While the situation between Russia and Ukraine remains extremely delicate and evolving at a daily rate, in this blog we give an overview of how the situation is impacting ebi portfolios and the economic impact on the market.

Topics we cover:

• Current situation

• How the markets react in times of war

• Economic impacts

• How the situation affects ebi portfolios

• What actions are our fund managers taking

Current situation

On the 22nd of February when Putin announced that Russia recognises the two regions of Luhansk and Donetsk as separatist governments, this was the first proclamation of the war. The situation has now escalated and Russian troops are driving deeper into the country, having attacked Ukraine from 3 directions causing such tragic loss of life and a humanitarian crisis.

The world was taken by surprise by Russia’s escalation of the conflict. Vladimir Putin’s decision to authorise military action against Ukraine shows the disdain that Russia has for international law and the United Nations. The actions have not only ripped through both international laws and the Minsk agreement, but shows an obvious disregard for human life.

The declaration of war has instantly marked a major paradigm shift of western politics towards Russia. A colossal amount of sanctions have been announced by the west, which may well mark the start of a protracted stand-off between Russia and the west.

With the west targeting Russia with financial sanctions intended to cripple the Russian economy, the Russian economy has dived into a deep recession, while the economic pressures on the country are only intensifying. An array of sanctions have been announced so far that target Russia in a multitude of directions including politicians, individuals, Russian companies, and in particular the financial sector. Some of the major sanctions consist of freezing Russian assets, removing Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment system and restricting sovereign debt trading. The world now waits to see ‘what’s next’; we could also see more western arms and materials supporting any Ukrainian insurgency.

Markets in times of war

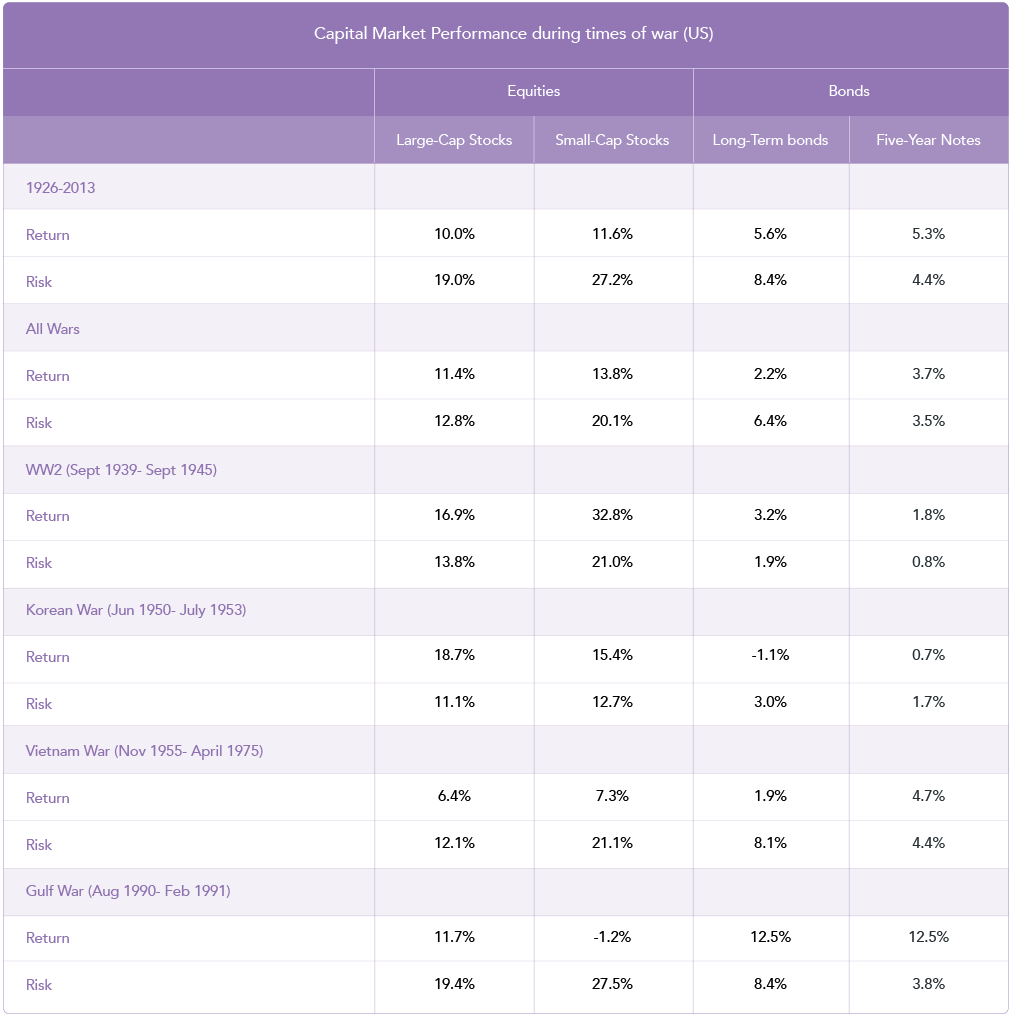

When studying markets, typically the threat of war has shown to have a negative impact while actual war itself tends to favour markets. The immediate impact of Russia’s hostile actions have been seen already; equities fell sharply with many regions, including the U.S. and Europe, having seen equities hitting new lows for the year. On the other side of the coin, Russian assets have taken a nosedive due to sanctions that will likely intensify.

Economic Impacts

The geopolitical breakdown between the west and Russia has had sudden effects on oil and gas prices, as seen by price increases of recent days. The headwind from higher energy prices and increased volatility is creating pressure on economic growth. However, the hit experienced due to this would most likely be limited; even in Europe, energy consumption only accounted for around 2% of gross domestic product before this crisis. The scenario will create further upward inflation pressure; the central bank meetings generally showed the idea of leaving the energy sector to deal with itself and normalise throughout 2022, but with recent events, supply-driven inflation may go through a phase where the recovery is delayed and raising its peak. The west now also have to find another route to fill the gap left when dependency on Russian energy and fossil fuels is eradicated. In addition, demand for certain commodities that would be commonly used as pantry stock may also increase boosting causing upward inflation pressure.

The economy was starting to feel the effects of the prospect of central banks’ monetary tightening policy before the advancements of Russia within Ukraine. This headwind may now be eased due to the number of sanctions being imposed by the west on Russia. The sanctions may protect the western economies by slowing down growth, the initial reason for the monetary policy tightening.

How will it affect ebi portfolios?

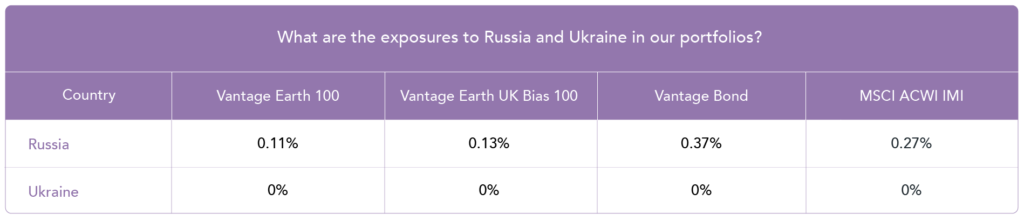

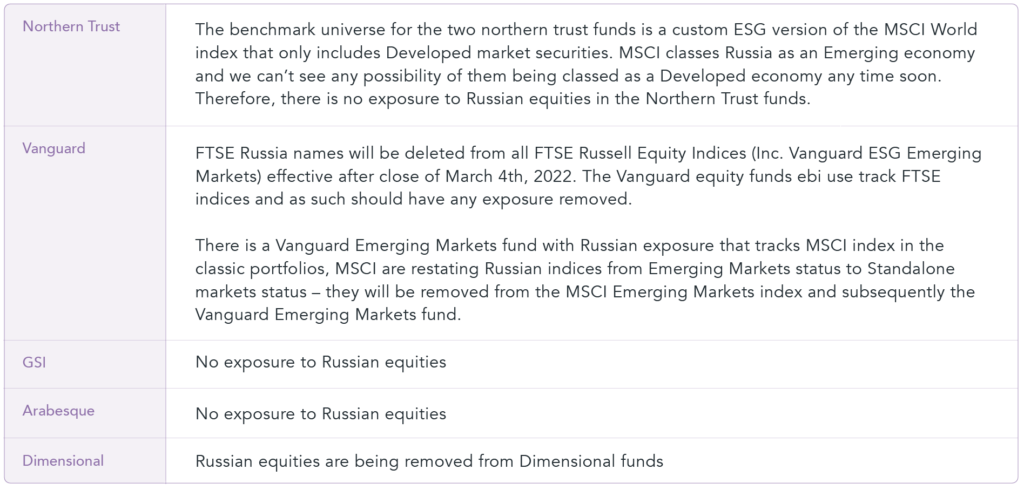

As for Russian and Ukrainian equities, our exposure to Russia is minimal and we have no exposure to Ukrainian equities or bonds in our Vantage Earth portfolios. This was not a tactical decision, and our portfolios still maintain a close to market-cap approach, with small differences due to factor exposures. This can be seen in the table below. It’s worth noting that many fund managers reduced their exposure to Russian equities following the 2014 annexation of Crimea.

For every £100,000, that’s invested in our Earth 100 portfolio would equate to approximately £110 in Russia and £0 amount in Ukraine. Picking winners and losers is a dangerous game and one of the key advantages our portfolios offer is through diversification. Diversification will naturally minimise the risk of loss; if one country’s exposure performs poorly over a certain period, other countries may perform better over that same given period, reducing the potential losses of the portfolio from concentrating all the capital under one type of investment.

What are ebi’s fund managers doing?

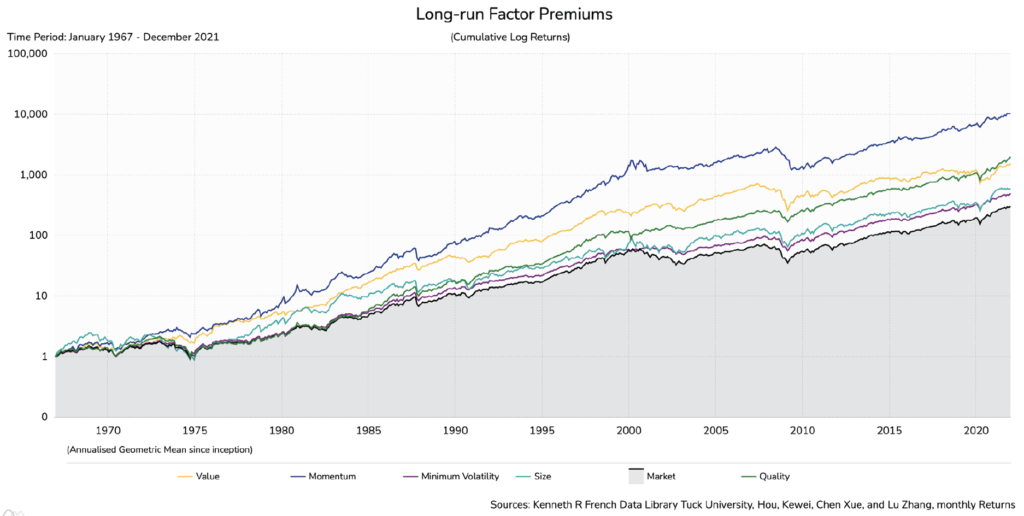

Even in these times predictions are exactly that, just predictions. If you would have asked anyone what the economic environment would have looked like today 3 years ago, it’s almost certain that none of them would have been close to predicting the current economic landscape. Therefore while we are not certain about the future, we invest on the core principle that ESG passive investment, with diversification among factors, is the preferred long-term course of action for superior risk-adjusted returns.

The argument that these factors have certain moments in the economic cycle where they shine brightly is true. However, moving in and out of these positions at optimum times and predicting when we are entering a certain stage in the economic cycle is near impossible to do, consistently. We, therefore, believe that including factors in our portfolios at all times has positioned them well to deal with any market regime, and only by stepping back and taking a holistic portfolio view over a long-term time horizon can we fully appreciate the interaction among these various factors.

ebi monitor the portfolios daily to ensure the risk profile is maintained. We will continue to hold extremely well-diversified assets which will help cushion the falls compared to owning a single equity investment. We are also monitoring the underlying funds within the portfolios to ensure that they are performing as anticipated, and in line with the index they are tracking.

Blog Post by Raj Chana

Investment Analyst at ebi Portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- Q2 Market Review 2025

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025