Investors are becoming increasingly concerned by the inflationary pressure on their portfolios. In its latest blog, ebi examines how advisers can manage inflation risk, and the outlook might not be as gloomy as you think.

Topics we cover:

• Inflation strategies

• Stocks

• Fixed Income

• Diversification

Over the past few months, headlines have been dominated by talks of inflation and stagflation. The concerns largely stem from Covid-19; supply chain disruptions, record amounts of government spending, and a sharp v-shaped recovery, all of which have contributed to an increase in inflation. Understanding where the current bout of inflation is coming from will give a better perspective of its potential impact.

The first Covid-19 infection wave sent markets into freefall causing a shift in investors sentiment with many investors and the general public hoarding their disposable income. When markets began to recover and economies opened up, there was huge pent-up demand which caused people to spend, travel and enjoy leisure activities at such an increased rate that a bottleneck was caused. Manufacturers are all chasing the same raw materials and are having to pay a higher price to gain access. This increase in price feeds through to suppliers and in turn, consumers bear the brunt of the higher cost.

Many people are asking how they can prepare for potentially higher inflation. As you consider strategies, remember that while market prices already contain inflation expectations, there may be discrepancies between the inflation expected and the actual inflation. Inflation may turn out to be higher or lower than expected, and this risk of unexpected inflation is what is causing fear levels to rise amongst investors.

Inflation strategies

Investors can implement the following measures to protect themselves from the declining purchasing power of money during periods of inflation:

- Hedging the immediate effects of inflation.

- Having returns that are higher than inflation.

- Diversification.

Hedging involves choosing assets whose value tends to rise with inflation. Assets that are positively correlated with inflation can help an investor keep up with rising consumer prices, at least over the short term.

Stocks

Equities have been a natural inflation hedge; stocks generally have an advantage during high inflation periods while bonds will suffer since they earn a fixed income through coupon payments. Many stocks also pay dividends and these will naturally grow over time in a high inflation scenario; as company revenues increase the dividends will also most likely increase. Investors will then benefit from an increase in their purchasing power.

When looking at ebi’s portfolios, there is almost no argument for repositioning on the equity side, as equities have historically been one of the best ways to counter inflation/rising inflation over the long term. High inflation can be partly offset in equities due to price rises countering any increase in costs for the company that may come in an inflationary environment.

Equity securities have provided a positive inflation-adjusted return over the long term. From 1926 through September 2021, the S&P 500, outpaced inflation and had an inflation-adjusted return of 7.3%[i] and from February 1955 through December 2009, the total UK stock market, as measured by the FTSE All-Share Index, outpaced inflation by an average of 6.05% per year[ii]. To achieve this higher expected real return in stocks, however, an investor had to accept more risk, as measured by greater volatility in returns, and endure periods when stocks did not outpace inflation. As a result, stocks may be less effective for hedging short-term inflation and more suitable for investors who want to beat long-term inflation by earning a higher total return.

Fixed Income (Bonds)

A high inflationary environment is more likely to affect bonds than equities. A standard counter to high inflation is raising interest rates which erode the real value of interest payments and principal (the amount of money the issuer agrees to pay the lender at the bond’s expiration) at maturity. It should be noted that this tends to impact the prices of long-term bonds more than those of short-term bonds, and therefore to an extent investors can minimise the impact by holding shorter-term instruments.

When rate hikes are in full flow, bonds with shorter-duration maturities enable an investor to more frequently roll over principal at a higher interest rate. This helps manage the impact on inflation and reduces volatility, leading to higher compounded returns and growth of real wealth.

ebi’s average bond duration is short-dated at 4.3 years. Duration can be interpreted as the measure of the sensitivity of a bond’s price to changes in interest rates; duration measures the percentage change in a bond’s price for a 1% increase in interest rates. For example, for the price of a bond in ebi’s portfolios to decline by 4.3%, interest rates would have to rise by 1%. Furthermore, short-term bonds are closer to maturity (the final payment) and have fewer coupon payments remaining than longer-dated bonds, and it’s less probable that interest rates will change over a shorter time frame.

It should also be noted that market distress is normally accompanied by a flight to quality, meaning the majority of investors rush towards higher-quality bonds. The increased demand creates upwards pressure on the price of investment-grade bonds. The bond portion of ebi’s portfolio is also well-positioned to benefit from this occurrence, including high-quality hedged to sterling bonds (nothing lower than BBB or junk bonds are included).

ebi’s bond portfolio is highly diversified with exposure to 10,000+ securities across a wide range of governments, government agencies, intranational organizations, and corporate issuers covering all economic sectors, thereby reducing risk through diversification. With such a highly diversified short-dated portfolio, many bonds will be held to maturity and redeemed at par (face value), unaffected by changes in price, and may benefit from interest payments being reinvested at higher rates.

Diversification

Most investors are very well versed with diversification and its seemingly endless list of benefits. A diversified portfolio of stocks that isn’t concentrated in any specific region will naturally act as a way of managing inflation. For example, if a portfolio is highly concentrated in Chinese equities and the Chinese economy is experiencing a decline in purchasing power, other economies such as the US, Japan, Germany, and South Korea may be experiencing stable cycles that produce positive returns for investors.

Factors

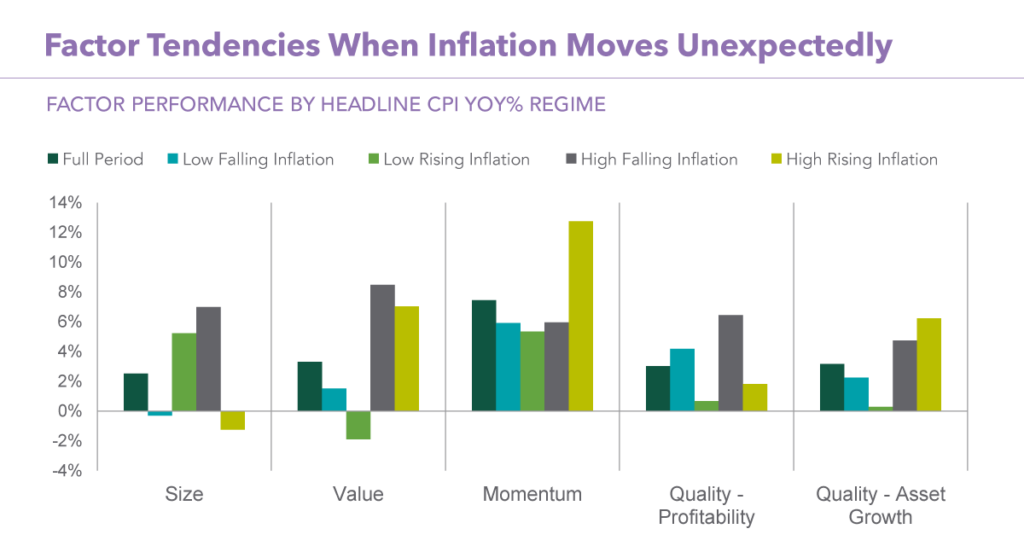

Studies have shown that popular factors like Value provide some benefit during periods of high inflation[iii]. Inflation also tends to follow a rotation in defensive stocks and the Quality factor has returned around 3%[iv] in a high inflationary environment. ebi portfolios have exposure to 5-factors, with Quality and Minimum Volatility being associated with defensive factors. However, ebi doesn’t attempt to market time by moving into these defensive factors in response to a high inflationary environment, moving in and out of these positions and predicting when we are entering a certain economic cycle stage is nearly impossible to do consistently and at optimal times. ebi, therefore, believes that including factors in our portfolios at all times has positioned them well to deal with any market regime and the chart below supports this theory and shows that it works well throughout different inflation regimes.

Source: Northern Trust Quantitative Research, Bureau of Labor Statistics, Bloomberg, Ken French Data Library. From June 1963 through March 2021. This information is obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The information is subject to change based on market or other conditions.

Summary

It’s extremely difficult to predict the trajectory that inflation rates will have; 2-years ago no one would have predicted inflation to overshoot assumptions as much as it has done. Investing in a high inflationary environment is not always doom and gloom and an inflation upswing need not necessarily be catastrophic for a well-positioned portfolio.

[i]https://www.dimensional.com/us-en/insights/will-inflation-hurt-stock-returns-not-necessarily Accessed Jan. 23, 2022.

[ii] The FTSE All-Share Index Composition: 98-99% of the UK market capitalization, aggregation of the FTSE 100, FTSE 250, and FTSE Small Cap Indices. Source: FTSE. RPI data supplied by the Office for National Statistics.

[iii] Neville, Henry and Draaisma, Teun and Funnell, Ben and Harvey, Campbell R. and van Hemert, Otto, The Best Strategies for Inflationary Times (May 25, 2021). Available at SSRN: https://ssrn.com/abstract=3813202 or http://dx.doi.org/10.2139/ssrn.3813202

[iv] Ibid

Blog Post by Raj Chana

Investment Analyst at ebi Portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025