January Economic Background

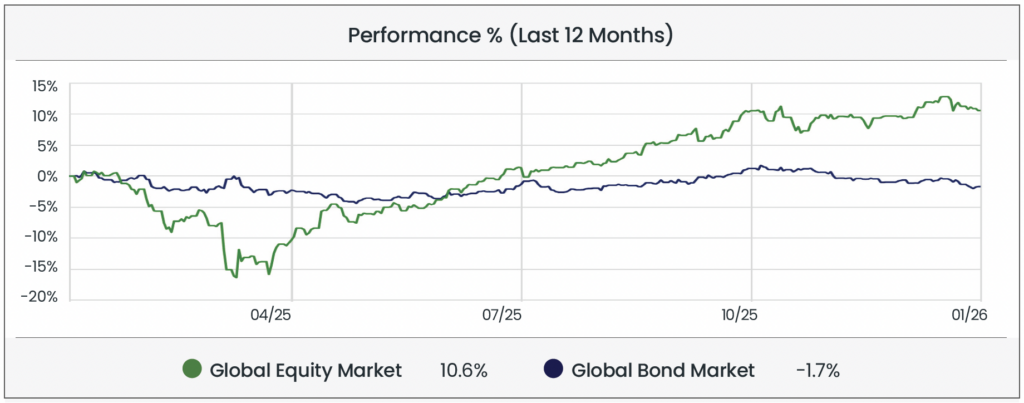

Global equity markets began the year with cautious optimism, rebounding from negative returns in November and December. Investor sentiment remained measured, as elevated technology valuations and ongoing geopolitical tensions continued to weigh on equities. Fixed income markets faced pressure amid shifting expectations for monetary policy and economic growth. Japanese government bond yields rose to multi-year highs ahead of a stimulus package from the newly elected Prime Minister, pressuring bond prices. In the US, the Federal Reserve held interest rates at 3.50-3.75% in January, signalling a pause in tightening while monitoring economic conditions.

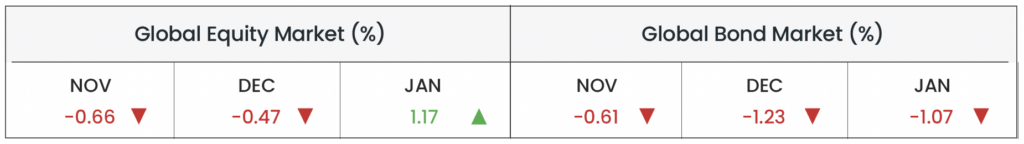

Equity & Bond Performance (Last 3 Months)

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 31/01/2026 in GBP terms.

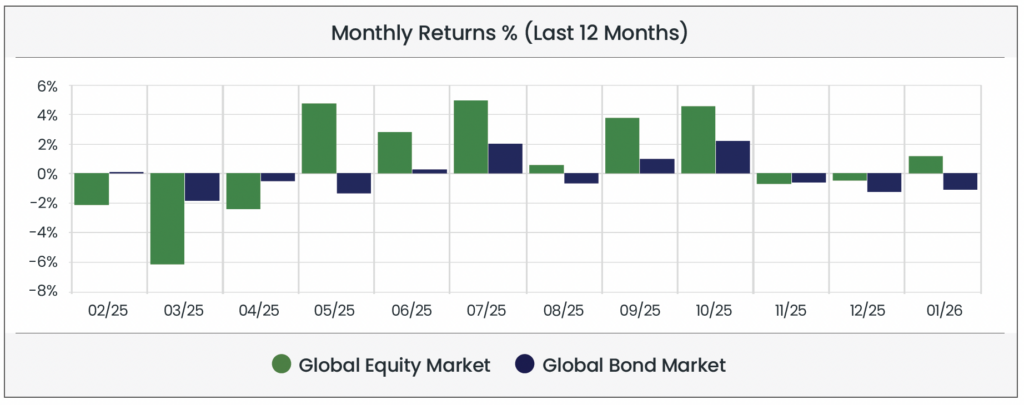

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 31/01/2026 in GBP terms.

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 31/01/2026 in GBP terms.

Economic Background

Elevated geopolitical uncertainty fuels investor flight to safety

It was a turbulent start to the year for US President Donald Trump, who in January made several decisions that disrupted geopolitical stability and long-established norms, including:

Capturing Venezuelan President Nicolas Maduro and his wife Cilia on 3rd January, in what his administration positioned as a law enforcement operation based on charges of narco-terrorism, but which he later heavily implied was motivated by access for US energy companies to the Central American country’s vast oil reserves

• Renewing his previous threats to invade/acquire Greenland (currently sovereign territory of NATO ally Denmark) to prevent Russia or China from doing the same

• Encouraging Iranians to keep protesting and to “take over your institutions” on social media. The protests left thousands dead (official numbers are disputed)

• Threatening a 25% tariff on European allies in the build up to the World Economic Forum

• Ordering a flotilla of naval warships to the Middle East to incentivise Iran to approach the negotiation table on nuclear weapons, despite saying last year that US military strikes had destroyed Iran’s nuclear capabilities

President Trump announces a nominee for Federal Reserve Chair, calming markets

President Trump announced that he will nominate former Federal Reserve governor Kevin Warsh to succeed Jerome Powell as Fed Chair. Viewed as more experienced and less political than other potential nominees (White House economist Kevin Hassett and current Treasury Secretary Scott Bessent amongst them), Warsh’s selection eased concerns that Trump would push for aggressively lower interest rates, which could fuel inflation and weaken the dollar. The announcement helped halt gold’s rally, while the DXY Dollar Index rose by around 0.8–1% in subsequent sessions. Treasury yields climbed across the curve, signalling expectations of a more hawkish Fed.

Warsh’s term will begin after Powell’s ends in May 2026, though Trump has repeatedly suggested he would like to remove Powell earlier, despite lacking legal authority to do so without cause.

Japanese government bond yields surged to multi-decade highs in January, marking a clear break from decades of ultra-low rates. The sell-off reflected unease over expansionary spending promises ahead of February’s general election and growing concern from the Bank of Japan about inflation risks and falling behind the curve. Rising Japanese yields disrupted global carry trades and added to market volatility at a time when geopolitical uncertainty was already forcing investors to reassess traditional safe-haven assets.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Simpson

Investment Oversight Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025