This blog looks at why investors may prefer gaining greater exposure to assets listed in their home country as opposed to overseas. It looks at the causes and possible effects of taking this investment approach.

Introduction

Home bias refers to the tendency for investors to invest the majority of their portfolio in domestic equities, ignoring the benefits of fully diversifying into foreign equities.

Academics have long argued that it is not optimal to invest with a home bias, yet it is undeniably a reality, and not just in the UK. Studies in Sweden have shown that Investors overwhelmingly buy their own domestic shares and a study by Sercu and Vanpee1 demonstrates that it occurs across the world and across time periods.

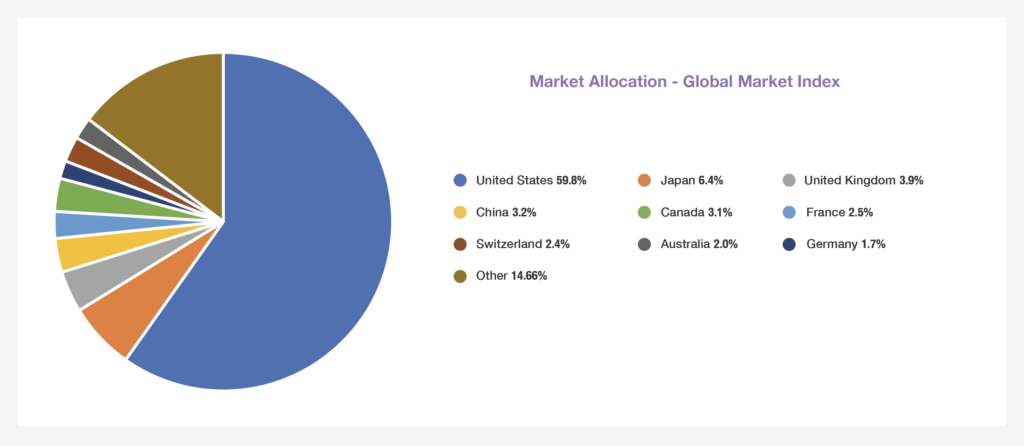

As of July 2022, investing in a global market index will provide exposure to c. 10,610 stocks, but a UK market index will only give you access to c. 378 stocks2. Despite the purported benefits of diversifying into foreign equities, this phenomenon is sometimes a question of familiarity and the comfort it can bring UK investors investing in UK equities. However, as of July 2022, UK shares account for less than 4% of global stock markets, as this chart shows.

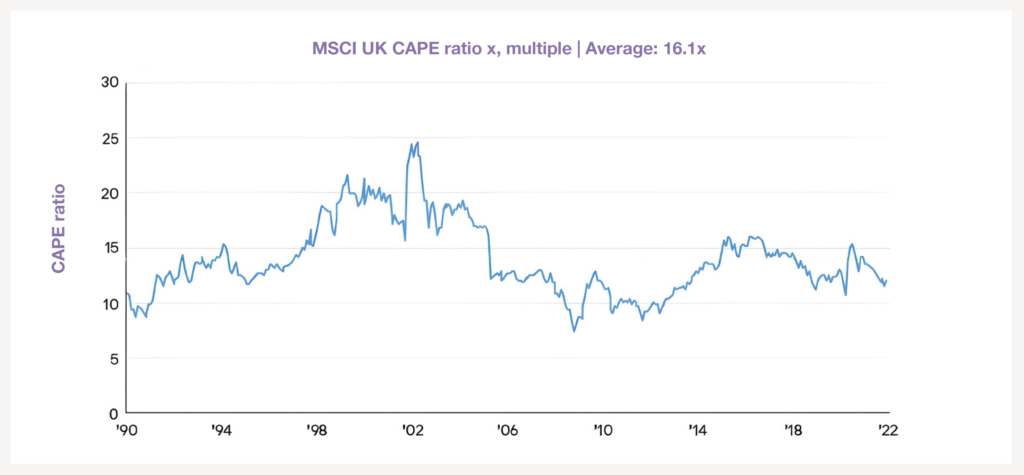

Shown below, the cyclically adjusted P/E ratio (CAPE) is price-to-earnings ratio adjusted using trailing 10-year average inflation-adjusted earnings and is nearing levels experienced during the 2008 financial crisis; meaning that UK stock valuations are currently as low as they have been in the last 30 years, offering an attractive dividend yield relative to other equity markets and at a good value compared to historic MSCI UK CAPE ratios3. Recent market turbulence has exacerbated valuation discrepancies in the UK market; thus, some active fund managers may believe it has created fertile conditions for active stock picking. However, studies have shown that only about 1% of active fund managers beat the market over the long term and a piece written by Larry Swedroe4 states active fund management is a zero-sum game where investors must exploit the mistakes of others to outperform the market.

5 potential explanations for home bias:

1. Hedging domestic risk

This argument is related to the principle that one would wish to have assets and liabilities in the same currency to avoid currency/inflation risk. For example, a Global USD portfolio would fall in value for a sterling investor if the US dollar fell against the pound. Similarly, a rise in domestic inflation, which is greater than that experienced worldwide, would put the sterling investor at a disadvantage, as it would likely be accompanied by a rise in the pound (via Purchasing Power Parity considerations), with similar effects on the investor’s returns.

It is important to note that home bias for fixed income investors has generally been greater than for equity investors. While this might be construed as a negative, the reasoning behind it may actually be rational. For example, Fidora, Fratzscher, and Thimann5 (2006) found that home bias was influenced by exchange-rate volatility and, as a result, was generally greater for assets with low local currency return volatility (i.e., fixed income). They further showed that a reduction in exchange-rate volatility reduced fixed income home bias to a greater extent than it reduced equity home bias.

These points probably had more poignancy in earlier years. We now live in an increasingly “Financialised” world, where currency and interest rate swaps can now deliver exact replication of returns in (almost) any currency, they no longer have the force they once did.

In reality, circa 75% of revenue payments of the FTSE 100 companies are from overseas6, so a home bias does not guarantee you insulation from currency fluctuations. The big multi-national companies (e.g., Shell and BP) routinely hedge their global exposures and therefore it can be said that an investor is getting the forex risk hedged on their behalf (for free, or nearly so). In addition, according to some7, evidence for a positive correlation between domestic stocks and that nation’s inflation rate is weak. Value stocks perform better during times of high inflation, whereas growth stocks perform better when inflation is low.

2. Implicit/explicit costs & governance

This argument holds that the costs of investing abroad make it less attractive, as expected returns are reduced by those costs (transaction fees, legal restrictions, extra taxes etc). If these costs are higher than the expected returns, then the case for the risk reduction benefits of international investment is weakened. International dividends did have withholding tax deducted at a higher rate than for (say) UK shares: the tax applied on US income to Irish domiciled funds was twice that of an equivalent UK fund. Emerging Markets had much higher costs associated with them than their Developed Market equivalents (as can be seen in the differing OCF’S/TER’S). Nonetheless, the differential between Emerging and Developed Markets have now narrowed considerably.

In any case, Cooper and Kaplanis8 have argued that the costs incurred are not great enough to explain the level of home bias, implying that some other factors are at work. If we look at Vanguard for example, the cost of their FTSE Developed World ex-U.K. fund is only 8bps cheaper than their FTSE Emerging Markets fund.

Further, there is more risk of implicit costs, such as capital controls, even expropriation than for the domestic market. The latter can have a devastating effect on overall returns. Again, the passage of time has rendered some of these factors less important. Costs have fallen significantly over the past 20 years or so, and political risk (wholesale nationalisations etc.) is much reduced, not least because governments who practise it are usually denied market access for a number of years thereafter. Corruption can be an issue in some (mainly smaller) nations, but it is not exclusive to “Third World” countries – Western Banks’ recent behaviour argues that it has not been eliminated domestically either.

Taxes generally fall into four categories: capital gains, dividends (from equities), interest income (from fixed income), and transaction or stamp taxes. By having a home bias, you are subject to domestic tax rates, which may be relatively high. By being globally diversified, you can gain exposure to countries with lower tax rates. Therefore, the role of taxes in the allocation of foreign exposure is important to consider within each portfolio.

3. Information asymmetries

According to this argument, investors prefer markets on which they have better information. Being unable to read the local newspaper (in Japan for example), renders the foreign (gaijin) investor at an informational disadvantage. Investors are more familiar with, and therefore more comfortable buying, domestic shares9 as the risks of management or government rent extraction are increased if one is not familiar with the local language etc. and are therefore unable to object.

This may be true, but it is more of a behavioural issue for investors. Solnik10 argues that investors only have a perceived informational advantage over foreign investors in their domestic market, and that it is a sign of “overconfidence” on their part. The rise of Indexing has all but eliminated the need for informational parity in overseas markets, making the risks of being blind-sided by the local knowledge of domestic market participants much lower.

4. Behavioural biases

All the previous arguments trying to explain home bias come up against the objection that they do not account for the absolute level thereof, nor the globally consistent nature of it. Therefore, something else must be causing it, and behavioural finance may be able to explain the phenomenon.

The most salient element of it would appear to be “Loss Aversion,” referring to humans’ strong preference for avoiding losses to acquiring gains11. This can be linked to regret theory12, whereby investors use domestic portfolios as a benchmark and feel the pain of regret when foreign investments under-perform (or try to avoid such).

A study by P. Sercu and R. Vanpee13 showed that equity home bias is lowest in the Netherlands, where only 32% of the total equity portfolio is invested in domestic stocks. Alternatively, the highest level home bias is in Indonesia, where nearly all equity investments are domestic. In general, the equity home bias is lower in developed countries and higher in emerging markets. It is interesting to note that the countries with the most volatile stocks (the emerging markets) are also the ones with their equity portfolios most heavily tilted towards domestic assets. This means that either domestic investors of those countries bear a substantial amount of unrewarded country-specific risk, or international investors are unwilling to cash in an expected return for a risk that, to them, is diversified away.

5. The ebi approach

We are very aware of the downside of the home bias – the costs are manifested in concentration risk and reduced returns. A study showed14 that the least diversified investors earn 2.4% less p.a. than the most diversified. Our Earth UK Bias portfolios remain globally diversified but deviates away from the market average to gain greater exposure to UK equities; c. 38% UK weighted compared to the 4.24% UK global weighting (as per the MSCI World Index as of 31/07/2022). Some important considerations are outlined below:

- Around 75% of the FTSE 100’s earnings are in Global markets6. Thus, the index (and by extension the All-Share Index), does not reflect what happens in UK with currency fluctuations playing a role. If the pound sterling weakens then dollar revenues, once converted back into sterling, will be worth more. The strength of the pound sterling against the euro is also important given the large chunks of revenue accounted for by France, Germany, Italy and other eurozone countries.

The notion that a falling currency boosts the local stock market applies to most markets, but the extent depends on the market’s reliance on foreign revenues. For example, Antofagasta is a FTSE 100 mining company that primarily runs assets in Chile. Only 1% of the firm’s revenue comes from the UK, so the majority of their revenue comes in the form of dollars. Thus, a depreciation in pound sterling (against the dollar) will see earnings strengthen. - An article by Swedroe on ETF.com pointed out15 “Global diversification matters because industries are highly concentrated within countries”. Referencing the Credit Suisse Investment Returns Yearbook, he notes that countries can be dominated by a handful of industries.

The UK’s foreign exchange market is the biggest in the world, and Britain has the world’s number- three stock market, number-three insurance market, and the fourth-largest bond market. London is the world’s largest fund management centre, managing almost half of Europe’s institutional equity capital and three-quarters of Europe’s hedge fund assets. More than three-quarters of Eurobond deals are originated and executed there and a third of the world’s swap transactions and more than a quarter of global foreign exchange transactions take place in London, which is also a major centre for commodities trading, shipping, and many other services16.

Investors will typically be investing in the largest local companies (e.g., from the FTSE 100), the vast majority of which, due to their size, receive revenues from all over the world. By investing in companies that investors can buy in their local currency, there is also no need to incur FX costs or incur hedging costs as previously covered in ‘Hedging Domestic Risk.’

Conclusion

To summarise, the quantitative aspects of this argument; high costs and tax versus greater diversification and risk reduction are frankly leaning ever more so in favour of global portfolios. The more qualitative arguments are probably the dominant factor.

At ebi, we believe that it makes more intuitive sense to have a global portfolio exposure to reduce idiosyncratic risk but also that it can be preferable for some investors (who, for example are close to retirement) to hold assets in their home currency. ebi offers investment solutions that are globally diversified and also investment solutions that have a greater allocation towards UK equities. Financial advisers are able to recommend whichever solution best suits their investors requirements.

References

[1] Home Bias in International Equity Portfolios: a review. P. Sercu, R. Vanpee, August 2007

[2] Morningstar Global Markets Index. As of 31 July 2022

[3] J.P Morgan, UK Capabilities, IBES, MSCI, Refinitiv DataStream, December 2021

[4] Swedroe, L., 2018. Active Fails in Fixed Income, March 2018

[5] Fidora, Michael, Marcel Fratzscher, and Christian Thimann, 2006. Home Bias in Global Bond and Equity Markets: The Role of Real Exchange Rate Volatility. Working Paper Series No. 685. Frankfurt am Main: European Central Bank

[6] Occam Investing: How diversified is the FTSE 100, Accessed 20/09/2022

[7] Adler and Dumas, 1983; International Portfolio Choice and Corporation Finance: A Synthesis, Journal of Finance 38.3, 925-984

[8] Cooper, Ian A. and Evi Kaplanis, 1994, Home Bias in Equity Portfolios, Inflation Hedging, and International Capital Market Equilibrium, Review of Financial Studies

[9] Huberman, G., 2001, Familiarity Breeds Investment, Review of Financial Studies 14, 659680

[10] Solnik, Bruno, 1996, International Investments. 3rd edn. Addison-Wesley Publishing, Reading, MA

[11] Loss aversion was first demonstrated by Amos Tversky and Daniel Kahneman in Kahneman, D. and Tversky, A. (1984). “Choices, Values, and Frames” (PDF). American Psychologist

[12] Hedging Currency Risk: A Regret-Theoretic Approach Sébastien Michenaud and Bruno Solnik HEC-School of Management, Paris

[13] P. Sercu and R. Vanpee, (Table 1) 2017, Home Bias in International Equity Portfolios: a review

[14] Diversification Decisions of Individual Investors and Asset Prices: W.Goetzmann, International Centre for Finance, NBER, Yale School of Management, Jan 14, 2004

[15] Swedroe., ETF.com 18/05/2015 – Diversify globally to limit risk

[16] Credit Suisse Investment Returns Yearbook 2022 p.37

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025

- Ruffled Feathers: Exploring Black Swan Events

- Q1 Market Review 2025