“If there must be madness, something may be said for having it on a heroic scale” – J.K Galbraith (The Great Crash of 1929).

There has been plenty of negative news over the last few months and an even bigger list of issues over the last year or so, but (US) markets appear blithely unconcerned; despite the litany of calls for a decline, (or a crash), nothing appears to dent sentiment and the buying continues.

The list of concerns is long and varied – North Korea, Impeachment, Turkey, Trade Wars with both Europe AND China, Economic Growth, US Budget deficits, etc. etc. etc. The Bank of America June Global Fund Manager survey, which asks 179 participants, who control $528 billion in AUM, reported that Cash allocations rose to 5.6%, the biggest rise since the 2011 US Debt ceiling crisis whilst equity exposures dropped by the second largest amount ever, as equity allocations relative to bonds fell to the lowest level since May 2009. Earnings expectations have also plummeted, as the global economy is judged to be close to the end of the up-cycle AND that trade wars will make the subsequent decline worse.

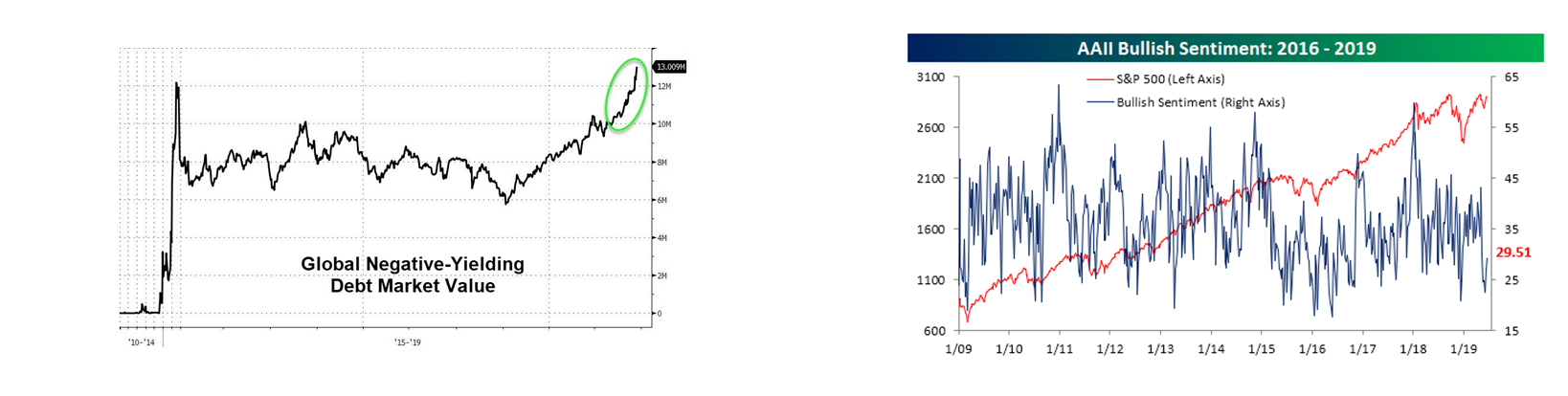

Meanwhile, US stocks are making all-time highs at the same time as the global negative-yielding debt pile reaches over $13 trillion dollars as interest rates collapse (see below). Even individual investors are getting spooked, with bullish sentiment near lows normally associated with on-going bear markets.

Why no market decline? Simple – a large number of investors are already bearish (and thus either out of the market or short), leaving few potential sellers; it is said (cliche alert!) that markets “climb a wall of worry”, meaning that bad news leaves investors nervous and inclined to sell into rallies, leaving them at risk of a renewed rise, which “forces” them to buy back in, and this has been repeated multiple times in recent months (and in truth has been a feature of market price action ever since the 2009 financial crisis lows). Hedge Fund Beta (i.e. market exposure), is currently at lows similar to that of the post-2009 period for example.

One CIO of a Hedge Fund, clearly frustrated by events, has lamented the fact that the “Wall of Worry never seems to end”, with each new concern merely extending the rally. One might have thought that he would adjust his trading strategy to accommodate this reality, but his view appears now to be that the Fed, for example, will fail to boost equity markets via interest rate cuts, or that inflation reawakens, both leading to sharp share price declines. So the view remains unchanged despite market confirmation (in the form of higher prices) that the investment thesis is wrong. Markets may be stupid, the Fed may be indulging in “lunatic” monetary policy (according to the Head of Investment Strategy at Rabobank) and the moon may be made of cheese, but this is not a viable investment policy. We have written before about the “overconfidence” bias in investing – it does not seem to have gone away and if anything, it has got worse.

Market psychology appears to have morphed into a state whereby the view is that the Fed will not cut interest rates unless stocks fall sharply and thus stocks won’t fall because players see interest cuts as the reaction function of the Fed and indeed ALL Central Banks. One recent article has gone so far as to suggest that Donald Trump’s trade tactics with China are specifically designed to force the Fed to cut interest rates. A rather Machiavellian theory, but if correct, how can asset prices fall to the extent that Hedge Funds, Traders and Investment Firms believe? On this (rather convoluted) premise, the more trade conflict the better for stocks!

Markets exist to maximise trade – if everyone has already sold, the path of least resistance is up, as those bears need to buy in – and vice versa when everyone is bullish (and thus long). At present, it appears that the balance of positioning is negative, so up we go, to force traders to buy. This process will continue as long as there are sufficient bears, but as we saw in 2000 (and again in 2007), once the majority are long/bullish, look out below.

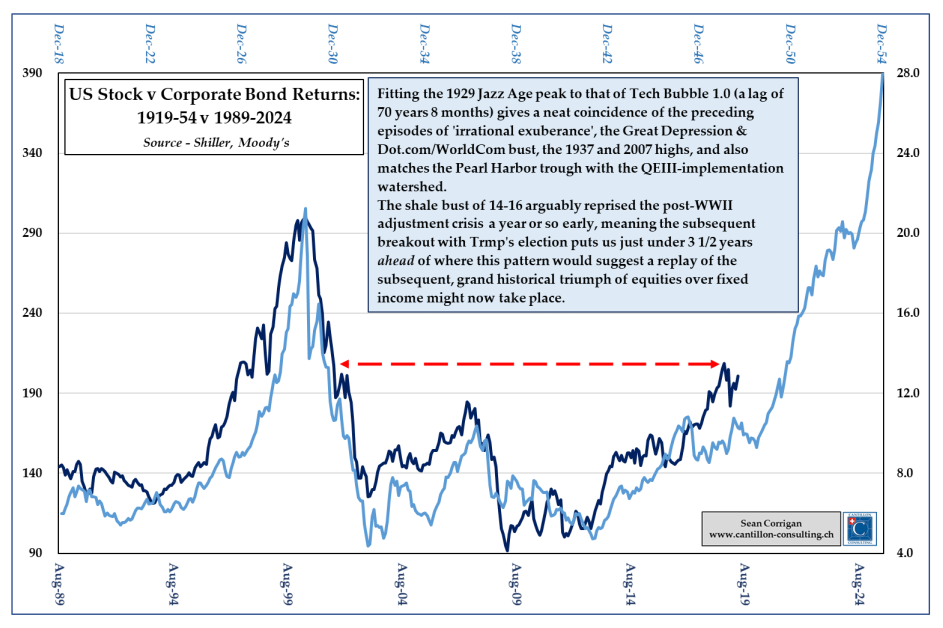

How does this all end? The chart below suggests an interesting (and most definitely non-consensus) outcome. Although we must be careful with analogues to the past, this chart calls for a melt-up in equity prices, starting around the end of this year. There is no obvious catalyst for this but given the strength and enduring nature of negative market sentiment, it would not necessarily be a major surprise. Should it eventuate, however, the bears will once again be absolutely destroyed, with many, Hedge Funds, in particular, staring down the barrel of extinction. It may look a long way down from here, but maybe investors are all facing the wrong way…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.