerns

• Japanese stocks hit record highs after new Prime Minister signals pro-growth agenda

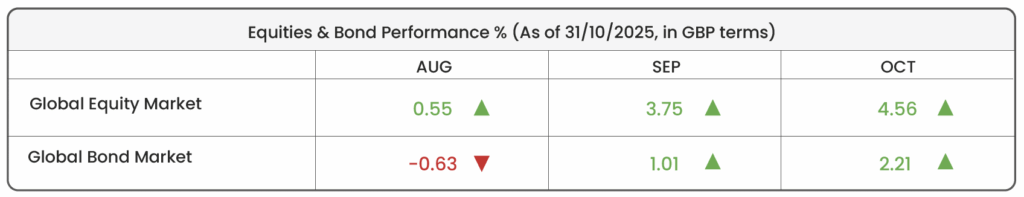

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

A Balancing Act on Interest Rates:

The final week of October brought another small shift in the global interest rate story. The US Federal Reserve (the Fed) cut rates by 0.25%, bringing its benchmark rate down for the second time in three months. The decision reflected a softer run of economic data, including slower hiring and easing inflation pressures. Fed Chair Jerome Powell noted that while growth has moderated, inflation is finally moving closer to the Fed’s 2% target, giving the central bank scope to lend a little more support to the economy. However, Powell warned that further cuts are “not a foregone conclusion.” The ongoing political wrangling in Washington and the potential for another government shutdown (the current one not yet being resolved) later this year have made policymakers cautious. Markets still expect one more cut by early 2026, but the Fed has made clear it wants to see stronger evidence that inflation will stay contained before committing to a longer easing cycle.

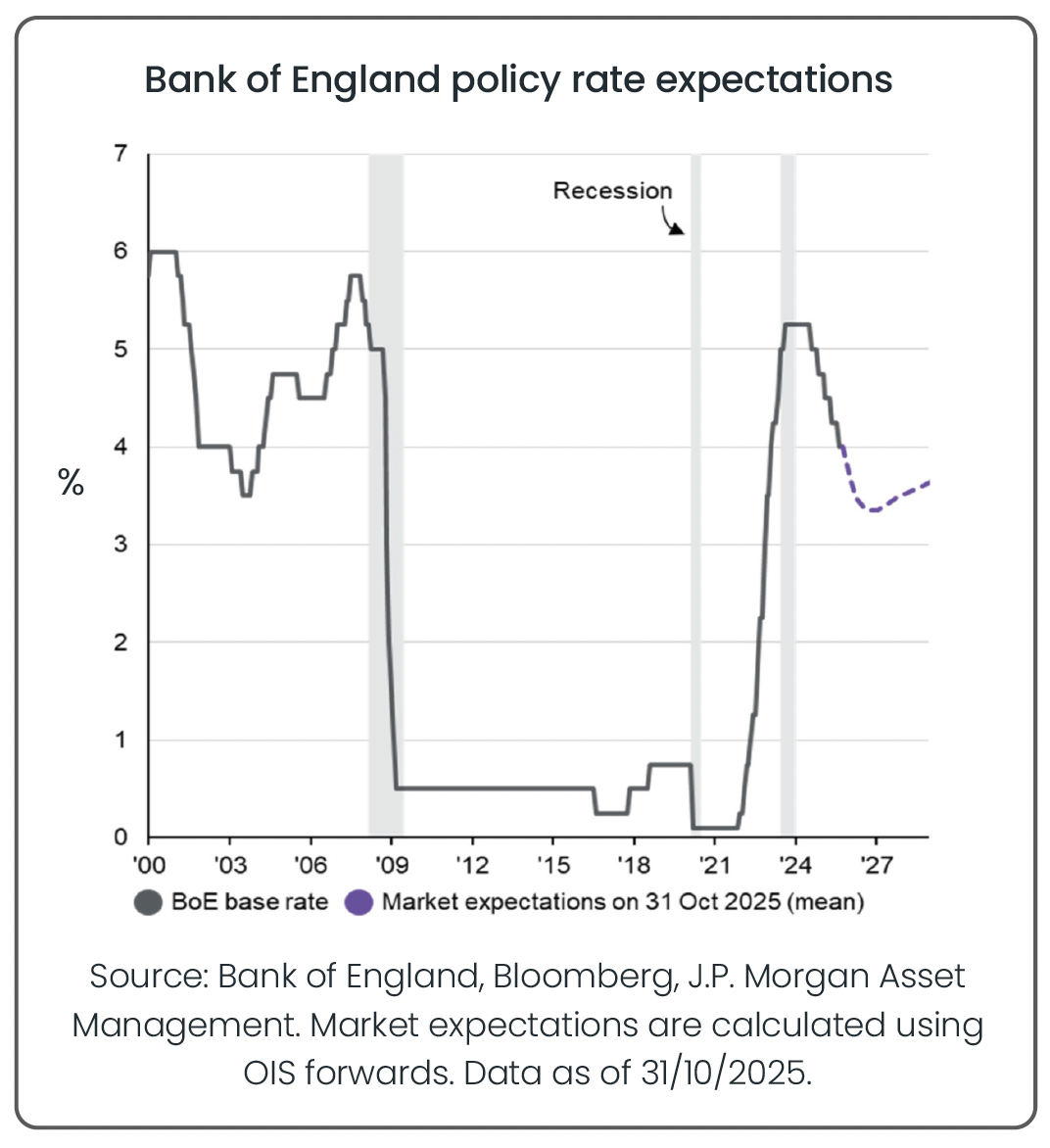

Across the pond, UK inflation unexpectedly held steady at 3.8% in September, below forecasts of 4%. That offered the Bank of England some welcome relief after months of battling stubborn price pressures. Chancellor Rachel Reeves has promised to use the upcoming Budget (to be delivered on 26th November) to introduce measures aimed at lowering inflation and easing household costs, which could pave the way for rate cuts early in 2026.

Meanwhile, in the euro area, the European Central Bank (ECB) left interest rates unchanged at 2% for a third consecutive meeting. Tentative signs of growth have begun to emerge, particularly in Germany and France, where industrial output has stabilised. The ECB continues to favour a “wait-and-see” approach, balancing the risk of reigniting inflation against the need to support a fragile recovery.

The AI Boom and Investor Caution:

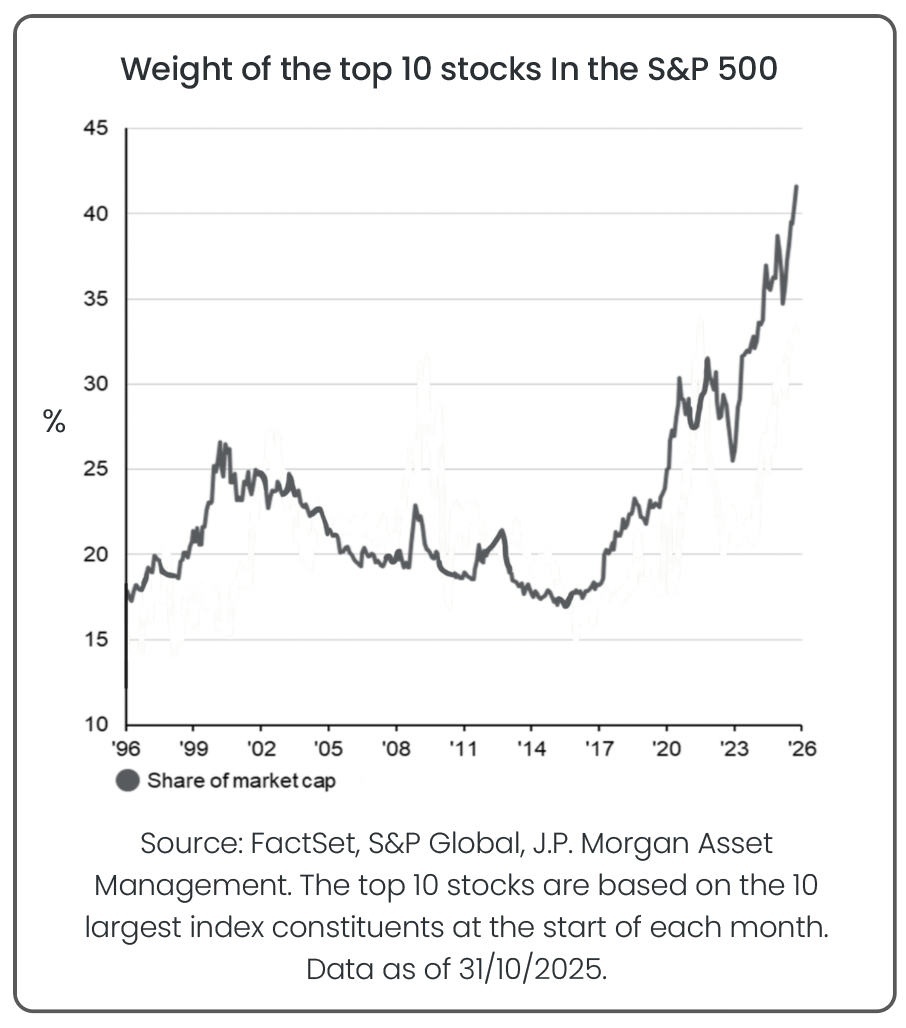

Technology stocks continued to dominate global markets in October, but enthusiasm is beginning to show cracks. In early October, the Bank of England warned that surging valuations in artificial-intelligence (AI) companies could pose a risk of a “sudden correction”, drawing parallels with the early-2000s dot-com era. This doesn’t mean a correction is inevitable, as many AI firms are delivering real productivity gains and robust earnings, but it does highlight growing concentration risk and investor caution regarding excessive valuations of the US tech giants in particular.

Our accompanying chart illustrates this trend clearly: the weight of the top 10 stocks in the S&P 500 has climbed from around 17% in 1996 to over 40% today. This unprecedented concentration means a handful of large-cap technology names now drive a disproportionate share of market returns. If sentiment towards these firms shifts, the impact could ripple quickly through broader equity markets. For investors, the takeaway is clear: maintain diversification. By holding assets across different regions, sectors, and styles, portfolios are better positioned to weather any potential pull-back in overheated parts of the market while still participating in long-term growth opportunities.

Japan’s “Takaichi Trade” Lifts Markets:

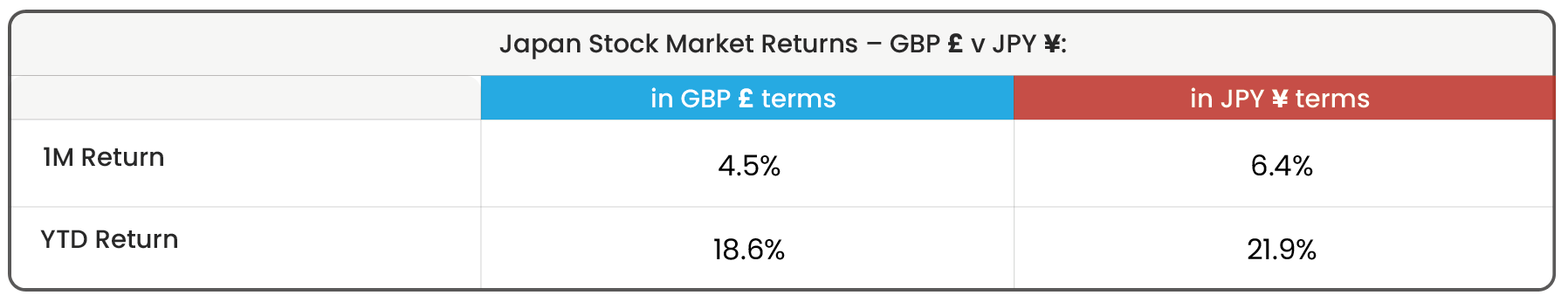

In Asia, Japanese equities surged to record highs after Sanae Takaichi won the leadership of Japan’s ruling party, paving the way for her appointment as prime minister. Investors expect her to pursue a pro-growth, pro-stimulus agenda centred on higher defence spending, tax cuts, and targeted infrastructure investment. This optimism (quickly dubbed the “Takaichi trade”) has fuelled strong market gains, with the Morningstar Japan Index rising 4.5% in October and up 18.6% year-to-date (in GBP terms, as of 31/10/2025).

However, expectations of looser fiscal policy and continued monetary support from the Bank of Japan have also driven the yen sharply lower against the US dollar. A weaker yen reflects the divergence between Japan’s ultra-easy policy stance and the higher interest rates seen in the US and Europe, which encourages capital outflows as investors seek better returns abroad. While a softer currency can boost Japan’s export competitiveness and corporate profits, it also erodes returns for UK-based investors once gains are converted back into pounds.

Source: Morningstar. Data shown in GBP (Pound Sterling) and JPY (Japanese Yen) terms. Data as of 31/10/2025. Index; Morningstar Japan Index NR.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025